Spotify: Bet on This ‘Perpetual Subscription’ Company (NYSE:SPOT)

Justin Lambert/DigitalVision via Getty Images

Take a moment and design the perfect business model in your mind.

If you’re like us, you’ll probably notice a few dynamics right away.

- Products that serve virtually every individual consumer global demographics

- Recurring revenue model that allows the company to build revenue growth over time

- Code or media product that is infinitely scalable with minimal additional input costs

- Very sticky product

- Monopoly or extremely strong market position

For us, this is an input into an incredibly profitable long-term business. Many companies have some of these features, but few have them all.

Today is Spotify(New York Stock Exchange:SPOT), a company that actually checks all the boxes above. SPOT not only enjoys incredible long-term tailwinds from its recurring revenue model; As a company with a dominant market position, but producing sticky, high-margin products targeting global consumers, we believe the company should easily scale over time and deliver good returns to investors. do.

With its first TTM earnings and on the brink of trading at a fair price, we ultimately think the company should be considered a ‘Strong Buy’ for all types of investors.

Let’s take a closer look at what makes SPOT such a special opportunity.

Spotify’s Strong Moat

Before we take a closer look at SPOT’s financials, let us first explain why the business opportunity SPOT is targeting is so exciting.

First of all, humans love music. Needless to say, music is a central element of the human experience and often serves as the backdrop to some of life’s most important moments. Humans loving music is almost built into us as a species. We have been fascinated by things that have been around us throughout history, across eras and regions.

Additionally, podcasts and audiobooks have recently started to gain popularity over the last decade or two and are becoming an increasingly larger part of people’s media diet. As print media declined, podcasts proliferated, and wireless earphones (AirPods (AAPL), etc.) became popular and the audiobook market grew.

All in all, the addressable audio market is global and connects all demographics. There is no group of people who do not listen to music. It is not intended for any particular race, gender or anything else. Listening to podcasts doesn’t make you ‘old’.

Therefore, as the world’s population grows, the demand for audio content remains incredibly stable and growing. long The tail of consumption. People tend to listen to music and other audio content throughout their lives.

this is a huge opportunity.

Despite this, auditory media receive much less competitive attention than visual media. Over the past year, investors from a variety of sectors have flocked to video content streaming platforms, including Disney+ (DIS), Netflix (NFLX), and Peacock (CMCSA).

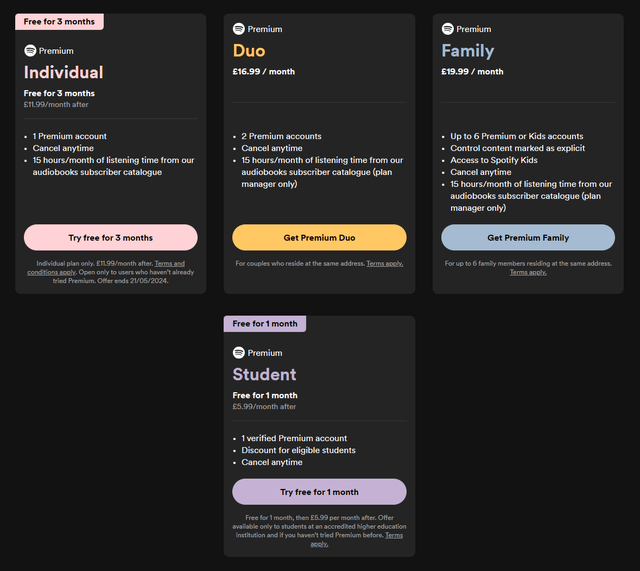

This is different from audio, where we only know of the two major players: SPOT and AAPL (GOOG, ranked #3 on YouTube Music). This is interesting, considering that SPOT Premium subscription prices aren’t much different from top streaming services like Netflix. Reducing competition for similar amounts of allocated customer spend is a huge advantage.

Finally, SPOT also benefits from incredibly high switching costs within the industry. Moving years of carefully curated music libraries from one service to another can be incredibly time-consuming and frustrating, and many people simply don’t make the effort. This pick-and-select content model is inherently different from the browse-and-forget UX commonly found in video streaming platforms.

Therefore, SPOT, with its large long-tail demand pool, strong market position, and anchored products, is poised to succeed in cashing in on this medium.

Spotify’s attractive economics

So how exactly does SPOT monetize its audio content?

Two ways – premium subscription and ad-supported model.

SPOT’s premium subscriptions are its recurring revenue business, accounting for the largest portion of the company’s revenue. Below you can see a sample of SPOT’s pricing plans.

spotify

With user consumption patterns of music preferring to revisit a library of selected favorites, a subscription model makes a lot of sense.

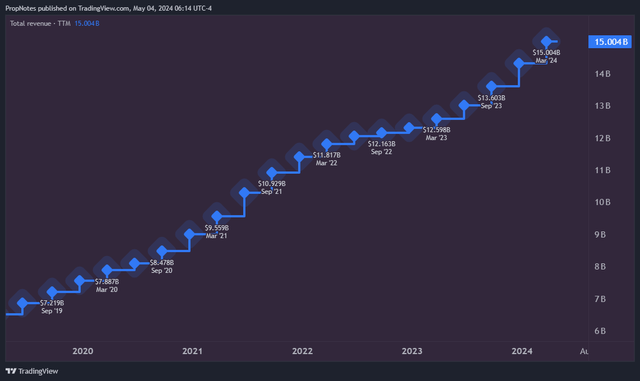

SPOT has executed this pricing strategy well, growing topline sales like clockwork over the past five years.

TradingView

We expect revenue growth to remain very stable and visibility to increase as users grow and prices rise, combined with the long-tail dynamics associated with demand for all audio content mentioned above and high platform switching costs. future.

But what about margins?

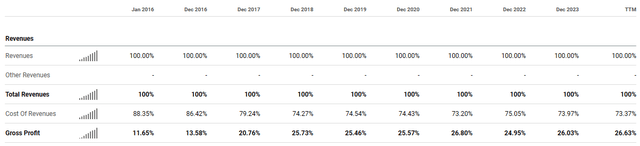

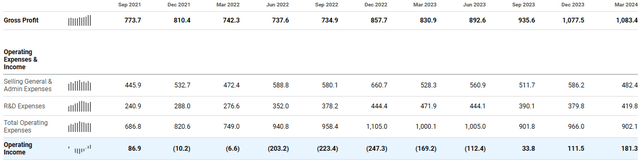

pursue alpha

Most importantly, approximately 75% of SPOT’s revenue is paid out to the platform’s creators in the form of royalties, a ratio that has not changed significantly since 2018. We expect this to remain stable going forward.

So looking at total income can give you a slightly better idea of the scope and size of SPOT.

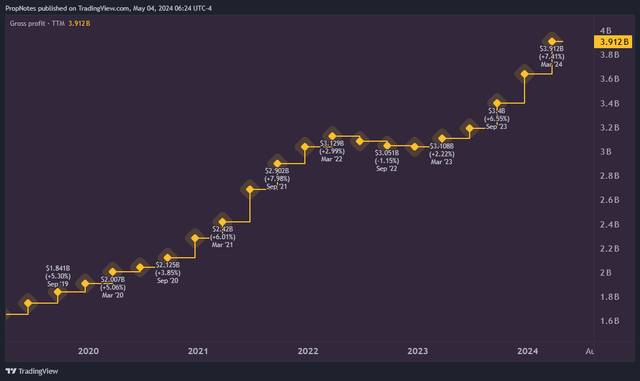

TradingView

At nearly $4 billion TTM, SPOT has significant room to increase profitability once all content costs are taken into account.

From an operational perspective, ‘fixed costs’ – the cost of running a business – do not seem to have increased significantly over the past few years, despite users increasing by up to 50%.

pursue alpha

This shows that the company can keep costs in check as users and the content offered grow. This has helped us quickly achieve positive profitability over the past few quarters.

As the company continues to perform and grow in terms of revenue and gross margins, this additional cash will flow straight into the bottom line. Therefore, although profitability appears to be weak at the moment, the net profit margin is expected to expand rapidly as the increase in costs becomes smaller than the increase in sales.

Finally, although most of our revenue, costs, and profits come from the premium side, we actually have more free users than paid users. As of the first quarter of 2024, there are 388 million free users and 239 million paid users. These numbers are only partial. Few days ago.

In our view, this ‘free’ pool is a large, existing base for further potential growth for the company. As the value proposition for SPOT subscriptions improves, we expect many of these free users to upgrade, providing a lower CAC tailwind to profitability.

Overall, SPOT appears to be an audio content powerhouse with very strong tailwinds that will drive further growth and significant profitability in the coming years.

How much is Spotify stock worth?

So the company appears to be well-positioned for the future. But how much is the market charging for the opportunity to own a stock?

Surprisingly, SPOT stock doesn’t seem that expensive.

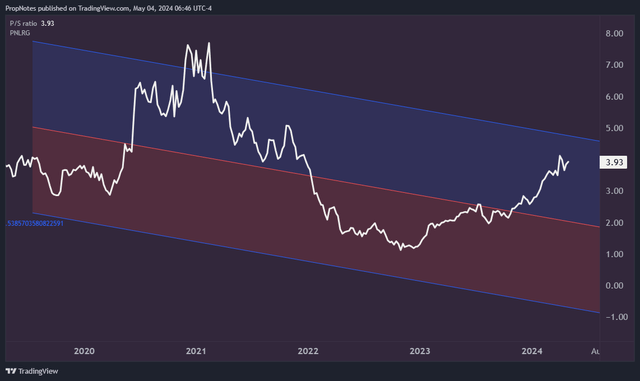

Even after the recent 300% rise in its stock price, SPOT is still trading at roughly 4x sales.

TradingView

As you can see above, it’s not ‘cheap’ from a historical perspective, but it’s also not incredibly expensive or trading above the upper linear regression band.

Looking at it another way, and taking future growth into account, SPOT stock appears to be ‘considerable value’ given its average sales multiple over the past 3.4 years.

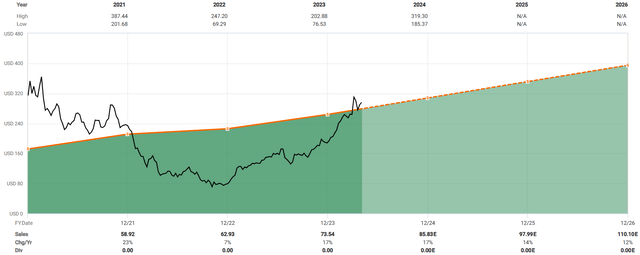

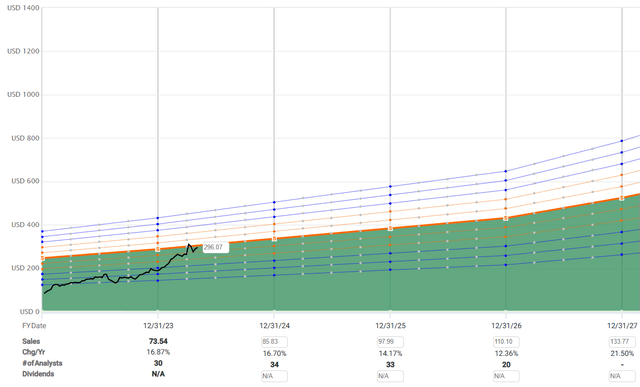

quick graph

Plugging in the blended rolling two-year P/S average of 3.92 over the past few years gives us a one-year fair value between $324 and $396.

quick graph

Although this range is large, it represents significant upside compared to where it closed Friday at around $296.

Plus, at this price, you can expect to be fully involved in the business from an organic perspective. As discussed, earnings are expected to grow significantly, so this could lead to annual returns in the high teens/low 20s over the next few years, assuming stable multiples.

danger

There are several risks to our paper.

The first risk is competition from Alphabet.

The Apple Music/Spotify rivalry has largely been done to end things as is, but a new market entrant in the form of YouTube Music could shake things up considerably.

Many of your Spotify users are likely to also use YouTube, as each has a large user base. As a result, as YouTube Music becomes more and more pushed forward, many people may try to switch to the fledgling music industry. The benefit of having both video and audio content within one platform can be an attractive value proposition for users who want to pay for just one subscription. This can increase churn, slow revenue growth, and hinder GI growth.

We believe the risk here is somewhat ameliorated by the high switching costs that would require significant effort to recreate libraries on other platforms. But we may underestimate this threat.

There may also be a risk that SPOT will reach market saturation sooner or later. With over 600 million users as of a week ago, the platform has already reached 7% of the world’s population, many of whom can support purchasing music subscription plans indefinitely.

Populations in Southeast Asia, Africa, Latin America, and other regions may not be able to support SPOT’s adjusted prices.

In other words, as GDP per capita increases globally, it is expected that a significant portion of the Second and Third World populations will prefer SPOT products in the long term.

summary

Overall, SPOT appears to be a tremendous opportunity in the current market. The stock price appears fair, but with a strong recurring value proposition, high stickiness, strong market position, and massive global demand for audio content, we believe SPOT has a clear opportunity to substantially outperform the market over the next few years.

Therefore, we present a ‘strong buy’ investment opinion.

Cheers!