6 Reasons to Hold Bitcoin in Retirement

Originally published on Unchained.com.

Unchained is Bitcoin Magazine’s Official US Co-Managing Partner and an essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services offered, our storage products, and the relationship between Unchained and Bitcoin Magazine.

For newcomers, especially those nearing retirement age, the idea of investing in or owning Bitcoin can evoke reactions ranging from skepticism to disbelief. But if you look beyond the popular story, you’ll see that there’s more to the story than first impressions might suggest. Here are six reasons why you should own at least some Bitcoin during your retirement.

1. Bitcoin helps broaden your asset allocation base.

Traditionally, investors use a strategy called asset allocation to distribute and protect their funds from investment risk over time. A sound asset allocation strategy is the antidote to putting all your eggs in one basket. There are several types of asset “classes” or categories that diversify risk. Typically, advisors seek to build a dynamic mix between debt instruments (e.g. bonds), equities (e.g. stocks), real estate, cash and commodities.

The more categories you use to distribute your assets, and the lower the correlation between those categories, the more likely you are to balance risk, at least in theory. More recently, as an unintended consequence of the aggressive expansion of social debt and the money supply, previously uncorrelated assets now tend to be more similar to each other. Today, when one sector is hit, many other sectors often suffer as well.

Regardless of this current situation, asset allocation remains a well-thought-out strategy for mitigating risk. Bitcoin, still in its infancy, represents a completely new asset class. Because of this, and its unique properties, especially when compared to other “cryptocurrencies,” owning at least some Bitcoin provides an opportunity to broaden your asset base and diversify your overall risk more effectively.

2. Bitcoin provides a hedge against inflation and currency depreciation.

As a retiree, protecting yourself from inflation is important to maintaining long-term purchasing power. In the asset allocation discussion above, we mentioned the recent aggressive money supply expansion. Anyone who has lived long enough to reach retirement age knows that a dollar doesn’t buy you as much as you used to. When the government issues new currency in large quantities, the value of dollars already in circulation falls. When newly created dollars start chasing the existing, limited supply of goods and services, prices typically go higher.

Our own Parker Lewis covers this extensively in his book. gradually and then suddenly series:

In summary, when trying to understand Bitcoin as money, start with gold, the dollar, the Federal Reserve, quantitative easing, and why the supply of Bitcoin is fixed. Money is not simply a collective hallucination or belief system. There is a rhyme and a reason. Bitcoin exists as a solution to the monetary problem of global QE, and if you think that local currency deterioration in Turkey, Argentina or Venezuela could never happen to the US dollar or to developed economies, then we are just at a different point. Same curve.

Unlike fiat currency, no one can arbitrarily reduce the value of Bitcoin by increasing its supply. There is no centralized authority that oversees monetary policy. Despite claims to the contrary, Bitcoin is similar to gold, but not exactly. This is because gold miners continue to inflate gold supply at a rate of 1-2% per year.

As Bitcoin is slowly introduced into circulating supply (i.e. mined), the inflation rate decreases and eventually stops. This fact makes Bitcoin uniquely scarce among the world’s monetary assets. Ultimately, this scarcity, along with Bitcoin’s other monetary characteristics, should protect its purchasing power. Therefore, owning Bitcoin during retirement provides a hedge against inflation.

3. Bitcoin offers opportunities for asymmetric returns

Bitcoin’s ability to alleviate many of the problems discussed here will depend on its ability to achieve asymmetric returns. The supply is fixed (there are only 21,000,000 Bitcoins) and the demand for the asset is steadily increasing. As this limited supply collides with the growing adoption of stores of value by individuals, institutions, and governments, Bitcoin has the potential to dwarf the returns of nearly every competing asset class.

It’s worth noting that generally, people’s returns improve when they hold Bitcoin for a long period of time. In modern society, more and more people are retiring for several decades or more. During such periods, even a limited allocation to Bitcoin provides ample opportunity to benefit from its upside potential. We just need time to endure short-term volatility. Contrary to popular belief, this is not evidence of a lack of ability to store value.

Sequestering a portion of your funds solely for audit purposes in retirement runs somewhat counter to conventional wisdom. Modern retirement plans typically optimize liquidation of portfolio funds to provide income. However, setting aside small, consistently managed amounts of Bitcoin in funds earmarked for income opens the door to profiting by cashing out the limited supply of Bitcoin.

4. Bitcoin provides protection against the risks of long-term bonds.

High-quality bonds, traditionally held directly or as fund shares, are an important part of most retirement portfolios due to their lower risk profile and tendency to preserve capital. But things have changed.

Monetary expansion and rising social debt have driven bond yields (or the amount of interest paid (i.e. coupons)) to historically low levels. Most bond yields today are well below the rate of inflation. This “negative real rate of return” means that owning bonds may cost you money. But the difficulties do not end there.

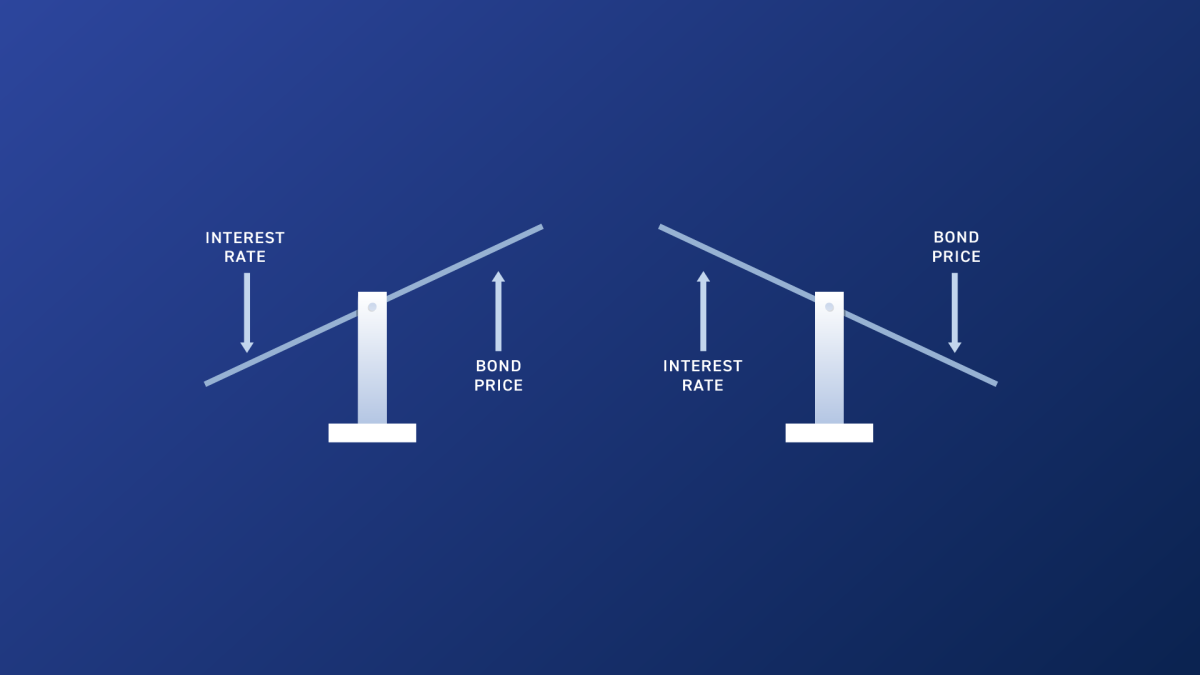

Because retirees need funds from their portfolios to pay bills, they typically need to sell assets at current market rates to earn income during retirement. For bonds, this can be very problematic at the moment. Consider the following equation:

- How much money is needed for a bond paying 2% interest to yield $20? Answer: $1,000. ($1,000 x 2% = $20)

- How much money is needed for a bond paying 4% interest to yield $20? Answer: $500. ($500 x 4% = $20)

These two equations show that the market value of the underlying bond changes with the promised interest rate to produce the same $20 return.

- When interest rates rise, the market value of bonds falls.

- As interest rates fall, the market value of bonds rises.

The market value of a bond is inversely related to interest rates. Consider that interest rates today are near historic lows. What will happen to the market value of bonds held by retirees if interest rates rise significantly over the next 20 to 30 years? The answer is that the market value of bonds will collapse.

This changes the entire risk paradigm for bonds in retirement portfolios and potentially makes them much less safe than commonly imagined. Bitcoin exists as a separate asset class from bonds. It is a bearer instrument that is not exposed to the same money market risks. Therefore, owning Bitcoin could help offset at least some of the potential risks of owning bonds in retirement.

5. Bitcoin offers a potential solution to long-term health care risks

Another concern for retirees is medical costs. We are not talking about general medical expenses here, but the possibility of incurring long-term care expenses in old age. Insurance is available for long-term care, but there are unique and increasingly difficult challenges to overcome.

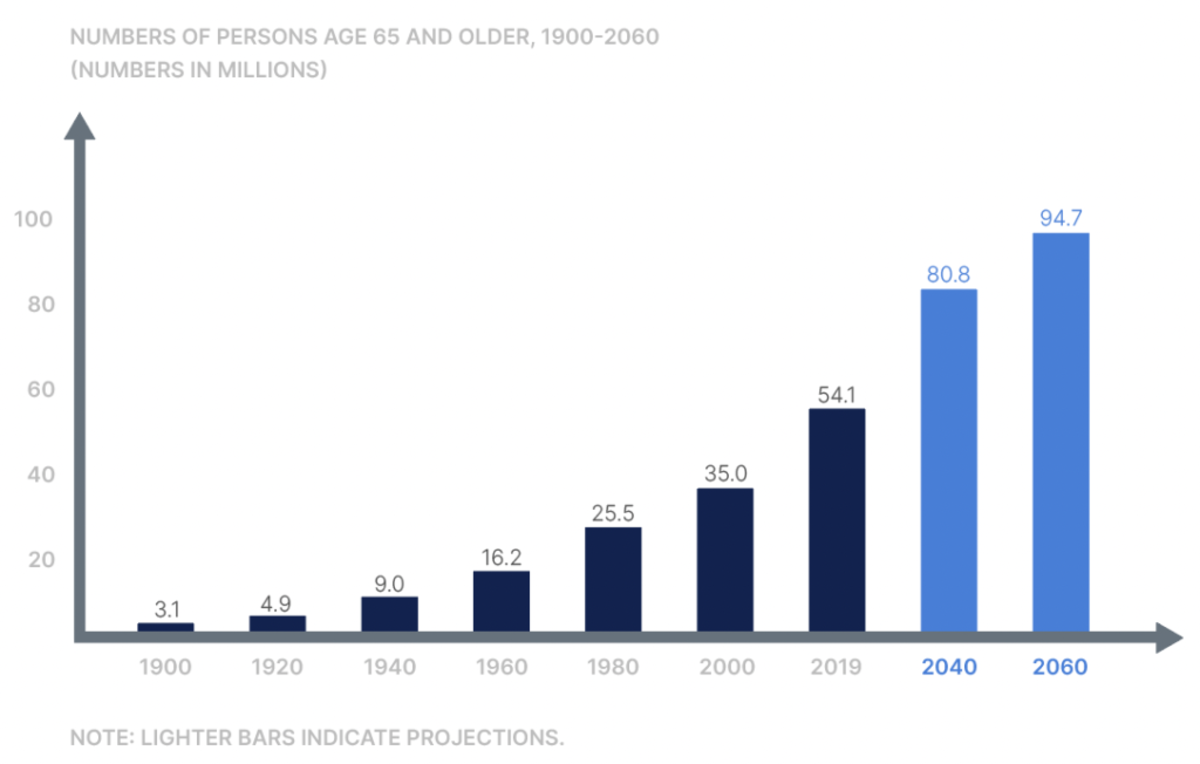

Healthcare in general takes a double hit from price inflation. In addition to rising health care costs due to currency depreciation, health care faces additional headwinds due to demand from a growing aging population.

States regulate insurance for long-term care. To keep policyholders safe, insurers must scrutinize where and how they invest their policy premiums. To preserve capital for future claims, insurers typically rely on low-risk, medium-term, and long-term bonds. However, as seen in the discussion of bonds above, low yields and the potential for rising interest rates complicate this practice. One of the immediate impacts has been a significant increase in premiums for long-term care insurance.

We previously mentioned Bitcoin’s usefulness as an inflation hedge and its potential for long-term price appreciation. As it relates to long-term health care, it may make sense to set aside explicitly dedicated Bitcoin as a hedge against these rapidly increasing costs.

6. Bitcoin provides personal sovereignty.

A final reason to consider owning Bitcoin in retirement is that it enhances your personal sovereignty. Bitcoin offers a level of ownership that cannot be achieved with other assets. They can be easily transported across borders, for example using hardware wallets or seed phrases, and can be transferred peer-to-peer anywhere in the world at low costs.

If you keep your Bitcoin safe in a wallet you control, no central bank can print your Bitcoin and steal its value into oblivion. No CEO can dilute its value by issuing more “stock.” Additionally, banks cannot arbitrarily block or confiscate access to your funds. Unlike centralized financial custodians who can be ordered to freeze or withhold funds at the whim of a government or other third-party authority, Bitcoin, with its keys properly stored, is resistant to this kind of overreach.

You can also hold your own keys to your Bitcoin in an IRA, especially for retirement purposes. Products like Unchained IRA are powerful tools for tax-advantaged wealth building and savings. And holding your Bitcoin keys in the form of a multi-signature shared custody vault eliminates every single point of failure while doing so.

Sound Financial Principles and Bitcoin Ownership

Reaping the benefits of Bitcoin does not require speculation or reckless abandonment of sound financial principles. In contrast, the more you look at Bitcoin through sound financial principles and apply them to your thinking, the greater the opportunities Bitcoin presents. One solid financial principle consistent with Bitcoin ownership is prudence.

Macroeconomic investment strategist Lyn Alden often talks about establishing a “non-zero position” (i.e. owning at least some of it) in Bitcoin. I think the risk of losing a few portfolio percentage points in a worst-case scenario is worth the potential upside. But let me be clear: each person’s situation is unique. You need to do your own research and make the best decision about which method is right for your particular scenario.

Originally published on Unchained.com.

Unchained is Bitcoin Magazine’s Official US Co-Managing Partner and an essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services offered, our storage products, and the relationship between Unchained and Bitcoin Magazine.