Will we see a rate cut in 2024? Comments from Federal Reserve Presidents

Last week, the Federal Open Market Committee (FOMC) decided to take no action on the federal funds rate, which has remained in the 5.25-5.5% range since July of last year.

Federal Reserve Chairman Jerome Powell did not offer more than a general response, but said it was unlikely the next step would be a rate hike.

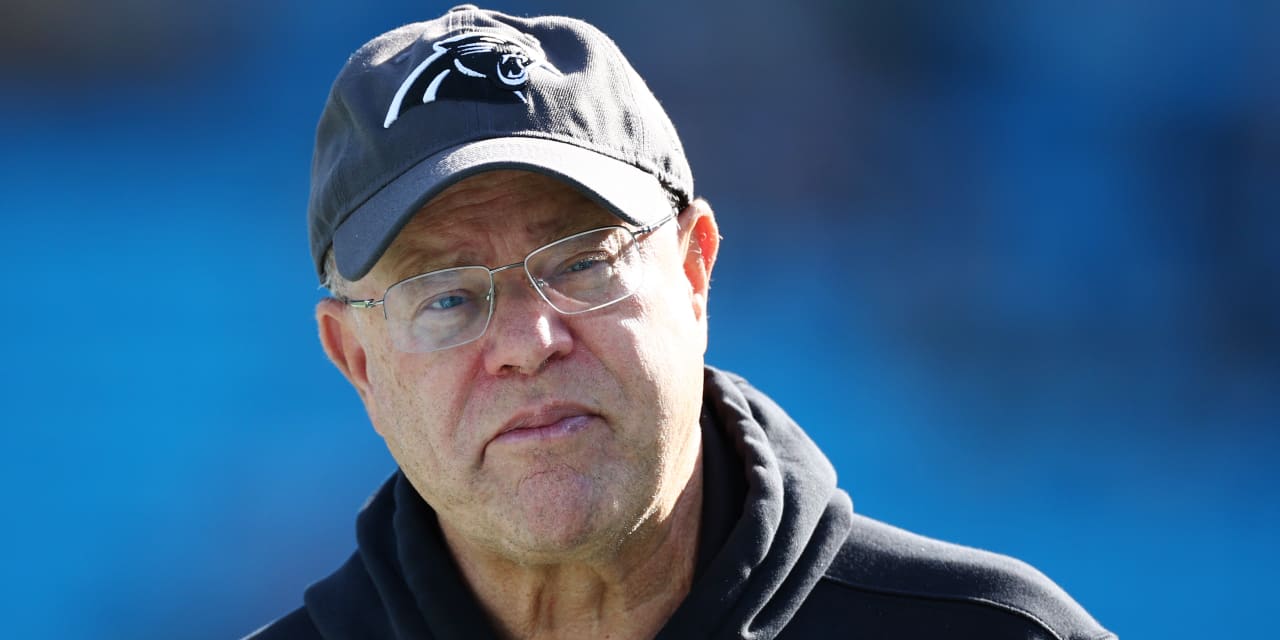

Over the next few days, several Federal Reserve chairs and FOMC members spoke publicly and offered insight at various events. Two of them, New York Fed President John Williams and Minneapolis Fed President Neel Kashkari, spoke this week at the Milken Institute Global Conference in Los Angeles.

Answers to questions about the trajectory of interest rates and the state of monetary policy can shed some light on where things are headed.

The policy is in a good position

Williams, who is now at the FOMC, told the Milken Conference on Monday that things are generally moving in the right direction.

“We are seeing the process of restoring a better balance between supply and demand continue,” Williams said. This is critical to returning inflation to the 2% target. “Is our stance on monetary policy appropriate for the situation we face? “I think that’s very true at the moment.”

“We will eventually cut interest rates, but I think policy is in a very good place right now,” Williams added.

So he agreed with the presenter: “Steady as she goes.” He did not provide an estimate for when the rate cut would occur, saying only that the committee would rely on data to guide it and “hopefully we will continue to see progress.”

Most Likely Scenario

At Tuesday’s meeting, Kashkari began his remarks by talking about the “mysterious” nature of what happened in 2023, when inflation rates fell sharply but the economy did not slow, as it usually does.

“It made me ask the question: Is monetary policy putting as much downward pressure on demand as I expected?”

He also wondered whether the Fed had put enough of a brake on monetary policy.

“Perhaps monetary policy just has one foot on the brake rather than both feet,” he said.

Regarding interest rate movements, Kashkari said the most likely scenario is “to stay still for an extended period of time until it becomes clear whether disinflation is actually here to stay.”

If inflation begins to fall again or the labor market weakens noticeably, this could lead to interest rate cuts. But he also said he would need to see multiple reports showing inflation rates falling before lowering interest rates.

Kashkari did not rule out the possibility of raising interest rates. But he said that scenario was the least likely and would only be considered if inflation rose higher and was “stuck” for an extended period of time.

“I think I will if necessary. “It’s not the most likely scenario, but we can’t rule it out.”

Later in the conversation, Kashkari discussed inflation and said his most likely scenario was that inflation could remain flat for some time.

“In that scenario, we as policymakers would say we would have to keep interest rates in place for longer than expected. I think it’s much more likely that we’ll be sitting here longer than expected. “For now, we’re looking forward to it until we see what impact monetary policy has.”

How many times will interest rates be cut in 2024?

Kashkari also responded to questions about the last “dotplot,” or summary of forecasts, from last March, which called for three rate cuts in 2024. Kashkari wrote in March that there would be only two interest rate cuts this year and what to expect in 2020. June will vary depending on data released at that time.

“I could stay around 2 o’clock. It could be 1 or 0,” Kashkari said. “We have to look at the body of data.”

He added that there would be no more than two.

Keep in mind that these are just two voices. Other members of the FOMC have also commented since the last meeting and more are expected this week. In fact, Federal Reserve Vice Chairman Philip Jefferson and Boston Federal Reserve President Susan Collins were scheduled to speak at various events Wednesday.

We will continue to cover what these and other members are saying about interest rates and monetary policy.