Why Are LegalZoom Shares Still Struggling? (NASDAQ:LZ)

Jose Luis Pelaez Inc/DigitalVision via Getty Images

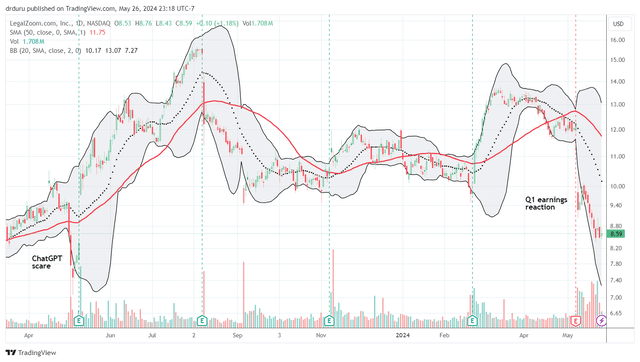

The yo-yo trading I described last year continues for LegalZoom.com, Inc. (NASDAQ:LZ). Whereas last August the stock collapsed despite a hike in guidance, this time around the company reiterated guidance at its Q1 2024 earnings conference call and took a big hit. LZ lost a whopping 23.9% post-earnings and is still selling off at the time of writing. Even a $75M increase (75%) to its existing buyback authorization failed to hold investor interest. LZ closed last week at a 52-week low. I reviewed the latest report to understand why LegalZoom continues to struggle (as a stock). I concluded that LZ has become a “show me” stock.

Three Main Problems

The company’s report revealed three main problems to me.

First problem, LZ suffered a large decline in market share. LegalZoom formations declined 18% year-over-year, causing a share decline of 1% year-over-year to 9.3%. While management reminded analysts that a decline was expected and the current problem may be “overstated” given Secretary of State data, realizing such a large loss is alarming given previous momentum. Finding reassurance in Secretary of State data showing a softer economic environment than the Census EIN data rang a bit hollow given expectations for a stronger go-forward macro environment forms the basis for reiterated guidance. Thus, the combination of diverging economic stories puts the company on watch as a “show me” stock.

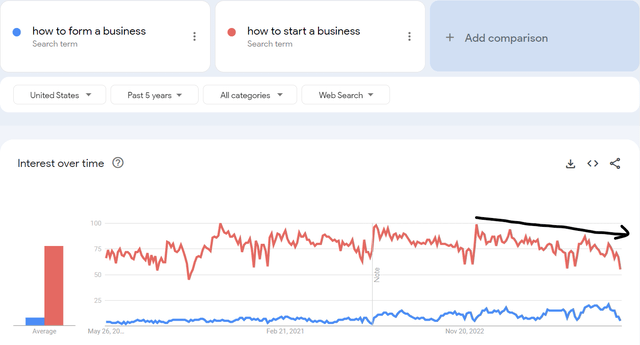

The decline in formations confirms a concerning picture from Google search trends for business formations. In my first piece on LZ, I used Google Trends to tease out positive underlying trends for business formations. At that time, momentum was in LegalZoom’s favor, and I used that clue as a basis for recommending a buy in LZ ahead of earnings. Things are much different this time around.

The chart below implies weakening, not strengthening, trends in business formations. While “how to form a business” started the year stronger than 2023’s start, the past month produced a sharp decline. More importantly, the much larger search activity on “how to start a business” started 2024 much weaker than 2023’s start. That weakness has extended the entire year-to-date. Layer on LegalZoom’s acknowledgement that “generally speaking, dissolution rates have been a little bit higher than they have historically been”, and I see the makings of a “show me” stock.

Google search trends imply a declining trend in business formations in the U.S. (Google trends)

When an analyst asked for details on the source of the company’s confidence in a rebound for market share growth, management responded with a laundry list of initiatives that are either in test mode or in the early stages of launch. For example, the company is “still actively testing the market” with “some things that we changed around at the end of the quarter, where we feel pretty confident it will reaccelerate some of our share through better conversion.” LegalZoom also plans to do brand spending now that they have confidence in the product experience and its sales channel. The conversion of brand-new marketing efforts presents a major “show me” scenario, especially in the context of a disappointing earnings report.

Second problem, generative AI essentially disappeared from LegalZoom’s product story. Last year, I wrote about how the company successfully navigated a “ChatGPT scare”. The market panicked out of the stock, concerned that generative AI would undermine LegalZoom’s business. The sell-off delivered a major buying opportunity. However, a year later, the company is not touting any further significant or material advances with AI, generative or otherwise. Management made a single reference to AI in the conference call, and this occurred in the Q&A session, not the prepared remarks: “We can take things like our forms capability and our AI capability in Doc Assist, and we can integrate those all into an experience which will create a new way for people to interact with their attorney. And so prenup is an example of that, and it’s really just the very first example, but we expect to expand into a lot of matters over the coming quarters.” The prenup product is brand new (see below), so it sounds like LegalZoom does not have any material innovations in generative AI (did the stock suffer a fresh ChatGPT scare redux?). I hope future earnings reports dissolve my concerns and show me wrong.

Third problem, management touted the potential upside from its BOIR offering. The Beneficial Ownership Information Report, or BOIR, is a new requirement for businesses from the Financial Crimes Enforcement Network (“FCEN”) in the U.S. Department of the Treasury. LegalZoom implied that this process is so complicated that small business would pay up for the service and attach through a general compliance service. I visited the FECN website, filled out the form and submitted all requirements in under 15 minutes for my LLC. Accordingly, I worry LegalZoom may be over-estimating the uptake from the new BOIR compliance requirement. Again, I hope I am proven wrong.

Where Are the Numbers in the Strategic Pillars?

LegalZoom has three strategic pillars: scale the business, build the ecosystem, and integrate experts. Each pillar sounds good, but the company reported on them without quantifying the contributions of the components. Thus, analysts are left to largely guess about building models from a sum-of-the-parts basis. Such a situation can be overlooked for a high-performing business. Unfortunately, LegalZoom is in the middle of several new product launches and business overhauls. So the lack of clarity can hinder confidence in the overall guidance. Statements like “the early results are promising” and “the early results have been strong, but we expect further acceleration with additional testing” are insufficient and ooze “show me.”

Here is a summary of the pillars as reported in the Q1 earnings, along with some editorializing:

- Scale the Business

- Objective: Growth through “improving the LLC experience”

- Key Challenge: “The majority of our product sessions are mobile, and they convert at less than 1/3 of the rate of desktop sessions.”

- I am surprised by the focus on mobile conversions. I think of a prospective business formation on the mobile phone as a casual browser looking formation. I wonder whether LZ could motivate users to finish the process (perhaps through an email?) on the preferrable form factor of a laptop or desktop. Most serious business owners should have one or the other (except perhaps aspiring social media influencers).

- Opportunity for Quantification: “Estate planning is an important front door to our ecosystem, and many of the infrastructure investments we’ve made around our SMB experience and fulfillment infrastructure have been built in a way that allows us to leverage them across other offerings with relatively minimal investment.”

- Given estate planning’s importance, an understanding of share of transactions/revenue growth would be helpful.

- How minimal is “minimal investment”?

- Key Challenge: “The estate planning product has not been refreshed for close to a decade and has created a revenue headwind over the last 3 years post pandemic.”

- That admission of an archaic, revenue-dragging user experience is concerning when applied to an important front door to the entire ecosystem. The good news is that improvements here hopefully offer healthy upside. Knowing the potential upside would go a long way to building confidence.

- Build the Ecosystem

- Objective: “Optimize the experience after the formation is complete.”

- Key Challenge: “The recent changes to our formation flow may put some pressure on the performance of our subscription add-ons in the near-term, but we feel confident the changes we are making will benefit us in the long run.”

- CEO Dan Wernikoff celebrated a doubling in myLZ logins from December to March, but provided no measure of how that surge converted into product engagement or revenue. Moreover, Q1 is a seasonally strong period, so a year-over-year comparison for the growth would provide better context. (For example, logins looking for tax-related information).

- Opportunity for Quantification: All of the associated initiatives are in early stages with no quantified results reported.

- Integrate Experts

- Objective: “Modernizing how solopreneurs can have affordable and easy access to (accountants and attorneys).”

- Key Challenge: “There remains a large portion of our customers we’re not yet serving when it comes to their early tax needs, which is still a large and unrealized opportunity.”

- It is not clear to me how LZ can realize the opportunity when so many of the formations are not yet ready to file taxes. Per the company: “Approximately 40% have not yet started operations at the time of formation and over 35% generate less than $10,000 in their first year in operations.” Thus, it could take a year or more to understand whether the tax offering is meaningful to the new businesses that last that long.

- Opportunity for Quantification: Wernikof touted the attractiveness of launching prenuptial agreements as its first partnership with a network of attorneys to participate directly in legal matters: “This matter was selected intentionally, given its quick time to value, low jurisdictional complexity and forms-based engagement.” LegalZoom prenups currently cost $1499, but the scale of the opportunity is not calculable without the number of attorneys in the partnership. Still, the company is confident about its expanding legal offerings: “This will be a platform play in a space that currently has no established players and certainly no one with the brand name recognition, technology capabilities and attorney reach.”

Overall, the various initiatives across the strategic pillars sound promising. However, the number of moving parts without specific quantified business contributions means that guidance is the more salient aspect of expectations for LZ.

Aggregating the Pillars to the Guidance

LegalZoom reiterated its guidance, despite guiding down its macro expectations. Compliance performance, including BOIR, is supposed to make up for weaker economic expectations. Given the direct impact on formations, a guide down for macro is bound to dampen enthusiasm even with promising moves in the product mix. I compiled a summary of guidance, including items sprinkled across the Q&A section of the conference call:

- At least 10% growth in market share calculated from Q1

- By early Q3, the company will recover its prior sales capability.

- Q2 flat year-over-year AOV (average order value) and “mid single-digit decline in AOV for the full year, compared to the full year 2023.”

- Q2 CAM (Customer Acquisition Marketing) expenses up “approximately $5 million compared to the first quarter of 2024 due to higher brand spend, some of which was deferred from Q1…”

- Q2 total revenue of $172M to $176M, representing a 3% year-over-year increase at the midpoint

- Full-year revenue of $700M to $720M, representing a 7% year-over-year increase at the midpoint (thus LegalZoom is relying on acceleration in the second half of the year like it experienced in 2023)

- Q2 adjusted EBITDA of $25M to $27M, representing a 15% margin at the midpoint.

- Full year adjusted EBITDA of $135M to $145M, representing 20% margin at the midpoint (again, the company is expecting improved business conditions in the back half of the year)

- Full-year mid single-digit decline “in the formations macro for the full year 2024 versus our original expectations of flat to low-single-digit growth.”

- Continue to expect subscriptions to outpace transactions.

- LLCs will strengthen on a year-over-year basis “as we get to the end of the year.”

The growth numbers are decent, but not inspiring enough to offset concerns about the downside potential to guidance. Full-year guidance’s reliance on improved performance in the second half of the year deeply underlines the show-me theme…especially given the formation trends implied in Google search trends (as described above).

Conclusion and the Trade

Having said everything above, LZ does over a technical justification for holding shares. The all-time lows set with last year’s ChatGPT scare could hold as support. With cash sitting at a two and a half year high and a buyback in place, LZ is in a better place than it was during those all-time lows. Moreover, the company promised to “opportunistically repurchase shares of our common stock as part of our balanced approach to capital allocation.” Given the company recently spent $13M repurchasing 1.2M shares at an average price of $10.91, current price levels offer LegalZoom a very attractive spot to start spending its increased authorization.

On a valuation basis, LZ is dirt cheap again, making holding shares more palatable despite the formations risk I described above. Both price/sales and EV/sales are at all-time lows.

The yo-yo trading in LegalZoom shares. (Tradingview.com)

I was a little over-eager in re-accumulating LZ shares after the post-earnings collapse. Given the company is in “show me” mode, I rate shares as a hold. I want to see Q2 earnings definitively show progress on answering the questions above before deciding on a rating upgrade.

Be careful out there!