EMQQ: A Promising Emerging Markets ETF But with Notable Downsides (NYSEARCA:EMQQ)

piranha

investment thesis

Emerging Markets Internet and E-Commerce ETF (NYSEARCA:NYSEARCA:EMQQ) is on hold due to its high risk and high expense ratio relative to its profit potential. The fund is appropriately focused on growing internet consumption, The trend of underperformance in the e-commerce sector for the middle class in emerging markets is likely to continue. Additionally, there are alternative global internet and e-commerce funds that may better capture emerging market demand with lower expense ratios and potentially lower risk.

Fund Overview and Comparison ETFs

EMQQ is an actively managed ETF aimed at capturing emerging market companies in the Internet and e-commerce industries. Launched in 2018, the fund is rebalanced semi-annually and holds 112 stocks with AUM of $377.25 million. By sector, the telecommunications sector (41.74%) was the largest, followed by consumer discretionary (34.74%) and financial sector (9.33%). By country, EMQQ has the highest proportion. This was followed by China (53.37%), India (16.22%), and Argentina (7.73%). The primary goal of the ETF, which we will discuss in more detail later, is to capture the growth of the middle class in emerging markets as they pursue products such as smartphones and leverage online commerce.

Other funds examined for comparison purposes include Vanguard FTSE Emerging Markets ETF (VWO), iShares Core MSCI Emerging Markets ETF (IEMG), and Global X E-Commerce ETF (EBIZ). For investors looking for a diversified emerging markets fund, VWO is similar to Schwab’s equivalent Emerging Markets Fund (SCHE). VWO is the largest fund by AUM and the most diversified of the ETFs studied. IEMG includes a 22.54% weighting in Information Technology and a 20.17% weighting in Finance. With nearly 3,000 holdings, it is still very diverse, but has a greater focus on technology holdings than VWO. Unlike all other funds, EBIZ is strictly speaking a global fund for emerging markets, and the country proportions are 51.0% in the United States, 23.10% in China, and 7.3% in Canada. EBIZ also has the least diversity, with only 40 holdings.

Fund Comparison: Performance, Expense Ratio, Dividend Yield

Emerging markets funds rose significantly in value in 2020, peaking in 2021, largely driven by Chinese technology companies. For example, stock prices of Taiwan Semiconductor Manufacturing (XTAI:2330) and Tencent Holdings (XHKG:700) roughly doubled in 2020 alone. After that, EMQQ’s strong returns in 2020 were almost all gone by the end of 2023. EMQQ had a five-year average annual return of -0.29%, for a total return of 13.75%. In comparison, peer funds were less volatile and delivered similar or better returns. VWO’s five-year average annual return is 2.69%, IEMG’s five-year average return is 2.80%, and EBIZ’s five-year average return is 6.70%.

5-Year Total Price Returns: EMQQ and Comparative EM Funds (Look for alpha)

The biggest drawback to me is that EMQQ’s expense ratio is high at 0.86%. This is higher than all other comparable funds and higher than the average ETF expense ratio of 0.57%. If you see EMQQ’s consistent excellent performance, this will suit your taste. However, as we covered earlier, this is not necessarily the case. Broadly diversified, VWO and IEMG have respectable dividend yields. Because EMQQ focuses on internet and e-commerce holdings, its dividend yield is quite low at 0.72%. However, EMQQ’s dividend has been growing at a three-year CAGR of 29.23%.

Cost ratio, AUM, dividend yield comparison

|

EMQQ |

VWO |

IEMG |

Ebiz |

|

|

cost ratio |

0.86% |

0.08% |

0.09% |

0.50% |

|

operating assets |

$377.25M |

$1038.1B |

77.67 billion dollars |

$67.51M |

|

Dividend Yield TTM |

0.72% |

3.38% |

2.78% |

Not applicable |

|

Dividend Growth 3 Year CAGR |

29.23% |

14.74% |

7.98% |

Not applicable |

Source: Seeking Alpha, June 1, 24

EMQQ Holdings and emerging market outlook factors

With 112 holdings, EMQQ is much less diversified than the broad-based VWO and IEMG. However, it still holds similar holdings in the likes of Reliance (XNSE:RELIANCE) and Tencent Holdings. Because EBIZ is a global fund, EMQQ has few similarities to Sea Ltd (SE).

Top 10 Holdings in EMQQ and Comparative Emerging Markets ETFs

|

EMQQ – 112 owned |

VWO – 5,846 owned |

IEMG – 2,941 owned |

EBIZ – 40 holdings |

|

Reliability – 8.80% |

2330 – 7.02% |

2330 – 7.40% |

CVNA – 8.11% |

|

700 – 8.32% |

700 – 3.40% |

700 – 3.62% |

SE – 6.53% |

|

9988 – 7.73% |

9988 – 2.00% |

005930 – 2.96% |

WSM – 4.99% |

|

Melly – 7.65% |

Dependency – 1.49% |

9988 – 1.85% |

TCOM – 4.80% |

|

PDD – 7.56% |

HDFC Bank – 1.28% |

Dependency – 1.21% |

GDDY – 4.63% |

|

3690 – 7.32% |

PDD – 0.95% |

PDD – 1.06% |

eBay – 4.56% |

|

NPN – 3.69% |

3690 – 0.92% |

000660 – 0.90% |

JD – 4.16% |

|

9618 – 3.45% |

939 – 0.76% |

3690 – 0.82% |

Female – 4.05% |

|

SE – 3.45% |

INFY – 0.75% |

ICICIBC – 0.81% |

4755 – 3.98% |

|

NETTF – 3.19% |

2317 – 0.72% |

939 – 0.80% |

RBA – 73.49% |

Source: Multiple, edited by the author on June 1 and 24

There are a number of reasons to be cautious and optimistic about emerging markets funds and EMQQ going forward. Emerging markets have underperformed significantly, but there are a number of growth factors that could reverse this trend. However, EMQQ’s holdings are based in emerging market regions, which pose significant risks. In contrast, EBIZ is in a stronger position because its top holdings are physically located in developed countries, allowing it to take advantage of emerging market growth. These outlook factors are discussed in more detail below.

Why Traditional EM Funds Underperform

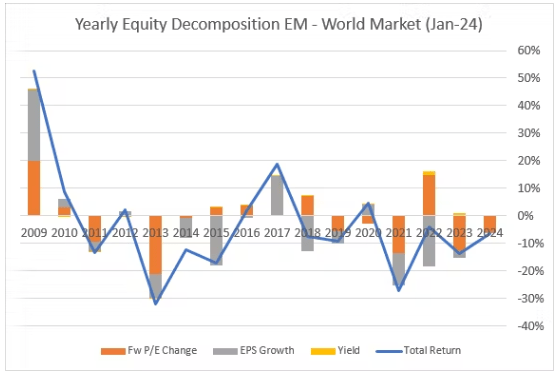

Emerging markets have significantly underperformed domestic U.S. equities over the past 25 years. The S&P 500’s total 10-year return was over 170%, while emerging markets were virtually flat. Domestic bias, emerging market investment outflows over the past decade, and geopolitics have all contributed to underperformance over the past two decades. But a more immediate factor is that emerging market stocks have delivered subpar returns. Price-to-earnings and earnings-per-share growth rates have been low and even negative for several years.

Emerging Markets Stock Performance (Macrobond)

Another risk factor is that emerging markets tend to be highly concentrated in specific sectors and companies. We can see this today with Taiwan Semiconductor Manufacturing and Tencent Holdings. Since only about 27% of total global market capitalization comes from emerging markets, ETFs are particularly sensitive to a small number of top holdings.

Greater potential than EMQQ’s larger, more diversified EM funds

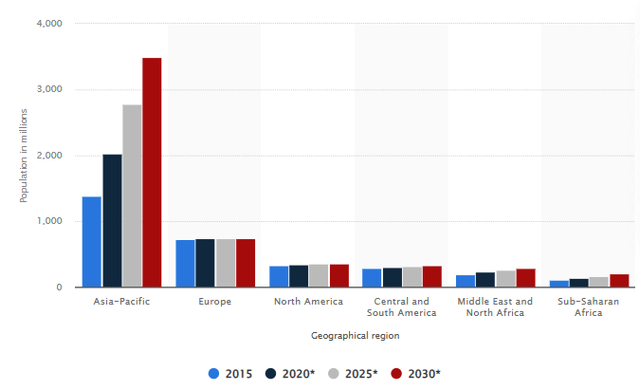

Although emerging markets have underperformed over the past decade, there are reasons for optimism. Emerging markets recently accounted for about 27% of global market capitalization, up from 19% in 2009. Goldman Sachs even predicts that emerging markets will reach 47% of global GDP by 2050, along with 60%. Much of this impressive increase is due to the growth of the emerging market middle class. The global middle-class population growth forecast by region is expected to grow explosively in the Asia-Pacific region, while middle-class population growth in Europe and North America has stagnated.

Forecast of middle class population growth by region (Startista, June 24, 1)

According to Global X, e-commerce is expected to grow from less than 20% to 23% of global retail sales by 2027. The emerging market middle class will consume new products and services such as mobile phones and the internet. Therefore, while the broad-based VWO and IEMG capture a more diverse segment of emerging markets, we believe EMQQ is well positioned to best capture consumer demand for the growing middle class.

Why EBIZ is likely to outperform EMQQ

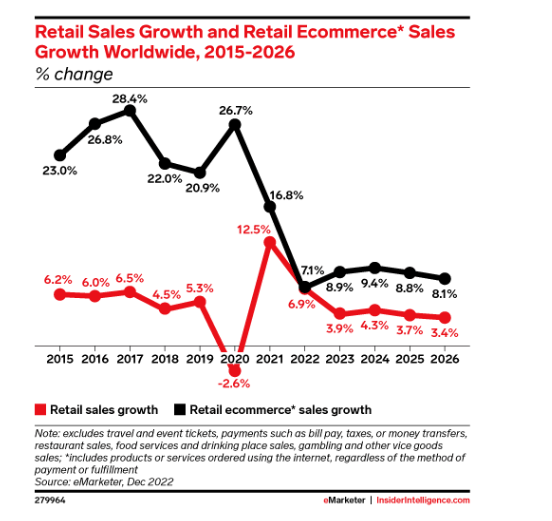

Despite EMQQ’s competitive advantage over the broadly diversified VWO and IEMG, its main drawback is that the companies included in its holdings also belong to emerging market countries. Global retail e-commerce is expected to grow by more than 8% year-over-year, but this growth will not necessarily be captured by companies physically located within emerging countries.

Global e-commerce sales growth by 2026 (eMarketer, 2022)

Importantly, EBIZ is an ETF that captures holdings that benefit from the emerging market middle class and e-commerce growth while reducing the risks associated with a company’s physical location. GoDaddy (GDDY), the fifth-largest holding in EBIZ, is an example of a U.S.-based company that is benefiting from emerging market growth by selling services in 200 markets around the world. GoDaddy’s latest annual report shows that 48% of its customer base and about a third of its revenue come from international sources. eBay (EBAY) is another company that offers e-commerce across 190 counties. According to eBay’s last annual report, only about 9% of its tangible assets were outside the United States, but 50% of the company’s net revenue came from foreign sources. Both companies are therefore expected to capture emerging market consumer demand while reducing geopolitical risk.

current valuation

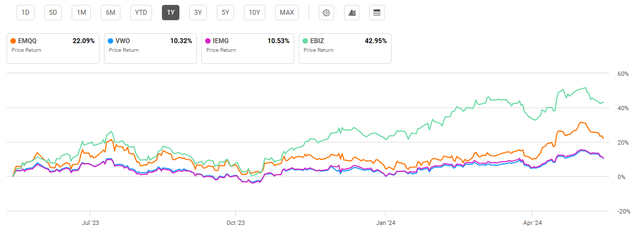

Emerging markets have had relative success compared to developed markets in controlling inflation. Additionally, strong global demand has helped emerging markets perform well over the past year. As a result, all EM funds studied have returned more than 10% since the summer of 2023. In particular, EMQQ recorded a return of more than 20% in one year, which is almost equivalent to the S&P 500 index. However, it underperformed its EBIZ, which includes U.S. Internet and e-commerce holdings globally.

One-Year Performance: EMQQ and Comparative ETFs (Look for alpha)

The strong performance of EMQQ and EBIZ earned both funds higher ratings compared to the broadly diversified VWO and IEMG. Looking at the price-to-earnings ratio and price-to-book ratio, EMQQ has a more attractive valuation than EBIZ, but is significantly more expensive than VWO and IEMG. However, given the inherent strengths of EMQQ and EBIZ, I don’t see VWO and IEMG as a buy for reasons already discussed. In contrast, EBIZ has the highest P/E and P/B ratios, but we believe it has the strongest potential to capture emerging market earnings growth.

Evaluation indicators for EMQQ and similar competitors

|

EMQQ |

VWO |

IEMG |

Ebiz |

|

|

Price/Earnings Ratio |

24.85 |

14:50 |

15.22 |

27.96 |

|

P/B ratio |

2.60 |

2.10 |

1.78 |

3.97 |

Source: Compiled by author from multiple sources, 1 June 24

Risks to Investors

As discussed, all emerging markets funds carry a significant level of risk due to their concentration in specific sectors and companies, as well as their geopolitical exposure. The overall volatility can be measured by the standard deviation of each fund. Both EMQQ and EBIZ have had a standard deviation of about 30 over the past five years and a beta of 1.52 compared to MSCI Emerging Markets. Although this is relatively volatile, EBIZ believes it faces less geopolitical risk due to its global diversification. Tensions between China and Taiwan, Internet restrictions in China, and numerous other factors are all unknown variables and represent additional risks for investors.

Conclusion Summary

The decade from 2010 to 2020 was the worst decade for emerging market returns since the 1930s. However, there are many reasons to believe that emerging markets are poised for a recovery, including a massive increase in the middle-class population, leading to increased consumer demand for goods and services such as mobile phones and internet access. So while broadly based VWOs and IEMGs may have greater diversity, EMQQs are better positioned to capture this demand. However, EMQQ’s top holdings still face significant levels of risk. For this reason, I believe that EBIZ, which includes both emerging markets and U.S.-based companies, is best equipped to capture this emerging market growth. Lastly, EMQQ has the highest expense ratio of the comparable funds, which is a major negative in my opinion.