Emerging Market Links + The Week Ahead (December 11, 2023)

Another Substacker has asked an interesting question: What would happen if throughput of the Suez and Panama canals were impaired at the same time? After all, 15% of total world trade (12% via the Suez canal and 3% via the Panama Canal) goes through these two waterways every day while Caixin has reported that Chinese auto exporters are already facing costly detours after Red Sea attacks.

Finally, Bloomberg has reported that Hong Kong’s stock slump has triggered wave of brokerage closures e.g. the small and medium sized ones. According to FT, India’s NSE is also set to take Hong Kong’s spot among world’s largest markets.

$ = behind a paywall / 🗃️ = Archived article

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Shanghai Port’s shipping service spinoff surges 58.6% in strong debut (Caixin) $

🇨🇳 China has a new e-commerce top dog as global gains lift PDD past Alibaba (Bamboo Works)

The company formerly known as Pinduoduo passed Alibaba (NYSE: BABA) in terms of market value after reporting strong third-quarter growth fueled by its international Temu platform

PDD Holdings (NASDAQ: PDD)’s Temu international platform has grown rapidly since its launch in September 2022, with one analyst estimating it contributed 28% of the company’s third-quarter revenue

The discount-focused e-commerce company has an edge over Alibaba due to its closer ties with suppliers, giving it more control over sourcing, pricing and inventory

🇨🇳 TikTok owner ByteDance to buy back shares after amassing $50bn cash pile (FT) $

🇨🇳 ByteDance declares ‘game over’ for gaming division (Bamboo Works)

The parent of short-video sensation TikTok made the decision in the face of stiff competition from established gaming giants like Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY)

ByteDance will phase out its Nuverse gaming division, laying off hundreds of employees and terminating all ongoing gaming projects by the end of the year

The internet giant’s decision follows previous similar scale-backs in its education, real estate and virtual reality businesses

🇨🇳 Bitdeer, Canaan mint hedges against crypto volatility in AI (Bamboo Works)

Each company is seeking to develop businesses related to the hot emerging technology as their core crypto operations lose money

Bitdeer Technologies Group (NASDAQ: BTDR) said it was picked as a preferred cloud services provider for artificial intelligence cloud services powered by an Nvidia chip

Cryptocurrency mining machine maker Canaan Inc (NASDAQ: CAN) is looking to create a separate unit for its business making chips for AI applications

🇨🇳 Tongdao Liepin looks for work amid weak economy, rising unemployment (Bamboo Works)

The online recruitment platform’s profit tumbled 84% in the first nine months of the year as employers reined in their hiring

Tongdao Liepin Group (HKG: 6100 / FRA: 6WT / OTCMKTS: TGDLF)’s profit fell 72% in the third quarter to 32 million yuan, while its revenue fell about 13% to 559 million yuan

The company is expanding to Hong Kong and working more closely with headhunters as part of several new initiatives to jumpstart growth

🇨🇳 Li Ning (2331 HK): Buying A HKD2.2bn Office Building – Now A Corporate Governance Discount? (Smart Karma) $

Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF) announced yesterday that the company has acquired a HK office project, the Harbour East, from Henderson Land Development (HKG: 0012 / FRA: HLD / OTCMKTS: HLDCY / HLDVF), for a total consideration of HKD2.2bn.

The acquisition is quite unexpected given that Li Ning has had a clean corporate governance track record.

The company now trades at 11x foward PE, assuming no growth in 2023 and 2024 earnings. It is now a value stock, though the visibility is very low.

🇨🇳 Wuxi Biologics (2269 HK): Lowered 2023 Revenue Expectation Amid Challenging Industry Outlook (Smart Karma) $

Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) has guided for weaker-than-expected revenue and lower profit in 2023, as the operating industry is facing near-term challenges due to biotech funding slowdown.

$300 million lesser revenue in development business due to reduced number of projects and manufacturing revenue deficit of $100 million due to CMO deferral contributed to the miss.

Following the announcement, Wuxi Biologics shares nosedived 24% on HK stock exchanges, marking its biggest one-day slide since listing in 2017.

🇨🇳 GDS under pressure to step up overseas expansion as China market cools (Bamboo Works)

The data center operator’s revenue growth slowed in the third quarter, as it officially launched its first offshore data center in Malaysia

GDS Holdings (NASDAQ: GDS)’ revenue grew 6.4% in the third quarter, slowing from 7% in the second quarter and 15% in the third quarter of 2022

The company is investing heavily in Southeast Asia to jumpstart growth as its home China market cools amid a broader economic slowdown

🇨🇳 Meitu dolls up with spinoff for Singaporean unit (Bamboo Works)

The unit being spun off, AI-powered digital design platform Pixocial, was a major contributor to Meitu’s net profit last year

Meitu Inc (HKG: 1357 / FRA: M5U / LON: 0ZNC / OTCMKTS: MEIUF) has completed a new funding for its Singapore-based Pixocial unit that accounted for a major portion of the company’s net income in 2022

The new funding raised $22 million from participants including Fidelity’s Eight Roads investment arm, valuing Pixocial at more than $100 million

🇨🇳 Makeover complete? Yatsen says the worst may be behind it (Bamboo Works)

The cosmetics and skincare company said it will boost its share repurchase plan, seeking to prop up its shares after it reported its revenue fell in the third quarter

Yatsen Holding (NYSE: YSG) reported its revenue fell 16.3% in the third quarter, but forecast a probable return to growth in fourth quarter

🇨🇳 Rept Battero IPO: The Bull Case (Smart Karma) $

REPT BATTERO Energy (1998104D CH), a leading EV battery manufacturer, is premarketing a US$300 million HKEx IPO, according to press reports.

According to Frost & Sullivan, in 1H23, Rept was the tenth-largest lithium-ion battery manufacturer globally for annual installations for new energy applications.

The bull case rests on rapid ESS revenue growth, reducing customer concentration risks, ambitious capacity expansion plans, promising margin trajectory and improving cash collection cycle.

🇨🇳 Rept Battero IPO: The Bear Case (Smart Karma) $

The bear case rests on market share losses, high related party revenue, weak outlook, EV battery weak performance, FCF burn, high impairments and receivable financing.

🇨🇳 REPT BATTERO Energy IPO – Fastest Growth, Lowest Margins, No Valuation Discount (Smart Karma) $

REPT BATTERO Energy (REPT) is a lithium-ion battery manufacturer in China, focusing on R&D, production, and sales of EV/ESS lithium-ion battery products such as battery cells, modules and packs.

We have looked at the company’s past performance in our previous notes. In this note, we talk about valuations.

🇨🇳 Its IPO finally approved, Yan Palace flies towards uncertain future (Bamboo Works)

China’s top “bird’s nest stock” faces ongoing challenges from high marketing costs and concerns over product efficacy as it nears the finish line in a long Hong Kong listing journey

Yan Palace reported its profit in the first five months of 2023 rose more than 20%, as its Hong Kong listing application was finally approved after several failed attempts

China’s No. 1 “bird’s nest stock” is spending heavily on marketing and building up distribution channels to maintain its growth

🇨🇳 Misfortune for DouYu as CEO faces gambling charges (Bamboo Works)

Douyu International Holdings (NASDAQ: DOYU)

The company that was once China’s biggest livestream gaming platform has been accused of hosting gambling activities and allowing pornography

Founder Chen Shaojie has been arrested on charges of running a gambling business that could be linked to livestreamers’ lottery schemes

The fallout from the arrest is likely to affect the company’s strategy of focusing on its hardcore gamers

🇹🇼 China Airlines (2610 TT, NEUTRAL, TP:TWD 23.00): Superb 2023 Masks Upcoming Challenges (Smart Karma) $

China Airlines (TPE: 2610) will deliver record profit in 2023 on strong passenger and rising cargo rates

Beyond 2023, hard to forecast due to high exposure (~30%) to volatile cargo, and it lacks brand recognition and customer loyalty evidenced by its weaker yields to local rival

Target price of TWD23 based on 1.71x FY2024 P/BV ratio – one SD above mean. Limited 6% UPSIDE, with 3,9% dividend yield. Prefer Eva Airways (2618 TT)

🇹🇼 Eva Airways (2618 TT, BUY, TP:TWD34.90) The Best, but Not the Cheapest (Smart Karma) $

Eva Airways (EVA) (TPE: 2618) is enjoying the perfect tailwind of strong demand from both inbound and outbound, capacity deficit, a resurgence in corporate travel, and rising cargo rates

Consensus believes FY2023 will be peak earnings as 2024 capacity rollout will balance the demand-supply, but our observations suggest things will likely remain the same until the end of 1H24

Target price of TWD34.90 based on 13.4x FY2024 PE ratio – its long-term mean. Borderline attractive with a modest 11% UPSIDE, but 5.9% dividend yield is a sweetener

🇹🇼 Himax Technologies: No Buying Opportunity (Seeking Alpha) $

Himax Technologies (NASDAQ: HIMX) announced Q3 FY23 with revenue growth and healthy margins due to recovery in the automotive sector.

Headwinds such as increased local competition and a muted festival season may hamper sales in the coming quarters.

The stock is trading in a downtrend, with a bearish price chart and high valuation, making it a risky investment.

🇮🇳 Ipca Laboratories (IPCA IN): Stellar Domestic Performance; US Business Poised for Scaling Up (Smart Karma) $

In Q2FY24, Ipca Laboratories (NSE: IPCALAB / BOM: 524494) reported 10% growth in domestic formulation business, driven by 12% growth in pain management. In FY24, domestic formulation is expected to growth 12–14%.

Ipca now holds 52.67% stake in Unichem Laboratories (NSE: UNICHEMLAB / BOM: 524494). Ipca is confident to clock revenue of INR1.7–1.8B and EBITDA of INR300M from Unichem within two years of acquisition.

As facilities are back onstream, Ipca is augmenting the supply chain and revalidating of all the formulations and updating them. Shipment to the U.S. may begin in Q1FY25.

🇸🇦 Roving Around Riyadh – A Look into a Kingdom Forging its Future Through Reform (Part 1) (Pyramids & Pagodas)

Work trip to Saudi Arabia sheds light on reform progress, geopolitical shifts, and consumer habits.

From September to October, Desertfox spent 1 month in Riyadh, the capital of Saudi Arabia.

We will be releasing a two-part Series covering Desertfox’s recent trip to Riyadh, during which he gained interesting insights into how Saudi Arabia’s soft power push translated to real life experience working with the Saudi public sector, how this might benefit a Hong Kong-listed proxy, and the notable rise of Chinese automakers on the Kingdom’s streets.

Pico Far East (HKG: 0752 / FRA: PJFB / OTCMKTS: PCOFF) (market cap – USD 230 million) (“Pico”) is a Hong Kong-listed company principally engaged in providing exhibition and event marketing services with Middle East operations since the early 1990s. The Company is set to increase its investments in the Kingdom over the next few years, presenting potential opportunities for growth and expansion.

🇰🇿 Kaspi.kz: Compelling Growth Story With A U.S. Listing Catalyst (Seeking Alpha) $

The KASPI (LON: 80TE / FRA: KKS) growth story isn’t slowing down.

Beyond the core businesses, Kaspi is actively reinvesting in new growth areas as well.

Yet current valuations assign little to no credit for Kaspi’s current and future growth.

Kaspi’s upcoming US listing could well be a major re-rating catalyst.

🇳🇬 Nigeria – betting on Africa’s Milei? (Undervalued Shares)

Nigeria’s telecoms sector could be about to experience just that. The country’s new president, Bola Tinubu, is aiming for a radical reform of the sector’s tax code.

Ditto for Nigerian manufacturers, which suffer from 197 different taxes, levies, and fees. Tinubu has identified that just ten of them bring 97% of tax revenue. Guess what he is thinking of doing with the other 187.

Despite this progress, few other countries experience such a degree of investor negativity. Over the past ten years, foreign ownership of Nigerian equities has dropped from 50% to just 9%.

Of late, the currency situation was so dire that some high-net-worth investors engaged in a peculiar type of arbitrage: they bought the stocks of Airtel Africa (LON: AAF / FRA: 9AA / OTCMKTS: AAFRF) (ISN GB00BKDRYJ47) and Seplat Energy (LON: SEPL / FRA: 134) (ISIN NGSEPLAT0008), both of which are listed in London, then transferred custody of the shares to Lagos and sold them there, usually to someone who wanted to have their money go the other way. I am reliably informed this is still done to this day.

Nigeria currently has 50,000 mobile phone towers, but it needs another 70,000 if estimates of the country’s telecoms regulator are correct. The leading operator of such towers in Nigeria is IHS Holding (NYSE: IHS) (ISIN KYG4701H1092), which is listed on the New York Stock Exchange.

Investors in countries like Nigeria should look out for basic industries that will benefit from consumers gaining more purchasing power. Companies whose name will make immediate sense to anyone include Guinness Nigeria (NGX: GUINNESS) (ISIN NGGUINNESS07), Unilever Nigeria (NGX: UNILEVER) (ISIN NGUNILEVER07), Nestlé Nigeria (NGX: NESTLE) (ISIN NGNESTLE0006), and Lafarge Africa (NGX: WAPCO) (ISIN NGWAPCO00002). These are all local subsidiaries of large Western companies, and their stocks are listed on the Lagos Stock Exchange.

Other companies have names that will appeal to anyone who has seen how such frontier markets build basic infrastructure. Dangote Cement (NGX: DANGCEM) (ISIN NGDANGCEM008) is one such name, and one that is associated with Aliko Dangote, who sometimes gets ranked as Africa’s richest man.

🇿🇲 Zambian energy business registers US$200m green bond, country’s first (Capital Markets Africa)

Bond proceeds will support investment into renewable power generation, mainly solar and wind

Copperbelt Energy Corporation (CEC) Plc (LuSE: CECZ), Zambia’s largest private power utility, has announced the registration of its US$200 million green bond on the sidelines of the ongoing COP28 Climate Summit in Dubai. The green bond is Zambia’s first.

CEC is one of the Lusaka Securities Exchange’s most actively traded stocks. The company’s share price has risen 98% for the year to date. Last year, it recorded a net income of US$50.8 million, down slightly from the previous year when it reached US$51.2 million.

🇳🇱 🇬🇧 Unilever: New CEO Making Changes (Seeking Alpha) $

Unilever (NYSE: UL) is undergoing a management change and starting fresh with a new approach, showing potential for a turnaround.

The valuation gap between Unilever and its competitor Procter & Gamble (NYSE: PG) is widening, suggesting undervaluation of Unilever.

Unilever has a number of key strengths, including its strong position in emerging markets and a well-diversified and innovative product portfolio.

🇵🇱 Text SA: Another Compounding Machine (Compounding Quality) $

An Owner-Operator quality stock that translates almost all revenue into pure cash.

Let’s start with a beautiful quote from Chris Mayer: “A lot of beautiful companies can be found in Poland.”

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) is a global provider of solutions for managing online business communications, generating leads, and selling online.

The Company offers its solution under a SaaS (Software as a Service) model. They are used for managing text communication with customers both in business-to-consumer (B2C) and business-to-business (B2B) sectors.

Text SA focuses mainly on the United States. One third of revenues are generated in the US and two-thirds of sales are derived from English-speaking countries. Text SA is headquartered in Poland but Poland only accounts for 2% of the company’s revenues.

🇦🇷 Grupo Financiero Galicia: Risk-On For Argentina’s Largest Private Sector Bank Into 2024 (Seeking Alpha) $

Grupo Financiero Galicia Sa (NASDAQ: GGAL) reported Q3 earnings highlighted by continued profitability despite the challenging macro environment in Argentina.

The Presidential election victory of pro-markets Javier Milei could be positive for Grupo Financiero Galicia to consolidate its market share from government-owned banks.

The stock is a good option to gain exposure to the high-level trends in Argentina where there is building optimism for its long-term outlook.

🇦🇷 Transportadora de Gas del Sur Trades At Fair Value And Is Not An Opportunity (Seeking Alpha) $

Transportadora de Gas del Sur Sa (NYSE: TGS) operates half of Argentina’s natural gas network and has a natural gas derivative liquids processing facility.

TGS’ recent 9M23 performance aligns with previous forecasts, with the transportation segment at breakeven, the liquids segment experiencing a 32% decrease in operating profit, and the midstream segment showing growth.

The company’s future forecasts suggest potential operating profits of $390 million in FY25, leading to a fair value assessment and a recommendation to hold TGS shares

🇦🇷 Pampa Also Trades At Fair Value Waiting For The New President (Rating Downgrade) (Seeking Alpha) $

Pampa Energia Sa (NYSE: PAM) is an Argentinian energy company involved in electricity generation, gas and oil extraction, and petrochemicals.

The company’s electricity generation segment has underperformed due to delays in peso adjustments, but its PPA contract generation is expected to remain profitable.

PAM plans to enter the oil market to overcome capacity constraints in natural gas, but the success of this venture remains uncertain.

A sum of parts valuations yields a conservative fair value at these levels, in expectance of regulations from the new Argentinian government.

🇦🇷 Beware Of Impending Dilution At Bioceres (Seeking Alpha) $

Bioceres Crop Solutions Corp (NASDAQ: BIOX) is an agricultural inputs company with a good profitable position in adjuvants and fertilizers, and R&D breakthroughs in genetic traits.

The company has shown lack of performance on its new business ventures, and its more mature business is not growing.

I fear dilution to repay impending maturities, or their refinancing in aggressive terms.

Further, I don’t like some of the company’s management governance practices, particularly regarding information disclosure.

🇨🇴 Bancolombia: An Undervalued Enticing Income Stock (Seeking Alpha) $

Bancolombia (NYSE: CIB / BVC: PFBCOLOM) faces headwinds in loans and deposits due to Colombia’s economic slowdown, high inflation, and regulatory uncertainties.

The bank’s loan portfolio extends across Colombia, Panama, Guatemala, and El Salvador, providing crucial geographical and revenue diversification.

CIB shows resilience with recovery trends, strong liquidity, and a positive net income margin.

Despite consumer loan issues and regulatory challenges, Bancolombia’s recovery, robust ROE, and attractive valuation make it an appealing investment, boasting a dividend yield exceeding 10%.

Short-term challenges persist, but the Company’s cautious 2024 GDP growth forecast aligns with expected improvements in the Colombian macroeconomic landscape.

🇵🇪 Cementos Pacasmayo Dividend Might Be At Risk (Rating Downgrade) (Seeking Alpha) $

Cementos Pacasmayo (NYSE: CPAC) is a major cement producer in Peru with a quasi-monopoly in the northern region.

The company is expected to grow alongside the Peruvian economy and offer a dividend with a good yield.

However, in a few years, the company may require better financing and should avoid excessive leverage.

Further, the dividend is potentially at risk in the short-term, which could make the company’s stock price volatile.

🇺🇾 🇻🇬 Satellogic: Nice $140 Billion Market, Bad Investment (Seeking Alpha) $

Satellogic (NASDAQ: SATL) provides Constellations-as-a-Service, offering low-Earth observation satellites and multispectral imaging.

The company sees a $140 billion market opportunity in geospatial analytics for energy, forestry, and infrastructure.

Satellogic’s lack of funds and slow growth make it an unattractive investment opportunity with a fair value of $2.21 per share.

🇺🇾 DLocal: One Of The Best Emerging Markets Bets (Seeking Alpha) $

Dlocal (NASDAQ: DLO) offers payment solutions and currency conversion services for businesses expanding into emerging markets.

The company reported strong financial results in Q3, with increased payments volume and gross profit, and reaffirmed its 2023 guidance.

DLO’s valuation is attractive compared to its peers and presents a potential upside of 55% according to a DCF model.

🇺🇾 Arcos Dorados: Digital Growth Drives Earnings Growth (Seeking Alpha) $

Arcos Dorados Holdings Inc (NYSE: ARCO) operates McDonald’s franchised restaurants in Latin America, with around half of the company’s operations in Brazil.

The company has seen significant revenue growth and improved margins through its 3D strategy, driving digital revenue growth.

The stock seems to be priced with slight overvaluation with the growth that I expect, as the stock has heightened currency risks and geographical risks.

$ = behind a paywall

🌐 What would happen if throughput of the Suez and Panama canals were impaired at the same time? (Calvin’s thoughts) $

A deep dive into the importance of the Panama and Suez Canals to global trade and an exploration of the threats they face and the opportunities and consequences those threats create

Let’s start by establishing why the Suez and Panama canals are so important. 15% of total world trade (measured in dollars using the formula cargo value passing via Suez / Panama canal / total global cargo values) goes through these two waterways every day – 12% via the Suez canal and 3% via the Panama Canal.

🇨🇳 Chinese auto exporters face costly detour after Red Sea attacks, expert says (Caixin) $

The recent spate of attacks against Israel-linked vessels could force cargo ships to divert from the key Red Sea shipping route, significantly increasing the cost and time of Chinese car exports to Europe, a logistics expert told Caixin.

The Red Sea sits at the entrance to the Suez Canal, which forms the shortest shipping route between Asia and Europe, making it crucial for trade between the two regions. Multiple commercial ships have been attacked or targeted in or around the Indian Ocean inlet since mid-November, including at least three Israel-linked ships, among which was the Galaxy Leader, a vehicle carrier seized by Yemeni rebels.

🇨🇳 Will China continue to grow? — views from Weijian Shan (Ginger River Review) PDF File

In October, GRR published the translation of 经济增长的政策空间 Policy space for economic growth by 单伟建 Weijian Shan, one of the most influential private equity figures in Asia. The article is one of the most popular pieces GRR published in October. Today, we present you a newly-released piece by Mr. Shan: Will China Continue to Grow? (Update: The Chinese version 中国能否持续增长?is now available on Mr. Shan’s WeChat Account)

In this article, Mr. Shan takes stock of, based on 22 exhibits, what China has been really going through over the past five years, both interally and externally. At the end of the article, Mr. Shan answers the question “Will China continue to grow?”

The article breaks down into the following parts:

China’s Challenges

China’s Policy Space

Health of China’s Banking System

China’s Avenues for Growth

The U.S – China Trade War

China’s Technological Progress

Demographic Bomb – or Bust

The China Opportunity

🇨🇳 Moody’s Told Staff In China To Work From Home Ahead Of Downgrade To Country’s Credit Outlook (Zero Hedge)

According to the FT, some Moody’s department heads in the country told associates on Friday that non-administrative staff in Beijing and Shanghai should not go into the office this week, they said.

“They didn’t give us the reason . . . but everyone knows why,” said one China-based Moody’s employee, referring to the request to work from home. “We are afraid of government inspections.”

🇨🇳 Millions drop out of China’s state health insurance system (FT) $

🇭🇰 Hong Kong’s Stock Slump Triggers Wave of Brokerage Closures (Bloomberg Law) (Zero Hedge Reposting)

Thirty local brokerages have closed down this year, after a record 49 shut up shop in 2022, according to Hong Kong stock exchange data. That comes as Wall Street banks lay off dealmakers due to a plunge in initial public offerings.

“This wave of shutdowns and layoffs at brokerages is the worst I’ve ever seen,” said Edmond Hui, chief executive officer of Hong Kong-based brokerage Bright Smart Securities. “The key lies in improving the liquidity of the market. Now everyone is struggling. I simply don’t see any light at the end of the tunnel.”

Small-and medium-sized brokerages, whose revenue mainly comes from trading commissions and margin businesses, are bearing the brunt of the market downturn.

🇮🇩 Indonesia hopes global investors will follow the carmakers (FT) $

The south-east Asian country has the potential to develop wealth management offerings if per capita income improves

At a conference held by UOB Asset Management in March, Colin Ng, head of Asia equities for the financial services group, called Indonesia, a “sitting jackpot”. “When you invest in Indonesia, you are basically investing in the future,” he said.

🇮🇳 🇭🇰 India’s NSE set to take Hong Kong’s spot among world’s largest markets (FT) $

🇻🇪 🇬🇾 The Venezuela-Guyana Dispute Explained In 3 Charts (Visual Capitalist)

Recent events, however, have reignited the dispute. Between 2015 and 2021, Guyana announced the discovery of about 8 billion barrels of oil, elevating a country with fewer than a million people to a prominent position among the top nations in terms of oil reserves. ExxonMobil, leading a consortium, operates three offshore projects in the country, earning nearly $6 billion in 2022 alone.

With a population of around 125,000 people, the disputed region is full of dense rainforest, making a military incursion from Venezuela feasible only by sea or through the Brazilian state of Roraima. Brazil, maintaining good diplomatic relationships with both countries, has already increased military personnel on the border. The U.S. announced joint military flight drills in Guyana on December 7.

🇵🇪 Peru’s deadly gold mine attack highlights growing security risk, costs (Reuters)

A dramatic and deadly attack on a gold mine in Peru on Saturday has thrown a spotlight on illegal miners and criminal gangs targeting mines, which in recent years has left scores dead and cost billions of dollars in losses, according to industry and government officials.

Nine workers were killed and 10 others gravely injured in the latest attack where men armed with explosives raided and took hostages at a mine belonging to Poderosa (BVL: PODERC1), one of Peru’s top gold producers.

The impact is showing up on balance sheets, a headache for firms and Peru’s government as it battles to dig out of a recession, with mining the country’s main economic engine.

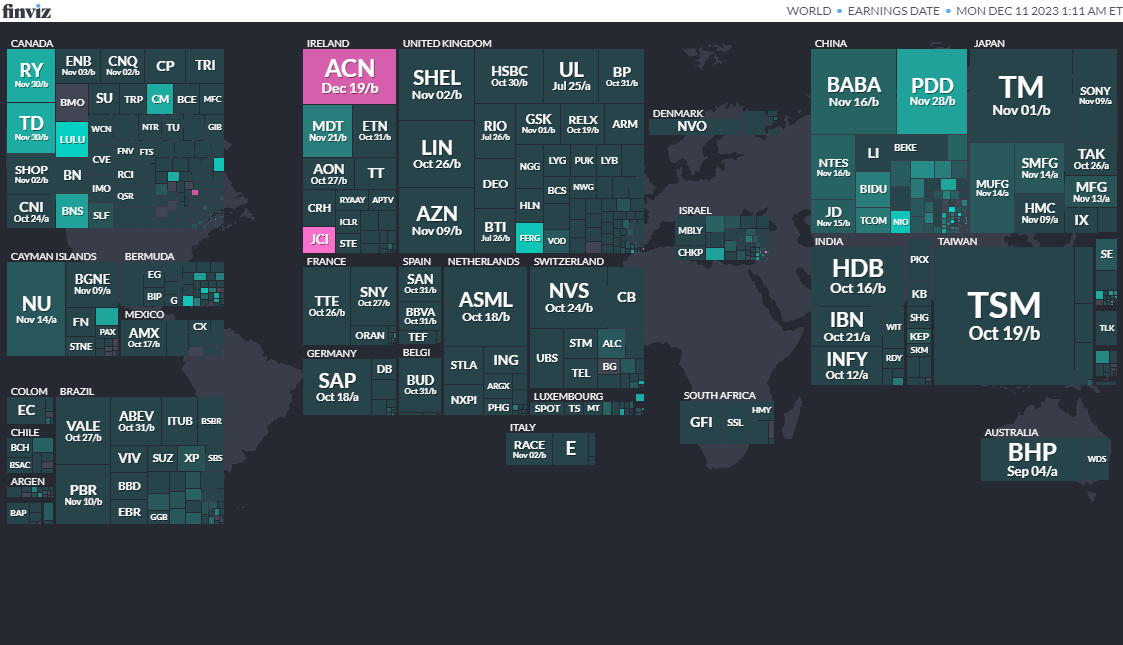

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

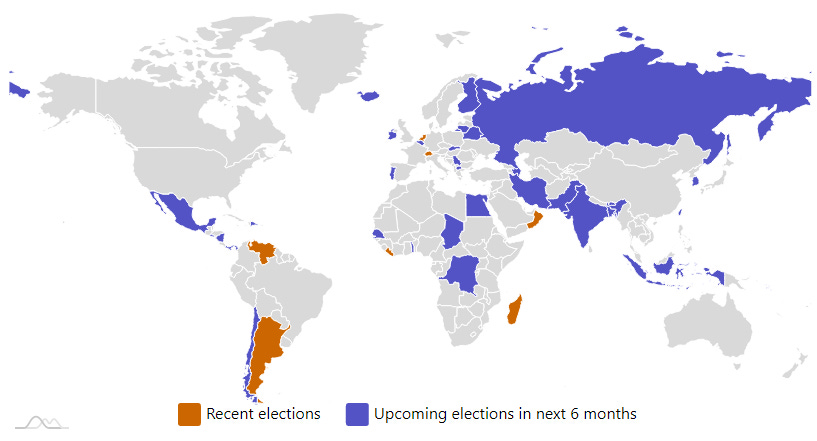

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

EgyptEgyptian PresidencyDec 10, 2023 (d) Confirmed Mar 26, 2018 -

Chile Referendum Dec 17, 2023