Pivot Point Strategy Analysis – Trading Strategy – May 22, 2024

Pivot Point Strategy Analysis:

Merchant Guide

Pivot point strategy is key. technical analysis In the foreign exchange market. It utilizes historical price data to provide a framework to identify potential support and resistance levels and assist with entry and exit points for trades. Let’s take a closer look at the mechanics of the strategy and see how to use it for profitable results.

Understanding pivot points

calculate: Pivot points are calculated based on the previous day’s high (H), low (L), and closing price (C). The central pivot point (PP) acts as a support point with the resistance levels calculated above (R1, R2, R3) and the support levels calculated below (S1, S2, S3).

Translate: PP acts as a direction indicator. all price deal Prices above PP indicate strength, while prices below PP indicate weakness. Support levels (S1, S2, S3) represent areas where the price decline may stop and potentially reverse, while resistance levels (R1, R2, R3) represent areas where rising prices may face selling pressure.

The formula for the main pivot point is:

PP = (H + L + C) / 3

The remaining levels are derived using the multiplier of the difference between PP, high and low.

Trading with Pivot Points

There are several ways to integrate: pivot point To your trading strategy:

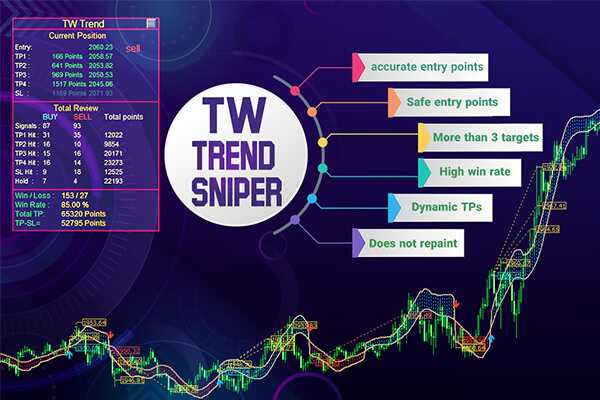

- Identify support and resistance: Pivot points and their levels serve as potential areas where price action may pause or reverse. A price test of a support level may indicate a buying opportunity, while a resistance test may indicate a selling opportunity.

- Breakout Trading: If the price clearly breaks through the resistance line, it may indicate continued strength, and vice versa, it may break below the support line. This can be a good entry point for trend following trading.

- Range of transactions: In range-bound markets, pivot points can help identify range boundaries. You can then look for opportunities to buy near support and sell near resistance.

- Confirmation through indicators: Pivot points provide valuable insight, but they should not be used in isolation. combine them technical indicators Like moving averages or RSI to strengthen trade signals. Look for price approaching a pivot level while the indicator is generating a confirming signal (e.g. RSI oversold near support or overbought near resistance).

Strengthen pivot point strategy

Pivot points provide valuable insight, but they should not be used in isolation. Here’s how to strengthen your strategy:

- Combined with price action: Strengthen the uptrend by confirming price rejection of candlestick patterns or pivot levels. Entry signal.

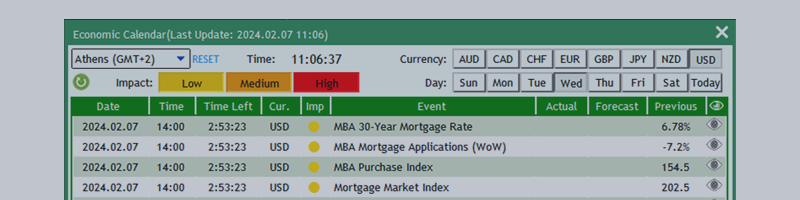

- Consider market conditions. factor economic news releases, central bank policy, and overall market sentiment when interpreting pivot points.

- Risk Management: Regardless of the strategy used, always use stop-loss orders to limit potential losses.

- False breakout: Watch out for false breakouts where the price breaks a support/resistance level but quickly reverses. Use stop-loss orders judiciously to manage risk.

- Select a period: Pivot points can be calculated for various time periods (daily, weekly, etc.). Choose a time period that suits your trading style and strategy.

conclusion

The pivot point strategy provides the following value: A tool for forex traders. By understanding the mechanisms and incorporating them into your trading framework, you can identify potential entry and exit points, improve trade setups, and potentially increase profitability. Remember that no strategy guarantees success. Therefore, practice sound risk management and always conduct a thorough market analysis before engaging in any trade.

happy trading

May Pip be in your favor!