How soon can AVAX reach $100? Deciphering the altcoin rise

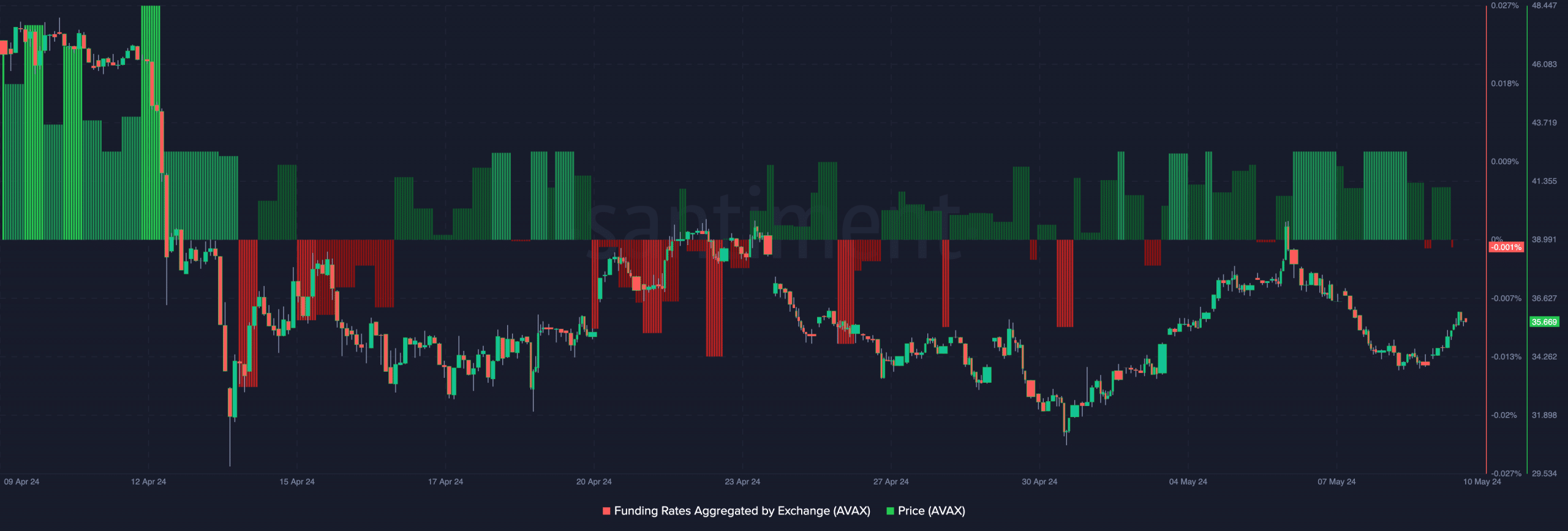

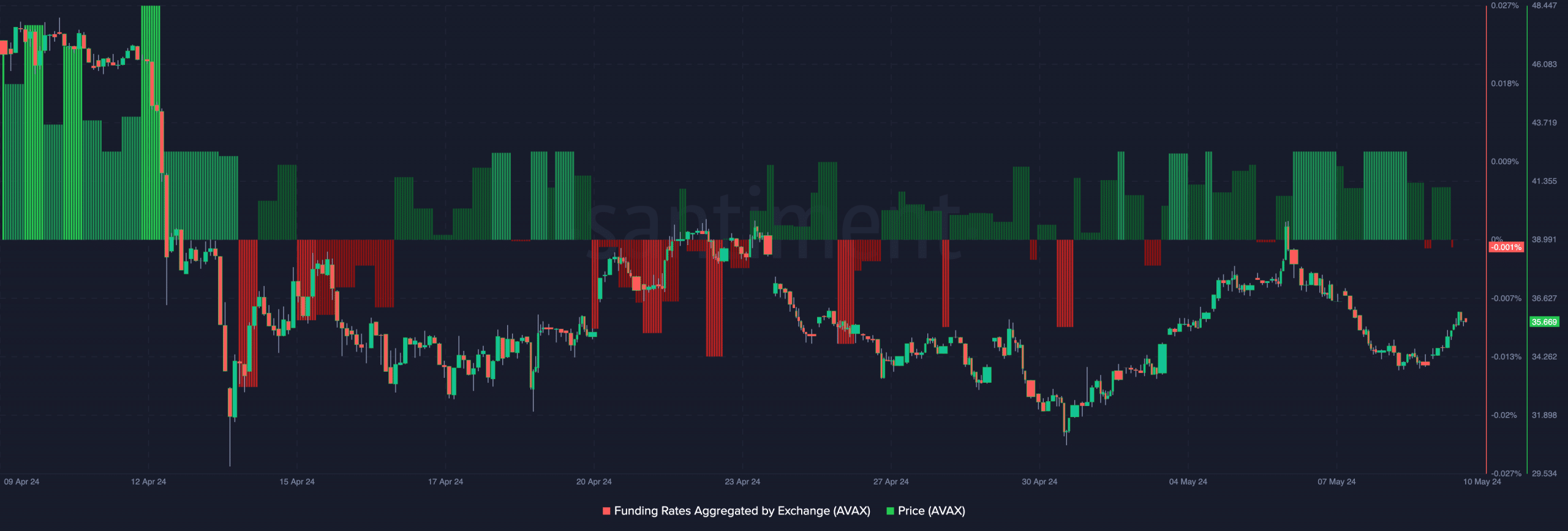

- Data from the derivatives market shows that short selling dominates positions.

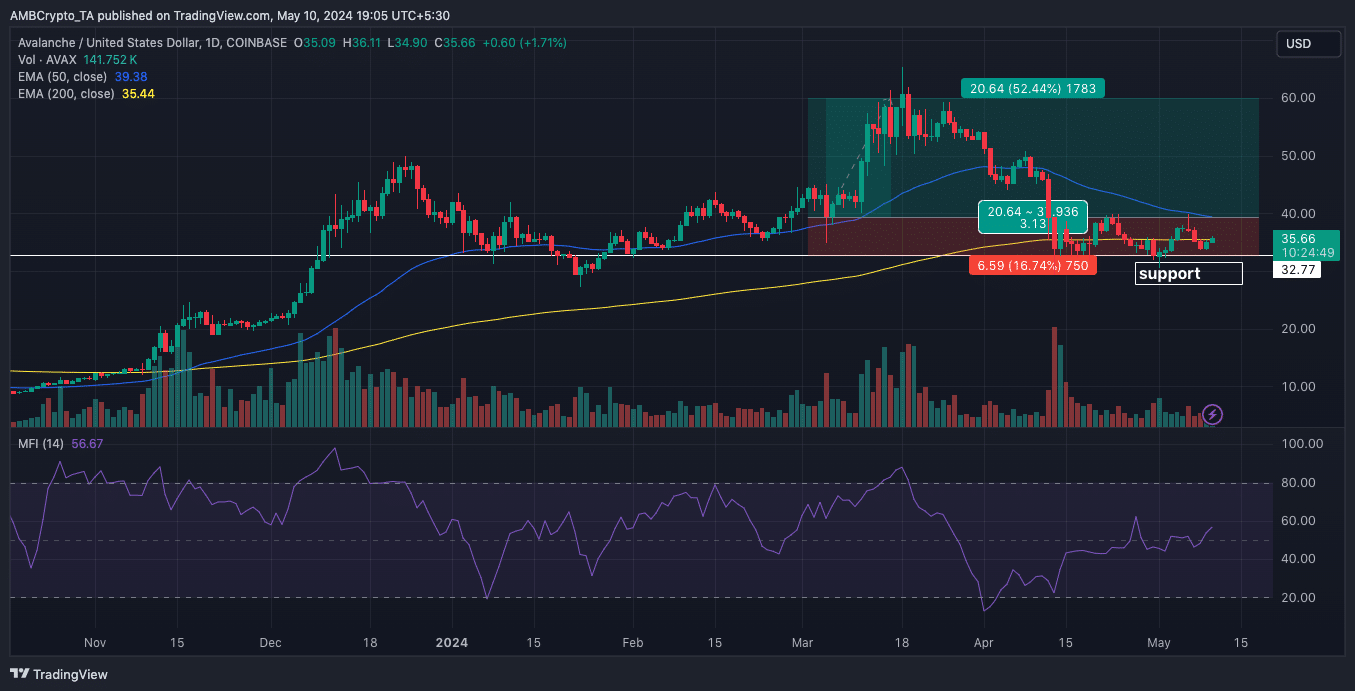

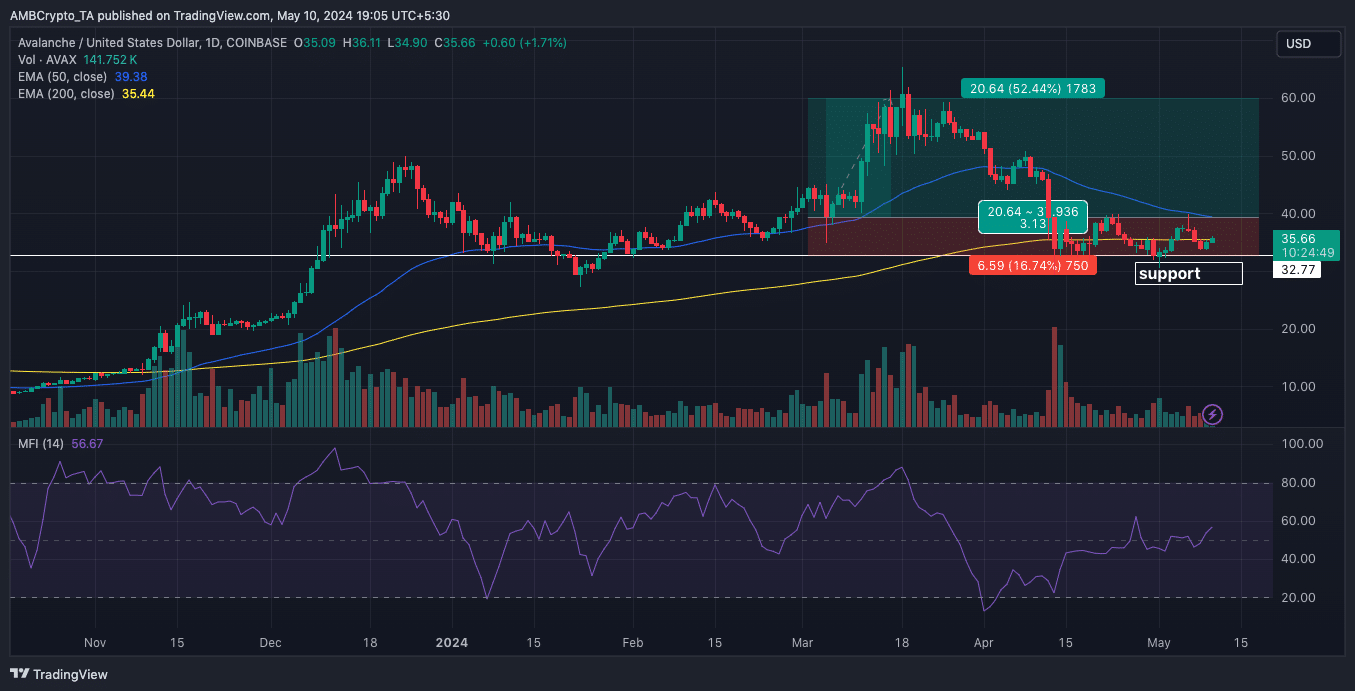

- A golden cross on the daily chart suggested a near-term rise to $60.

The price of Avalanche (AVAX) increased to $35.77, once again sparking speculation that the token could reach $100. The latest increase is 4.30% in 24 hours.

However, this is still nowhere near the $61.90 cap the cryptocurrency reached in March.

Nonetheless, some key indicators have suggested that the token may continue to rise. First, AMBCrypto took the funding rate into consideration.

Funding rate is the cost of maintaining an open position in the derivatives market. A positive funding rate reading means that buyers are paying sellers to maintain their positions.

Trader loses, AVAX gains.

In this case, most bets are tilted towards the bulls. However, negative funding suggests that most traders’ short positions are bearish in anticipation of their long positions.

In context, long refers to a trader who expects the price of an asset to rise. Short selling, on the other hand, is predicting a price decline and hoping to make a profit.

At press time, the exchange’s total funding rate was -0.001%. While AVAX’s price is rising, negative funding means short selling is being aggressive.

Source: Santiment

However, they are not being compensated for their positions. Moreover, the price increase suggests that spot buyers are in an aggressive position, which could be positive for AVAX.

If this indicator holds this way, the cryptocurrency price may attempt to exceed $40 in the near term. On the daily chart, the Money Flow Index (MFI) reading rose.

MFI shows whether capital is flowing into cryptocurrencies. If MFIs maintain their upward trend and traders do not pull liquidity out of AVAX, the price may continue to increase.

$100 is coming, but not now

AMBCrypto also confirmed support at $32.77, indicating that bulls have formed support and are defending it. On a broader outlook, the 50 EMA (blue) has crossed the 200 EMA (yellow).

This crossover is called a golden cross, which suggests that AVAX’s mid- to long-term outlook is optimistic. Due to this trend, the token price may hit the $60 resistance in the medium term.

Source: TradingView

AVAX bulls may also try to push the price to triple-digit levels. However, this can only be realized in months, not weeks.

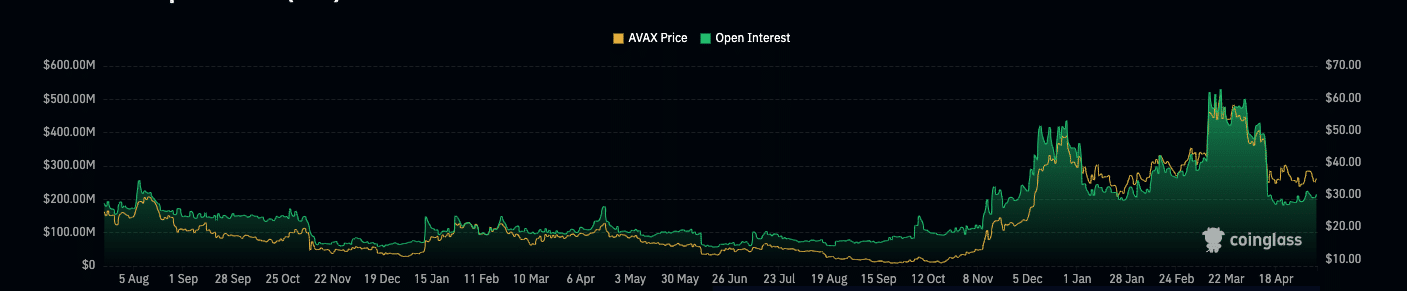

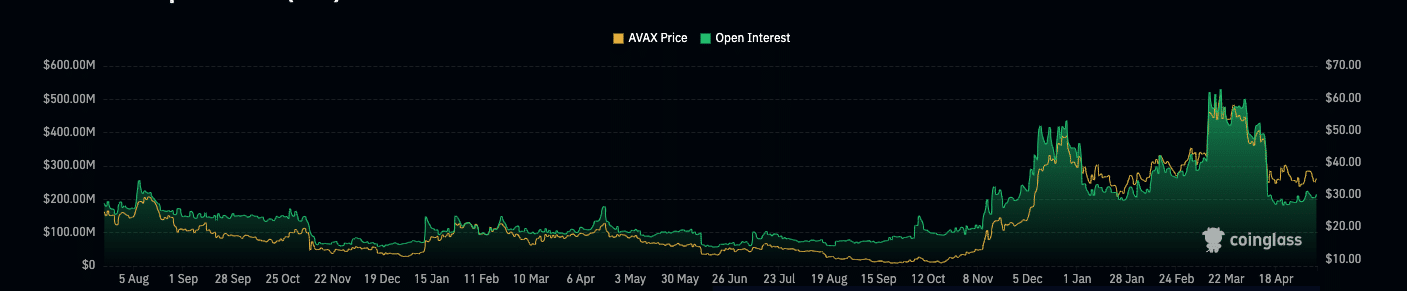

In terms of open interest (OI), Coinglass data showed a slight upward trend. This increase means that traders are starting to increase their positions more in an attempt to profit from price action.

Source: Coinglass

Is your portfolio green? Check out the AVAX Profit Calculator

If OI continues to increase along with price action, AVAX’s price could hit a weekly high before the end of this week.

Therefore, the $100 prediction remains an option for the token. But that could be later this year or next year.

Source: https://ambcrypto.com/how-soon-can-avax-reach-100-decoding-the-altcoins-rise/