Three Powerful Financial Stocks Are Poised to Soar | RRG chart

key

gist

- XLF with strong RRG orientation, rotating back to the leading quadrant

- XLF price approaches overhead resistance after brief setback

- The three biggest financial stocks are poised to rally to lift the sector further.

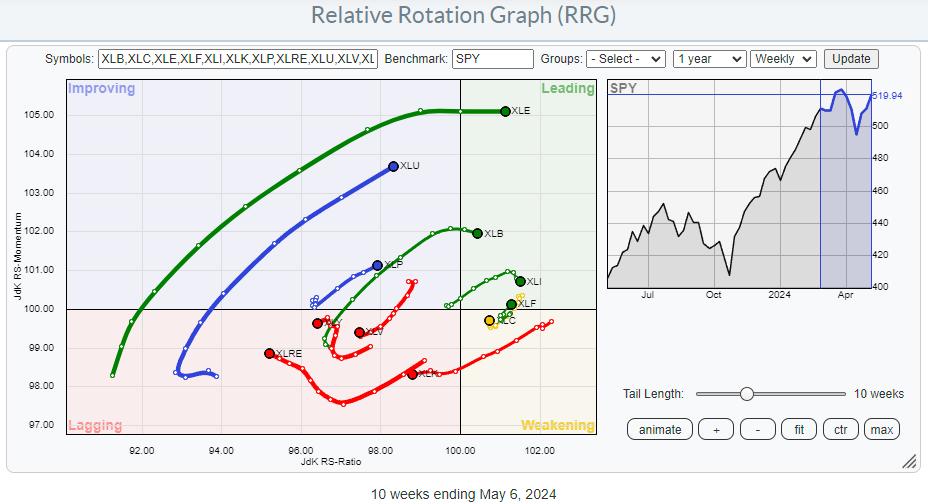

The relative rotation graph for the US sector shows a long tail for XLE and XLU. Both are in strong RRG directions towards or into the leading quadrant. Also inside the leading quadrant are XLB and XLI, but they have rolled over and started to lose relative momentum.

Sectors with a negative RRG direction and inside the lagging quadrant are XLRE,

In this article, I want to focus on the financial sector (XLF). XLF’s tail has completed a short rotation through the weakening quadrant and is now returning to the leading quadrant.

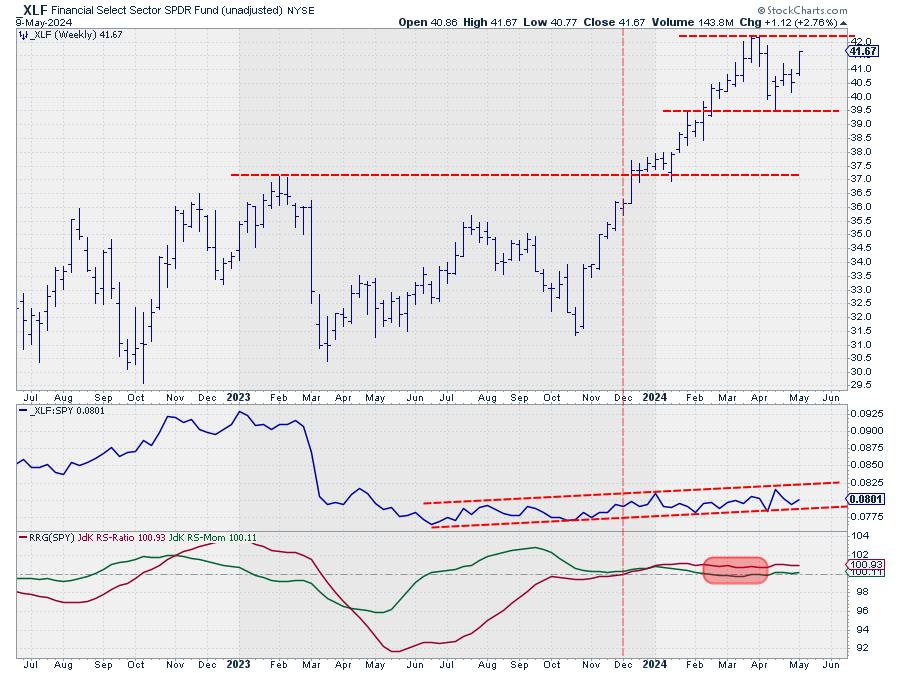

weekly chart

The chart above combined with the RS-Line and RRG-Line shows what is currently happening. At the vertical dotted line, both RRG lines are above the 100 level, pushing the XLF tail into the front quadrant of RRG. In early 2024 the green JdK RS-Momentum line began to overturn and lose some strength, causing the XLF tail to overturn while still within the leading quadrant. At the beginning of the red shaded box, the RS-Momentum line falls below 100. This pushed the XLF tail into the weaker quadrant. The red JdK RS-Ratio line remains above 100. At the end of the shaded box, the RS-Momentum line crosses back above the 100 level, pushing the tail back into the front quadrant.

Looking at the raw RS-line, we can see that it is moving inside a narrow uptrend channel. The period indicated by the shaded area reflects a period of uniform relative strength within that channel, after which the rhythm of higher highs and higher lows continues. This rotation in RRG reflects a continuation of an existing relative uptrend and is therefore much less risky than the transition from a downtrend to an uptrend that occurs on the dotted vertical line.

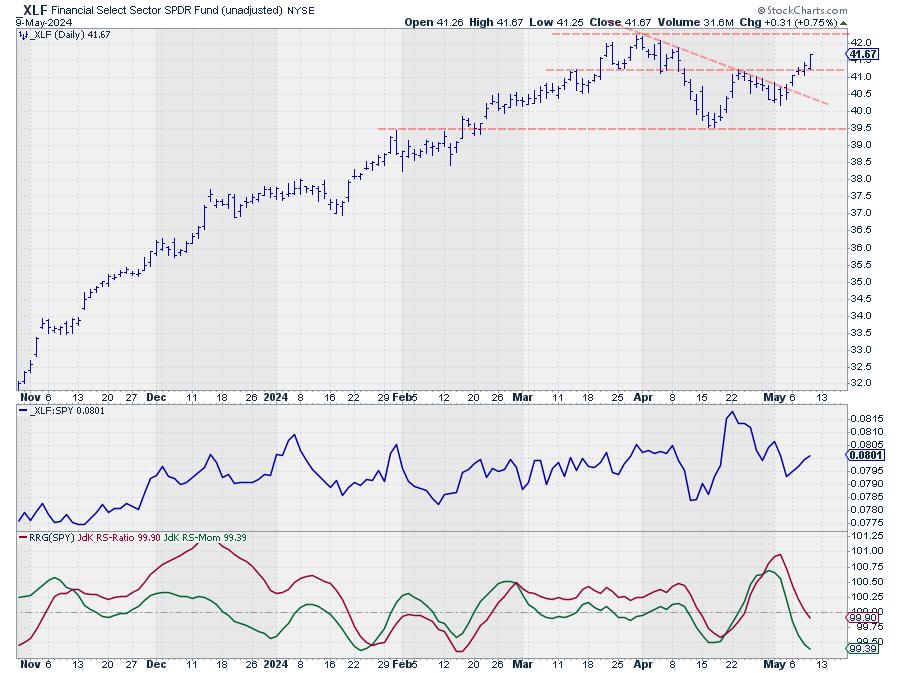

daily chart

The recent decline to 39.50 and the subsequent rally are shown in more detail on the daily chart. This week, XLF hits its most recent high and begins new highs and lows. The next resistance level is 42.20, the all-time high from the end of March. The drop from the all-time high caused a slight correction in relative strength, causing the (daily) RRG line to fall below 100 and the XLF tail to lag the daily RRG.

With the price chart already showing an upward trend again, relative strength is expected to follow soon. Once the daily tails begin to shift back toward the 0-90 degree RRG, we expect XLF’s relative strength to improve further, making it one of the leading sectors of the S&P 500.

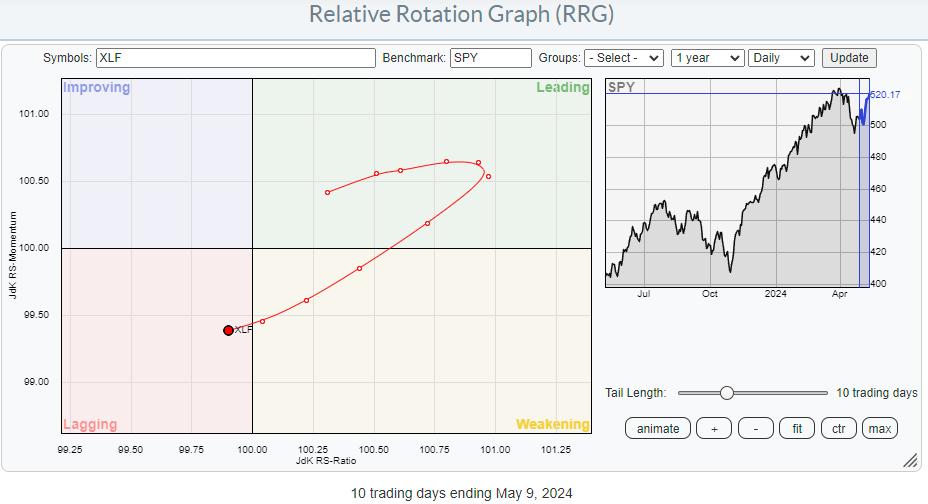

individual stocks

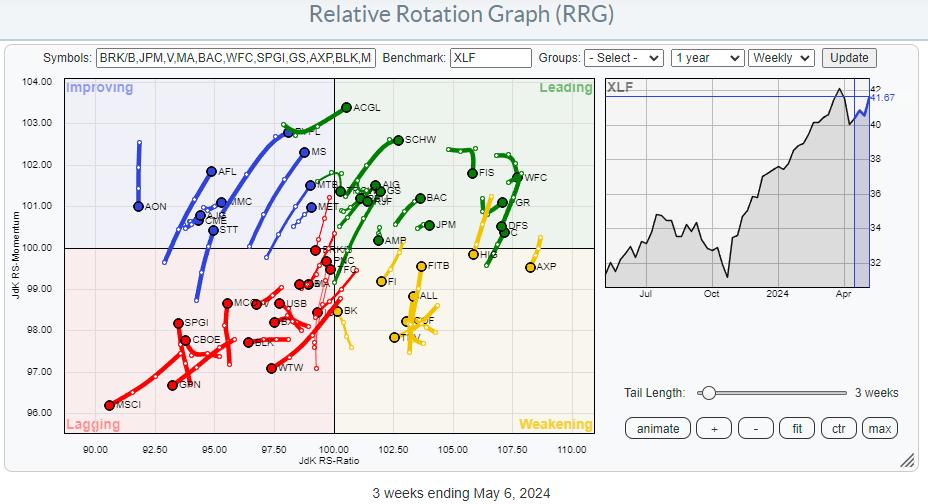

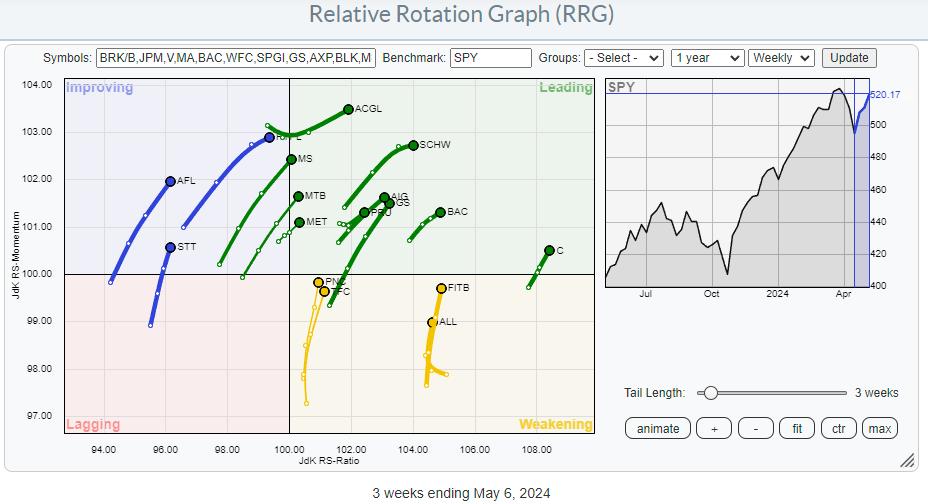

RRGs for individual stocks within the financial sector show an evenly distributed universe around the (XLF) benchmark. As I looked at the tails of individual stocks, I discovered a few names worth taking a closer look at.

This RRG narrows your search for good stocks by showing strong directional tails. As I checked the individual charts, I came across several promising names. The three I’d like to mention here are major names in the sector that are not only on a strong rotation trajectory but also (close to) a breakout.

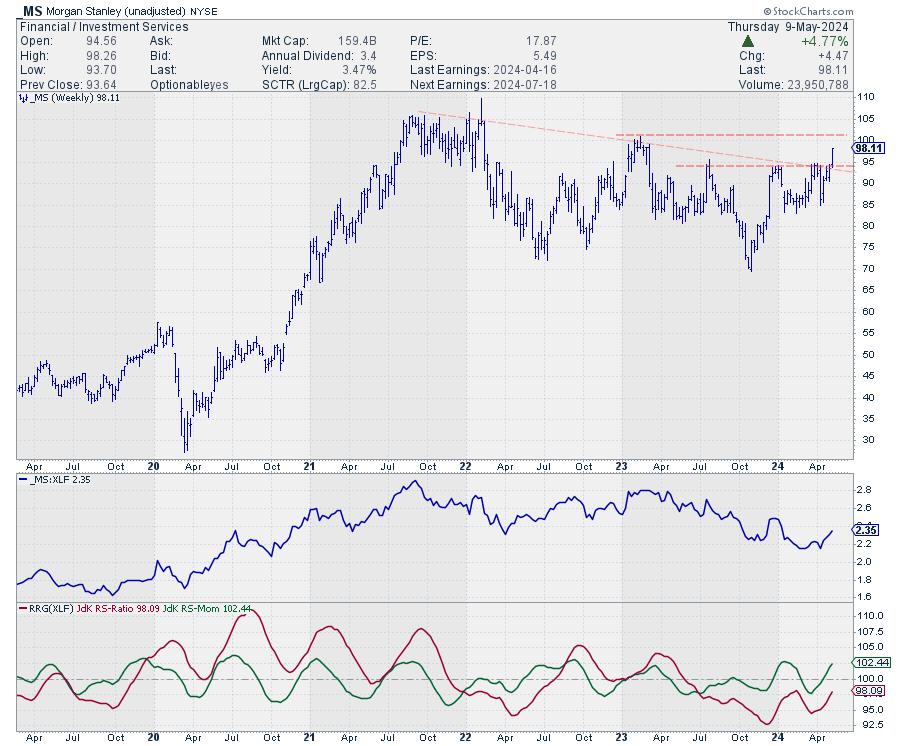

Morgan Stanley

MS is breaking a double resistance line this week as the horizontal barrier to the most recent high coincides with the resistance line falling from the 2021 high. This opens up new upside potential for MS, with intermediate resistance waiting for around 100 before getting closer to the area near the all-time high of 105.

As a result, breaking these barriers will push this stock further into the leading quadrant and make it a leader in its segment.

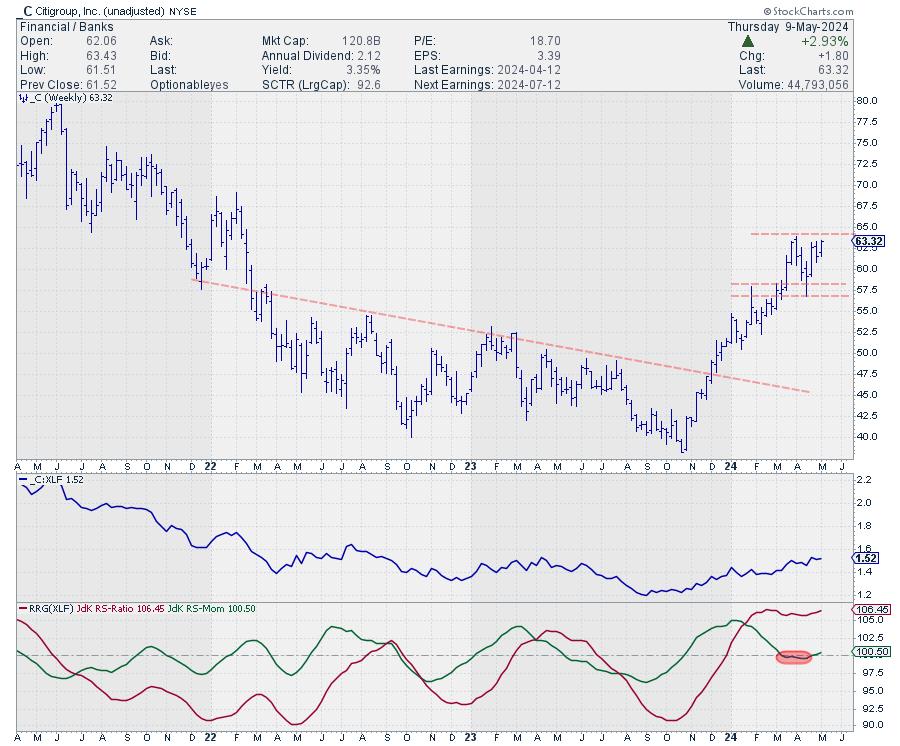

Citigroup

Citigroup is still trading below its previous highs. However, considering the recent rise from lows and the strong rally, there is a high possibility of an upward reversal. This breakout is supported by the recent resumption of relative rotation from the bearish side.

Like MS, C is also one of the biggest names in the financial sector. The strength of the big names is usually what drives the sector higher.

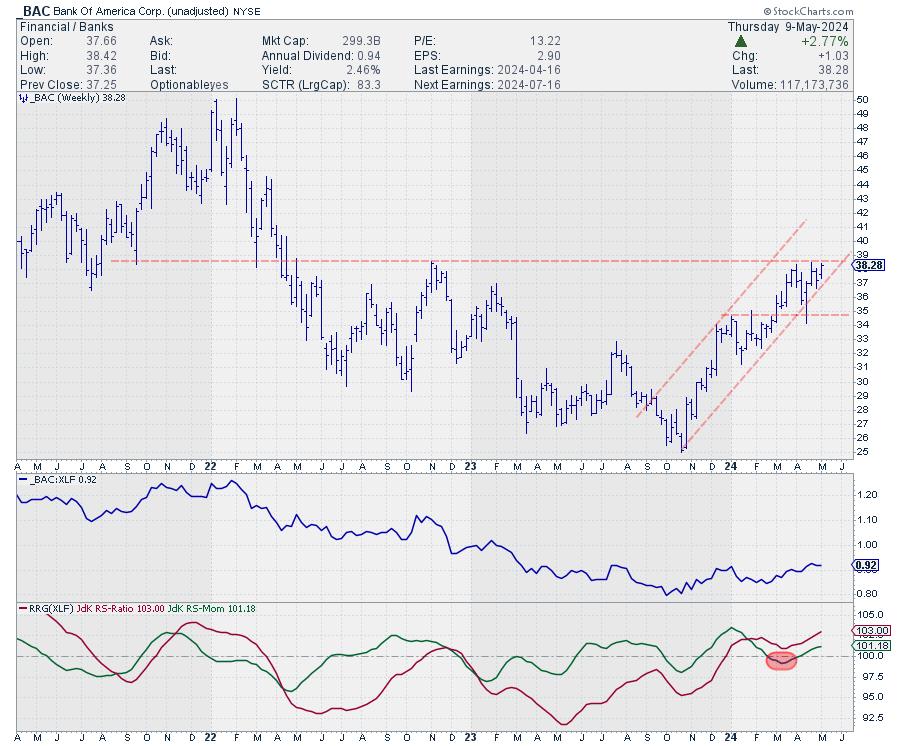

bank of america

BAC is also close to breaking above overhead resistance and there is plenty of upside ahead of it. The relative strength is coming from a long decline that began in early 2022, so this is a major reversal. Removing the barrier of 38 opens the way for further movement towards 50, which is significant. However, contrary to what you might think, this area is not the all-time high for BAC, which was set at around 55 in October 2006.

Like MS and C, BAC is also one of the most important stocks in the financial sector. Another important name in this segment is GS. I did not include GS because it has already risen and is doing well.

When all these important names in a sector start rising, it’s good news for that sector.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG Research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within various securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more