Annovis Bio: Search for efficacy against Alzheimer’s disease (NYSE:ANVS)

D-none

Monday, April 29th, Annovis Bio (New York Stock Exchange:ANVS) announced primary results from a phase 2/3 Alzheimer’s disease (AD) clinical trial. This test was described as follows:

The Phase 2/3 study was a randomized, double-blind, placebo-controlled trial investigating the efficacy, safety, and tolerability of buntanetop. In patients with mild to moderate AD. This was a dose-ranging study in which patients received one of three doses of buntanetab (7.5 mg, 15 mg, or 30 mg) or placebo in addition to standard treatment for 12 weeks. In this study, more than 700 patients were screened, and a total of 353 patients were enrolled; 325 patients completed the study. It spans 54 sites across the United States. This study included patients with mild to moderate AD with a Mini Mental State Examination (MMSE) score of 14 to 24 at baseline.

(Source; bold emphasis added)

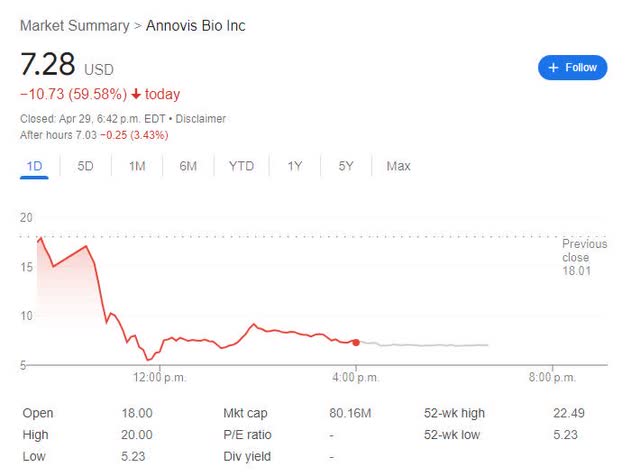

Despite the very positive headlines “Annovis Bio Announces Statistically Significant Phase 2/3 Data for Patients with Early Alzheimer’s Disease.” The market reacted negatively to this news, dropping the stock price by ~60%. That is, it fell from the closing price of $18.01 on April 28 to $7.28 on July 28, 2019. April 29

ANVS 1-day chart ends on April 29, 2024. (Google)

To understand this dramatic market reaction, you must first understand the consequences. Now let’s take a look.

Pre-specified (efficacy) endpoints

According to the trial protocol (NCT05686044), there are two cavities.mainly Efficacy endpoints*, namely ADAS-Cog11 and ADCS-CGIC, 3 middle and high school grades Efficacy endpoints*, namely ADCS-ADL, MMSE and DSST.

*Note: Check the protocol for the full names of these endpoints.

Of five efficacy endpoints (two co-primary and three secondary) Only ADAS-Cog11 data is reported in some detail.

What is important to note here is that, according to the announcement, no Statistically significant (improvement) Data from ADCS-CGIC (co-primary endpoint) and ADCS-ADL (secondary endpoint)

furthermore, none of them MMSE nor Results of the DSST (two secondary endpoints) have been published.

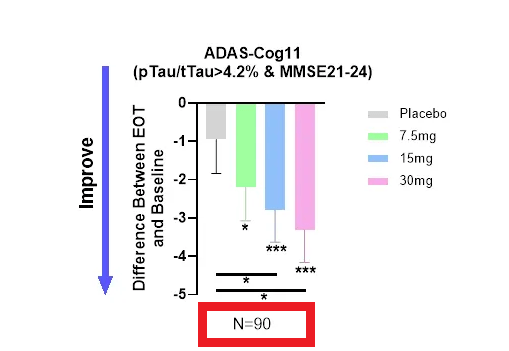

ADAS-Cog 11 data from non-prespecified subgroups (n=90) biggerSubgroup not prespecified (n=202)

According to PR:

We observed significantly higher improvements in ADAS-Cog 11 scores at each treatment dose compared to placebo in patients with mild AD. An analysis focused on biomarker-positive early AD patients (MMSE 21-24, pTau217/tTau≥4.2%) found that ADAS-Cog 11 had a highly statistically significant effect compared to placebo and placebo at all three dose levels and at the combined dose level. It turns out that it is. As a baseline (Figure 1)

Dose-dependent improvement in cognition in a population with confirmed early AD. (ANVS April 29, 2024 PR)

(red box added by author)

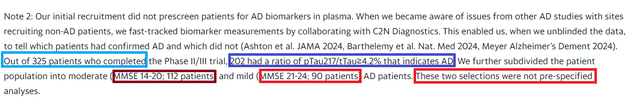

There is one important item in this section to pay attention to in your PR (Note 2): See screenshot below.

ANVS April 29, 2024 PR

(Add color box)

To summarize: To measure ADAS-Cog 11, the company ~ no We report original data from completed patients (n=350), i.e., intention-to-treat (ITT) or per-protocol (PP) patients, and instead report: Only Data from ~28% (90/325) of patients completed; cherry picking after death Based on two non-prespecified selection criteria.

Safety and biomarker data

1. Safety

According to the PR, “buntanetop, a once-daily oral medication, has an exquisite safety profile” and there is little specific information about its safety, except that it is “extremely well tolerated.”

2. Biomarkers

Regarding the biomarker data, PR said:

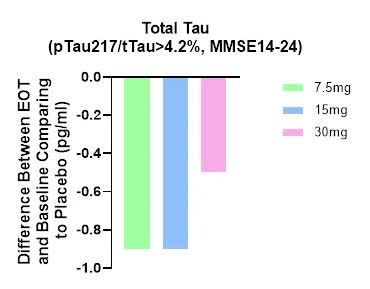

We observed a decrease in plasma tTau (total Tau) after treatment, providing further confidence in the efficacy and mechanism of action of buntanetap (Figure 3).

ANVS April 29 PR

A few things worth noting here are:

- Biomarker data is ~ no dose dependent, the 30 mg group least difference( worst data).

- no Biomarker data are presented for the entire group (n=325) or for the group with a Tau ratio ≤4.2% (n=123, i.e. 325-202).

- there is no blood A given value for this difference, i.e. probability Not statistically significant biomarker data, Compared to the placebo group.

- Unlike ADAS-Cog 11 data, the biomarker results ~ no It was “further subdivided” into two groups (MMSE 14-20 vs. MMSE 21-24), with no differences shown between these two subgroups.

Argument

As an R&D biotech investor, I believe this sector is extremely judicious and punitive toward any company that fails a test and/or attempts to sugarcoat its test data.

In the case of Annovis Bio’s p2/3 AD results, both appear to be the case.

Instead of presenting really Based on the topline data, the company decided to report a post-mortem analysis. Only The result is a trial failed In ~ every Five prespecified efficacy measures in patients with ITT or PP (n=325).

In my opinion, such decisions/actions only discredit the R&D efforts and harm the average investor who trusts and follows the company’s expertise in reporting clinical trial data. exactly.

In ANVS’s previous p2a AD trial, small Number of patients (n=14); short The duration (25 days) was claimed as the reason for the lack of statistically significant data in the trial. The problem is this longer (12 weeks), bigger (n=325) p2/3 trials had to be modified. Obviously this ~ no case.

Again, the company seems to be saying that a different set of inclusion criteria, namely baseline Tao percentage (>4.2%) and baseline MMSE score (21-24), will solve the problem. next trial.

In my opinion, if ANVS raises enough funds and the FDA approves it, the next AD trial will likely share the same fate as the previous two trials (p2a and now p2/3). That means the next AD trial is likely to happen again. Failure to meet pre-specified efficacy endpoints in pre-specified patients.

This makes post-mortem analysis, screening and reporting useless and unreliable. best data.

finance

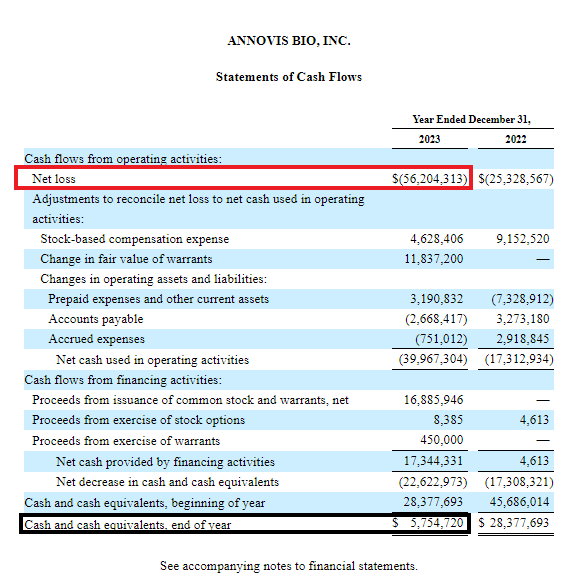

According to the 2023 Annual Report (see F-7 below), the annual net loss was $56.2 million.

As of December 31, 2023, cash and cash equivalents were $5.75 million.

ANVS 2023 Annual Report

On April 25, 2024, ANVS entered into a common stock purchase agreement with “Equity Line Investors… pursuant to which the Company may, from time to time, in its discretion, offer and sell ELOC and the purchasers of ELOC have committed to purchase,” according to a recent SEC filing. According to the company, it holds up to 2,051,428 shares.

conclusion

Annovis Bio expects to soon obtain another important piece of information from the p3 trial for Parkinson’s disease (PD).

Although it is possible unlikely I think the p3 PD trial will succeed where the p2/3 AD trial failed in being longer and larger than the previous p2 trial. mixed result.

For ratings, select STRONG SELL. This is because we anticipate that the probability of success in the upcoming PD trials will be low and that there will be little to no chance that Buntanetap will be successfully developed even if the Company chooses to proceed with AD and PD. It is approved for these indications.