Weekly Outlook: NIFTY remains vulnerable to a break in the main trend. Likelihood of maintaining volatility | India analysis

The market traded in a much wider range last trading week. Over the past few days, we have seen the market and VIX moving in the same direction, slightly rising. In a previous technical note, we explicitly mentioned this concern because instances of simultaneous rises in the VIX and indices often signal warning signs of an impending corrective move. The last trading day of the week saw the index fluctuate significantly. During the week, Nifty oscillated in the 446.65 range before ending the week on a flat note. The benchmark index recorded a slight weekly gain of 55.90 points (+0.25%).

There is something additional to note on the technical side. While Nifty remained volatile, there was a significant spike in volatility. This can be seen in the India Vix surge of 33.80% to 14.62. This continues to show a degree of anxiety in the market. Moreover, with VIX and NIFTY rising over the past few days, the market has become vulnerable to profit taking like we saw on Friday. Historical data shows that VIX often uses this behavior to issue advance warning of an impending profit-taking bout. NIFTY hit a lifetime high of 22794.70. However, the 22775 level was not dislodged convincingly and therefore still remains the immediate high level in the market. That said, as long as Nifty remains below 22775, both sides are likely to consolidate into a broad trading range with highly volatile moves.

Trading is likely to begin on a steady basis on Monday. The 22650 and 22775 levels are likely to act as potential resistance levels. Support is provided at the 22300 and 22050 levels.

Weekly RSI is 65.61. It remains neutral and does not show any difference in price. Weekly MACD remains bearish and is trading below the signal line. A doji was formed on the candle. If it appears near a high point, it has the potential to disrupt the continued trend of the market. Historically, Doji has been relatively more powerful in forming reversals. However, confirmation is needed in the next section.

Pattern analysis of the weekly charts shows that Nifty continues to trade in a small upward channel and the 20-week MA currently at 22045 appears to be the nearest support for the index. A violation of this level will be the first sign that the market may take a breather and see a temporary break in the current trend.

Overall, the market is likely to adopt some degree of a defensive bias in the future. Over the next few days, we may see some defensive pockets perform well. Some technical bounces can also be expected. However, it is advisable to take advantage of these technical bounces when they occur to protect profits at higher levels. New purchases should be made very carefully and only for stocks that are developing or improving their relative strength compared to the broader market. We recommend a cautious approach next week.

Next week’s sector analysis

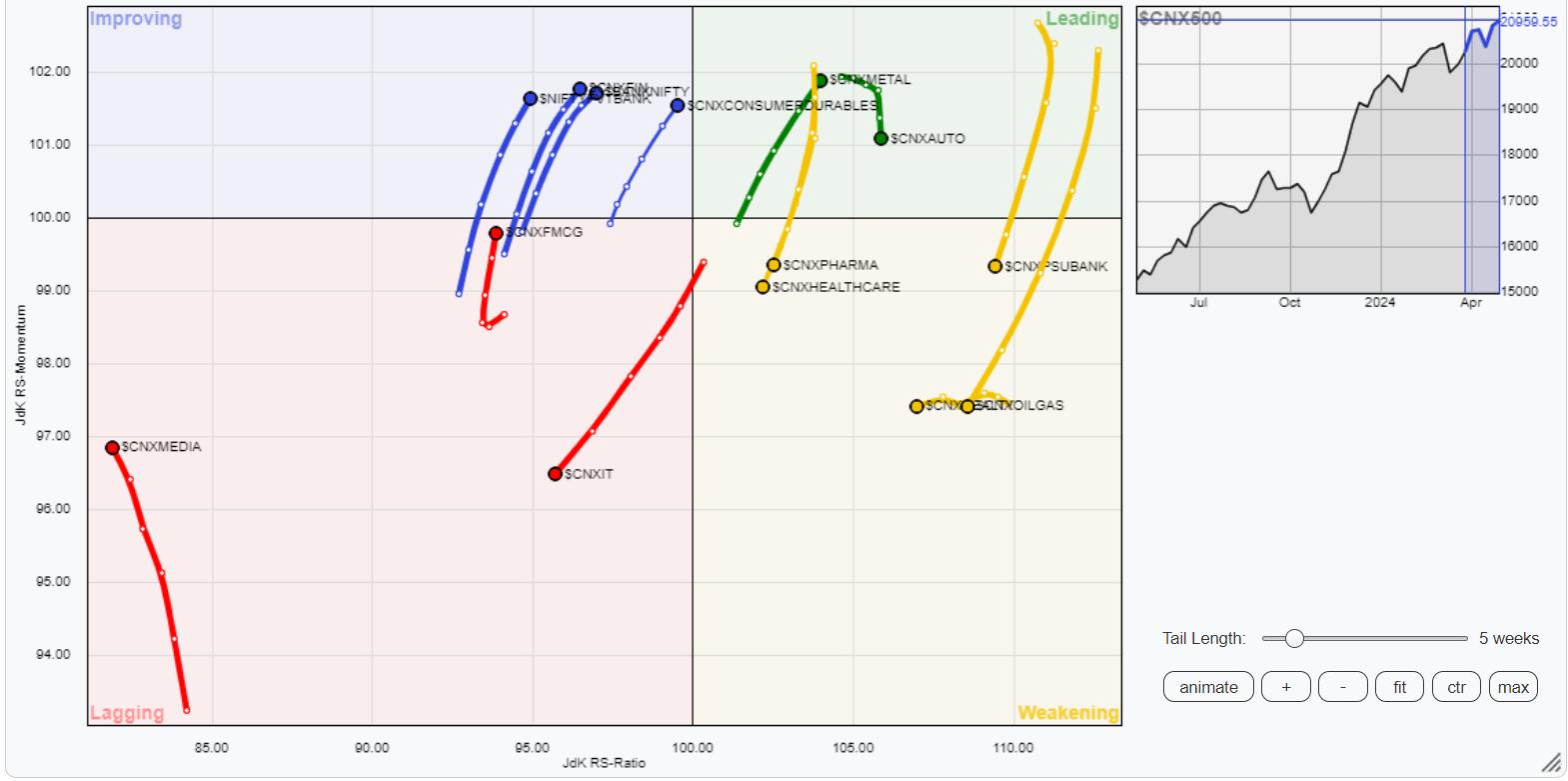

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents more than 95% of the free float market capitalization of all listed stocks.

Relative Rotation Graph (RRG) shows that only Nifty Metal, Auto and Consumption Index are within the major quadrants. Among these, the Auto group is losing some relative momentum, but these groups are likely to relatively outperform the broader market as a whole.

Nifty Commodities, Energy, Midcap 100, Realty, PSE, PSUBank, Infrastructure and Pharma indices are within the bearish quadrant. Relative performance is expected to slow. You can see shows for individual stocks.

While Nifty IT continues to underperform within the lagging quadrant, FMCG and Media indices appear to be improving their relative momentum compared to the broader Nifty 500 index.

Banknifty, Nifty Financial Services and service sector indices are within the improving quadrant. They are expected to continue to improve their relative performance compared to the broader market.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more