iShares Micro-Cap ETF: Structural Underperformance to Avoid (NYSEARCA:IWC)

Paper Boat Creative/DigitalVision via Getty Images

iShares Micro-Cap ETF (NYSEARCA: IWC) provides diversified exposure to America’s smallest publicly traded companies. The beauty of this stock sector is that some hidden gems can emerge as the “next big thing” that could potentially yield significant returns over the long term.

While that may be true, this idea doesn’t seem to work well in this ETF structure. The problem is that the best microcaps ultimately grow out of the fund, leaving behind a fundamentally weak set of companies.

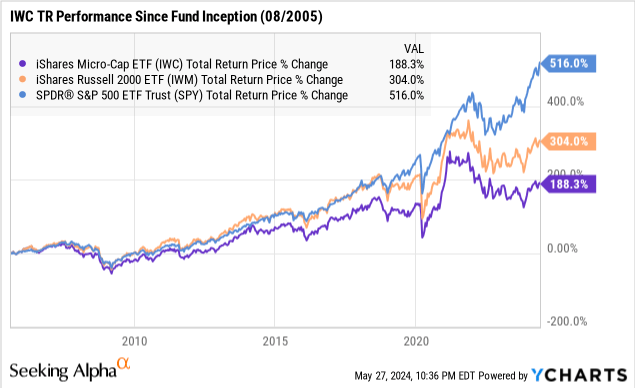

In fact, IWC has lagged the returns of broad market indices for nearly two decades and underperformed the small-cap focused iShares Russell 2000 ETF (IWM). Here’s what you need to know:

What is IWC ETF?

IWC was created to track the “Russell Microcap Index,” which consists of the smallest 1,000 companies and the next-smallest 1,000 companies within the Russell 2000 index. Eligible securities based on market capitalization.

The mid-microcap index company has a market capitalization of just $213 million, which is below the $300 million threshold for what is typically classified as a “small-cap” stock. The indices and funds are reconstituted annually based on the float-adjusted market capitalization weighting of each stock.

Importantly, IWC utilizes an exponential sampling strategy. This means that rather than holding all 2,000 microcap stocks, we have a current portfolio of 1,468 stocks that we expect to closely represent the index returns and risk profile.

This also includes companies that qualify for an investment mandate that allows up to 20% of total exposure to stocks that are not technically microcaps but have similar economic characteristics that are substantially the same as index constituents. This is important in the small-cap world because some stocks are too small for IWC to have a meaningful position in them.

IWC Portfolio

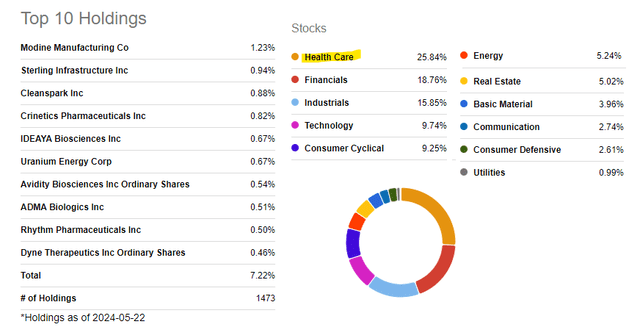

Looking through the IWC portfolio, we discover a diverse group of companies and lesser-known names. Modine Manufacturing Co (MOD) currently holds the largest holding with a weighting of 1.2%, followed by Sterling Infrastructure, Inc. (STRL).

MOD’s share has risen more than 420% over the past year due to high demand for data center cooling solutions within AI infrastructure. STRL has a similar story as a construction and engineering provider that specializes in building data centers. STRL is up 44% in 2024.

Naturally, the best-performing stocks gain relative importance within the fund as their weight contribution increases. This happens at the expense of rejecters.

We mentioned that IWC holds stocks that are not technically microcap. In this case, MOD, with a market capitalization of $5.4 billion, and STRL, valued at $3.9 billion, are already in “mid-cap” territory, meaning they will likely be excluded from the IWC portfolio in the next reorganization.

pursue alpha

IWC Performance

Given the overall size of the IWC portfolio, where the top 10 stocks represent only 7% of the total, the performance of any single stock is ultimately dominated by the larger themes facing the microcap sector.

What stands out to us is the exposure to the healthcare sector, which currently accounts for 26% of the fund. In the microcap world, most companies are biotech companies, which themselves are perceived as highly volatile and speculative.

In many cases, microcap biotech companies are only in the development stages of commercialization strategies with limited or no returns. Some have survived, but recurring losses and dilution of funds are common themes weighing on groups without blockbuster drug approvals.

The same goes for microcap financial sector holdings, which account for 19% of the fund. In this case, many small regional banks are struggling to keep tabs on the ongoing fallout from the short-lived 2023 banking crisis that saw several institutions fail.

In our view, small-cap stocks are structurally disadvantaged compared to large-cap leaders with more competitive resources and stronger fundamentals.

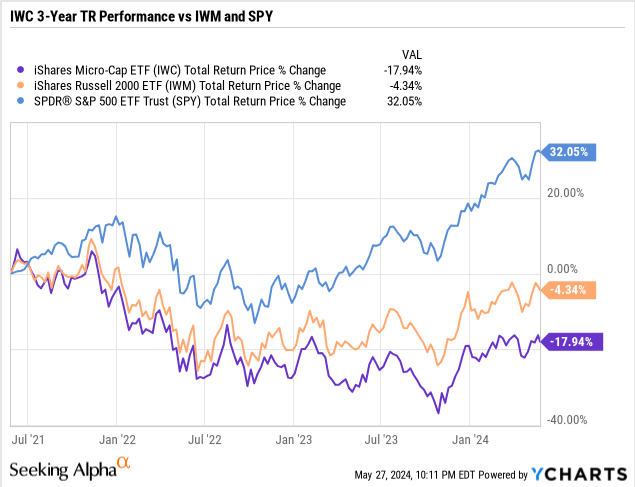

Over the past three years, IWC has lost about 18%, a huge spread compared to the 32% gain for the SPDR S&P 500 ETF Trust (SPY). Investors holding IWM didn’t fare much better, with the small-cap fund still down 4% over the same period.

Another factor that explains IWC’s weakness is its limited technology sector holdings, which account for less than 10% of the fund. Overall, it’s something that’s hard to get excited about.

What’s next for IWC?

There is some thought that the next phase of the stock bull market could push microcaps higher.

One scenario from IWC is that the U.S. economy remains resilient and a downward path for interest rates opens the door to more positive risk sentiment for the riskiest types of investments. Highly leveraged companies or companies with poor fundamentals can benefit from improved credit quality.

Nevertheless, I would say that it is impossible for IWC to achieve a significantly superior performance due to its numerous shortcomings. The best microcaps move into larger fractions, leaving a low-quality residue in the fund.

If there was a good reason to buy IWC, it would be its diversified nature, considering it holds companies that most other index funds don’t. Nonetheless, the iShares Russell 2000 ETF (IWM) is likely a better middle ground with a better chance of converging with S&P 500 returns.

The negative side of IWC is that economic and market conditions will worsen in the future. A setback in the inflation outlook or the possibility of interest rate hikes would add significant volatility to the smallest and most vulnerable companies in the stock market. We expect IWC to trend lower in the next market correction.

final thoughts

Microcap stocks represent an overlooked but important part of the market. Unfortunately, IWC using a passive index strategy does not provide an attractive investment vehicle. Readers are advised to avoid this fund.