Grayscale’s GBTC Bleeding Has Stopped: First Inflow Since Launch

Grayscale Investments achieved its first day of net inflows for Grayscale Bitcoin Trust (GBTC). This comes after nearly four consecutive months of fund outflow since switching to a Bitcoin exchange-traded fund (ETF) in January.

Grayscale’s GBTC recorded inflows of $63 million on May 3, after recording outflows of about $17.5 billion since the launch of 11 spot Bitcoin ETFs on January 11, according to preliminary data from Farside.

Among other funds reporting so far, Franklin Templeton’s Bitcoin ETF (EZBC) recorded its highest inflow ever at $60.9 million.

Meanwhile, Fidelity Wise Origin Bitcoin Fund (FBTC) led the day’s inflows with $102.6 million, followed by Bitwise Bitcoin Fund (BITB) with $33.5 million and Invesco Galaxy Bitcoin ETF (BTCO) with $33.2 million.

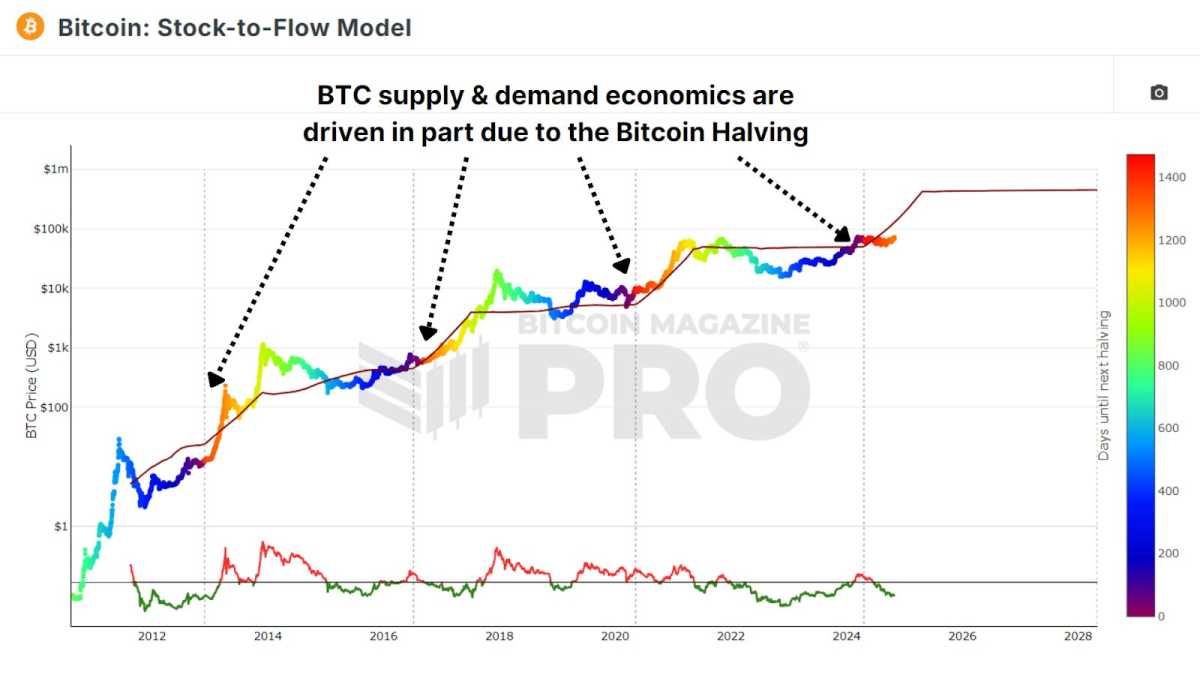

The cryptocurrency community has been speculating what impact this event could have on the price of Bitcoin (BTC).

Anonymous cryptocurrency investor DivXman told his followers that GBTC is the “main source” of selling pressure for all spot Bitcoin ETFs, but “the tide” could turn.

“This means that while the ETF is collectively purchasing more BTC than miners can generate, selling pressure is greatly reduced and demand is further increased,” he told his 20,800 followers in a May 3 post. explained.

Crypto trader Jelle predicted on the same day to his 80,300 X followers that a new all-time high for Bitcoin was just around the corner.

“The Grayscale ETF received $60 million worth of inflows. “The halving is over and six-figure Bitcoin will soon follow.”

Related: Grayscale spot Bitcoin ETF before BTC halving ‘halving’

Meanwhile, cryptocurrency trader Jordan Lindsey pointed to the price of Bitcoin and responded, “It’s definitely reacting to both outflows and inflows.”

Bitcoin price was at $62,840 at the time of publication, up 4.91% over the past 24 hours, according to CoinMarketCap data.

Several factors have contributed to Grayscale’s continued outflows following the launch of its 11 spot Bitcoin ETFs. One reason is that GBTC’s fees are higher compared to other ETFs. GBTC’s commission is set at 1.5%, but the commissions of all other ETFs are less than 1%.

The cheapest one is currently Franklin Templeton with a fee of 0.19%. Another key driver is the massive sale of GBTC shares by bankrupt cryptocurrency companies FTX and Genesis to repay creditors.

On April 6, Cointelegraph reported that Genesis liquidated approximately 36 million GBTC shares to purchase 32,041 Bitcoins for $2.1 billion.

magazine: 68% of runes are red. Is this really an upgrade for Bitcoin?