Top 5 Stocks in the “Go” Trend | Friday, May 17, 2024 | GoNoGo Chart

key

gist

- trend continues

- escape

- Check the momentum

- bull flag

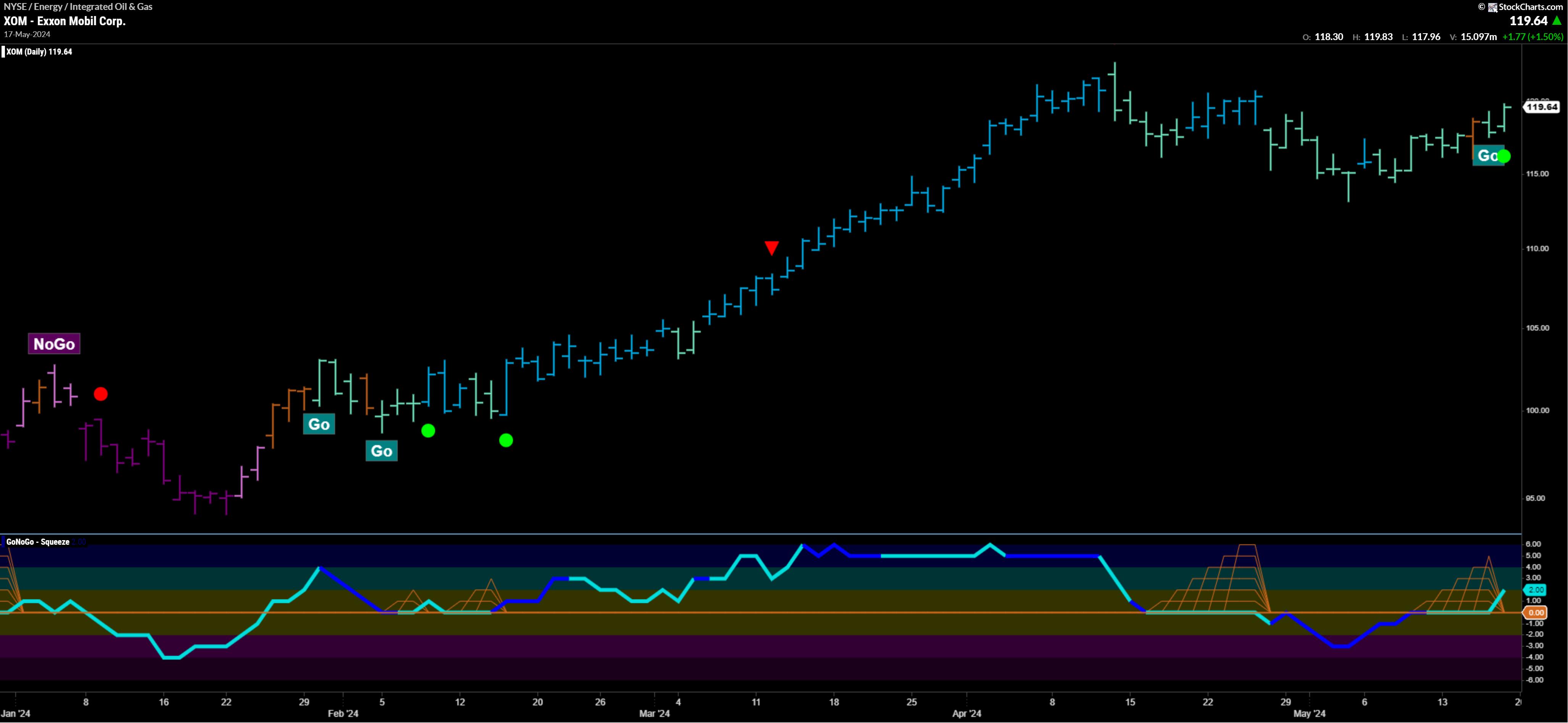

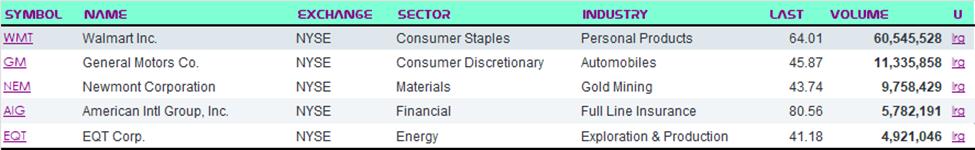

Top 5 Stocks in the “Go” Trend

Trend continues with upward momentum

GoNoGo Charts® uses intuitive icons directly on the price action to highlight low-risk opportunities for trend participation. The resurgence of momentum in the direction of the underlying price trend is a great entry opportunity or an opportunity to expand a position.

GoNoGo Icons® mark these events on charts as green circles (or red circles to highlight the continuation of the NoGo trend). When GoNoGo Trend® Paints the Picture blue or aqua Whenever the GoNoGo Oscillator® finds support at 0, a green solid circle will appear below the price.

Here are the top five stocks/ETFs in the “Go” trend with surging momentum by volume in the S&P 500 as of daily close.

GoNoGo Scan StockCharts to continue the “Go” trend

GoNoGo Scan StockCharts to continue the “Go” trend

Walmart Inc – (WMT)

§ The GoNoGo icon signaled a continuation of the trend on Thursday (24/05/16).

§ After neutral candle reversal on Wednesday amber Trending conditions, price action gapped higher, ending the week with strong “Go” conditions. blue bar.

§ The GoNoGo oscillator rose on overbought momentum on Friday, finding support at the zero line.

§ Walmart has been trading on high relative volume throughout the week.

General Motors (GM)

§ GoNoGo trend is back to strength. blue “Go” conditions to end the trading week at previous highs, just below $46 per share.

§ The GoNoGo icon signaled a continuation of the trend on Thursday (24/05/16).

§ The GoNoGo oscillator closed the week in positive territory, breaking out of the Max GoNoGo Squeeze®, with momentum compressing from the neutral zero line over the past two weeks.

Newmont Corporation (NEM)

§ GoNoGo trend remains strong blue “Go” conditions throughout the trading week.

§ The GoNoGo icon indicated a continuation of the trend on Friday (24/05/17).

§ GoNoGo Oscillator ended the week in positive territory after retesting the zero line on weak relative volume.

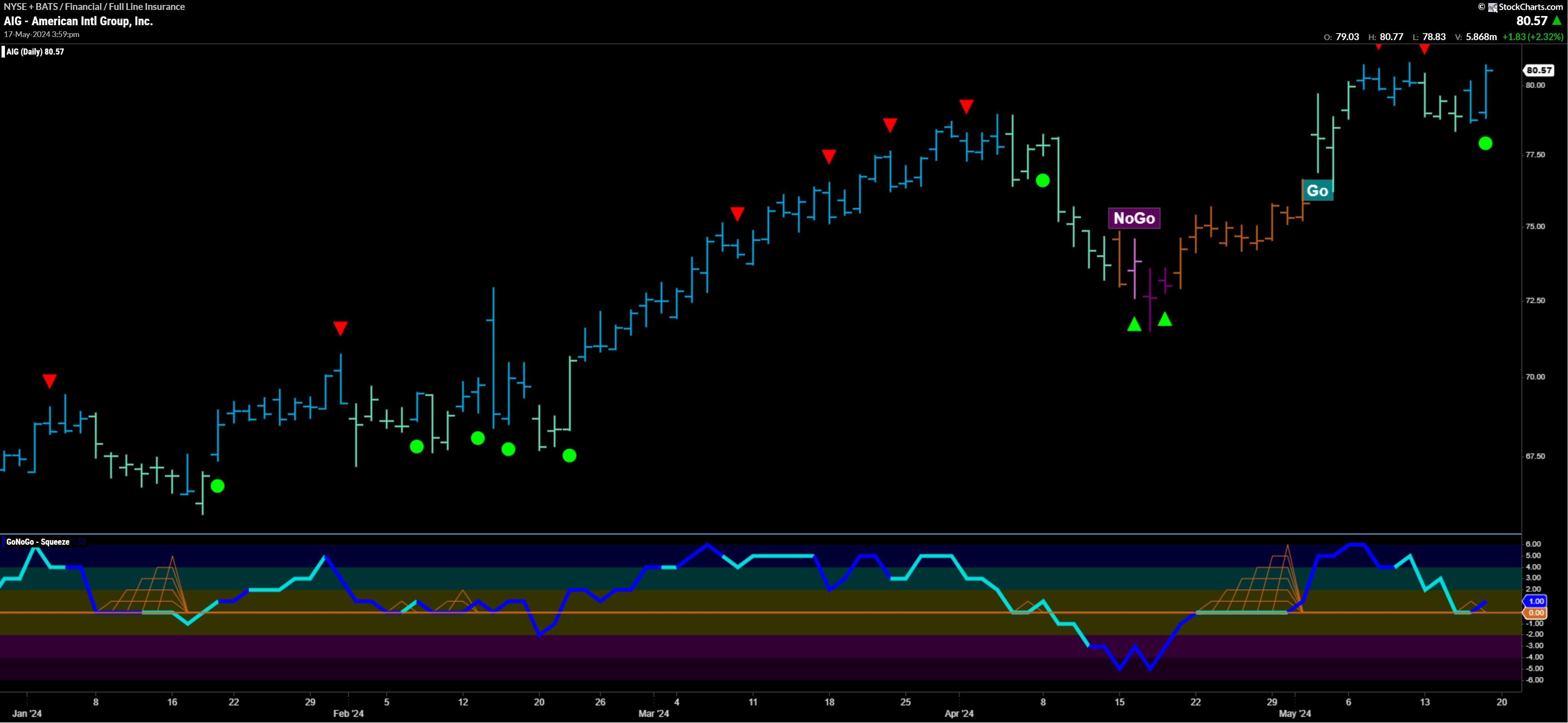

American International Group (AIG)

§ The GoNoGo trend returned to a strong blue “Go” condition to end this trading week.

§ This recovery is due to weakening trend conditions and price correction actions.

§ The GoNoGo icon indicated a continuation of the trend on Friday (24/05/17).

§ GoNoGo Oscillator has been tested and found support at the zero line.

§ Momentum turned to the upside on Friday, driven by high relative volume.

EQT Corporation (QT)

§ GoNoGo Trend ended the trading week strong. blue “Go” condition.

§ The GoNoGo icon indicates a continuation of the trend on Wednesday and Friday (5/17/24).

§ The GoNoGo oscillator entered the trading week at the neutral zero line, forming a small pressure, bouncing back and then testing again to close the week in positive territory again on Friday.

§ EQT Corp. has traded on relatively light volume since early May.

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis, removing emotional bias from investment decisions. Tyler served as Executive Director of the CMT Association for more than 10 years to advance the proficiency and skill of investors in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more