Why AerSale stock is so volatile today

Investors liked the results, but questions remain about promising new product lines.

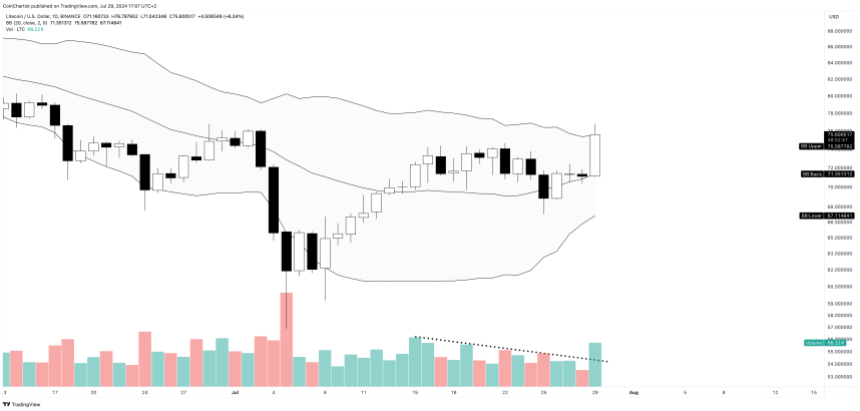

Aircraft parts and systems supplier air sale (ASLE 7.42%) Despite reporting stronger-than-expected quarterly results, the company is yet to report much interest in one of its hottest products. AerSale’s shares initially rose 25% after earnings, before falling back 8% as of 2pm ET on Thursday.

Core sales are strong, but we’re still waiting for AerAware.

AerSale’s core business is maintaining and selling used aircraft, engines and aerospace parts. The company earned $0.11 per share in the quarter on revenue of $90.5 million, beating Wall Street earnings estimates of $0.04 per share and revenue of $85 million, driven by strong demand from airlines looking to utilize more of their existing fleets.

Revenue increased 15% year-over-year, and generally accepted accounting principles (GAAP) net income increased to $6.3 million from $5,000 in the prior-year period.

“We are off to a good start to the first quarter of 2024, driven by higher sales levels driven by increased purchases of feedstock in 2023,” said CEO Nicolas Finazzo. “Our (maintenance, repair and operations) facilities are benefiting from robust demand as airlines operate at high capacity levels.”

However, the company has not reported any sales progress for its AerAware vision system, which is approved for use in certain older countries. boeing A plane at the end of last year. Investors expect AerAware to be a driver of future revenue growth and margin expansion.

AerSale has not yet received initial orders for AerAware, but has offers for five airlines and three others who have expressed some interest.

Is AerSale stock a buy?

The core business is solid, if not stellar, and AerSale has reasonable visibility suggesting the business will continue to deliver stable profits. But for investors, this story is about AerAware, so the lack of revenue won’t be as noticeable.

Finazzo told analysts that he believes the complexity of the product, including the need for pilot training, is to blame for the lack of AerAware orders, not a lack of interest or an issue with pricing.

If he’s right, it’s a problem that can be resolved over time. However, other products are also coming soon that could erode its pricing power or take market share over time.

The jury is still out on that product. For investors, it would be wise to take a closer look at its core components business to determine whether it’s an asset worth owning, regardless of whether AerAware takes off.

Lou Whiteman has no position in any of the stocks mentioned. The Motley Fool participates in and recommends AerSale. The Motley Fool has a disclosure policy.