Why the Fed must cut interest rates before the inflation target is achieved

Daniel Grizelj/DigitalVision via Getty Images

The Federal Reserve holds the federal funds rate as one of its main tools for managing the inflation rate. The purpose of this tool is to encourage borrowers to borrow money if they want to borrow money. Lowering interest rates, or increasing the cost of money, reduces demand for borrowers. When the Fed tries to lower inflation, its ultimate goal is to reduce the growth rate of total debt. Because we have a debt-based monetary system, the inflation resulting from money growth is simply the rate of increase in total debt per capita.

There is an important check and balance to this tool and that is the interest cost associated with higher interest rates. As the Federal Reserve raises interest rates to reduce inflation to meet its target. At 2%, the economy as a whole would be dealing with much higher interest costs.

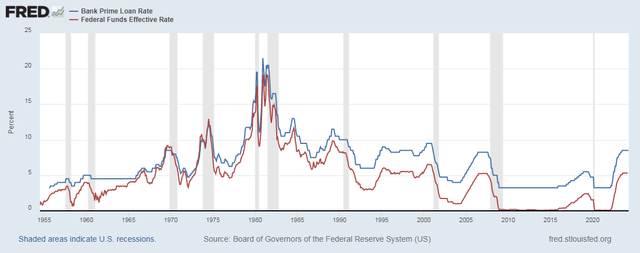

Preferential interest rate vs. federal funds rate

To illustrate these checks and balances, I like to use the prime rate, which is the interest rate that banks charge their best customers. Currently it is 8.5%. The federal funds rate is 5.33%.

Below is a chart of these two interest rates dating back to 1955.

Prime Rate and Federal Funds Rate (St. Louis Fed FRED)

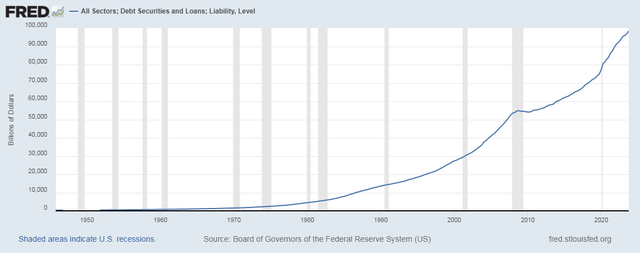

debt

As of the fourth quarter of 2023, the total debt of the U.S. economy stands at $98.37 trillion. This includes personal debt, business debt, and government debt. Below is a chart of total debt figures.

total debt (St. Louis Fed FRED)

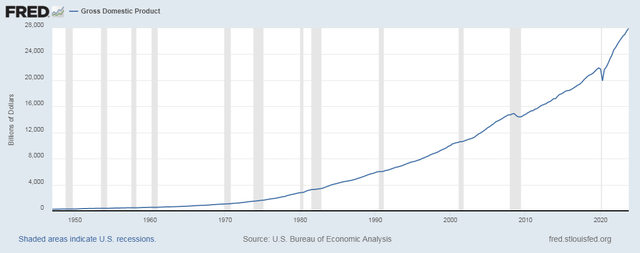

US Economy – GDP

As of the fourth quarter of 2023, U.S. GDP was $27.957 trillion.

US GDP (St. Louis Fed FRED)

Our economy has a GDP of $27.957 trillion and a total debt level of $98.37 trillion, a debt-to-GDP ratio of about 3.5 times.

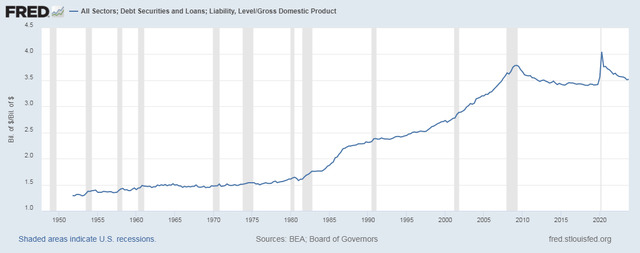

The historical ratio of debt to GDP is:

Debt to GDP ratio (St. Louis Fed FRED)

Debt to GDP ratio

Simply put, it’s good to get an idea of how the prime rate interest costs compare as a percentage of GDP.

What I will do is apply the prime rate to the entire outstanding debt to get the total interest cost as if the entire outstanding debt had been loaned at the prime rate. Let’s then look at what those costs are as a percentage of GDP.

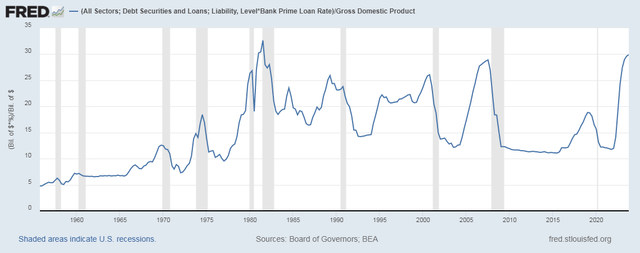

Debt to GDP ratio (St. Louis Fed FRED)

In the fourth quarter of 2023, this exercise shows a hypothetical interest expense of $8.242 trillion at a prime rate of 8.5% and $98.37 trillion in outstanding balances. This is equivalent to approximately 29.9% of GDP.

What gives this exercise justice is that we’ve only ever been at this level once in history, using the same metrics. This was in the third quarter of 1981 when it reached 32.65%.

What’s also worth noting is that whenever this indicator spikes like this, the federal funds rate is about to crash.

inflation

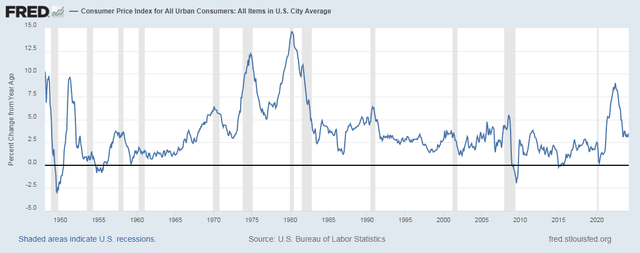

As of March, inflation is showing a year-on-year rise at 3.48%, well above the target of 2%.

Here is a long-term chart of inflation rates.

inflation (St. Louis Fed FRED)

Recently, inflation peaked at nearly 9% in June 2022 and then began to decline until around the summer of 2023, before rebounding in the 3.0-3.5% range. This is a concern because the Fed was hoping to have already hit its 2% inflation target by now.

Productivity – Cost Table

Inflation has two components that affect inflation.

1. Per capita total debt growth rate

2. Enter cost or cost table

Too much attention is focused on the Federal Reserve trying to control inflation. Too little attention is paid to the cost tags of all aspects of the U.S. economy.

A huge driver of cost savings comes from productivity resulting from improved cost sheets.

Over the past five years, many improvements have been made in terms of cost savings. For example, many workers are now working from home, which helps cut down on transportation costs and the cost of commuting to work. Another example is AI improvements for white-collar work.

At the same time, the war and the significant influx of asylum seekers added to government funding were simply major input costs, which would not necessarily improve the cost sheet and could be a source of inflation. The higher the interest rate, the higher your interest costs, which also add to the cost sheet of the goods and services you buy with borrowed money.

conclusion

The Fed has been very successful in lowering the inflation rate from its 2022 high. However, the 2% point appears to be difficult to reach. There will be much more time before rates need to be cut again, as the longer interest rates remain high again, the greater the unintended economic damage could be.

The geopolitical environment continues to become more uncertain, and war has always been a major driver of inflation.

Inflation will continue to be driven by the input cost crisis, and the Fed will be much more powerless to affect it.

Expectations that inflation will fall to 2% are low. It is much more likely that the Fed will have to cut interest rates before it reaches its 2% inflation target. An interest rate cut is expected in the second half of 2024.

Our best hope for lowering inflation is to better manage the cost tables of every American business, every American household, and every American government agency.