The yen may have already performed a long-term reversal. USD/JPY Overview – Outlook – May 25, 2024

Business activity in Japan is growing at the fastest pace in nearly a year, suggesting economic growth could recover in the second quarter after slumping in the first three months of the year. But inflationary pressures continue to ease, raising questions about the Bank of Japan’s ability to continue raising interest rates without pushing the economy back into deflation.

The Jibun Bank Japan flash composite PMI index rose to 52.4 in May, marking the fastest growth in activity since August 2023.

At the same time, both input cost and output price inflation moderated in May, along with an overall recovery. According to S&P Global, this suggests “inflationary pressures will ease across official indicators.” Just an hour after the report was released, the BOJ announced that its purchases of Japanese government bonds would remain unchanged in future operations and that it would refrain from further cuts. Earlier this month, markets had expected the BOJ to raise interest rates and reduce bond purchases, so this news marks a small change from previous forecasts, adding to pressure on the yen.

The national consumer price index for April is due to be released Thursday night, with core inflation expected to slow to 2.2% from 2.6%. If the data results are close to forecasts, the USD/JPY pair may rise. This is because it lowers the possibility of a BOJ interest rate hike due to easing inflation.

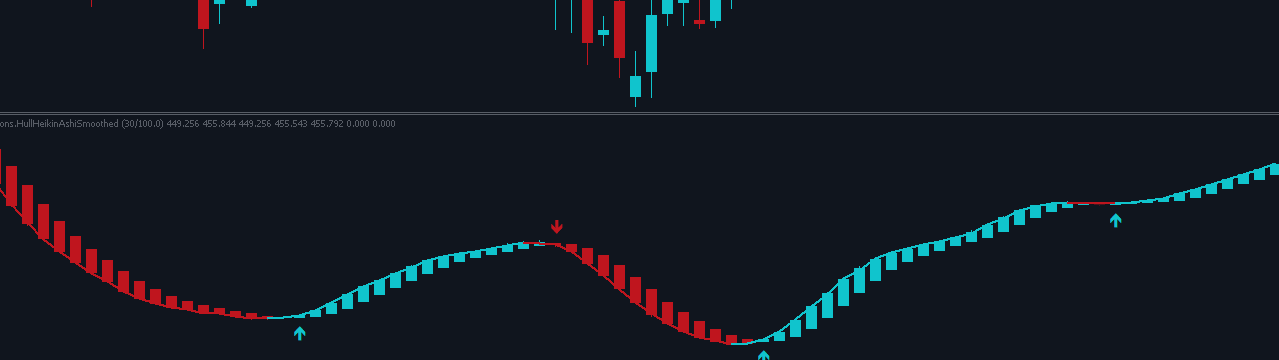

JPY net short position decreased to -10.5 billion, marking the third consecutive week of decline. Nonetheless, speculative positioning remains firmly bearish and it is still too early to expect a long-term turnaround. Prices are below their long-term average and are trending downward.

There is a growing possibility that USD/JPY will hit a long-term high of 160.20 on April 29th. The BOJ’s strong currency intervention (reportedly worth $60 billion) halted the pair’s rise. However, over the past three weeks, the yield on Japan’s 10-year government bond has approached 1%, reflecting the market’s re-evaluation of future interest rate prospects.

We expect the pair to reverse before it approaches 160, so the most rational strategy at this stage is to sell on the rally in anticipation of a long-term reversal. The nearest target is 153.40/60 and the local low is 151.78. Consolidation below this level will strengthen bearish sentiment.