RISR: Alternative Income ETF, high yield of 6.8%, very low credit and interest rate risk.

photo techno

Maintaining our coverage of short-term and floating rate funds, the FolioBeyond Alternative Income and Interest Rate Hedge ETF (NYSEARCA:NYSEARCA:RISR). RISR invests in traditional mortgage-backed securities (MBS) and interest. Just MBS. Both securities offer good returns ranging from 6.0% to 8.0%, with the fund’s own return being 6.8%. Since we only invest in AAA-rated MBS, our credit risk is very low. Since the duration of an interest-only MBS is negative, the fund’s duration is negative.

In my opinion, RISR’s good 6.8% yield, very low credit and interest rate risk make this fund a buy. The fund’s key differentiator is its negative duration, making it particularly suitable for portfolio hedgers or hawkish investors.

RISR – Basic

- Investment Manager: FolioBeyond

- Expense Ratio: 1.13%

- Dividend Yield: 6.79%

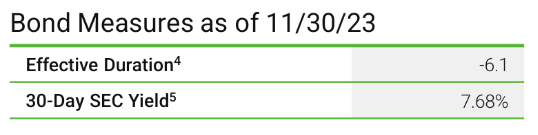

- Period: -6.10 years

- Total Return CAGR (start): 21.29%

RISR – Holdings and Strategy

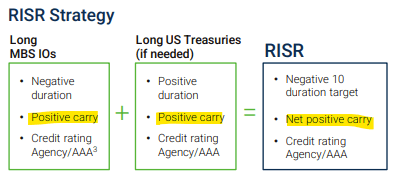

RISR has a fantastic investment pitchbook that simply explains the fund’s strategy, features and benefits. I will explain the fund myself, but I recommend you read about it through Pitchbook.

RISR has two main goals: generating income and protecting against rising interest rates.

Income is generated through investments in MBS, which are bundles of mortgages. The homeowner pays the mortgage and the investor in the MBS receives the payment (the process is more complicated, but close enough).

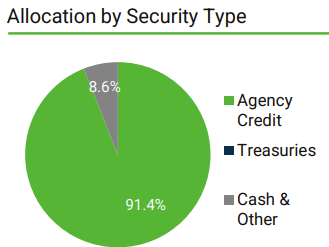

MBS currently make up more than 90% of the fund’s portfolio, with cash and other short-term securities making up the remainder.

RISR

The fund is protected from rising interest rates by investing only in MBS. Investors in this security Only You receive the interest rate portion of that mortgage payment.

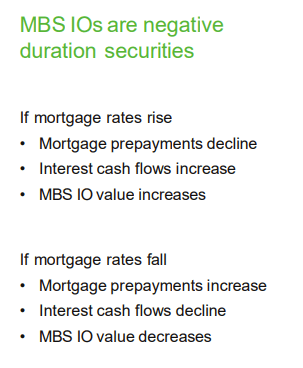

Prepayments tend to damage these funds as homeowners stop lending. interest You pay it when you prepay your mortgage (the prepayment is pure principal). When interest rates fall, down payments tend to increase because homeowners refinance their mortgages at lower interest rates. As a result, interest-only MBS prices and income fall when interest rates fall. On the other hand, interest-only MBS earn higher prices and earnings when interest rates rise due to lower upfront payments. According to the fund:

RISR

It took me some time to understand the above process, but as you can see from the negative duration of RISR, it makes sense and works as expected.

RISR

RISR’s holdings and strategies benefit investors in several important ways. Let’s take a look at these.

RISR – Benefits and Advantages

good dividends

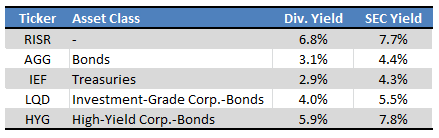

The Federal Reserve’s interest rate hike has caused mortgage rates to rise sharply, with the benchmark 30-year rate reaching 8.0% last week. Because RISR focuses on mortgage-backed securities, the fund’s income and yields are indirectly tied to these higher mortgage rates. RISR’s current yield is 6.8% and its monthly SEC yield is 7.7%. Both are reasonably good numbers and above average. High-yield corporate bonds yield more, as do more niche income-producing securities, including BDCs and mREITs.

Fund Reports – Table by Author

As an aside, the Fund sometimes describes these positions as follows: Positive Carry refers to the positive expected return (by holding this position). Carry is important for some niche investments and strategies, such as commodity futures. Because sometimes there are hidden costs. That doesn’t seem to be the case with RISR, according to fund executives.

RISR

low risk

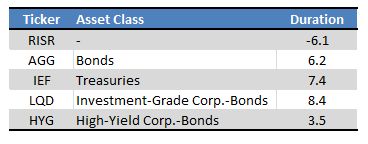

RISR invests in positive securities. and Negative period. The result is a fund with the following periods: negative 6.1 years. Since the above numbers are very close to zero, the overall interest rate risk is quite low and below average.

Fund Reports – Table by Author

The duration of RISR is negative, contrary to most bond funds, the fund’s price tends to rise as interest rates rise. If interest rates rise, as they have since early 2022, expect sizable returns and outstanding performance.

The opposite is also true, and if interest rates fall, the fund will suffer significant losses and underperformance. Diminish.

In my opinion, the duration of RISR is negative Neither positive nor negative. The fact that it lasts lowOn the other hand, it is definitely a positive as far as reducing portfolio risk and volatility is concerned.

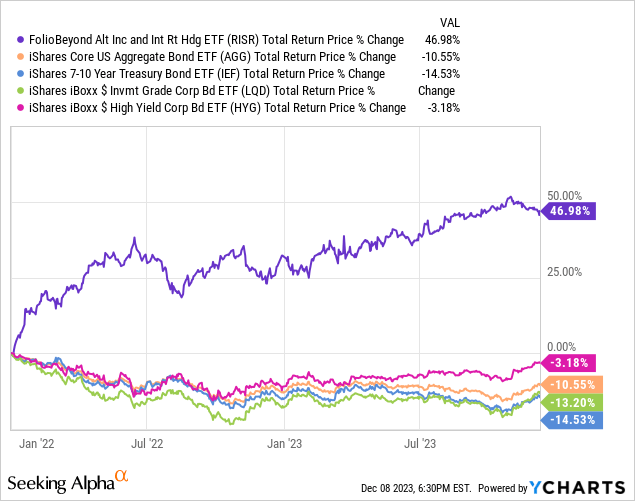

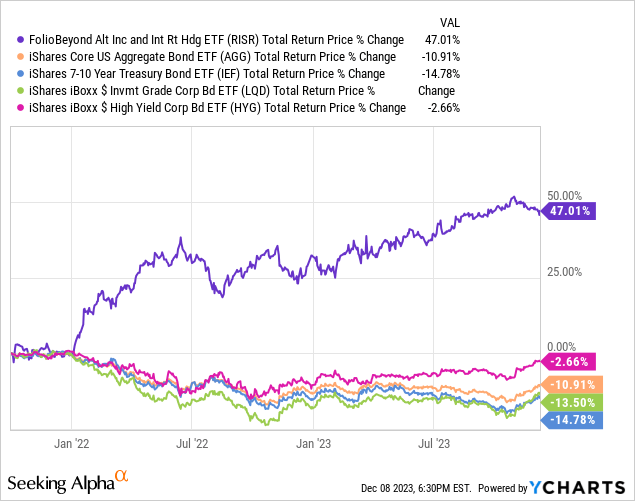

Strong performance track record

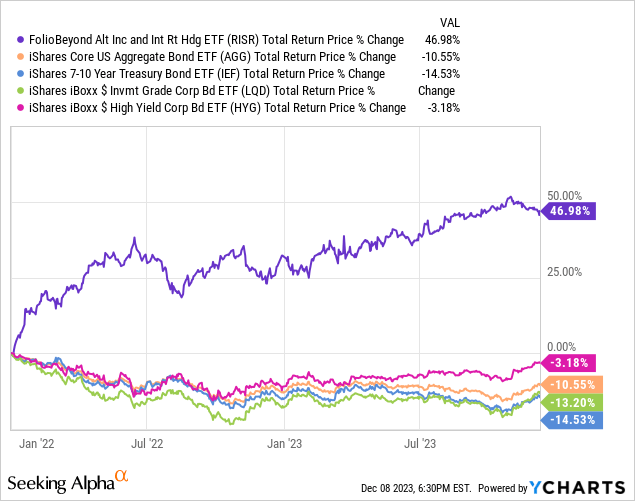

RISR’s performance record is outstanding, and the fund has significantly outperformed most bonds and bond sub-asset classes over most relevant periods since inception.

RISR’s returns and outperformance are due to the fund’s negative duration and significant Federal Reserve (Fed) hikes. It is highly unlikely that the fund will perform that well long termHowever, much will depend on future Fed policy and each investor’s investment horizon.

RISR – Key Differentiator

RISR’s good dividends, low interest rate risk, and strong performance record are all important advantages for the fund and its shareholders. These are also Common This is a benefit shared with many securities and funds. I’ve covered dozens of them over several months, including a focus on high-quality CLO tranches, senior loans, and various floating rate securities. Although the details vary, these funds have many similarities and their value propositions are broadly similar.

Considering the above, it would be a good idea to look at the keys of RISR. differentiator: What differentiates it from other bond funds with short duration. This fund’s negative duration and strong carry power stand out. Let’s take a look at these.

negative period

Most short-term and floating rate funds low It lasts a long time and is difficult. low Rising interest rates result in capital losses. RISR is negative period, so see positive gain When rates increase. Because of this, RISR tends to significantly outperform other short-term and floating rate funds when interest rates rise, as they have since early 2022.

In my opinion, the negative duration of RISR can be exploited in two main ways.

First, bond and bond fund investors can use RISR to hedge the interest rate risk in their portfolios. For example, investing in the iShares Core US Aggregate Bond ETF (AGG) or the iShares 20+ Year Treasury Bond ETF (TLT) carries significant interest rate risk. Invest in TLT and RISR is many Interest rate risk is low. Investors can shorten the period by adjusting their portfolio weights. zero also.

Second, hawkish investors can use the fund to (potentially) benefit from higher interest rates. RISR’s revenue is very They have been strong since the Federal Reserve started raising interest rates, and they could continue to strengthen if rates stay high for longer. Which brings me to the next point.

good carry

Some interest rate hedges include: negative Because you carry it around, it is expensive to store. This includes most short-term Treasury ETFs and most that use interest rate options or derivatives. Negative carry implies negative long-term expected returns, but short-term returns are still largely dependent on interest rate movements.

On the other hand, RISR Positive By holding them, investors can benefit from higher interest rates and receive good dividends. without Excessive costs occur. This makes RISRs a much stronger long-term investment opportunity than most other interest rate hedged securities and ETFs. That said, I feel much more comfortable investing long-term in RISR than I do the ProShares Short 20+ Year Treasury ETF (TBF) or the Simplify Interest Rate Hedge ETF (PFIX).

conclusion

RISR’s excellent 6.8% yield and very low credit and interest rate risk make the fund a buy. The fund’s key differentiator is its negative duration, making it particularly suitable for portfolio hedgers or hawkish investors.