Emerging Market Links + The Week Ahead (June 3, 2024)

Mexico elections were held yesterday and there is no real mystery with who will become the next President there. However, the ANC in South Africa only received just over 40% of the vote with serious concerns they will need to form a “doomsday coalition” with more radical parties (the EFF and/or MK) rather than the DA (the traditional opposition).

Meanwhile, its been reported that chipmakers can disable advanced chipmaking machines remotely – which makes you wonder what else has backdoors or backend kill switches. Its probably another reason why China is pouring $47.5 billion into a third fund to boost chip development.

Finally, Malaysia is also planning to spend 25 billion ringgit (US$5.3 billion) to lure more semiconductor investments to the country and train local engineers.

$ = behind a paywall

-

🇮🇳 Quick Service Restaurant (QSR) Stocks in India (May 2024) Partially $

-

Last posted moneycontrol Stock of the Day stocks (from April) plus Indian QSR stocks, Indian fine dining restaurant stocks and restaurant proxy player stocks (e.g. QSR suppliers, etc).

-

-

🌐 EM Fund Stock Picks & Country Commentaries (June 2, 2024) Partially $

-

The case for India + 10 reasons to invest, El Niño + La Niña Latam impacts, Turkish stocks, EM elections to watch, South Korea reforms, EM w/o China, is China exporting deflation, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 NetEase Inc.: Will The Increased Revenue From Game Innovation & Expansion Last? – Major Drivers (SmartKarma) $

NetEase (NASDAQ: NTES)‘s first quarter earnings highlighted the company’s ongoing growth, driven in large part by its game portfolio.

Net revenue for Q1 rose to RMB 26.9 billion, marking an accelerated YoY increase led by the company’s diversified game offerings.

There was significant growth from established game franchises which have managed to maintain high popularity among their user bases, showcasing the sustainability of the company’s games.

🇨🇳 Alibaba/JD.com: Thoughts On The Recent Convertible Bond Issuance (SmartKarma) $

Alibaba Group (NYSE: BABA) and JD.com (NASDAQ: JD) both announced the issuance of convertible debt last week (Alibaba on May 23 and JD.com on May 21).

Both have mentioned that the reasons for the issuance are the low funding cost (0.25% coupon for JD.com and 0.5% for Alibaba) and to fund their current share repurchase program.

I think the convertible debt structures makes sense and it is beneficial for both companies to buy back as much as possible at the current share price.

🇨🇳 Alibaba signs David Beckham to boost global sales (Caixin) $

Alibaba Group (NYSE: BABA) ’s global online marketplace AliExpress has enlisted English soccer star David Beckham as a global brand ambassador, the company announced Monday, as the Chinese e-commerce giant doubles down on efforts to boost sales overseas.

The one-year partnership is part of a campaign for the upcoming UEFA Euro 2024 soccer tournament, AliExpress said. Users of the online marketplace will get a chance to win discounts and other prizes like match tickets, the company said in a statement.

🇨🇳 JD rights its shopping cart with first-quarter turnaround (Bamboo Works)

The e-commerce giant’s latest results beat market expectations, earning new confidence as it seeks to regain its lost momentum

JD.com (NASDAQ: JD) reported a profit of 7.1 billion yuan for the first quarter, up nearly 13% year-on-year

Many investment banks upwardly revised their price targets and ratings for the stock after the release of the latest report

🇨🇳 JD.com Inc.: How Are They Strengthening the Platform Ecosystem & Continuing Their Market Dominance? – Major Drivers (SmartKarma) $

JD.com (NASDAQ: JD), a China-based multinational technology conglomerate, has announced its first-quarter results for 2024 in an earnings call and reported robust profit and revenue growth, along with an encouragingly high Net Promoter Score (NPS).

The revenue growth was accelerated by strong execution amidst evolving industry dynamics, improved user experience, price competitiveness, and platform ecosystems.

Importantly, the general merchandise and supermarket category recorded a notable jump in terms of gross merchandise value (GMV) and revenue growth.

🇨🇳 Commentary on Pinduoduo’s Q1 2024 Earnings (Investing in China)

Fraud or opportunity?

PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Q1 2024 earnings report raised eyebrows with a 100% increase in revenue and over 200% growth in earnings. Some critics quickly labeled these results as fraud, claiming such performance is impossible. Here, I’ll share my experience, insights about Pinduoduo, and my perspective on this situation.

In summary, Pinduoduo’s status as a latecomer in the market has necessitated a high level of secrecy to effectively compete with well-established players. This secrecy often leads to confusion and fear among investors, who equate it with a lack of transparency and, given that it’s a Chinese tech company, potential fraud. However, I prefer to rely on the insights of more knowledgeable entities, like Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY), which has a significant stake and better access to Pinduoduo’s data. If Tencent starts selling their shares, I would be concerned. Until then, I trust their judgment over speculative concerns.

🇨🇳 Chart of the Day: PDD’s Growth Leaves E-Commerce Rivals in the Dust (Caixin) $

Chinese e-commerce giant PDD Holdings (NASDAQ: PDD) or Pinduoduo’s quarterly growth far outpaced rivals Alibaba Group (NYSE: BABA) and JD.com (NASDAQ: JD), reflecting online shoppers’ preference for cheaper products during an uneven economic recovery.

PDD Holdings Inc., which owns e-ecommerce platforms Temu and Pinduoduo, reported its first-quarter net income soared 246% from a year earlier to nearly 28 billion yuan ($3.9 billion) on revenue that more than doubled, according to its earnings results released Wednesday.

🇨🇳 Trip.com voyages back from pandemic lows, but lags global peers in valuation (Bamboo Works)

The latest results from China’s top online travel agent showed it continues to dominate its home market, as it attempts to replicate that success overseas

Trip.com (NASDAQ: TCOM)’s revenue grew 27.8% in the first quarter, as its stock caught up to the company’s strong business gains from last year

The company’s overseas businesses, Trip.com and Skyscanner, are shaping up as new growth drivers

🇨🇳 EDA woos investors with its cross-border e-commerce story (Bamboo Works)

Shares of the e-commerce logistics services provider jumped 84% on their first trading day last week, though they later gave back some of the gains

EDA Group Holdings Ltd (HKG: 2505 / FRA: 7OZ)’s revenue rose 71% last year on strong demand for its logistics services for Chinese cross-border e-commerce merchants

The company’s “pre-sale stocking model” could give it an advantage as the direct-shipping model used by rivals Temu and Shein comes under fire in the U.S.

🇨🇳 Hello Group still looking for investor love as revenue declines accelerate (Bamboo Works)

The company sometimes called the ‘Tinder of China’ said its revenue fell 9% in the first quarter, and predicted the rate of decline would accelerate

Hello Group (NASDAQ: MOMO)’s three years of revenue declines continued in the first quarter and are accelerating as the company faces both internal and external headwinds

The dating-app operator said it could soon receive a policy boost, in an apparent reference to China’s recent efforts to raise its tumbling birthrates

🇨🇳 iQiyi beats profit estimates but leaves subscriber numbers a mystery (Bamboo Works)

iQIYI (NASDAQ: IQ)

Lacking a megahit drama series this time, the Chinese streaming platform logged lower first-quarter earnings but still exceeded market expectations

The platform’s operating revenue fell 5% in the first quarter and non-GAAP profit dropped 10% from a high base a year earlier

The streaming service was not able to match the success of online drama “The Knockout”, which screened last year

🇨🇳 Yeahka braces investors for bad first half while trying to depict a rosy future (Bamboo Works)

The payment services company said an extraordinary adjustment that hit its revenue last year will continue to weigh on its first-half results, as it talked up progress in its overseas expansion

Yeahka (HKG: 9923 / FRA: 4YE / OTCMKTS: YHEKF) said a “non-recurring adjustment on revenue” will no longer be a factor for the company from July, indicating it will continue to impact its first-half results

The company also said its “strategic upgrade” is making good progress, including an overseas expansion to diversify beyond China

🇨🇳 In Depth: Mega blunder adds to Li Auto’s troubles as Huawei rivalry hots up (Caixin) $

Li Auto (NASDAQ: LI) (理想汽车) had reasons to be upbeat heading towards the official launch of its much-anticipated Mega electric vehicle (EV) on March 1.

However, an edited image that went viral after the launch event suggested the 559,800 yuan ($77,800) Mega looked like something else — a hearse. After the launch, orders fell short of expectations.

Moreover, this blunder comes as the company, despite its rosy financials, is facing tougher competition than ever, especially from rival Huawei Technologies Co. Ltd.

🇨🇳 Evergrande auto business gets lifeline after problems pile up (Bamboo Works)

China Evergrande has found a potential buyer for its electric car unit (China Evergrande New Energy Vehicle Group Limited (HKG: 0708 / FRA: 4NM1)), which is mired in debt and has been ordered to repay 1.9 billion yuan in government subsidies, but the prospects for the company are still uncertain

The Evergrande auto subsidiary landed more than 10 billion yuan in the red last year, with revenue coming mostly from property sales

If the deal goes through, the new buyer would have to put the struggling car business back on track

🇨🇳 China Merchants to consolidate cargo operations amid shipping boom (Caixin) $

China’s state-owned conglomerate China Merchants Group is shaking up its subsidiaries to consolidate its container line operations amid a boom in the global shipping industry.

China Merchants Energy Shipping Co. Ltd. (SHA: 601872), the Shanghai-listed cargo shipping unit of China Merchants Group Ltd., unveiled a plan to spin off its container shipping arm Sinotrans Container Lines Co. Ltd. and car carrier Guangzhou China Merchants RO-RO Transportation Co. Ltd. (CMES RoRo).

🇨🇳 U.S. rethinks timing of biotech crackdown, easing pressure on WuXi family (Bamboo Works)

The latest draft of a U.S. biosecurity law would give drug companies until 2032 to cut their ties with Chinese contract suppliers, allowing Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) / WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY) / WuXi XDC Cayman Inc (HKG: 2268 / FRA: L74) companies time to focus on Europe instead

The new version of the U.S. bill to restrict business with Chinese biotechs would give U.S. companies an eight-year grace period to find other service providers

The Chinese market alone may not be able to absorb the production capacity that WuXi companies had ramped up for U.S. clients, driving a pivot towards Europe

🇨🇳 Inaugural operating profit fails to lift 111 Inc. (Bamboo Works)

The drug distributor expects to benefit from an ongoing crackdown on corruption in its industry due to the company’s focus on distribution to pharmacies rather than hospitals

111 Inc. (NASDAQ: YI)’s revenue fell in the first quarter from an unusually high base in the year-ago period when drug demand spiked after China ended its pandemic restrictions

The company’s stock remains depressed, trading at a P/S ratio of just 0.05, despite reporting its first-ever operating profit in its latest quarterly report

🇨🇳 Topsports disappoints as it focuses on quality over quantity in ‘uneven’ economy (Bamboo Works)

Shares of the seller of Nike and Adidas shoes in China fell by 9% after it reported a weak second half in its latest fiscal year

Topsports (HKG: 6110 / OTCMKTS: TPSRF) reported its revenue and profit rose 6.9% and 22%, respectively, in its latest fiscal year through February

Despite the full-year growth, the seller of Nike and Adidas sportswear in China’s profit was below analyst expectations

🇨🇳 Futu: Turning Bullish On Strong Customer Growth (Rating Upgrade) (Seeking Alpha) $

Futu Holdings Ltd (NASDAQ: FUTU)‘ most recent quarterly financial performance surpassed expectations as the company’s Q1 2024 revenue and earnings in HK$ terms beat consensus by +1.2% and +8.0%, respectively.

Looking ahead, FUTU anticipates that the company can add 400,000 new paying customers this year, which is way better than the 220,000 new paid client additions it achieved last year.

My rating for Futu Holdings is revised to a Buy, as I am impressed with the company’s above-expectations results and upward client growth guidance revision.

🇨🇳 Futu Holdings Continues To Grow, But Lock In Some Profit (Seeking Alpha) $

Futu Holdings Ltd (NASDAQ: FUTU) is an online brokerage firm based in Hong Kong with millions of customers and a range of services.

The company has reported growth in registered and paying clients, as well as an increase in client assets.

Despite this growth, total revenues only increased by 3.7% and there was a decline in net income, raising concerns about margins and profitability.

Take some profit on this trade, and consider a house position, but watch those margins.

🇲🇴 Wynn Macau Ltd board to consider semi-annual dividend (GGRAsia)

Casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) says its board approved on Thursday amendments to the company’s existing dividend policy, with immediate effect.

According to the amended dividend policy, the firm’s board “shall meet semi-annually to consider the declaration of dividends,” stated a filing that day to the Hong Kong Stock Exchange.

The company’s board “may also meet at any time during the year as the board deems fit to consider the declaration of special dividends,” it added.

Wynn Macau Ltd said it “does not have any pre-determined dividend payout ratio”.

🇰🇷 Maker of Shin instant ramen expands overseas as Korean noodles become hit (FT) $ 🗃️

NongShim Co (KRX: 004370)’s products have gone mainstream in US, where the company plans to add production lines

🇰🇷 End of Mandatory Lock-Up Periods for 45 Companies in Korea in June 2024 (Douglas Research Insights) $

We discuss the end of the mandatory lock-up periods for 45 stocks in Korea in June 2024, among which 5 are in KOSPI and 40 are in KOSDAQ.

These 45 stocks on average could be subject to further selling pressures in June and could underperform relative to the market.

The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in June include Hanwha Ocean (KRX: 042660), LS Materials (KOSDAQ: 417200), and Komico (KOSDAQ: 183300).

🇰🇷 Legal Complications on Put Options on SSG.Com to Result in Ongoing Concerns for Emart and Shinsegae (Douglas Research Insights) $

E-Mart Inc (KRX: 139480)and Shinsegae Inc (KRX: 004170) are facing concerns about put options of nearly 1 trillion won on private equity investors’ investment in SSG.com nearly six years ago.

From AEP and BRV’s point of views, they want to get their money back through put options since an IPO is not likely in the near term.

The most probable result appears to be that this is likely to be dragged on for some time, which will cause continued concerns on both Emart and Shinsegae.

🇰🇷 DS Dansuk: Block Deal Sale by Stonebridge Capital (Douglas Research Insights) $

After the market close on 28 May, it was announced that Stonebridge Capital plans to conduct a block deal sale of a portion of its stake in DS Dansuk (KRX: 017860).

This deal involves 210,000 to 290,000 shares of DS Dansuk. The block deal price range is from 99,800 won to 101,400 won, which represents 7.06% to 8.52% discount.

After this second block deal, there will be further overhang concerns about additional sales of DS Dansuk by Stonebridge Capital in the coming months.

🇰🇷 Korea Gas Corp: Drill Baby Drill (Douglas Research Insights) $

On 3 June, the shares of Korea Gas Corp (KRX: 036460) jumped limit up 30% to 38,700 won on huge volume (13.4 million), which was 37x higher than the previous day volume traded.

This was driven by the announcement of the South Korean President Yoon giving the approval to conduct exploratory drilling for potentially vast oil and gas prospects near Pohang.

The Korean government announced that there is a “very high” possibility the area contains as much as 14 billion barrels of oil and gas.

🇰🇷 South Korea seeks to join top arms dealers with new fighter jet engine (FT) $ 🗃️

🇰🇷 Webtoon Entertainment IPO Preview (Douglas Research Insights) $

Webtoon Entertainment is getting ready to complete its IPO on the NASDAQ exchange in 2H 2024. Webtoon Entertainment is a subsidiary of NAVER Corp (KRX: 035420).

Webtoon is seeking to raise as much of US$500 million at a valuation of US$3 billion to US$4 billion.

Webtoon Entertainment is one of the largest Korean company related IPOs in 2024.

🇲🇾 GEN Malaysia 1Q rev up 21pct y-o-y, posts US$8mln profit (GGRAsia)

Global casino operator Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) reported first-quarter net profit of just under MYR36.7 million (US$7.8 million), compared with a net loss of MYR45.4 million a year earlier. Judged sequentially, net profit was down 83.1 percent, according to a Thursday filing to Bursa Malaysia.

The group’s performance in the fourth quarter of 2023 had been aided by net foreign exchange gains of MYR130.4 million.

Revenue in the three months to March 31 was just above MYR2.76 billion, up 21.1 percent from a year ago, but down 1.6 percent quarter-on-quarter.

Genting Malaysia operates Resorts World Genting (pictured in a file photo), Malaysia’s only licensed casino property. The group also runs casinos in the United States, the Bahamas, the United Kingdom, and Egypt.

🇲🇾 Maybank lowers earnings estimates for Genting group (GGRAsia)

Maybank Investment Bank Bhd says Malaysia-based Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) had an “auspicious start” to 2024, driven by “luck” at its gaming operations run by Genting Malaysia (KLSE: GENM) and Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY).

On Thursday, Genting Bhd reported first-quarter net profit of MYR998.6 million (US$212.3 million), on revenue that grew by 27.6 percent year-on-year, to MYR7.43 billion.

Resorts World Sentosa (pictured), a gaming resort in Singapore run by Genting Singapore, and Resorts World Genting, operated by Genting Malaysia, are said to be the group’s main assets.

Genting Malaysia also runs casinos in the United States, the Bahamas, the United Kingdom, and Egypt.

🇲🇾 RGB back to black in 1Q, revenue doubles y-o-y (GGRAsia)

Malaysian casino equipment supplier and distributor RGB International Bhd (KLSE: RGB) reported revenue of MYR210.1 million (US$44.6 million) for the first quarter of 2024, up 120.8 percent from a year ago. Revenue was up 93.4 percent judged quarter-on-quarter, according to a Thursday filing to Bursa Malaysia.

The firm posted a first-quarter profit attributable to its shareholders of just below MYR22.2 million, compared to a profit of MYR10.5 million a year earlier. The company posted a loss of MYR26.8 million in the preceding quarter.

🇸🇬 Riding the AI Wave with Data Centres: 5 Singapore REITs and Business Trusts for Your Watchlist (The Smart Investor)

The rapid expansion of Artificial Intelligence and Machine Learning has led to a higher demand for data centre space. Here are five Singapore REITs and business trusts that stand to benefit from this trend.

🇸🇬 Frasers Centrepoint Trust: Watch Both External And Internal Factors (Rating Downgrade) (Seeking Alpha) $

I have a Neutral view of Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) taking into account both internal and external factors.

FRZCF’s future performance could be affected by external headwinds like a new competing retail mall and sluggish retail sales for the Singapore market as a whole.

Internally, the REIT can rely on asset optimization moves to boost its rental income.

🇸🇬 SATS’ Profit Leaps 10-Fold for 2H FY2024, Resumes Paying Dividends: 5 Highlights from the Ground Handler’s Latest Earnings (The Smart Investor)

The airline food caterer enjoyed a surge in revenue with the consolidation of WFS.

Several beneficiaries include Singapore’s blue-chip carrier Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF) and maintenance, repair and overhaul (MRO) specialist SIA Engineering Company Ltd (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF).

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) also reported a robust set of earnings for its latest fiscal 2024 (FY2024) results ending 31 March 2024.

Here are five highlights from the group’s latest FY2024 earnings report.

A surge in profit and free cash flow

A diversified business mix

Operating metrics soar

Encouraging commercial wins for Cargo

A promising market for Food Solutions

🇸🇬 Singapore Airlines: Turbulence Ahead (Seeking Alpha) $

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)‘ financial results show a challenging revenue environment, with total revenues increasing 7% but cargo revenues tumbling 22.4%.

Unit costs have declined, but operating profit margins have declined from 15% to 14.3%.

The investment case for Singapore Airlines is not highly compelling, with expectations of pressure on free cash flow and unit revenues remaining under pressure.

🇸🇬 JOYY Q1 Earnings: Disappointing Revenue Guidance, Maintaining My Hold Rating (Seeking Alpha) $

(Several social product operator) JOYY Inc (NASDAQ: YY)‘s near-term revenue outlook is lackluster, as the company has guided for its top line to contract by -2% QoQ to $553.5 million in the second quarter of the year.

On the flip side, JOYY’s latest quarterly results and disclosures had favorable read-throughs for its future share repurchases, the developed countries’ growth outlook, and its ability to manage costs.

There were both good and bad takeaways from JOYY’s performance and prospects, so I choose to leave my existing Hold rating for the stock unchanged.

🇮🇳 The Beat Ideas: Action Construction – A Bet on Manufacturing & Infrastructure Theme (SmartKarma) $

Action Construction Equipment Ltd (NSE: ACE / BOM: 532762) – a leader in construction and heavy equipment theme is going for transformation with a defence foray and new product launches

With strong guidance and the historical success of good execution makes a good bet on the current infrastructure and manufacturing theme

The risk includes a slowdown in the election period and stiff competition from larger players

🇮🇳 Inox Wind : Block Deal Trade Special Situations and Tactical Trade Strategy (SmartKarma) $

Inox Wind Ltd (NSE: INOXWIND / BOM: 539083)

Impending block deals which generally create supply over-hang on the stock leads to a negative impact on the stock

These block deals generally include selling promoters and big funds at a price discount to its current market price

Historically, such events suggest once the block deal is done; stock reacts positively creating a Special Situation Opportunity

🇸🇦 Saudi Arabia to sell $12bn worth of Saudi Aramco shares (FT) $ 🗃️

Saudi Arabian Oil Co (TADAWUL: 2222)

🇹🇷 Turkcell: Margin Expansion Thesis Playing Out; Maintain Buy (Seeking Alpha) $

Turkcell (NYSE: TKC) is a leading telecommunications provider in Turkey.

My margin expansion thesis continues to play out as the company was able to raise prices faster than inflation in Q1.

Looking forward, as long as this dynamic remains, Turkcell’s earnings should continue to rise, driving shares higher.

🌍 Africa Oil Corporation: Buy The Punished Small Cap (Seeking Alpha) $

Africa Oil (TSE: AOI / STO: AOI / FRA: AFZ / OTCMKTS: AOIFF) has been punished by the market as a small cap oil company as prices have dropped.

The company has incredibly strong cash flow with the potential for additional developments in Nigeria.

Over the next few years, we expect the company to grow production, generating substantial long-term shareholder returns.

🇿🇦 Dis-Chem hikes dividend, continues to roll out new pharmacies (IOL)

Dis-Chem Pharmacies (JSE: DCP) raised its final dividend 22% to 22.49 cents a share in the year to March 1, 2024 after headline earnings a share fell slightly mainly due to an imbalance in six month performances in previous years.

The company said Friday it would invest in OneSpark, a life insurance business that Dis-Chem said possesses “the experience, capability and proprietary technology to offer transformative insurance products that align to the better health mandate of the Dis-Chem brand”.

Dis-Chem’s other area of focus for the new financial year included an accelerated retail space rollout, wholesale market share expansion, incremental improvement in total income, cost control to support positive operating leverage, working capital improvement, analytics at the core, and digital health ownership.

🇿🇦 Bumpy road forces Ackerman family to let go of control of troubled Pick n Pay after 60 years (IOL)

Pick ‘n Pay (JSE: PIK / FRA: PIK) has embarked on a restructuring plan to save its market position and claw out of huge debts, with chairperson Gareth Ackerman set to relinquish control of the South African grocer that yesterday reported a reversal of fortunes into a R1.5 billion loss.

As bigger rival operator Shoprite Group (JSE: SHP) and other competitors such as Woolworths Holdings (JSE: WHL) appear to be riding out South Africa’s turbulent economy, Pick n Pay is apparently feeling the pinch of a severe financial strain worsened by its breach of debt covenants.

🇿🇦 Pick n Pay enlists new strategy, set to raise capital after big loss (IOL)

Pick ‘n Pay (JSE: PIK / FRA: PIK) has embarked on a new strategy to restore it’s core Pick n Pay supermarket business to profit after its R3.2 billion taxed loss for the year to February 25, and plans for a R4bn rights issue and the listing of Boxer in November are in full swing, CEO Sean Summers said yesterday.

He said there would be costs to move staff from one store format to another – Pick n Pay traditionally pays good benefits such as 11 months maternity leave, and staff moving to other stores would get an ex-gratia payment for the loss of these benefits. There may be limited retrenchments from closures where staff could not be moved to other stores, said Summers.

He said the “back-to-basics strategy” had six priorities and would focus on simplicity, quality, affordability and sustainability.

🇿🇦 Pepkor store chains and fintech strengthening in the weak economy (IOL)

ROBUST trading in Pepkor (JSE: PPH / FRA: S1VA)’s popular store brands such as Ackermans, Refinery and PEP, and fast growth from its fintech business, saw group revenue rise a healthy 9.5% to R43.3 billion in the six months to March 31.

Retail sales growth strengthened in the second quarter after back-to-school campaigns and strong Easter trade, with brands expanding market share. Gross profit margins benefited from enhanced full-price sales and the continued recovery in Ackermans, where full-priced sales improved by 660 basis points.

🇿🇦 Opinion | The Promise of South African Small-Cap Industrial Stocks (daba + Capital Markets Africa)

This article was contributed to Daba by Chipo Muwowo, Founder, CEO & Managing Editor of Capital Markets Africa.

SA small-cap Industrials enjoy strong earnings potential

Some firms have completed judicious acquisitions in recent years

Stock prices remain attractive despite significant increases in their value

Afrimat Limited (JSE: AFT / OTCMKTS: AFTLF)is a mining and materials company listed on the Johannesburg Stock Exchange.

Hudaco Industries Limited (JSE: HDC) specializes in the importation and distribution of a broad range of high-quality, branded automotive, industrial, and electronic consumable products (mainly on an exclusive basis) for the South African and wider Southern African region.

Argent Industrial Limited (JSE: ART / OTCMKTS: AILTF)

The group sells and trades manufactured steel and steel-related products such as metal gates, railings, and shutters. It owns over 20 vertically integrated subsidiaries in South Africa, the UK, and the US while it sends exports to over 35 countries globally.

🇵🇱 CD Projekt: Rating Downgrade On Potential Miss In Earnings Targets (Seeking Alpha) $

CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF)‘s recent earnings report showed strong net income growth driven by tax benefits, but it is unlikely to be sustainable.

The company’s ambitious target of launching two big games within a tight timeframe seems unrealistic given the complexity of game development and the recent switch to Unreal Engine 5.

Partnership revenue is also unlikely to materialize by FY26/27, making it challenging for CD Projekt to meet its earnings target.

🇰🇾 Consolidated Water: Strong Balance Sheet And Promising Development (Seeking Alpha) $

Consolidated Water Company Ltd (NASDAQ: CWCO) achieved a 91.5% YoY increase in revenue and reached all-time high margins and profitability in FY23.

The company has a solid balance sheet with net debt of $-43.7m and potential for new strategic acquisitions and a share buyback plan.

The company’s business model faces risks, including the renewal of its water sales license in the retail segment, but its financial strength and growth trends justify a buy rating.

🇰🇾 Patria Investments: Stock Multiples At Historic Lows, Potential 7.87% Yield (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) has conducted a series of acquisitions that has more than doubled its AUM over the last three years at $32 billion.

Weak stock price performance has resulted in a -16% YTD stock decline, bringing PAX stock price and PE multiple to a previous support level.

Given its solid product offering and reputation within LATAM, buying this asset manager at its lows makes sense, especially since the elevated dividend could serve as to cover stock drops.

🌎 NUAM – the catalyst-rich “secret” new stock exchange (Undervalued Shares)

If a company goes public through a non-conventional process, its stock often ends up falling through the cracks – at least initially!

The peculiar case of Holding Bursátil Regional S.A. (SGO: NUAM) a company goes public through a non-conventional process, its stock often ends up falling through the cracks – at least initially!

The peculiar case of Holding Bursátil Regional, also known as NUAM, could become an interesting case study.

The company is newly listed following a merger of three regional stock exchanges, and it has not yet received formal analyst coverage. However, with 60 brokerage firms as members, 5-10 of them should come out with initiation reports in the foreseeable future.

The stock is also dirt cheap, which these initiation reports are likely to highlight.

“NUAM” is a story that you are going to hear a lot more about in the future. You’ve read it here first.

🇦🇷 Despegar.com Is Growing Profitably, But The Price Is Excessive (Seeking Alpha) $

Despegar.com Corp (NYSE: DESP) is the leading Latin American OTA.

The company posted strong top-line results in 1Q24, with 13% YoY growth and improved bottom-line results due to expense rationalization.

Despite its profitable growth, Despegar’s high P/E ratio of 35x is considered excessive, and the stock is still rated as a Hold.

🇦🇷 Despegar.com: Brazil Continues To Lead Growth (Seeking Alpha) $

Q1 2024 financials show impressive growth in gross bookings and revenue, particularly in the Brazilian market.

Despegar.com Corp (NYSE: DESP) has continued to reduce its long-term debt.

I continue to take a bullish view on Despegar.com.

🇧🇷 🇰🇾 StoneCo: Unjustified Dip In 2024 Makes It A Buy (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) is a Brazilian fintech company focused on MSMBs, offering financial services and software solutions.

The company demonstrates consistent growth across all key financial and operating metrics. The management’s long-term outlook is quite optimistic as well.

My valuation analysis suggests there is a 73% upside potential from the current share price levels.

🇧🇷 Banco do Brasil: Stronger Fundamentals Than Private Competitors (Seeking Alpha) $

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY) has a strong presence in agribusiness, which has been driving the country’s GDP growth.

The bank has the best financial indicators among Brazilian private peers.

Although, Banco do Brasil has the lowest P/E multiple among its competitors, indicating a cheap valuation and potential for significant upside.

🇧🇷 SABESP: A Company With Good Prospects In A Risky Economic Environment (Seeking Alpha) $

This water utility is undervalued and operates in a region with a rapidly growing population.

The economic environment in Brazil poses risks for investors due to inflation and political instability.

Companhia de Saneamento Básico do Estado de São Paulo – SABESP (BVMF: SBSP3)‘s expansion within the state of Sao Paulo and potential efficiency improvements through privatization are positive factors

🇧🇷 Companhia Siderúrgica Nacional Q1: Weak Result And Risks Materializing (Seeking Alpha) $

Companhia Siderurgica Nacional SA (NYSE: SID) released weak Q1 2024 results, failing to meet market expectations.

The steel segment is doing so badly that the mining segment is already the business that contributes most to the consolidated result.

CSN’s high leverage and unattractive valuation compared to peers make it a sell recommendation.

🇧🇷 Petrobras Can Continue Providing Strong Shareholder Returns (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) has hit production milestones in its offshore fields, driving substantial shareholder returns.

The company is generating increased cash flow, supporting additional shareholder returns and a proposed double-digit dividend yield.

Petrobras has strong assets, including new FPSOs, and is focused on increasing exports for future shareholder returns.

🇧🇷 Petrobras: It’s Hard To Be Bullish Now (Seeking Alpha) $

For many months, Petrobras (NYSE: PBR / PBR-A) stock traded at a significant discount due to the substantial risk posed by its location in an opaque economic zone, despite its high-quality assets.

Recent events (such as the firing of now-former CEO Jean Paul Prates about 2 weeks ago) have increased these risks further, in my opinion.

I understand the bulls’ argument that Petrobras stock looks cheap, as my comps valuation calculations show – the upside potential could be more than 50% if we disregard political risks.

However, I see no reason to neglect these risks today. The discount to Petrobras’ valuation is likely to remain the same or even widen.

In light of these points, I think it’s prudent to wait for lower prices for Petrobras stock or avoid it altogether, given the significantly increased risks. My rating is “Hold”.

🇧🇷 Sendas Distribuidora: The Costco Of Brazil (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI)

Assai is the second largest grocery player in Brazil’s cash and carry segment, with significant growth potential.

The company has been aggressively increasing its store count and expects continued organic store growth.

Profitability has been impacted by investments in store conversions and store openings, but is expected to improve as the stores mature and SG&A costs decrease.

🇧🇷 Sendas Distribuidora Q1: Raising The Recommendation From Sell To Hold (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI)‘s operating results in 1Q24 were good, with robust annual revenue growth and gains in operational leverage.

The company’s deleveraging process is underway, but its high leverage compared to competitors remains a concern.

The company’s valuation has improved, but there is still no margin of safety, leading to a recommendation to hold rather than buy shares.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Cover Story: China’s Pension Plan Faces Prospect for Change or Going Bust (Caixin) $

China’s pension system for non-government workers faces insolvency by 2035 due to demographic shifts.

Potential solutions include raising the retirement age, extending the contribution period, and encouraging private pensions.

Disparities exist between government and enterprise employee pensions, with government workers receiving significantly higher benefits, and reforms are needed for sustainability.

🇨🇳 China sets new rules on how major shareholders can sell their stock (Caixin) $

China’s top securities regulator has placed new restrictions on how major shareholders of listed companies, as well as members of their leadership, can sell their stock as the watchdog looks to protect the market from instability.

As part of new measures that took effect Friday, the China Securities Regulatory Commission (CSRC) banned controlling shareholders and actual controllers of publicly listed companies from offloading shares through centralized bidding or block trades under certain situations.

🇨🇳 Currency diversification can coexist with dollar dominance, vice finance minister says (Caixin) $

The global dominance of the U.S. dollar and a multi-currency international monetary system aren’t mutually exclusive, as alternatives such as the euro, yuan and Japanese yen are expected to play a greater role in trade and financing to maintain the system’s stability, a vice finance minister of China said on Monday.

The diversification of currencies is part of efforts to form a fairer and more orderly international financial system, according to Liao Min, who spoke at the opening session of this year’s Tsinghua PBCSF Global Finance Forum in Hangzhou, Zhejiang province.

🇨🇳 Europe’s business chiefs see EU-China relations worsening (Reuters)

🇨🇳 Exodus of US law firms from Shanghai accelerates (FT) $ 🗃️

🇨🇳 The world’s top chipmakers can flip a ‘kill switch’ should China invade Taiwan, Bloomberg reports (Business Insider)

Chipmakers ASML and TSMC can disable advanced chipmaking machines remotely, Bloomberg reports.

The move addresses growing fears of a Chinese invasion of Taiwan, a key semiconductor producer.

A China-Taiwan conflict could severely impact the global economy.

🇨🇳 China Piles $47.5 Billion Into ‘Big Fund III’ to Boost Chip Development (Caixin) $

China is investing 344 billion yuan ($47.5 billion) in the third phase of its National Integrated Circuit Industry Investment Fund to boost its semiconductor industry amid tensions with the U.S.

The fund, also known as the Big Fund, initiated in 2014, now faces a reset due to corruption probes involving former executives.

Big Fund III aims to address critical bottlenecks in the semiconductor sector, with significant investments from various state-owned entities and banks.

🇨🇳 China sets up third fund with $47.5 bln to boost semiconductor sector (Reuters)

🇰🇷 Korea Exchange Launches the Disclosure of Corporate Value Up Program on KIND System (Douglas Research Insights) $

The Korea Exchange introduced the Corporate Value Up program on the KIND website. This is a voluntary system aimed at boosting the corporate value of listed Korean companies.

Five key investment indicators for the 2,400+ listed Korean companies include PBR, PER, ROE, dividend payout, and dividend yield. The detailed data these indicators can be easily downloaded on excel.

Corporate Value Up program is a marathon, not a sprint. In this race, the runners (Korean companies) also need some water (such as improvements to dividend/corporate income tax policy).

🇰🇷 Value… Up? (Asian Century Stocks) $

Korean jealousy expressed in minor reforms.

The valuation disparity between Korean and Japanese equities has increased in recent years. This so-called “Korea discount” is due to conflicts of interest between controlling shareholders and minorities.

Poor minority protection is the heart of the problem. High dividend and inheritance taxes have exacerbated it.

Korea’s new Corporate Value Up program is a step in the right direction. However, since participation is voluntary, I don’t expect a wholesale shift in corporate governance.

Individual companies might take some positive actions, including repurchasing discounted preference shares, selling cross-holdings, or canceling treasury shares.

Towards the end of the article, I discuss 5 companies I’m paying attention to.

🇰🇷 FSC Head Remarks Short Selling Could Resume in 1Q 2025 and Launch of Financial Investment Income Tax (Douglas Research Insights) $

On 27 May, Lee Bok-Hyun (Head of FSC) remarked that short selling of stocks in Korea could resume sometime in 1Q -4Q 2025.

The centralized system to detect short selling of stocks in Korea on a live basis could be completed as early as 1Q 2025.

The financial investment income tax is likely to be LAUNCHED in January 2025, which could negatively impact the local stock market.

🇲🇾 Malaysia acts to boost semiconductor ambitions (The Asset) 🗃️

Sixth-largest exporter to spend US$5.3 billion to lure foreign investment, train engineers

To support this goal, the Malaysian government, according to Anwar, will provide fiscal support of at least 25 billion ringgit (US$5.3 billion) that will be used to offer incentives to foreign investors and to train 60,000 Malaysian engineers to meet future industry demand. The strategy also includes establishing at least 10 local companies focused on the design and advanced packaging of semiconductor chips.

By the early 1980s, Malaysia had become home to 14 semiconductor firms, including companies like AMD, Hitachi and HP.

The country’s semiconductor sector is diverse, comprising firms that specialize in outsourced semiconductor assembly and testing, automated test equipment manufacturers, and high-performance test socket designers and manufacturers.

🇮🇳 Exit polls forecast decisive majority for Narendra Modi in India’s election (FT) $ 🗃️

🇿🇦 ANC weighs coalition options after crushing South Africa election blow (FT) $ 🗃️

🇿🇦 South Africa on the precipice (FT) $ 🗃️

🇲🇽 Mexicans go to the polls after violent presidential campaign (FT) $ 🗃️

🇲🇽 Claudia Sheinbaum, the woman hoping to be Mexico’s first female president (FT) $ 🗃️

🌐 Visualizing the Countries With the Lowest Corporate Tax Rates (Visual Capitalist)

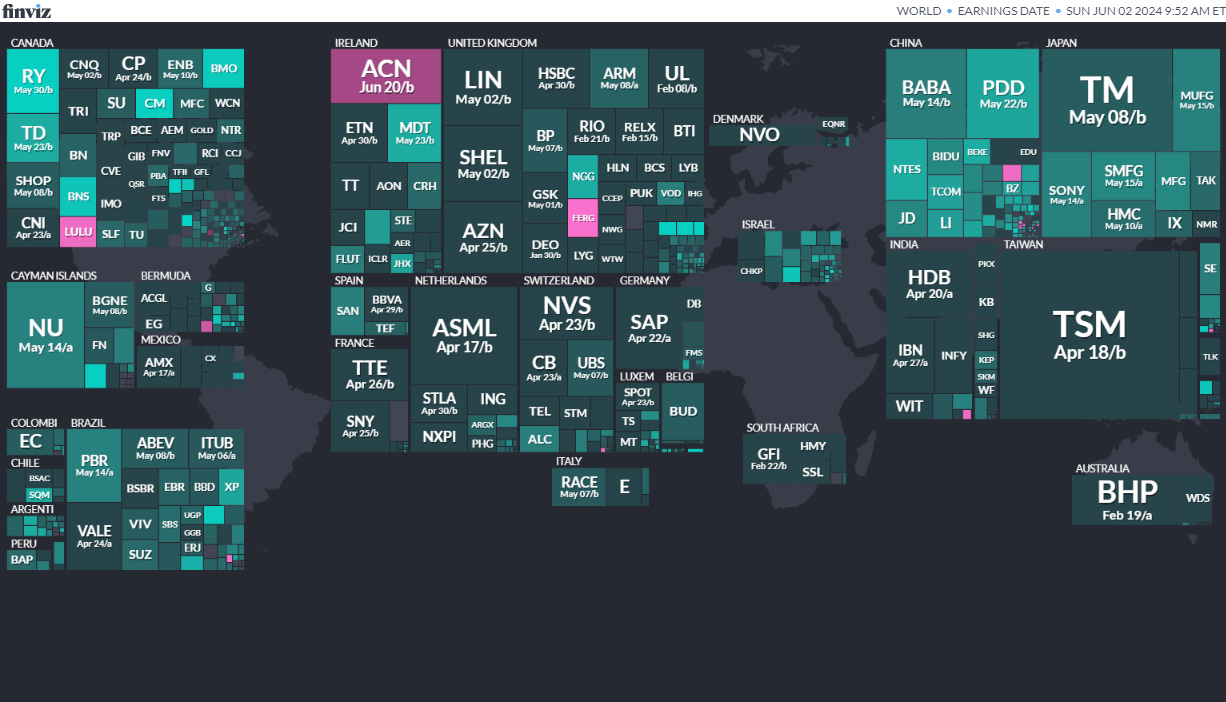

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

India Indian People’s Assembly Apr 19, 2024 (d) Ongoing Apr 11, 2019

-

South AfricaSouth African National AssemblyMay 29, 2024 (d) Confirmed May 8, 2019 -

MexicoMexican SenateJun 2, 2024