Porsche AG: Discontinuity with market expectations can create opportunities

jetcityimage/iStock editorial via getty Images

Why Porsche AG stock price fell

Let’s face it, bull markets energize investors and their portfolios. As a result, when we come across a stock whose performance appears to be completely disconnected from the overall market, we raise our eyebrows and become somewhat wary. this is For Porsche AG (OTCPK:DRPRF).

Now Porsche AG’s IPO in late 2022 seemed to have turned any possible tailwind aside. We were at the tail end of a bear market, the company is a globally known brand, it serves a rich customer base, and it has high margins, reflecting its unique supercar lineup. Many thought we could before a similar situation to Ferrari’s IPO (RACE), but the German manufacturer has disappointed the hopes of those who believed it could trade closer to Ferrari’s multiple.

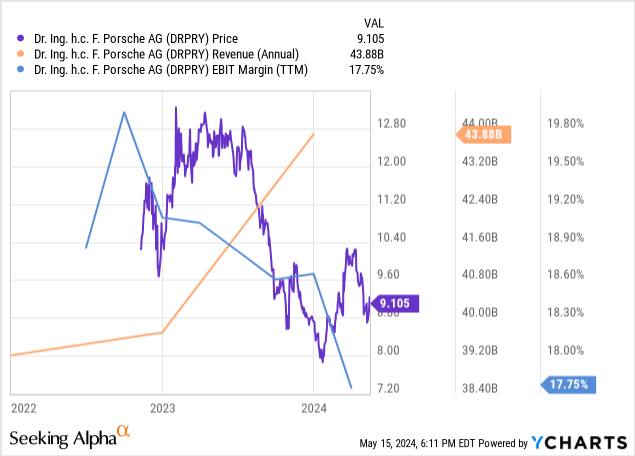

Here’s a picture. The stock prices are as follows It is an IPO and is over 25% below ATH. Meanwhile, while the company’s sales grew, Porsche’s EBIT margins took a hit, falling from nearly 20% to 17.75%.

So what happens to Porsche? Could one of the most famous luxury sports vehicle manufacturers run into difficulties and lose operations?

In this article, I will look at the development process of Porsche’s business, update the article I shared last December, begin my coverage, and explain my downturn. Since then, Porsche’s stock price has been flat, although it fell significantly in January and as recently as April. At the same time, the S&P 500 rose 12.60%, meaning that the opportunity cost of investing in Porsche rather than the index was high.

Porsche has two problems

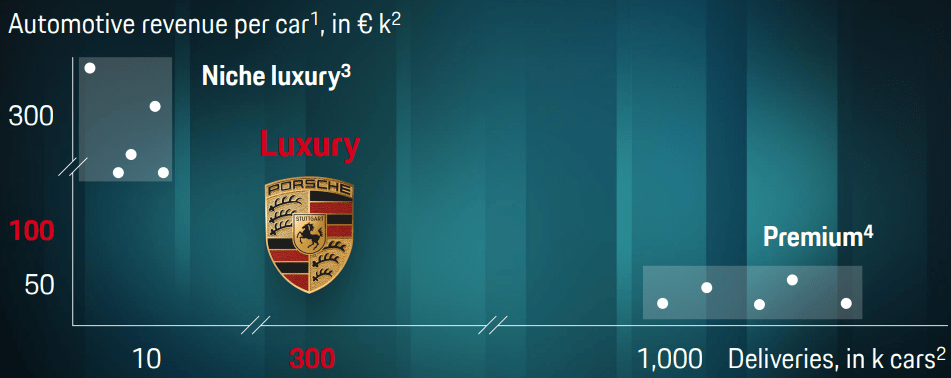

Porsche positions itself as a luxury brand, more exclusive than Mercedes or BMW and a step below Ferrari and Lamborghini. With over 3,020,000 vehicles sold annually and automotive revenue per vehicle of over 100,000 Euros, the company clearly stands out from the rest of the highly competitive industry.

Porsche Investor Presentation

Moreover, according to BrandFinance, Porsche is the most valuable luxury brand in the world, ahead of global leaders such as Louis Vuitton, Chanel and Hermes. Leading luxury brands should not be underestimated, because once they become status symbols, they are difficult to replace.

Porsche Investor Presentation

1. Porsche is struggling in China

But Porsche (and the German car industry as a whole) faces some difficult challenges. The misfortune is mainly coming from one place: China. Here, the automotive landscape appears to be witnessing a major paradigm shift in consumer preferences. In other words, Chinese consumers are increasingly willing to purchase BEV vehicles rather than ICE supercars or SUVs. Now the new frontier of luxury is eco-luxury. We all know that Chinese automakers are leaders in electric mobility. This puts enormous pressure on Porsche, which has had to push for electrification of its model range with the launch of the new Taycan and Macan in China. Recent rumors suggest that China will soon have to increase import duties on ICE cars with engines larger than 2.5 liters to 25%. This obligation will affect German car manufacturers such as Porsche.

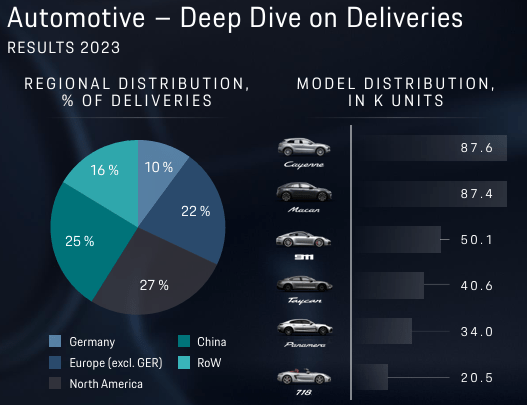

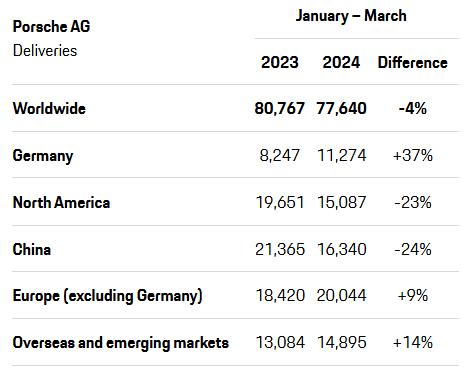

As a result, Porsche has had poor sales in China over the last quarter, with the country now accounting for just 21% of its sales mix (compared to 25% at the end of fiscal 2023, 26% a year ago and 26% in 2022). It was 32%).

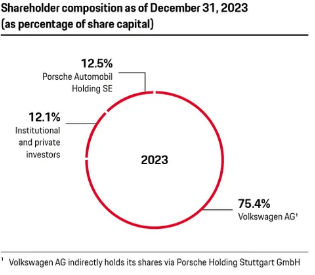

2. Porsche’s shareholder structure

Porsche’s shareholder structure may not be the most palatable to investors. We can see that Volkswagen AG (OTCPK:VWAGY) owns over 75% of the company. Many believe that Volkswagen first sold its stake in Traton ( OTCPK:TRATF ) and then Porsche to pay a hefty fine for Dieselgate and fund investments in electric mobility. As a result, Volkswagen still has significant influence over the company. In fact, both companies share the same CEO, Oliver Blume. So on the one hand, Porsche is controlled by a solid group. On the other hand, it was heavily influenced by the Porsche-Piëch family, which controlled Porsche SE and also had majority voting rights in Volkswagen.

Porsche IR webpage

Moreover, in Germany, trade unions have great influence over car manufacturers, not only because of the workforce they control, but also because corporate law requires them to be represented on supervisory boards. This can certainly force labor contracts in favor of employees, but it can also hinder the company’s operations due to political issues and fights. Moreover, this structure may prevent some investors from holding shares in such a popular and profitable company.

porsche finances

Now let’s take a look at Porsche’s financial health. As we will see, this company stands out among the larger automakers.

First, let’s understand Porsche’s sales mix. As you can see, Germany alone accounts for 10% of total sales. Europe accounts for 22% and North America accounts for 27% of the sales mix. Europe (including Germany) and North America are performing well, and as mentioned earlier, China is declining but still very important. Now we all know that the iconic model is the 911. However, this model only ranked third with 50,000 units sold. SUVs Cayenne and Macan account for more than 58% of global sales. Once again, we can see why bringing the electric Macan to China is strategically important.

Porsche Investor Presentation

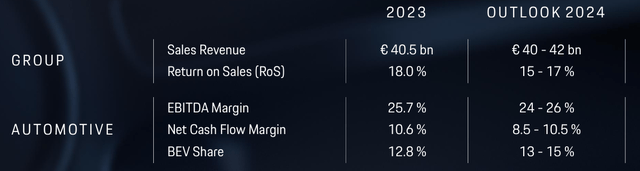

As of the end of fiscal 2023, Porsche recorded sales revenue of 40.5 billion euros and RoS of 18%. Automotive EBITDA margin was 25.7% and net cash flow margin was 10.6%.

Porsche AG announces first quarter 2024 results

Fiscal year 2024 guidance is as follows:

- Sales €4-€42 billion

- RoS 15%~17%

- Automotive net cash flow margin 8.5-10.5%

- Automotive EBITDA margin 24-26%

- Automotive BEV market share: 13-15%

This allows us to see how Porsche, looking at the decline of the Chinese market, has issued very cautious guidance with little top-line growth and low RoS and EBITDA margins. It could be said that the company is already preparing for the impact. Ultimately, little growth for luxury companies means prices can’t offset declining sales.

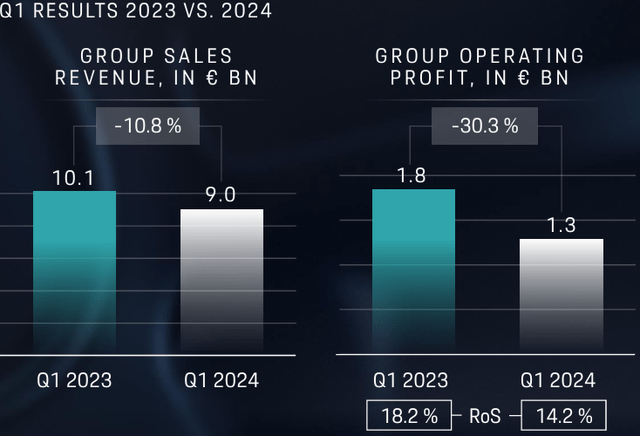

Porsche recently reported its first quarter results and investors were waiting to see if there were any signs of improvement in China. Spoiler alert: Investors were not satisfied.

Group sales fell by more than €1 billion and operating profit fell by 30% to €1.3 billion. Of course, a drop this big doesn’t come without explanation. This was partly due to low vehicle availability and high R&D expenditure. As a result, fixed costs have had a greater impact than usual. For a company like Porsche, a RoS of just over 14% is not enough (for example, Mercedes and Stellantis exceed 12%). However, factoring in the temporary headwinds, we could see investors getting excited about the stock again, as Porsche should increase its RoS as the year progresses.

Porsche AG announces first quarter 2024 results

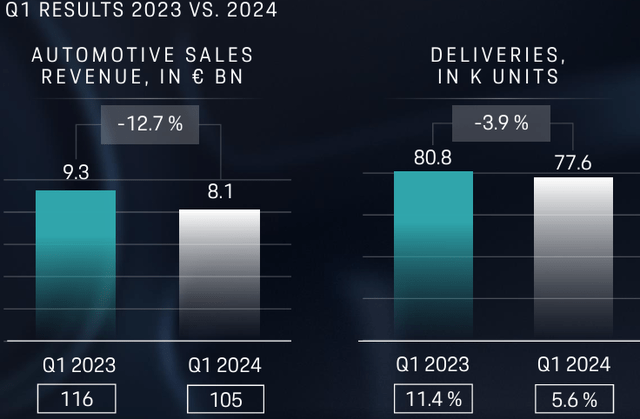

We saw a 10.8% decline in group sales revenue from €10.1 billion to €9 billion. However, car sales revenue actually fell 12.7% to 8.1 billion euros, and deliveries fell 3.9% to just 77.6 thousand units. As a result, AVS prices fell from €116,000 in Q1 2023 to €105,000 this quarter. To put this into proper context, Mercedes sold 67,000 top-of-the-line vehicles in the first quarter with an AVS of over €100,000. This means that Porsche performed slightly better than its competitors, which are mainly located in the premium segment, slightly below the luxury segment. Of course, investors weren’t happy. Mercedes is a much better deal considering its current multiples and high-end vehicle business.

Porsche AG announces first quarter 2024 results

As Porsche stated in its first quarter press release:

In Europe (excluding Germany), Porsche delivered 20,044 vehicles in the first quarter, a 9% increase compared to the same period last year. In the company’s home market of Germany, the number of vehicles delivered increased by 37%. A total of 11,274 units were delivered to customers. In China, sports car manufacturers delivered 16,340 vehicles from January to March, a 24% decline. The main reasons for this are the focus on value-oriented sales, the continued tight economic conditions in the Chinese market, and the strong equivalent period in the previous year due to the initial COVID-19 catch-up effect. In North America, Porsche delivered 15,087 vehicles to customers, a decrease of 23%. This decline is mainly explained by customs-related shipping delays for some models. Overseas and emerging markets saw 14,895 vehicles delivered to customers, up 14%.

Porsche Q1 2024 Press Release

With the positive news about the new all-electric Macan, orders were filling up quickly. As the first delivery is scheduled for the second half of the year, it could be the start of a turnaround.

According to our income statement, we’ve had some issues with our operating income, but overall, our company still outperforms other companies in our industry. However, it’s reasonable to expect Porsche to get RoS closer to 20% to truly stand out and differentiate itself from other premium players.

Porsche’s balance sheet is healthy, with cash of €7.8 billion and LT debt of €6.5 billion. The company operates without the aid of leverage, which could help it weather the shaky Chinese environment.

In terms of cash flow, considering TTM, we see cash from operations at €6.4 billion and CapEx at €4.2 billion, resulting in FCF of €2.2 billion. Considering that Frankfurt currently has a market capitalization of €36.25 billion, its FCF yield is over 6%, which should not be overlooked.

evaluation

The current consensus expects Porsche to hit a flat year in 2024 and then resume growth between 5.6% and 11% over the next three years.

Currently, the company is trading at 14 PE, which is a bit expensive compared to other car manufacturers, but very cheap compared to Ferrari. A Porsche should have a PE somewhere in the middle, between 18 and 22.

The company is sound and healthy, and its products continue to be loved by consumers. Profitability is already above average, so a premium is warranted. At the same time, the lack of growth will certainly put downward pressure on the stock, driving down its valuation. This is why we believe Porsche is currently trading around fair value, due to mixed sentiment from investors.

But while China may be a bigger problem than expected, there are two considerations worth sharing. First of all, if new electric vehicle models are successful, sales in China are expected to recover quickly. Second, if China continues to decline, Porsche can save time and diversify its operations into other regions, such as emerging markets or the strong region comprised by the United States and Germany.

Although we tend to think FY2024 sales will be somewhat flat, we think we’ll see the company resume growth starting in 2025. That’s why I’m willing to pay a multiple of 14 for the company’s current earnings. I expect the company to achieve a net profit of €5 billion this year on sales of €42 billion and a net profit margin of 12%. A multiple of 14 times earnings would give it a market capitalization of €70 billion, almost double the current market size.

I expect Porsche to be able to expand its earnings over time, which is why I increased my position by 20%, taking into account that the ex-dividend date is scheduled for June.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.