Best staking ratio for Coinbase profits

Main Content:

- Our investment strategy includes holding high-quality cryptocurrency assets for the long term. (Learn more about our investment approach and results.)

- You can earn additional income using staking products, like investing in an interest-bearing account. (Learn more about how to stake.)

- One of the most user-friendly staking products is Coinbase Earn, which allows users to stake multiple tokens with just a few clicks. (Here’s how to set it up.)

- Coinbase staking rewards may fluctuate depending on staking demand for the underlying protocol.

- This article lists: Best staking ratio For Coinbase Earn, you can see which tokens have earned the most rewards. (Note: The future may look different.)

Staking on Coinbase Earnings

Staking is the flagship service of Coinbase Earn, a product that allows users to earn rewards by operating cryptocurrency by staking digital assets on the platform.

Coinbase Earn offers earning opportunities for multiple cryptocurrencies based on the Proof-of-Stake (PoS) algorithm. This is why Bitcoin is not included in it. This is because it uses a proof-of-work (PoW) consensus mechanism.

As of this writing, Coinbase supports the following staking assets:

- Ethereum (ETH)

- Cosmos (ATOM)

- Solana (SUN)

- Polkadot (DOT)

- Polygon (POL)

- Tezos (XTZ)

- Cardano (ADA).

To start staking, you just need to deposit at least $1 in cryptocurrency.

Advantages of Coinbase Savings

There are several reasons why Coinbase Earn is the best choice for cryptocurrency staking.

- There are multiple PoS coinsAnd staking on each network individually requires significant effort to track all balances and rewards and monitor changes. Coinbase Earn allows you to easily stake all eligible coins from a single dashboard.

- Ethereum has the most staked coins.. However, to become a validator, you must deposit at least 32 ETH (about $100,000) as of this writing. Coinbase Earn lowers the barrier to entry for Ethereum staking by pooling staking capital and imposing no criteria on users.

- Coinbase Earn is user-friendly and excellent for beginners. You may not understand all the intricacies of staking.

- Coinbase takes steps to reduce any risks associated with validator failures., is called slashing and can lead to loss of staked funds. Coinbase has never experienced major losses.

This means that Coinbase Earn does all the behind-the-scenes work for staking crypto assets, while users simply enjoy the benefits.

In return for this convenience, Coinbase takes a 35% commission. By signing up with Coinbase One, you can reduce this fee by around 26% for certain tokens. (For more information on fees, see here.)

In addition to Coinbase’s fees, the blockchain network determines the staking rate. This is why staking rates vary greatly between coins. Find out more about this below.

Best staking rate today

Please note that it is higher compensation rate Doesn’t necessarily suggest better investment.

For example, Polkadot (DOT) currently pays over 9% in staking rewards, but has the highest inflation rate among major tokens.

Elsewhere, Solana (SOL) is currently yielding less than 5%, but is the best performing layer 1 coin after 2023, with its price increase reflected in its returns.

Our approach is to invest in valuable tokens for the long term and view staking rewards as further growth on your investment. Invest in tokens, not staking percentage.

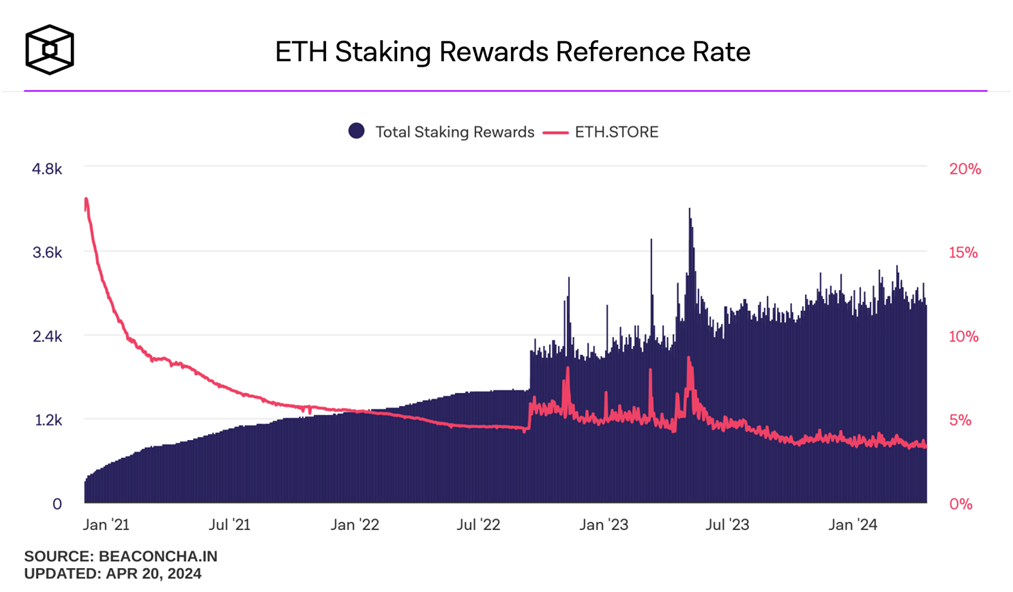

Staking ratio fluctuates

Cryptocurrency investors should also consider the volatile nature of staking rewards.

For example, a year ago Coinbase Earn offered annual percentage returns (APY) of 3.83% for Ethereum (ETH) and 2.5% for Solana (SOL).

These fluctuations depend on the underlying chain. In general, the two main factors that determine staking returns are the amount of coins staked and the participation rate. As more cryptocurrency holders stake, the reward rate tends to decrease because everyone shares the same pie.

The role of re-staking for ETH holders

Ethereum is an isolated case because the entire staking industry is built around it.

EigenLayer has introduced a staking innovation called restaking, which allows ETH holders to amplify their staking rewards by repurposing staked ETH to secure decentralized applications (dapps). (See the EigenLayer guide here.)

It is worth noting that while the growing popularity of re-staking and liquid staking protocols increases the appeal of ETH staking, it also dilutes the overall rewards, including the yield offered by Coinbase Earn. (Again, there are more participants, but the size of the pie is the same.)

Which platform offers the best staking percentage?

Although Coinbase may charge the highest fees of any managed staking platform, many cryptocurrency investors choose Coinbase for its simplicity, security, trust, and reputation.

Here’s how Coinbase Earn compares to other staking platforms. (Remember that Coinbase commissions can be reduced by up to 26.3% for eligible Coinbase One members.)

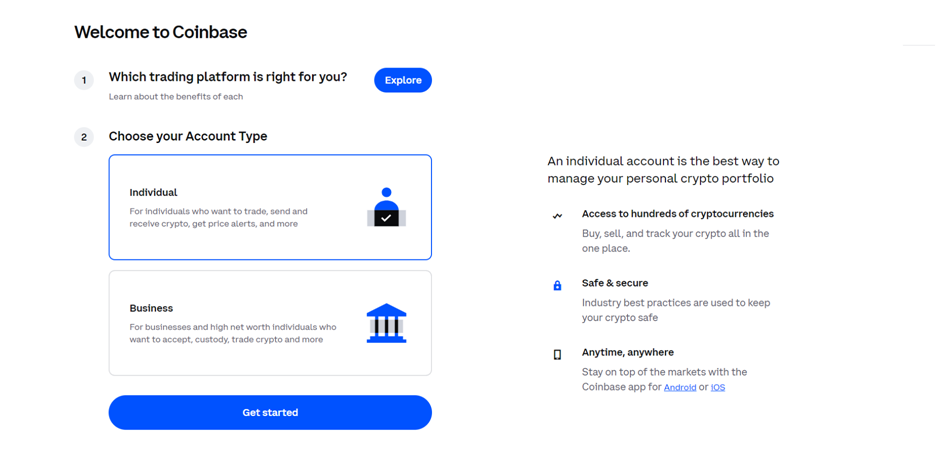

How to start earning on Coinbase

Getting started staking on Coinbase is easy. The main steps are:

- Set up your Coinbase account: During registration, you can select your preferred account type – personal or business – and then share data including your name and email address. Set a strong password.

- Confirm your email and phone number and provide additional personal information.

- After registering, you must go through the KYC verification process to upload your ID and link your payment method to make a deposit.

- Enable 2FA – If your password has been compromised, we recommend enabling two-factor authentication (2FA) to help keep your account more secure.

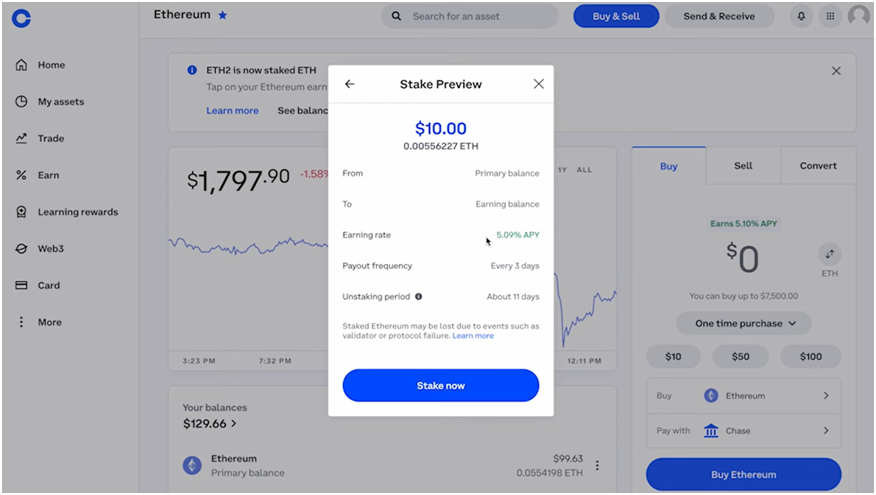

- Start staking with Coinbase Earn – After registering and depositing funds, go to the monetization page and select one of the suitable cryptocurrencies or click “Make Money” in your account. Follow our simple instructions to stake your cryptocurrency and earn rewards.

The frequency of reward payouts varies depending on the protocol, and trading cryptocurrency funds requires unstaking. Depending on the protocol, unstaking can take anywhere from hours to weeks.

The best way to minimize staking risk is to build a staking portfolio and allocate it to multiple coins.

Investor Implications

Coinbase Earn is ideal for beginners as it offers an accessible way to stake cryptocurrency assets with a low barrier to entry and a user-friendly interface.

This guide will help you see which cryptocurrency investments are giving you the most rewards. But first invest in quality cryptocurrency assets and enjoy the staking rewards as gravy.

Subscribe to the Bitcoin Market Journal newsletter to receive more cryptocurrency investment tips.