Top Cryptocurrency Gains Today, May 25th – Celesius, Yield Guild Games, Curve DAO Token, Combine

join us telegram A channel to stay up to date on breaking news coverage

Regulation of the cryptocurrency market shapes the space, fueling innovation and caution. Governments and financial watchdogs are tightening rules around the world to prevent fraud and ensure market stability. Although they sometimes cause short-term volatility, these measures are seen as a step toward broader acceptance of digital assets.

Ethereum’s recent price movements Reflects a dynamic regulatory sector. Ethereum initially soared but later fell 4% after the SEC approved the required regulatory filings for the Ether ETF. Despite this setback, Ethereum has surged 20% over the past week, boosted by expectations of approval.

These fluctuations demonstrate the impact regulatory developments have on markets and investor sentiment. However, today’s top performers reveal the varying reactions of the market by showing how tokens react differently to these changes.

Biggest Cryptocurrency Earners Today – Top List

today’s top winner You can get a glimpse of potentially profitable investments in the market. Trading volume over the past 24 hours soared to $367.03 billion, reflecting strong activity. The Fear and Greed Index is 76 (extreme greed), with an optimistic mood prevailing.

Remarkably, 91% of cryptocurrencies today have witnessed an increase in value, highlighting investor optimism. Among these rising companies are standouts Celels, Yield Guild Games, Curve DAO Token, and Complex, which show promising growth opportunities. Let’s take a look at an in-depth analysis of these major coins and their notable performance metrics.

1. Celsius (CEL)

Celsius is a comprehensive banking and financial services platform for cryptocurrency users launched in June 2018. We provide compensation for cryptocurrency deposits and provide services such as loans and wallet-type payments. Users receive regular payouts and interest on the assets they hold, and user payouts increase when using the native CEL token as the payment currency.

Chelsea aims to outperform traditional banks by offering financial services on better terms. These include higher returns on savings and deposits, fairer lending requirements, and automated rewards calculated by algorithms. The platform eliminates fines and bank fees and acts as a wallet through its CelPay feature.

It returns 80% of the profit margin on interest payments made by users who lend to institutional groups such as hedge funds. Since the loan is asset-backed, the borrower must provide at least 100% of the loan amount.

Following the Stretto data security incident and the results of the subsequent investigation, Chelsea has decided to resume plan distributions to all eligible creditors. A notice has been filed in the court records, which can be found at the following link: https://t.co/6dZ4cnX9X0

— Celsius (@CelsiusNetwork) May 16, 2024

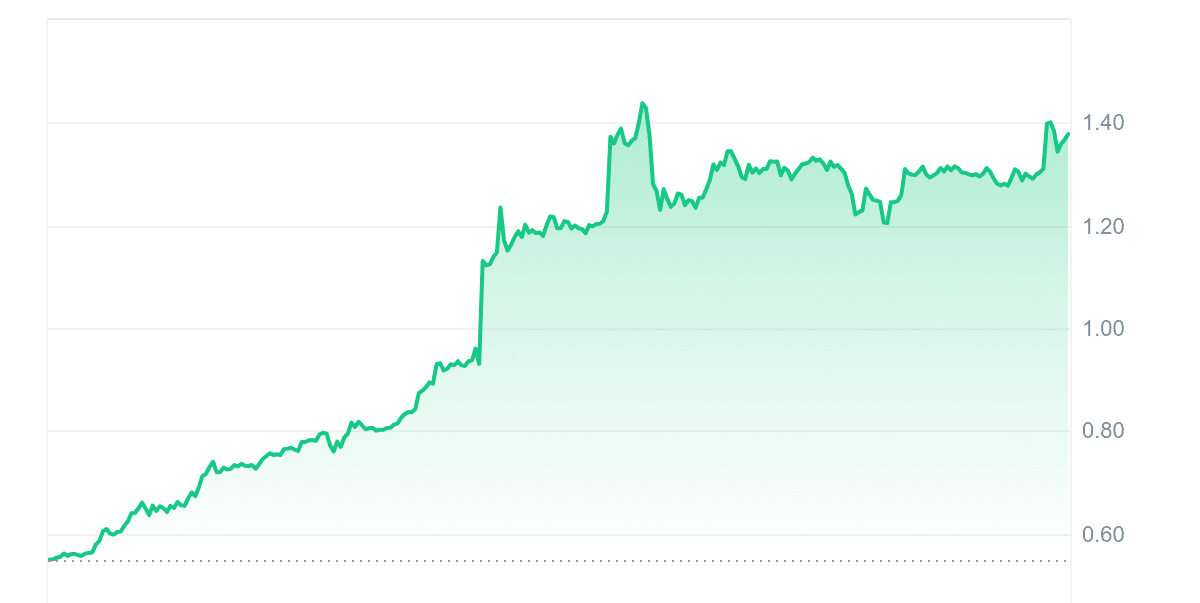

The current price of CEL is $1.389846, a surge of 153.04% in the last 24 hours and a rise of 539% over the past year. It is trading 486.81% above its 200-day SMA of $0.237196, and its 14-day RSI is 57.95, indicating a neutral status. Over the past 30 days, Green Day accounted for 37% on the 11th, and the 30-day volatility was 54%, indicating high price volatility. The platform’s current market cap is $589.34 million and its 24-hour trading volume is $206 million. Therefore, it boasts high liquidity with a trading volume to market capitalization ratio of 0.3395.

2. Yld Guild Games (YGG)

Yield Guild Games is the world’s first and largest web3 gaming guild. It provides a community for players to discover, level up, and succeed through initiatives like SuperQuest and the Guild Advancement Program (GAP).

Founded in the Philippines, YGG has grown into a global network with over 80 blockchain games and infrastructure projects. Its mission is to be the leading community-based user acquisition platform for web3 games. A performance-based reputation system helps members build their on-chain identity.

YGG allows players to earn NFTs and tokens by playing blockchain-based games, especially during difficult economic times. You can do this without purchasing expensive in-game characters. Instead, players can rent characters through gameplay to earn tokens and eventually purchase them. YGG tokens are valuable in that they can be used for staking and give their owners voting rights on guild decisions.

Have you started training your AI agent?👇

It’s very exciting to see our friends at BOGX pushing the boundaries of AI x Web3 Gaming⚔️

Check out this super informative thread about what they’re making and why you should be part of it too💯 https://t.co/couCYCL0u4

— Yield Guild Games (@YieldGuild) May 23, 2024

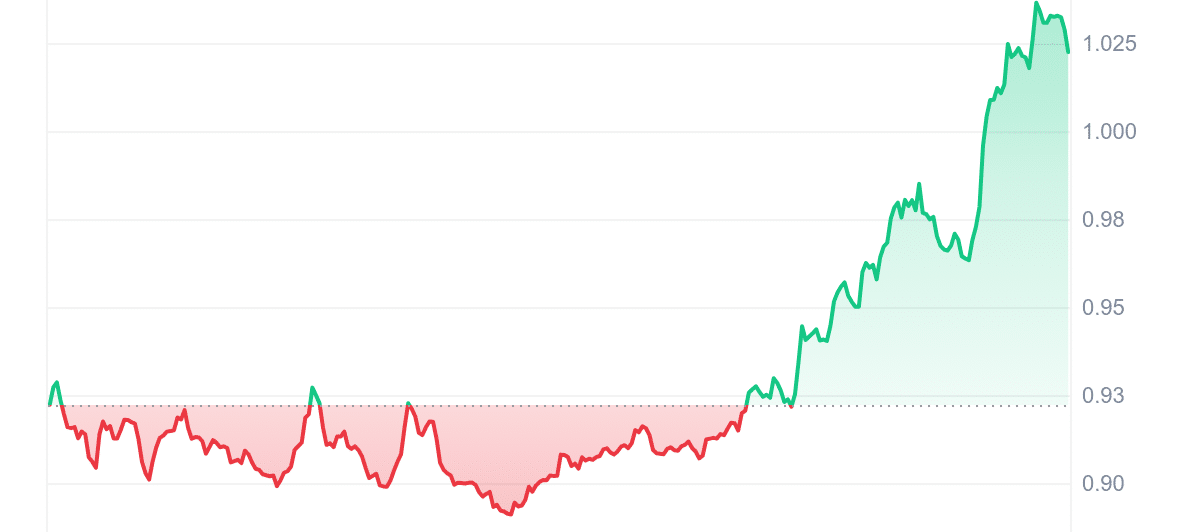

YGG’s stock is trading at $0.97, up 10.72% in the last 24 hours and up 444% over the past year. It is trading 251.21% above its 200-day simple moving average of $0.290544. The 14-day RSI of 35.08 indicates neutrality and a potential sideways trade. Over the last 30 days, 47% of the days were positive, and the 30-day volatility was 7%. YGG boasts an impressive volume-to-market cap ratio of 0.3961, ensuring ample liquidity for investors.

three. 99Bitcoin (99BTC)

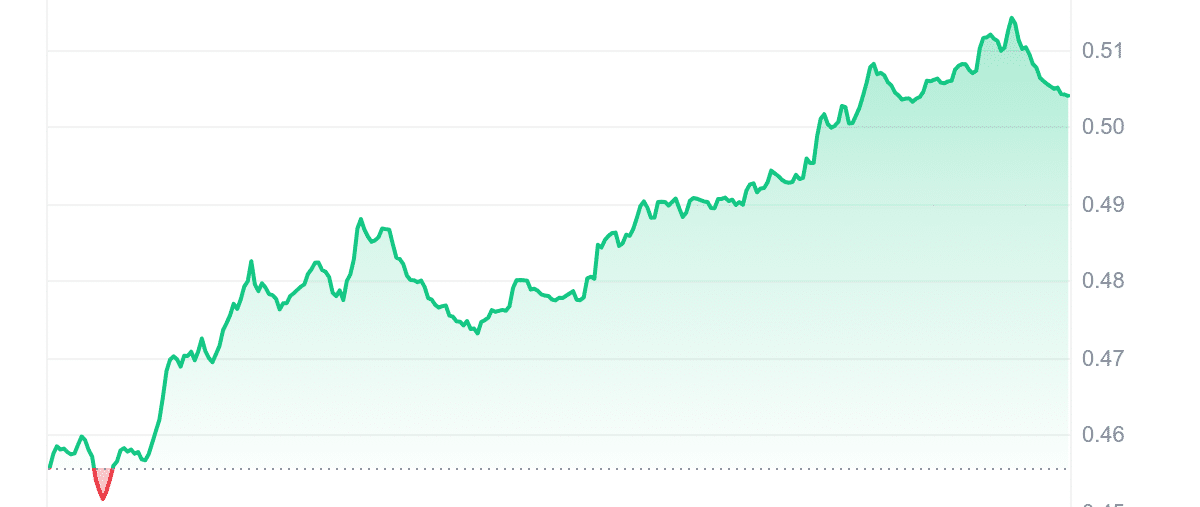

99Bitcoin The token achieved a significant milestone by raising over $1.6 million during the pre-sale phase. This achievement comes ahead of the launch of an innovative “Learn-to-Earn” protocol that aims to transform cryptocurrency education. Instead of passively consuming content, users participate in courses, quizzes, and tutorials to earn 99BTC tokens, providing a financial incentive to learn.

Is $73,000 the catalyst? #BitcoinWhat’s the next big move? 🚀

new #BTC #ATH They say it could signal the start of “escape velocity.” #Cryptocurrency Analyst James Check. This may be met with short-term holder resistance, but it is also a turning point. 📈

Read more: 👉 https://t.co/PepIrsQGUi

— 99Bitcoins (@99BitcoinsHQ) May 23, 2024

Gamified Learn-to-Earn features are just the beginning for 99Bitcoins Token. Developers plan to create a cross-chain bridge by converting 99BTC from an ERC-20 token to Bitcoin’s new BRC-20 standard. This transition could attract the attention of Bitcoin maximalists by positioning 99Bitcoins Token as a disruptive force in the cryptocurrency. The project’s $99,999 BTC airdrop campaign also generated pre-sale excitement, with 99 early adopters getting to share in the prize pool.

As pre-sales continue, the growth potential for 99Bitcoins Token in 2024 looks promising. Approval of a spot ETH ETF in the U.S. could lead to capital flowing into cryptocurrency markets, increasing demand for tokens like 99BTC. With a built-in staking protocol that delivers 1,101% annual returns and significant auditing by SolidProof, 99Bitcoin Tokens stand out as safe and promising investment opportunities.

Visit 99Bitcoins Presale

4. CurveDAO Token (CRV)

Curve is a decentralized exchange for stablecoins that uses automated market makers (AMMs) to manage liquidity. Curve, synonymous with the DeFi phenomenon, has seen significant growth since mid-2020. The platform launched a Decentralized Autonomous Organization (DAO) using CRV as its token. Connects multiple smart contracts for deposited liquidity using Ethereum-based Aragon.

The launch of DAO and CRV tokens increased profitability by using CRV for governance and payouts based on liquidity commitments and ownership period. The DeFi trading boom has ensured the longevity of Curve, with AMMs handling significant liquidity and user profits. It serves DeFi participants such as yield farmers, liquidity miners, and those who maximize returns by holding stablecoins. The platform generates revenue through modest fees paid to liquidity providers.

🎉 $sdCRV The peg keeper has done its job and completed the peg successfully. $sdCRV to 0.99 $CRV

The goal now is to lock down as many as possible. @CurveFinance Tokens as Possible $CRV @SteakDAOHQ Liquid storage! 🐘🙌 pic.twitter.com/1AZKAdVN8i

— Stake DAO (@StakeDAOHQ) May 24, 2024

When it comes to market performance, CRV has been volatile, with its price falling 38% over the past year. However, recent data shows that the token value is expected to increase by 9.51% in the last 24 hours. Despite trading 16.86% below its 200-day SMA, indicating a potential downtrend, the 14-day RSI suggests neutral trading conditions. Curve maintains high liquidity, with 43% of the last 30 trading days reporting positive performance. It boasts a market cap-to-volume ratio of 0.2150, indicating active market activity and investor interest.

5. Compound (COMP)

Compound is a prominent DeFi lending protocol known for its innovative approach to cryptocurrency lending. Users can earn interest by depositing digital assets into various pools supported by the platform.

Upon depositing, users receive cTokens, which represent their stake in the pool and accrue interest over time. This mechanism provides a unique way to generate passive income by converting idle cryptocurrencies into productive assets.

The versatility of this project extends beyond interest-bearing deposits. Borrowers can secure the loan by offering their assets as collateral to Compound. The platform offers customized maximum loan-to-value ratios and competitive interest rates. Meets a variety of lending needs while maintaining strong security measures.

The COMP token facilitates Compound’s decentralized governance model. This allows users to propose and vote on protocol changes. This ensures community-driven development that serves the collective interests of stakeholders.

Looking to improve your skills over the weekend? 🧑💻🧠

We have partnered with: @compoundfinance We produce high-quality tutorial videos on how to write your own compound clearing bot using Alchemy.

Check it! ⬇️https://t.co/ZxHa3DWuLf

— Alchemy University (@AlchemyLearn) October 13, 2023

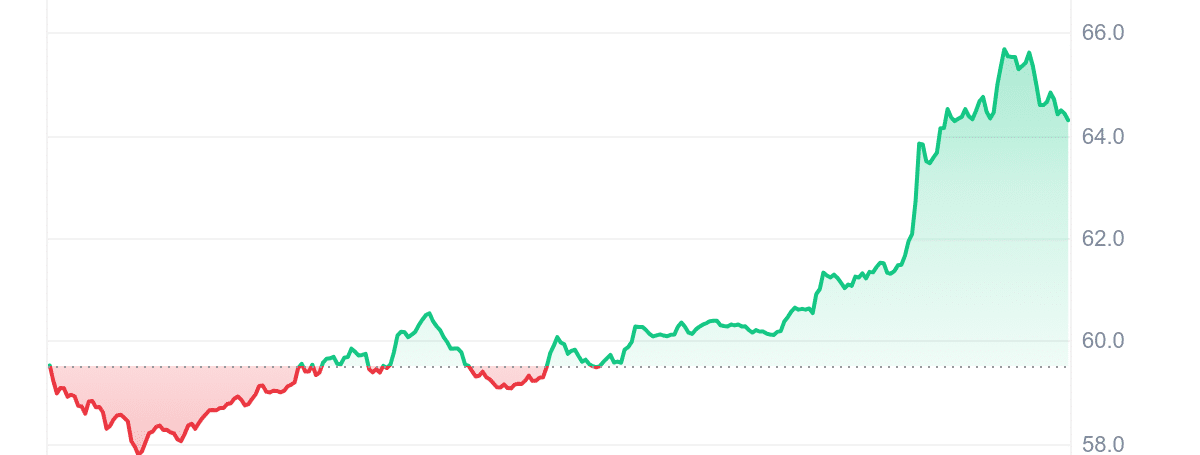

The current value of COMP is $64.21, showing a strong surge of 7.93% in the last 24 hours. Amazingly, the price has increased by 91% compared to last year. Trading comfortably 33.77% above its 200-day SMA of $48.11, the compound shows stability.

With the 14-day RSI hovering at 41.19, Compound stands at a crossroads reflecting a neutral stance in recent market dynamics. In particular, 14 out of the last 30 days were positive, accounting for 47% of the total period. Compound, which has a low 30-day volatility of 4%, boasts high liquidity with a trading volume to market capitalization ratio of 0.1329.

Learn more

SMOG – Meme Coin with Rewards

- Airdrop Season 1 Live Starts

- Earn XP to Win $1 Million in Stake

- Cointelegraph Special

- Staking Rewards – 42% APY

- 10% OTC discount – smogtoken.com

join us telegram A channel to stay up to date on breaking news coverage