High-Yield Singapore Banks & REITs (Mid-2024)

Singapore’s big 3 banks and REITs have attractive valuations and yields compared to similar investments in the USA right now plus Singapore stocks come with fewer currency and political risks than stocks from other markets.

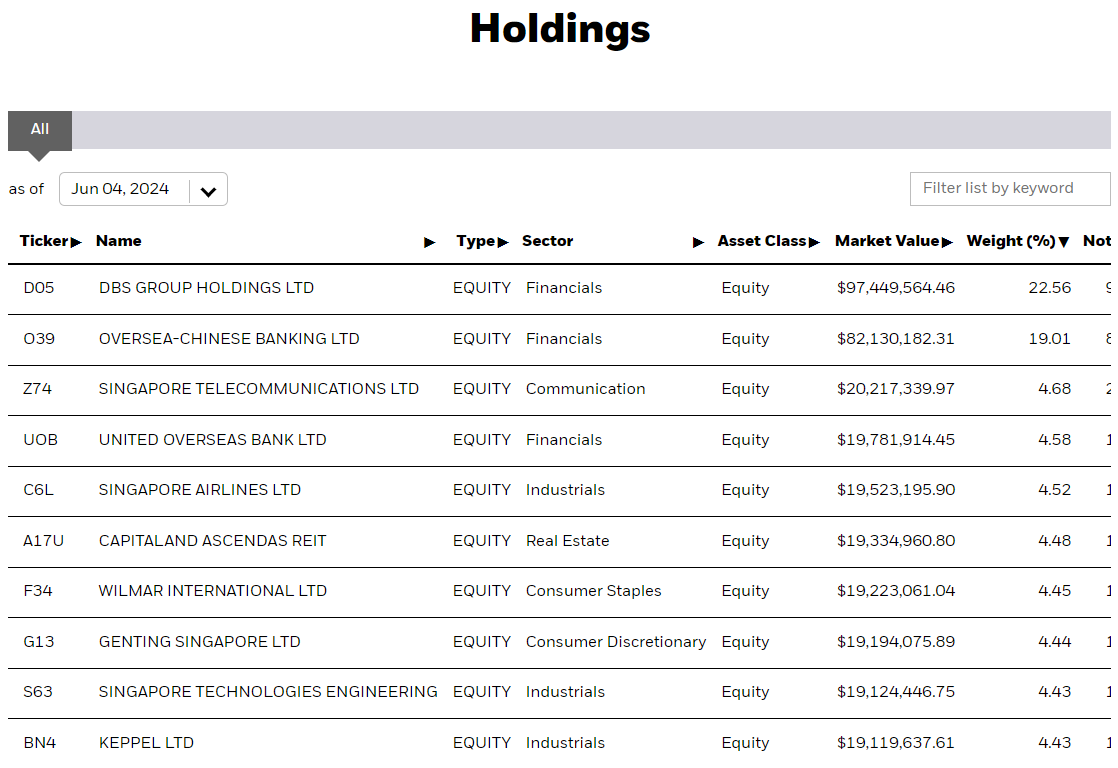

I should mention that I was originally planning to do a post covering the holdings of the Singapore ETF, but it only has 17 holdings:

That’s not a bad P/E or dividend yield albeit the ETF’s performance has been mixed:

And the ETF is concentrated in two of Singapore’s big 3 banks:

However, Interactive Brokers gives access to the Singapore stock market – meaning you don’t have to invest in the ETF and can buy some of the ETF’s individual holdings yourself…

Back in the late 1990s when I was attending university and the dot.com bubble was going parabolic, I bought my first stock as I had too much money in a low yielding savings account.

The stock I bought was Southern Company (NYSE: SO) – an electric utility operating in Alabama, Georgia, Florida, and Mississippi. I have never been to this part of the USA; but even in the 1990s, people and businesses were moving to this part of the country.

Southern Company is the type of stock you could buy and forget about – except I did get partially burned by it. In 2001, Southern Company spun off all its riskier assets into a new entity called Mirant which I received shares in. I should have sold those shares and bought additional stock in SO because after the bankruptcy of Enron, it was Mirant’s turn and those shares became worthless…

Nevertheless, I was under 20 years old when I bought Southern Company and now have a few hundred shares (thanks to continuous dividend reinvestments) giving me close to a thousand dollars worth of income every year (which I continue to reinvest into new shares). If I hold the stock and reinvest all the dividends for 50 years, I will be close to 70 years old and might then start drawing on that income stream.

Baring some kind of new miracle energy source or some kind of black swan event, I have no reason not to believe Southern Company will not be around in the coming decades…

However, Southern Company’s current P/E and dividend yield may not be so attractive for new investors:

-

Price/Book (Most Recent Quarter): 2.72

-

Forward P/E: 19.72 / Forward Annual Dividend Yield: 3.63% (Yahoo! Finance)

A few years after I bought Southern Company, I bought shares of Liberty Property Trust – a Pennsylvania based office, industrial and logistics REIT.

Roughly a decade ago and long before the work from home phenomena, they began selling off the office properties (mostly high quality suburban office parks) to focus more on the logistics and industrial sectors – something that turned out to be a wise move. Then they were acquired by Prologis Inc (NYSE: PLD), now the largest or one of the largest industrial and logistics REITs in the world, and I received shares of PLD.

Prologis got ahead of itself during the COVID years by hitting the $170 level before coming back down to earth to a level that is probably more appropriate and where it would otherwise be at if we had no pandemic. But as with Southern Company, Prologis’ current P/E and dividend yield may not be so attractive for new investors:

-

Price/Book (Most Recent Quarter): 1.90

-

Forward P/E: 47.17 / Forward Annual Dividend Yield: 3.53% (Yahoo! Finance)

I should also note that I have CDs at US banks yielding above the 4% level and such CDs are still available at many US banks – meaning the current utility and REIT yields available in the USA market are not so attractive at current stock valuation levels.

On the other hand, Singapore banks and REITs have more attractive valuations and yields right now while the Singapore dollar has been relatively steady with the USD for the past decade:

I should note that many Hong Kong stocks also have high yields while the HKD is pegged to the USD. However, Hong Kong is a hated market right now that still comes with China risk that many high yield Singapore stocks don’t have.

For more Singapore stock ideas, I also did this post back in December covering a number of stocks:

To make your life easier, the rest of this post includes:

-

For REITs, the type of REIT (Healthcare, Hospitality, Retail, Office & Commercial, Industrial & Data Centre, and Diversified or Other) and geographic coverage or currency (if USD or EUR).

-

A quick description of the stock with links to the IR page and stock quote(s) on Yahoo! Finance.

-

A link to any Wikipedia page (for what it might be worth…)

-

A price/book (most recent quarter) ratio plus forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

-

The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier by providing you with relevant information, links, and charts). It does not constitute investment advice and/or a recommendation…

I did these post about a year ago:

Frankly, I think you could select one of Singapore’s big 3 banks to invest in by throwing darts as all three should continue to do well for investors with a mong term time horizon…

However and for a more rigorous selection approach, Singapore based The Smart Investor (I think they are mostly ex-Motley Fool Singapore people) does regular articles comparing the key metrics for all three banks:

In addition, be aware that Singapore has granted digital banking licenses to create digital banks to compete with the big 3:

-

GXS and Trust Digital Banks Have Launched: Should DBS, UOB and OCBC Worry? (The Smart Investor) September 2022

-

Digital banks have launched attractive offerings for customers. Should the local banks worry about losing market share?

-

It has been nearly 21 months since the Monetary Authority of Singapore (MAS) handed out four digital banking licences to successful bidders.

-

However, history has shown that digital banks have not fared well in developed markets such as Singapore.

-

It’s questionable whether Singapore has sufficient numbers of under-served customers to enable each of these banks to achieve profitability.

-

I tend to agree with that last statement as Singapore is not exactly Brazil or Indonesia with many unbanked or underbanked consumers to help recoup all the technology investment costs…

And now a look at the banks themselves:

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) was set up by the Government of Singapore on 16 July 1968 to take over the industrial financing activities from the Economic Development Board. Today, DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world (See: DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF): Record Earnings But Profit Margins From Higher Rates Have Peaked)

-

Wikipedia

-

Price/Book (Most Recent Quarter): 1.58

-

Forward P/E: 9.23 / Forward Annual Dividend Yield: 6.11% (Yahoo! Finance)

Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) is one of the largest banks in SE Asia and has consistently ranked highly as one of the “safest banks in the world.”

OCBC Bank is the second-largest banking group in Singapore by total assets and among the top players in bancassurance sales, home loans, unit trust distribution, personal credit, small and medium-sized enterprises market and the Singapore dollar capital market. OCBC Bank has more than 400 branches and offices in Singapore, Malaysia, Indonesia, Vietnam and Thailand, as well as Mainland China, Hong Kong SAR, Macau SAR and Taiwan.

OCBC Bank offers private banking services through their wholly-owned subsidiary, Bank of Singapore, which operates on a unique open-architecture product platform to source for the best-in-class products to meet its clients’ goals. OCBC Bank’s insurance subsidiary, Great Eastern Holdings (SGX: G07 / OTCMKTS: GEHDY), is the oldest and most established life insurance group in Singapore and Malaysia.

OCBC Bank was born out of the Great Depression through the consolidation of three banks in 1932 — Chinese Commercial Bank (incorporated in 1912), Ho Hong Bank (incorporated in 1917) and the Oversea-Chinese Bank Limited (incorporated in 1919) (See: OCBC Bank (SGX: O39 / FRA: OCBA / OCBB / OTCMKTS: OVCHY): Record Profits as Money Flows to Singapore).

-

Wikipedia

-

Price/Book (Most Recent Quarter): 1.16

-

Forward P/E: 8.66 / Forward Annual Dividend Yield: 5.88% (Yahoo! Finance)

Founded in 1935 as United Chinese Bank, United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) is rated as one of the world’s top banks, ranked ‘Aa1’ by Moody’s Investors Service and ‘AA-‘ by both S&P Global and Fitch Ratings. With a global network of 500 branches and offices across 19 countries in Asia Pacific, Europe and North America. In Asia, the Bank operates through a head office in Singapore and banking subsidiaries in China, Indonesia, Malaysia, Thailand and Vietnam, as well as branches and offices throughout the region.

UOB provides a wide range of financial services globally through our three core business segments – Group Retail, Group Wholesale Banking and Group Global Markets. Our offering includes consumer banking, private banking, commercial banking, transaction banking, investment banking and treasury services. Through its subsidiaries, they also provide asset management, private equity fund management and insurance services, among others (See: United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF): Betting on ASEAN Growth With 2M New Citibank Clients).

-

Wikipedia

-

Price/Book (Most Recent Quarter): 1.11

-

Forward P/E: 8.60 / Forward Annual Dividend Yield: 5.54% (Yahoo! Finance)

The first S-REIT was listed on the SGX in 2002 and those that own Singapore real estate are required to distribute at least 90% of their specified taxable income.

Note that some listed Singapore REITs are completely focused on the USA, European, Chinese, Indonesian, Japanese, or Indian real estate markets while others are fairly diversified with only a few properties actually in Singapore.

Whether it makes sense to buy a REIT listed in Singapore owning properties in other markets versus buying one directly in these other markets is something for you to decide…

A number of Singapore REITs own office properties. However, I don’t think office properties in Asia will be impacted as badly by the work from home trend like in the USA for work culture reasons. Asian cities also tend to have decent public transportation (compared to the USA) and their downtowns or CBDs are fairly safe with many retail and F&B businesses that survived the COVID lockdowns – unlike their equivalents in the USA…

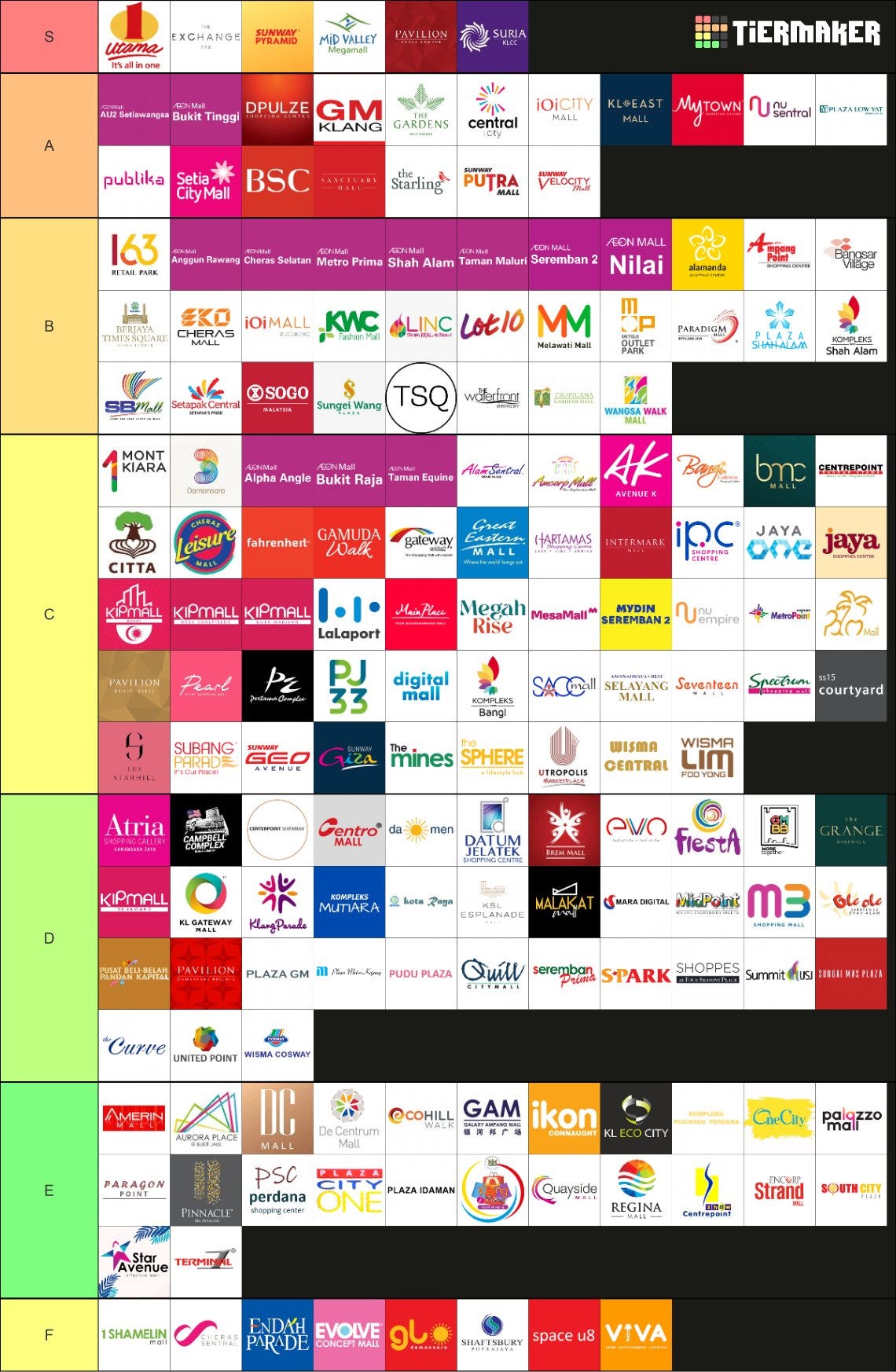

As for retail, I think its a mixed picture as eCommerce is obviously impacting brick-and-mortar retail in Asia, but malls are also social gathering places as they have air conditioning and are safe places to hang out in. In contrast and in the area of the USA I grew up, I am less inclined to visit nearby malls at night (especially on a Friday or Saturday night) on concerns for my personal safety…

However, the Rakyat post recently noted the increasingly ridiculous number of malls in the Greater Kuala Lumpur area (and more are on the way…):

In the Bukit Bintang area, I can easily walk to around a dozen malls and some are doing better than others as the area draws foreign and local tourists along with other city residents. In the suburbs though, there would be a growing number of half dead malls or those in need of repositioning or some kind of conversion (data centers?).

Nevertheless, a REIT owning a portfolio of high quality malls in well trafficked areas of gateway cities in Asia should continue to do well…

Finally, there are some S-REITs focused on or have invested in data centers which are also tremendous water and electricity hogs – something that is mysterious missed by environmentalists and the global warming crowd. In fact, Singapore had restricted the opening of new data centers on environmental and space concerns:

Something tells me that the environmentalist and global warming crowd will continue to overlook data center environmental concerns, but governments may increasingly be forced to address them or restrict their construction. My other concern is the development of new technology that allows for more data to be stored in a much smaller amount of space aka Moore’s law…