Elliot Wave Impulse – Guide – Analysis and Forecast – May 6, 2024

that much Elliott Wave Impulse This is a pattern confirmed in . Elliott Wave Theory, a form of technical analysis used to analyze financial market cycles. that much impulse wave It is considered the strongest and most powerful part of the Elliott Wave cycle because it indicates the fundamental direction of the market trend.

What is Elliott Wave Impulse?

Elliot Wave Impulse consists of: three tide It is a movement in the direction of the overall trend. These waves are labeled Waves. One, threeand 5. This indicates major directional movement in the market, whether it is an upward or downward trend.

Now the core idea of our strategy is to start trading when the trade starts. wave 3 Because it is the longest and strongest wave on Earth. Elliott Wave Impulse pattern. wave 3 They tend to offer significant profit potential. Because it shows the greatest drive and confidence from traders.

Examples include:

How do I set take profit and stop loss levels?

If you receive an entry signal at the start of wave 3:

1- Set the horizontal stop loss level. When wave 1 begins.

2- Set the horizontal take profit level. When wave 1 ends, wave 2 begins.

Examples include:

What is your risk-to-reward ratio?

after wave 3 my Elliott Wave Impulse The pattern is the longest and strongest wave, so it usually yields incredible returns! The profit potential is huge, especially if you trade on higher time frames like H1 and H4!

Below is an example of using a strategy using gold during H4. That single item trade gives us 2,400 pips!

What is the recommended time period for this strategy?

The Elliot Wave Impulse strategy can work on any time frame as long as it uses trade confluence with other technical analysis to confirm trades. At higher time frames, the strategy can be used as follows: standalone This is confirmed due to accurate information.

Our own recommendation is to start with: M15 Periods for intraday traders and M30 For day traders.

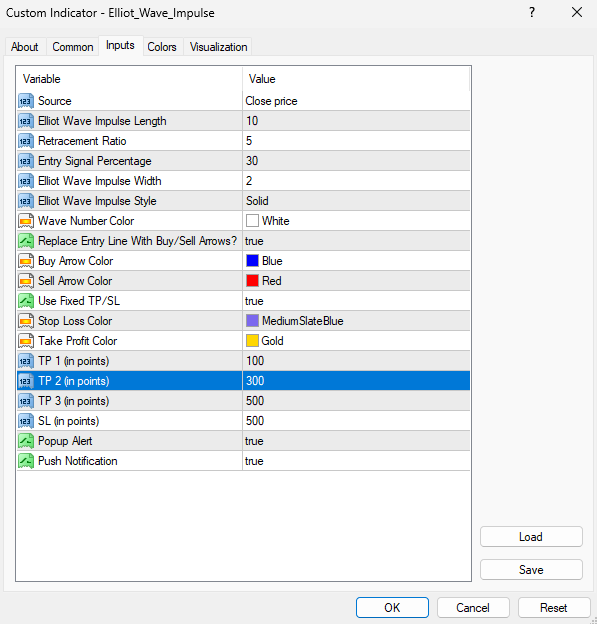

Elliott Wave Impulse Parameter Description

- Elliott Wave Shock Length: 10 // Minimum number length of all Elliot Wave Impulse waves. You can lower this number if you want more transactions/alerts, but this will also result in more false signals. If you want to reduce the number of transactions/alerts but increase accuracy, you can keep the number high. Basically, 10 Perfect balance for any period.

- Retracement Rate: 5 // This is a number that automatically adjusts the rate to have exactly the same retracement rate. This doesn’t need to be changed or tested.

- Entry Signal Percentage: 30 // When a secondary wave is formed, the entry signal appears after a 30% reversal of the secondary wave. These numbers may change. The higher the number, the more precise the signal. If the number is low, there may be a lot of false signals.

- Elliott Wave Impulse Width: 2 // This is the linewidth of Elliott waves. For visual purposes, you can change this number between 1 and 4.

- Elliot Wave Impulse Style: Solid // There are 5 options to choose from: This is the style of the Elliot Waves line.

- femaleave number color: white // When a wave is formed, numbers are automatically printed. You can change the color as you like.

- Do you want to change the entry line to a buy/sell arrow?: true // When a new signal appears at the beginning of the third wave, you have the option to visually see the arrow (buy or sell) or the entry horizon.

- Buy Arrow Color: Blue // You can change the color of the buy arrow when a buy signal appears.

- Sales Arrow Color: Red // You can change the color of the sell arrow when a sell signal appears.

- Enable static TP/SL: true // If true, this option provides a visual representation of take profit and stop loss levels.

- Stop Loss Color: MediumSlateBlue // When a stop loss occurs in real time, the level is visually displayed in the corresponding color.

- Take Profit Color: Gold // In real time, when a Take Profit level is reached, the level is visually indicated in the corresponding color.

- TP 1 (points): 100 // Your first Take Profit level is points. 100 = 10 pips.

- TP 2 (points): 300 // Second take profit level (points). 300 = 30 pips.

- TP 3 (points): 500 // This is the third take profit level (points). 500 = 50 pips.

- SL(Points): 500 // Your stop loss level (points). 500 = 50 pips.

- Popup warning: True // When a new signal appears, a notification will be sent to your MT4 terminal.

- Push Notifications: The Facts // When a new signal appears, a notification will be sent to the MT4 application on your phone.

💡How to enable notifications in MetaTrader 4 phone app?

Tools –> Options –> Notifications –> Check Enable Push Notifications –> Check Transaction Notifications –> Enter MetaQuotes ID –> Click OK.

How do I use confluence with other indicators?

If you want a very good combination Elliott Wave ImpulseIt is recommended to use it in conjunction with another indicator called . katana. katana Use moving averages to detect current trends. Here is a very good example of how to combine two indicators to start trading! If you purchased Elliot Wave Impulse, please contact us privately to receive the following benefits: katana for free!

If you have any questions, don’t hesitate to send us a private message via MQL5!