TUR: Turkish Stocks Provide Value Through Volatility (NASDAQ:TUR)

Matteo Colombo/DigitalVision via Getty Images

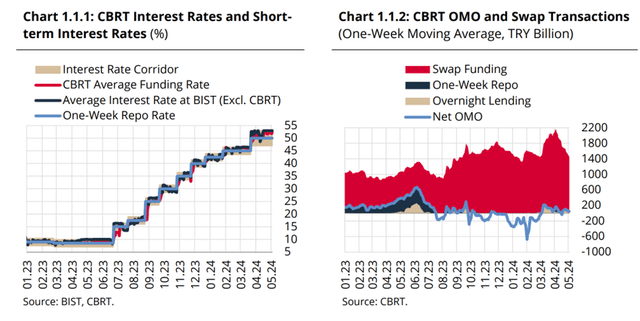

iShares MSCI Turkey ETF (NASDAQ:TUR) (see TUR: Clearing the Deck, Turkish Stocks Rising After Elections), the largest and most liquid Turkish language This is a large tracker fund listed in the US. In summary, after a period of unorthodox policies before the elections, we have seen a significant focus on post-election macro stabilization led by Finance Minister Mehmet Simsek. From a financial perspective, the current government has some reorganized in head The central bank has overseen a faster-than-expected pace of interest rate increases. promise A much lower inflation target (25% next year, 60-70% now).

CBRT

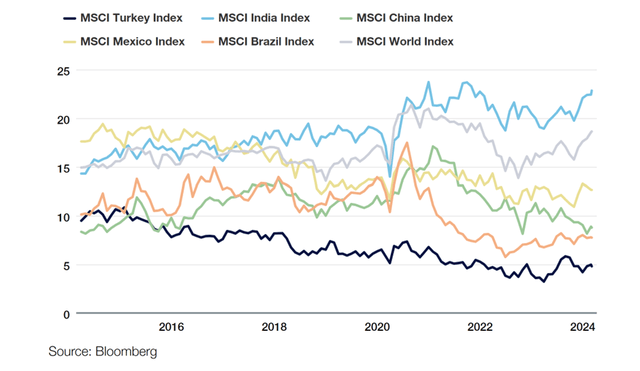

Austerity tends to be bad news for equity markets, but Turkeyye is a unique case in that earnings growth has been maintained very well, especially for banks (a key sector component). For TUR). In fact, Turkish stocks are currently available at cheap prices. Multiples more affordable than ever Future earnings less than 5x. Also noteworthy is that most of the recent gains in Turkish stocks have occurred without foreign participation. As more progress is made on macro aspects and reforms, foreign inflows become a catalyst for technological reassessment. Overall, as local election uncertainty is resolved, TUR will continue to rise.

Thornberg

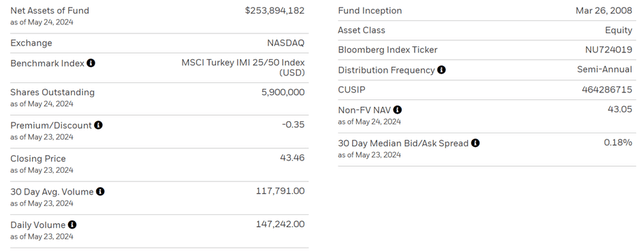

TUR Overview – Competitive cost ratios; Be careful of the spread

Basically, the MSCI Turkey ETF on iShares remains consistent with previous quarters. The fund maintains the same MSCI Turkey IMI 25/50 index benchmark comprised of the largest and most liquid Turkish stocks subject to concentration limits. But the biggest change in the latest quarter was that its asset base under management grew significantly, to $254 million. Larger size generally means better liquidity, but with a 30-day average bid/ask spread of 18bps, TUR still lags behind the iShares Emerging Markets ETF. On the other hand, TUR’s relatively competitive expense ratio of ~0.6% helps offset the spread to some extent. And given the lack of single-country investment in Turkish stocks, TUR continues to stand out.

iShares

TUR portfolio – increasingly biased towards banks and large corporations

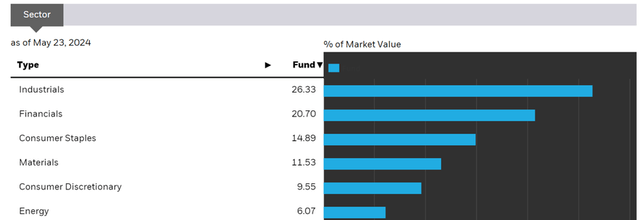

In terms of the fund’s sector composition, there has been a notable reorganization at the top. Industrials, into which Turkye’s diversified conglomerates are classified, continues to be at the top, albeit at a lower 26.3%. Financials and consumer staples have seen the biggest gains in recent quarters and now account for 20.7% and 14.9% of the portfolio, respectively. The more cyclical materials sector, on the other hand, gave up a significant portion of its portfolio share at 11.5%. While the top five sectors account for a high proportion of the portfolio, approximately 83%, the large proportion of large, diversified companies means the ETF is less concentrated than its sector breakdown would imply.

iShares

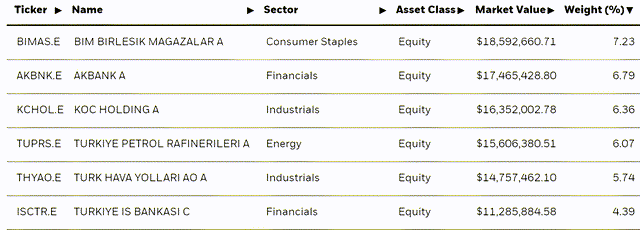

One big change at the single stock level is that the TUR portfolio is now broader with 97 holdings. Regarding the breakdown, there has been a significant reorganization, and discount store Bim (OTCPK:BMBRF) currently has the largest exposure at 7.2%. Akbank (OTCQX:AKBTY) also rose 6.8% along with other major Turkish banks after adopting a post-election monetary tightening policy. Conglomerate KOC Holding also gained share, but discretionary names such as state-owned carrier Turkish Airlines (OTCPK:TKHVY), previously the largest holder, underperformed, reducing its portfolio share to 5.7%. Including the fifth-largest holding, TURkiye Petrol Rafinerileri (TUPRF), TUR’s top five holdings cumulatively amount to about 32%. Although higher than before, this concentration is unusual by emerging market standards.

iShares

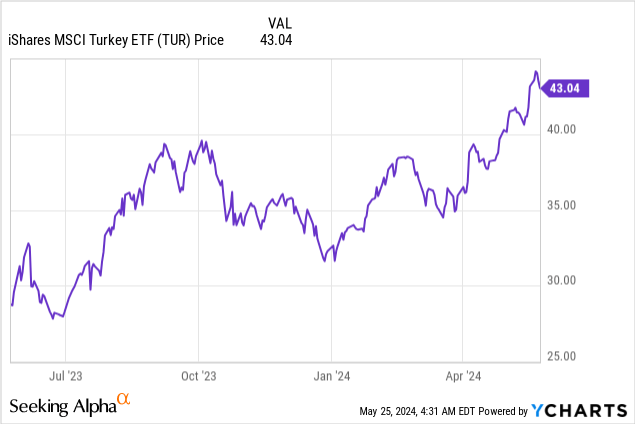

TUR Achievements – Full-fledged post-election rally

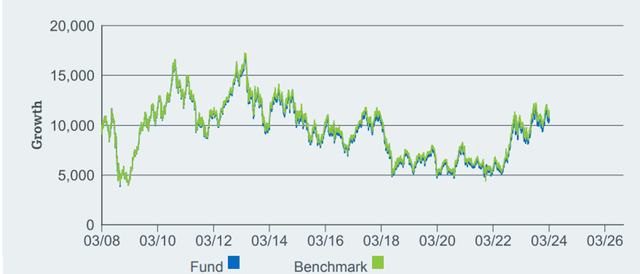

After years of poor performance, TUR has been on a hot streak in recent quarters. After significant gains from the second half of last year to date, the fund’s one-year total return is now +35.9%. As a result, the 3-year and 5-year annualized total returns were also impressive at +24.7% and +15.3%, respectively.

But zooming out, it’s worth noting that TUR’s blue chip basket has created very little shareholder value over the cycle, compounding just +1.1% since its inception in 2008. And the stock’s beta of 0.13 is among the lowest within the emerging markets space. Returns (relative to the S&P 500 (SPY)) have been very volatile over the years. Over the past five years, the ETF has cycled between major declines (-27.5% in 2021) and gains (+106.4% in 2022). This extreme volatility means that Turkiye is not an investment destination for the faint-hearted.

iShares

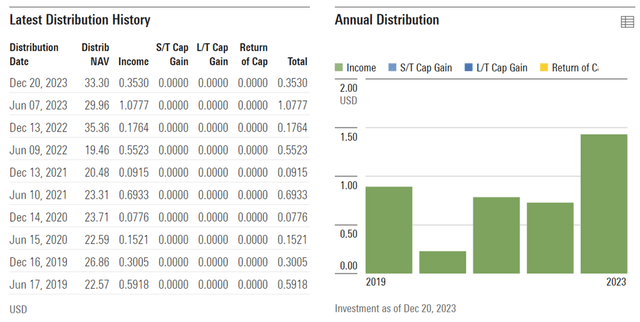

The TUR distribution remains fairly strong at 3.6% over the past 12 months, despite reflecting the cyclicality of the return profile. Given that these returns are funded by a diversified, cash-generating portfolio that is increasingly skewed toward banks, tighter monetary policy may actually Positive For income. In any case, TUR’s blue chip has a proven track record of earnings growth while navigating some vicious cycles, so we expect earnings to grow higher in the coming years.

dawn of fame

Turkish stocks offer value through volatility

Turkiye received a further boost after last year’s elections thanks to the new government’s surprising commitment to normalizing policies. Inflation may not yet be contained, but the direction of fiscal and monetary policy on travel bodes well for positive outcomes going forward. Meanwhile, earnings momentum remains strong for interest rate-sensitive banks, which can benefit from expanding net interest margins. For non-banks, the positive effects of moving away from a hyperinflation scenario have outweighed the short-term growing pains of austerity. Against this backdrop, TUR’s stock portfolio offers good value relative to its underlying earnings growth on a historical basis and currently with a forward P/E of around 5x. Net, we remain bullish on TUR as there is still plenty of room for re-evaluation.