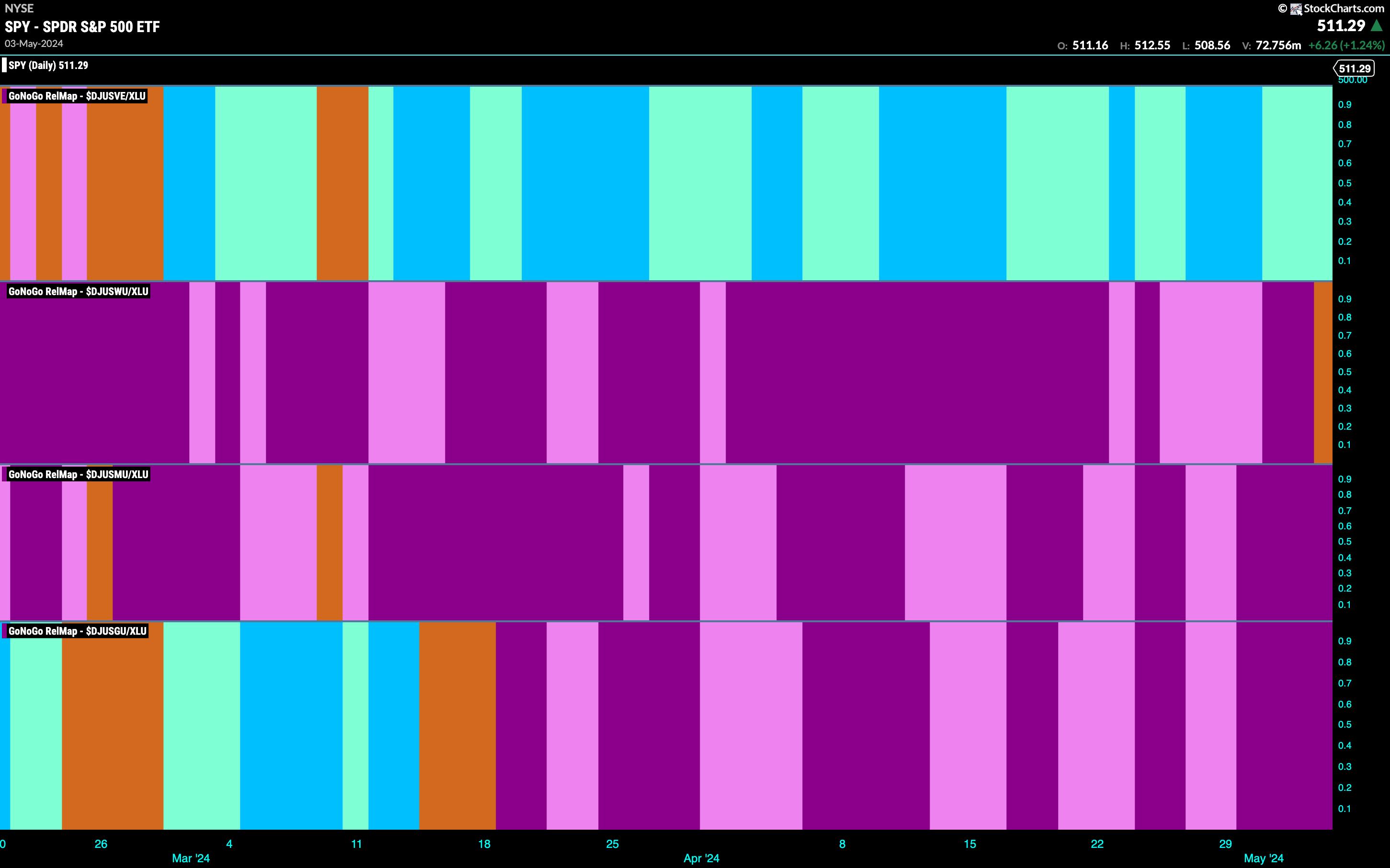

Defense works to help stocks fall to low levels | GoNoGo Chart

good morning. Welcome to this week’s Flight Path. The stock “NoGo” trend suffered this week as prices rose from their lows. An orange “Go Fish” bar is displayed as the market attempts to understand the trend. The GoNoGo trend paints a pink “NoGo” bar for Treasury prices, while commodity prices enter a period of uncertainty with consecutive yellow “Go Fish” bars. The dollar is currently the only asset in a “Go” trend as we see indicators drawing weak aqua bars. There is a lot of uncertainty this week!

Market with uncertain stock trends

The “NoGo” trend turned into an amber “Go Fish” bar at the end of the trading week. We know that the amber bars are painted because the GoNoGo trend indicator does not have enough criteria being met behind the scenes to identify a trend in either the Go or NoGo direction. Adding to the feeling of uncertainty are the candles themselves. A doji candle is when the open and close prices are the same or very close, which is what we saw on Friday. There was no clear winner between the bulls and bears. If so, if you look at the oscillator panel you can see that the GoNoGo oscillator is riding the zero line and Max GoNoGo Squeeze is actually running. This is a visual representation of the tug-of-war between buyers and sellers at this level. We’ll be watching closely to see which way Squeeze breaks. This will help determine price direction.

The larger weekly chart shows that we are at an inflection point here too. A fourth straight weak aqua “high” bar emerged as the price appears to have hit a new low. The GoNoGo Oscillator crashed above last month to test the zero line, and we’ll see if it supports it here. If so, you can see signs of a continuation of the trend on the price chart. A drop below the 0 line signals a further adjustment.

Interest rates fall after consolidation

Throughout this week, the GoNoGo trend has been drawing weak aqua “Go” bars as the price falls from its most recent highs. Looking at the oscillator panel, we can see that the GoNoGo oscillator has not found support at that level. As it enters the bearish zone, we can say that the momentum has not kept pace with the “Go” trend and we will wait and see if it falls further into the bearish zone. If so, you can see the trend change above. A rally back to the zero line is likely to continue the “Go” trend in the near term.

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis, removing emotional bias from investment decisions. Tyler has served as Executive Director of the CMT Association for over 10 years to advance investor proficiency and skill in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software developer. For the past 15 years, Alex has led technical analytics and data visualization teams, directing business strategy and product development of analytics tools for investment professionals. Alex has created and implemented training programs for large corporations and individual clients. His classes cover a wide range of technical analysis topics, from introductory to advanced trading strategies. Learn more