Monroe Capital: Rising Non-Accruals Threaten Current Dividend (NASDAQ:MRCC)

Richard Drury

outline

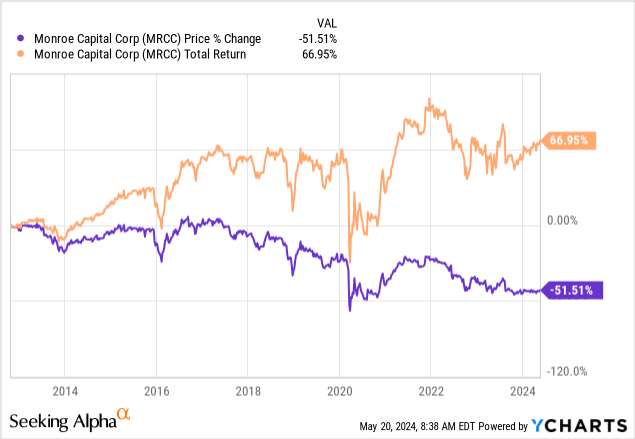

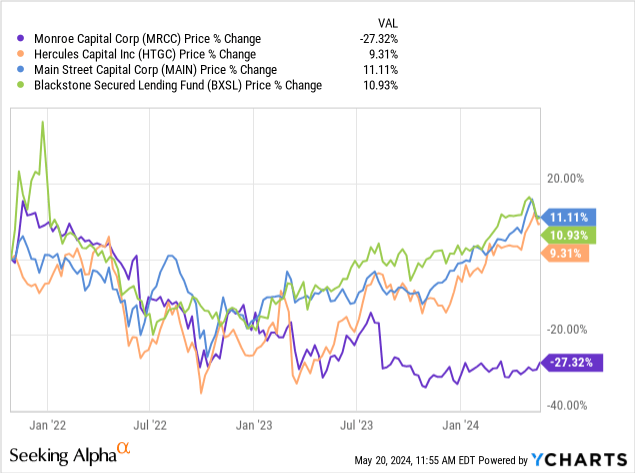

monroe capital (NASDAQ:MRCC) is a much smaller business development company with a market capitalization of just $160 million. This BDC focuses on lower-middle market companies based in the United States and Canada. they bring We increase returns by providing financing to lower middle market companies using senior secured, unitranch and subordinated secured debt. Although small in size, its history dates back to the beginning of 2012. You can see how the price has fallen more than 50% since then, and the high distribution has helped keep total returns in positive territory.

One of the main attractions of MRCC is that its dividend yield is very high at 13.5%, which could create a great income stream for investors who want to prioritize it. this high Yield is what keeps total returns positive despite falling stock prices. Over time, these high levels of distributions can become large enough to support retirees. However, I remain cautious about whether MRCC will actually be able to maintain its dividend at this level. This is because we believe we will experience another dividend cut in the future.

MRCC’s price is trading at a discount to its net asset value (NAV), which may represent an attractive entry opportunity. However, historical data shows that NAV has continued to decline over time. This is unusual because the current high interest rate environment is serving as a major catalyst for increasing the value of this BDC. Higher interest rates generally result in higher net investment income because BDCs are able to extract higher interest payments from the portfolio companies they lend capital to. Before we get into these topics, let’s first look at the portfolio construction to see how effective the strategy was.

portfolio

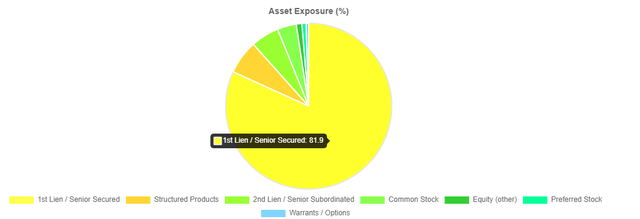

MRCC’s portfolio consists of nearly 100 diverse portfolio companies, and these investments have an average weighted rate of return of approximately 12%. The portfolio’s primary focus is on maintaining multiple exposure to senior secured debt obligations. Approximately 82% of the portfolio consists of first-lien senior secured debt investments, which provide some risk mitigation. This is because senior secured debt is at the top of a company’s repayable capital structure. This means that senior secured debt has the highest priority for repayment in the event of bankruptcy or liquidation.

CEF data

What makes this BDC stand out is that the majority of its portfolio industry exposure is within real estate. About 16% of the portfolio is exposed to the real estate sector. This is followed by healthcare and pharmaceuticals at about 13%, and service-based businesses at 11% of the total. While having a variety of holdings eliminates concentration risk, we believe exposure to real estate has hindered BDCs’ growth.

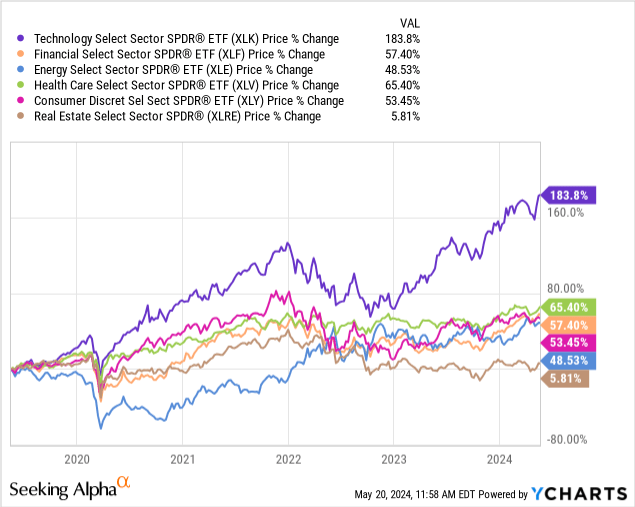

Companies in the real estate sector, including REITs, sometimes rely on inexpensive debt financing to finance the growth of their operations and operate their businesses at attractive margins. Because interest rates have risen, it has become more expensive to acquire and hold debt. As a result, this has slowed down many of the growing projects, construction and developments that could have fueled growth within the industry. To back this up, data shows that in this high-interest rate environment, commercial real estate lending is down 47% year-over-year.

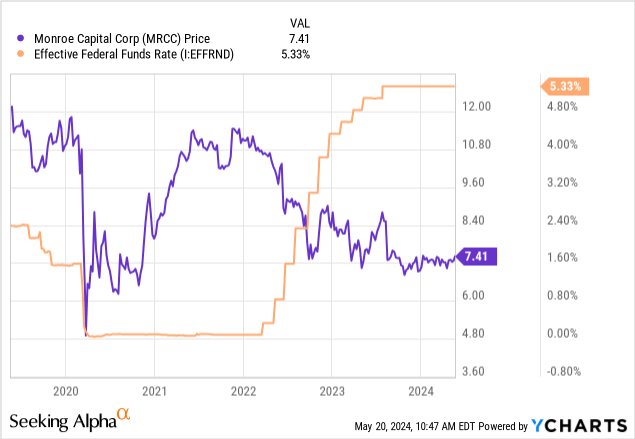

As a result, this BDC has struggled to achieve meaningful growth in its share price, NAV, or even its net investment income (NII) since interest rates rose sharply in mid-2022. If they receive interest income, this puts a burden on these borrowers as they may struggle to maintain their debt repayments at the same time.

Financial and Risk Profile

Monroe Capital recently reported its first quarter earnings, reporting adjusted net investment income (NII) of $0.25 per share. Total investment income reached $15.2 million, and fair value investments also increased to $500.8, up from a total of $48 million in the previous quarter. Total assets increased slightly to $527.4 million, but NAV per share decreased, which may indicate growing problems within the portfolio.

MRCC 1st quarter performance

This problem is evident in the growth rate of outstanding balances. Underpayment is an important indicator because it indicates the proportion of portfolio companies that are seriously behind in their debt repayments and whose ability to repay all loan balances is threatened by poor performance. Once a company reaches this state, it will no longer contribute to the BDC’s net investment income, which could eventually jeopardize its dividend.

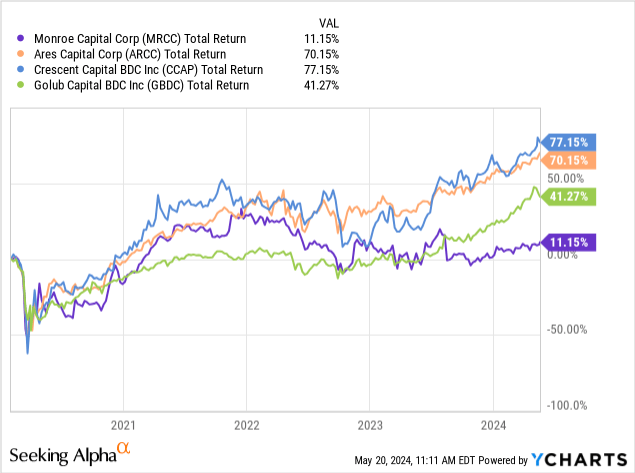

Based on last quarter’s performance, the current non-payment rate is 2.1%. This non-payment ratio is usually not a big deal, but MRCC’s portfolio is much smaller than that of alternative BDCs. Again, the current market cap is only $160 million. For reference, the alternative BDC market capitalization and payout ratio are as follows.

- Ares Capital (ARCC): Market capitalization of $13 billion, payout ratio of 1.3%.

- Crescent Capital (CCAP): Market capitalization of $662M, payout ratio of 2%

- Golub Capital (GBDC): Market capitalization of $2.8 billion, payout ratio of 1.1%.

As a result, we can see how MRCC has underperformed these peers due to its low-quality portfolio composition. MRCC has the highest returns among its peers, but its price has fallen so much that its total returns cannot keep up.

MRCC’s debt ratio also increased from 1.49 times to 1.6 times in the previous quarter. In general, a low debt to equity ratio is preferred. This is because it means MRCC can use more leverage, increasing its risk profile. Using more leverage but still underperforming peers and increasing accruals is a red flag for this BDC’s management and portfolio company valuations.

However, MRCC made additional investments during the quarter that could help grow its portfolio. During the first quarter, they funded three new portfolio companies worth $10.2 million. Of this $10.2 million, $8.6 million was in the form of debt investments and the remaining $1.6 million was in the form of equity investments. If these new investments are successful, additional investments can be a good way to mitigate risk in other areas of your portfolio.

dividend

The recently announced quarterly dividend is $0.25 per share and the current dividend yield is 13.5%. As mentioned earlier, NII was reported at $0.25 per share. This means that the dividend was 100% guaranteed, but it also means that there was a lack of additional buffering power. Ideally, larger cushions would be preferred. This is because it means MRCC is better able to weather potential headwinds, such as rising underpayment rates. If outstanding payments continue to increase due to pressure from higher interest rates, distributions may be reduced if NII is unable to maintain the $0.25 per share level.

Of course, the dividend growth here has been really disappointing. The dividend was cut in 2020, around the start of the pandemic. This is certainly understandable considering the severity of the situation at the time and the need to account for potential loss of returns as well as preservation of capital. However, despite constructing the portfolio in accordance with the current high interest rate environment, dividends were never raised again.

Is it really reasonable to expect dividend growth in a situation where the rate of return has already entered the double-digit range? We should consider the fact that many of our BDC peers have been able to increase their distributions because they have seen higher net investment income due to higher interest rates. For reference, here are some peer BDCs with a strong history of increasing their distributions over the past few years:

- Capital Southwest (CSWC): 5-year dividend CAGR of 10.33%.

- Main Street Capital (MAIN): 3-year dividend CAGR 4.66%.

- Hercules Capital (HTGC): 10-year dividend CAGR of 3.08%.

Portfolio Visualization Tool

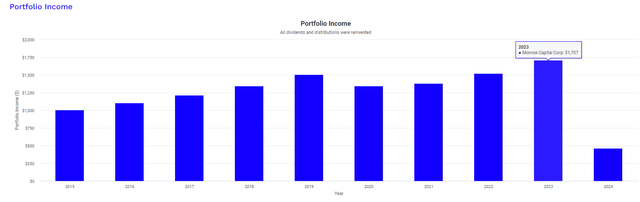

With such a mixed dividend history, the only way to see distribution growth is to essentially generate its own growth. You can do this by regularly investing the dividends you receive to accumulate more stocks. Portfolio Visualizer lets you see how this dividend income growth has played out. This graph assumes the original investment is $10,000 in 2015 and no additional capital is deployed thereafter. This calculation also assumes dividends are reinvested quarterly. In 2015, your dividend income totaled $1,003.

This total would have increased to $1,707 by the end of 2023. Dividend payments will technically increase over time, but this is not an ideal way to receive that increase. Many BDC investors ultimately want to use the dividends they receive, so they feel that reinvesting them over the long term would defeat the purpose, especially if dividend payments are cut again.

evaluation

Prices are still below pre-pandemic levels of $10 to $11 per share. The current price is trading at a little over 20% discount to NAV. For reference, the current stock price has traded at an average discount of 16.1% to NAV over the past three years. Wall Street’s average price target is also $8.42 per share, which represents a potential upside of more than 13%. This may initially give the impression of a good entry point, but this price decline is also accompanied by a decline in NAV, so we’re sitting on the sidelines for now.

CEF data

A decline in NAV over time indicates that the BDC is not maintaining returns at a sufficient level to grow its portfolio and maintain distributions. As I said, the distribution is currently barely affordable at $0.025 per share, but the net investment income hasn’t been large enough to fuel impactful growth in the portfolio itself. Note that BDCs that are successfully growing their NAV over time will not decline in price like MRCCs. If you look at some of my favorite BDCs, you can see how NAV growth has a direct impact on share price appreciation over time.

To be fair to MRCC, if interest rates fall again, the NAV growth potential will improve. The Federal Reserve has kept interest rates on hold due to high inflation and a strong labor market. However, economists predict that an interest rate cut may occur by the end of 2024. We will soon see how large the actual interest rate cut will be, but as real estate prices fall, it is expected to have a significant impact on the growth of MRCC in the future. It makes up a significant portion of the portfolio. Comparing all sectors against each other, we see that real estate is the sector most vulnerable to these interest rate increases.

takeout

In conclusion, I have decided to stay away from Monroe Capital as the current high interest rate environment has strained its portfolio companies and undermined their growth potential. Higher interest rates increased the percentage outstanding within the portfolio, robbing these BDCs of their earning power. Additionally, dividend growth here has been lackluster compared to peer BDCs. Due to its internal shortcomings, MRCC did not increase distributions or provide supplements to investors. NII per share is $0.25, which is exactly the distribution rate. If all profits were paid out to shareholders, MRCC would have little capital left to reinvest in portfolio growth. As a result, NAV has continued to decline over time and share prices have plummeted over the past decade. Therefore, I rate MRCC a Sell.