Arthur Hayes says the cryptocurrency bull market is ‘reawakening’ due to BOC and ECB rate cuts.

Arthur Hayes, co-founder and former CEO of BitMEX, who now manages a family office called Maelstrom, said the cryptocurrency bull market is “reawakening” this week due to interest rate cuts from the Bank of Canada and the European Central Bank.

On Wednesday, the Bank of Canada became the first major central bank to cut interest rates by a quarter of a point this year, to 4.75 per cent. The European Central Bank followed suit yesterday, cutting interest rates to 4.25%.

Hayes added in a June 6 Substack post that the “fireworks” from central banks set off by this decision will “kick cryptocurrencies out of the Northern Hemisphere summer recession.”

Could the Bank of England be next?

This was not Hayes’ base case, and he explained that the catalyst would come in August, when the U.S. Federal Reserve holds the Jackson Hole Symposium, where it typically announces significant economic policy changes.

Next on the economic calendar are the Federal Reserve’s FOMC meeting on June 11-12 and the G7 summit in Apulia, Italy, on June 13-14.

“The big question is whether the Fed will start cutting interest rates as we get closer to the U.S. presidential election in November,” Hayes said. But Hayes added that his base case is the Fed, saying the Fed typically doesn’t change its policy so close to an election and that he still believes it would be “political suicide” to cut interest rates in the U.S. now, given ongoing concerns about inflation. The rates will be decided at the next meeting.

Hayes also expected no change from the Bank of Japan, but suggested that given the BOC and ECB cuts, the Bank of England meeting immediately following the G7 event could provide the next interest rate surprise on the downside.

“The BOE has nothing to lose,” Hayes said. “The Conservatives have no reason to disobey the orders of their former colonial rulers to curb inflation because the next election will play into their own hands.”

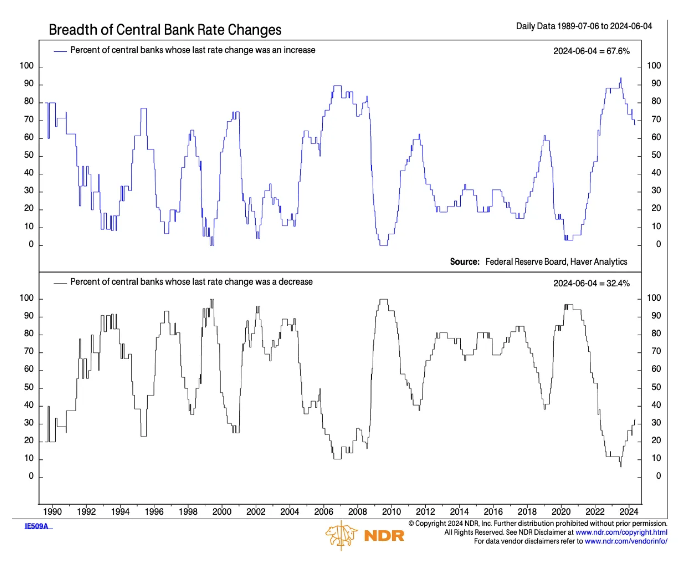

The extent of changes in central bank interest rates. Image: Arthur Hayes.

The beginning of a relief cycle?

Ultimately, the trend is clear, Hayes said. “Central banks on the margin are starting an easing cycle. Buy Bitcoin and then buy shitcoin.”

“We asked for our opinion on whether to launch tokens now or later for the Maelstrom portfolio project. I said “Let’s F*cking Go!”

With the price of Bitcoin hovering around $59,000 in early May, Hayes predicted that Bitcoin would hit $70,000 amid policy announcements from the U.S. Federal Reserve (Fed) and the Treasury that amount to a “secret form of money printing.” It was predicted that there could be a rebound.

bitcoin  BTC

BTC

-0.75%

It’s trading for $71,263 at the time of publication, according to The Block’s. Pricing page.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.