Euroseas: Things are going well, but you can’t buy stocks at these levels (NASDAQ:ESEA)

Thierry Dossaugne

ESEA is moving in a good direction

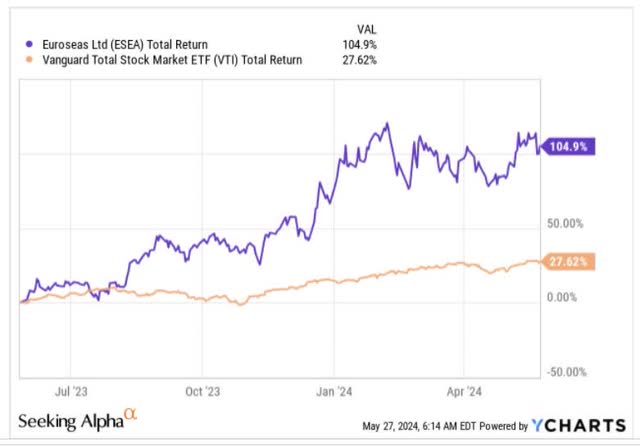

The broader stock market has been resilient enough over the past year to deliver returns of 28%. However, Euroseas Ltd. (NASDAQ:ESEA), Greek shipping company Do you operate in the container ship space? During the same period, ESEA outperformed the overall stock market by about 3.8 times.

Y chart

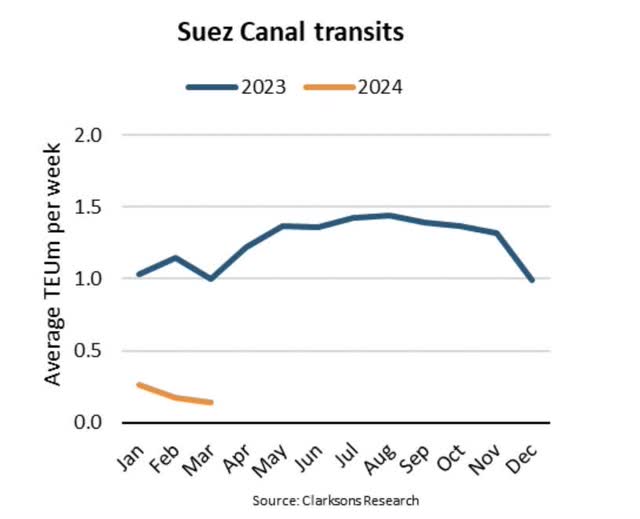

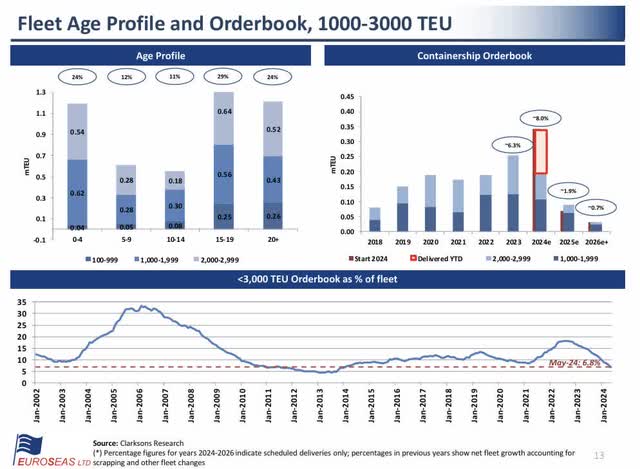

A surge in Houthi rebel attacks on ships transiting the Red Sea this year has thrown a spanner in the works for maritime traffic in the Suez Canal. Compared to last year, the average TEUm transportation volume per week in 2024 decreased significantly, and the resulting route change effect increased vessel demand by an additional 10%. This situation should also make investors pay attention to the speed of ship recycling. It is expected to be discontinued in FY24, increasing the life of the fleet. This would work very well for ESEA, especially considering the slow rate of new capacity additions in the sub-3000 TEU space until FY25 (more on this later). Overall, according to Clarkson’s forecast, container ship trade demand is expected to surge 9.2% this year, compared to the previous forecast of 5.5%.

Y chart

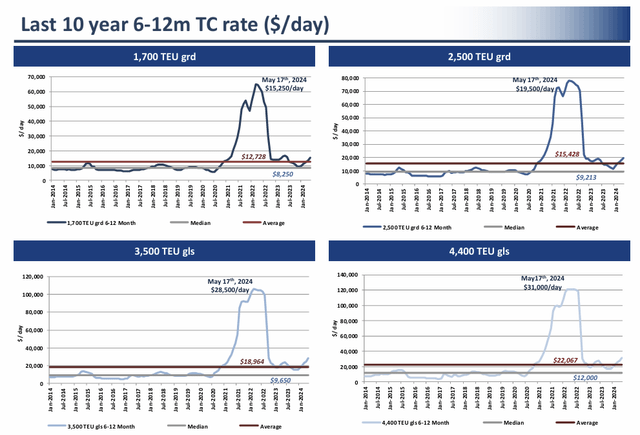

Nonetheless, changes in supply/demand positions have already boosted time charter rates this year, with ESEA executives noting rates have increased by 73% since the December 21 low.

As of May 17, ESEA’s sub-one-year time charter rates are currently trending well above the 10-year average, and ESEA is well-positioned to benefit from this momentum with seven vessels seeing time charters. It appears that there is. It expires this year. ESEA’s Charter coverage in 2024 is now at a somewhat higher threshold of 88%, which provides useful visibility.

First Quarter Presentation

Global GDP growth this year is expected to be 3.2%, but cargo volume is expected to record an average growth rate of 3.5%, slightly higher than in the first half of the year, especially due to last year’s low base effect.

As things stand, there appears to be no solution in sight regarding the Red Sea crisis. Recent days have seen strong rhetoric from the United Nations maritime agency to address the situation, but doubts remain whether real progress will be made.

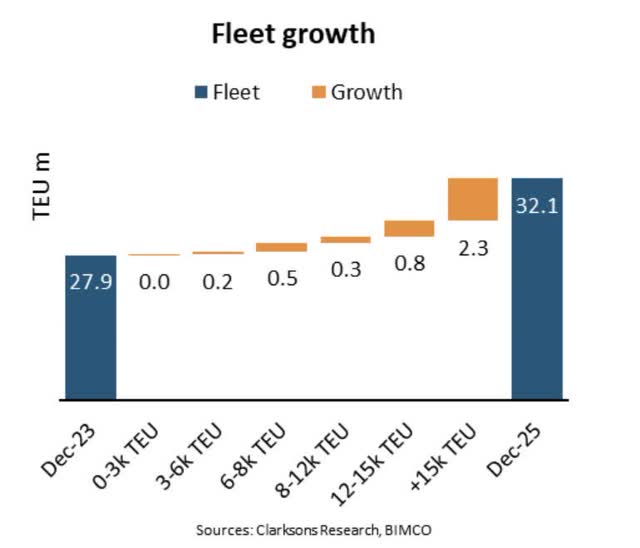

If not for these Red Sea developments, there is good reason to believe that container shipping rates are likely to remain stagnant at low levels, especially with the increased supply entering the market. By FY25, the container ship fleet in the system is expected to increase by about 15%, reaching a total TEU of 32.1 million TEU by the end of next year.

beamco

However, the key thing to note is that ESEA’s fleet consists only of feeder ships and midships (currently 22 in total) and primarily capacity vessels, so it is unlikely that ESEA will face the same supply-side pressures as its larger competitors. is. Less than 3,000 TEU. The projected new capacity in this space (see image above) is next to nothing, with most of the capacity increase (75%) expected to come from vessels with a capacity of 12000 TEU or more, rather than from regions where ESEA is involved.

First Quarter Presentation

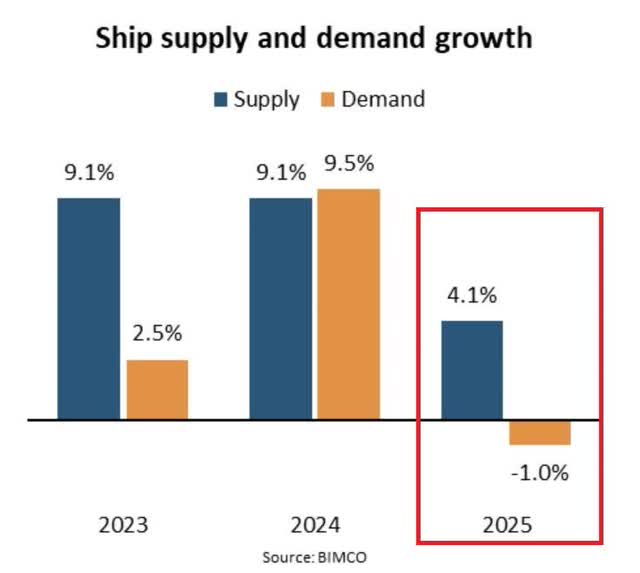

If these Red Sea tensions eventually ease over the next 12 months (and this is still a big IF), the container shipping industry is likely to face an unfavorable supply-demand backdrop through FY25, especially given the momentum of fleet expansion across the broader industry . For context, the order book as a % of the fleet is still significant at over 21%, while in the 1000-3000 TEU area it is still quite modest at less than 7%. This will provide some support on charter rates, especially since 50% of the vessels are already over 15 years old!

Closing Thoughts – Why ESEA Stock Is Bad Buy Now

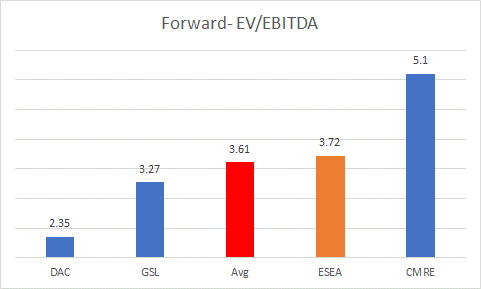

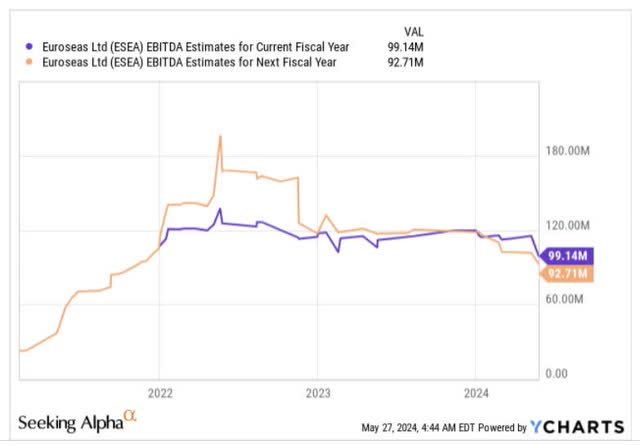

Despite our relatively favorable stance on ESEA’s prospects thus far, we are not convinced that it offers great value at these levels, especially when considering its future EBITDA outlook. According to YCharts, ESEA is currently priced at 3.72x future EV/EBITDA, which represents a 56% premium compared to its long-term average.

Y chart Y chart

At 3.72x, it is currently priced above the industry average. I wouldn’t be opposed to paying a premium if it achieved healthy levels of EBITDA growth by FY25. However, that is unlikely to happen given the likely tilt in industry-wide demand-supply dynamics in FY25 (ESEA may be better) and outranks peers due to focused vessels, but rates are as resilient as they are now I don’t think there will be any.

beamco

The sell side appears to be keeping this very much in mind as it is reflected in current estimates through FY24 and FY25. After generating adjusted EBITDA of $123.6 million, the YCharts consensus for ESEA is currently pointing to a two-year CAGR decline of -13%. This is not good news when the stock is priced at a premium of more than 50%.

Y chart

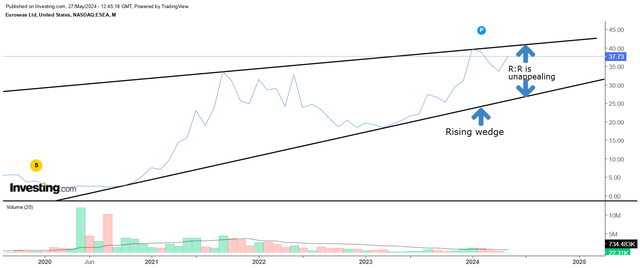

Meanwhile, ESEA’s standalone weekly chart shows a rising wedge pattern, with the risk of a reversal the higher it goes. As tempting as it may be to dismiss the possibility of a reversal, with the stock currently trading well outside the lower boundary of the wedge and nearly 7% off the lower boundary of the wedge, the risk-reward picture doesn’t look too attractive. upper limit.

invest

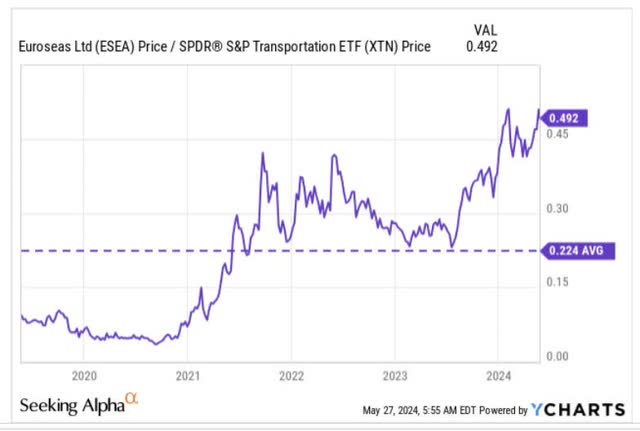

Finally, a relative strength chart that takes into account ESEA’s positioning relative to other transportation stocks (which can be used to identify promising turnaround opportunities within a particular sector) shows that its current ratio is significantly overextended relative to its upside potential and is currently trading well. It shows. That’s more than double the long-term average level. This relatively overbought position is likely to dampen cyclical interest in ESEA.

Y chart