More than half of the top U.S. hedge funds hold Bitcoin ETFs.

In retrospect, all that was needed for Bitcoin to be actually adopted institutionally was to introduce a product with minimal risk and easy to use in the form of an exchange-traded fund (ETF). In January, the SEC approved nine new ETFs that provide exposure to Bitcoin through the spot market, a significant improvement over the futures-based ETFs that began trading in 2021. In the first quarter of trading, both the size and number of institutional allocations increased. Consensus expectations for these ETFs have been dashed. Blackrock’s ETF alone set the record for the fastest time for an ETF to reach $10 billion in assets.

In addition to the eye-popping AUM numbers these ETFs produce, last Wednesday was the deadline for institutions with more than $100 million in assets to report their holdings to the SEC through 13F filings. These filings reveal a complete picture of who owns Bitcoin ETFs. The results are optimistic.

Institutional adoption is widespread.

In the past, reporting Bitcoin ownership by a single institutional investor could be a newsworthy and market-moving event. Just three years ago, Bitcoin rose more than 13% in one day after Tesla decided to add Bitcoin to its balance sheet.

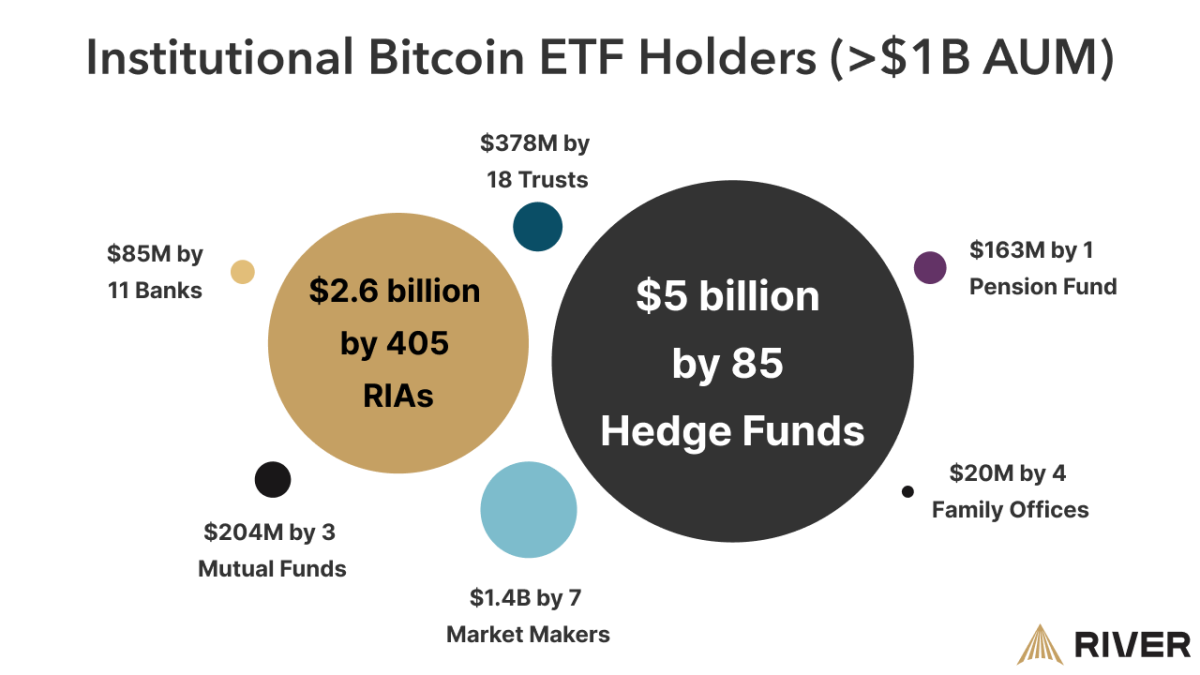

2024 will definitely be different. As of Wednesday, we know of 534 unique institutions with over $1 billion in assets that have chosen to begin allocating to Bitcoin in the first quarter of this year. From hedge funds to pensions and insurance companies, the scope of adoption is astounding.

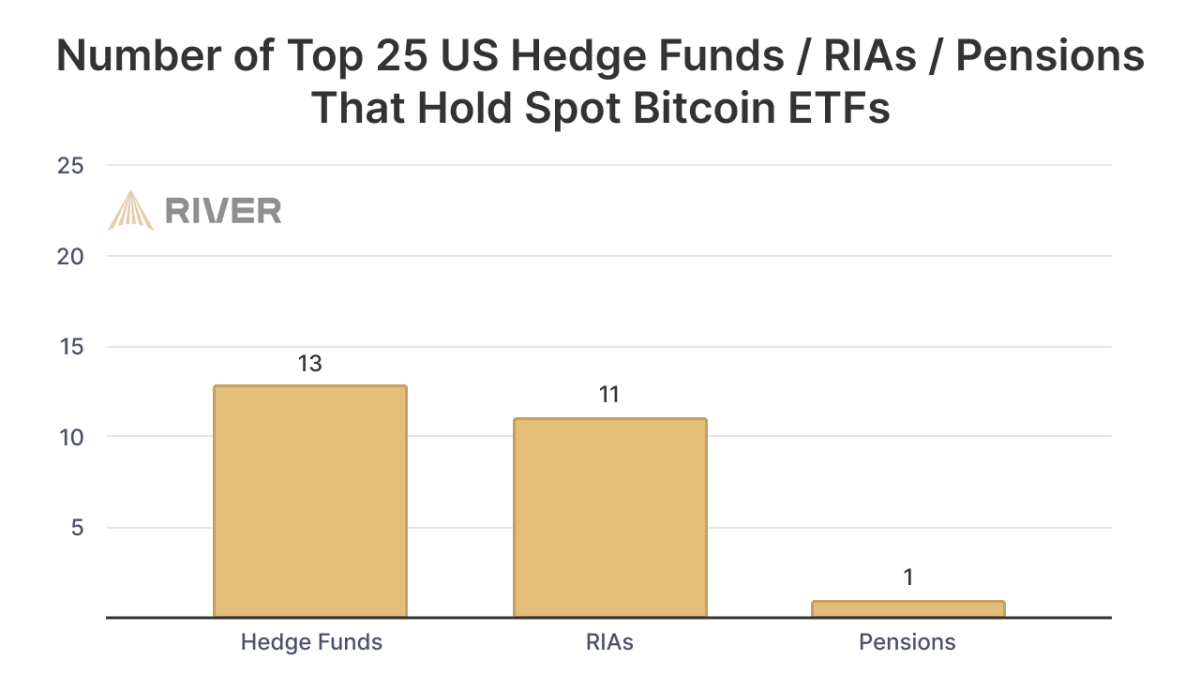

More than half of the 25 largest hedge funds in the U.S. currently have exposure to Bitcoin, most notably Millennium Management’s $2 billion position. Additionally, 11 of the current maximum 25 Registered Investment Advisors (RIAs) have been assigned.

But why are Bitcoin ETFs so attractive to institutions that were just able to buy Bitcoin?

Large institutional investors are slow-moving creatures in a financial system steeped in tradition, risk management and regulation. For pension funds to update their investment portfolios, it takes months, sometimes years, of committee meetings, due diligence and board approval, a process that is often repeated multiple times.

Gaining exposure to Bitcoin by purchasing and holding physical Bitcoins requires multiple exchange providers (e.g. Galaxy Digital), custodians (e.g. Coinbase) and forensic services (e.g. : A comprehensive investigation into Chainalytic is needed. , etc.

It is relatively easy to get exposure to Bitcoin by purchasing an ETF from Blackrock. Lyn Alden said on her TFTC podcast: “Every ETF, on the developer side, is basically an API for the fiat system. It allows the fiat system to connect to Bitcoin in a slightly better way than it could before.”

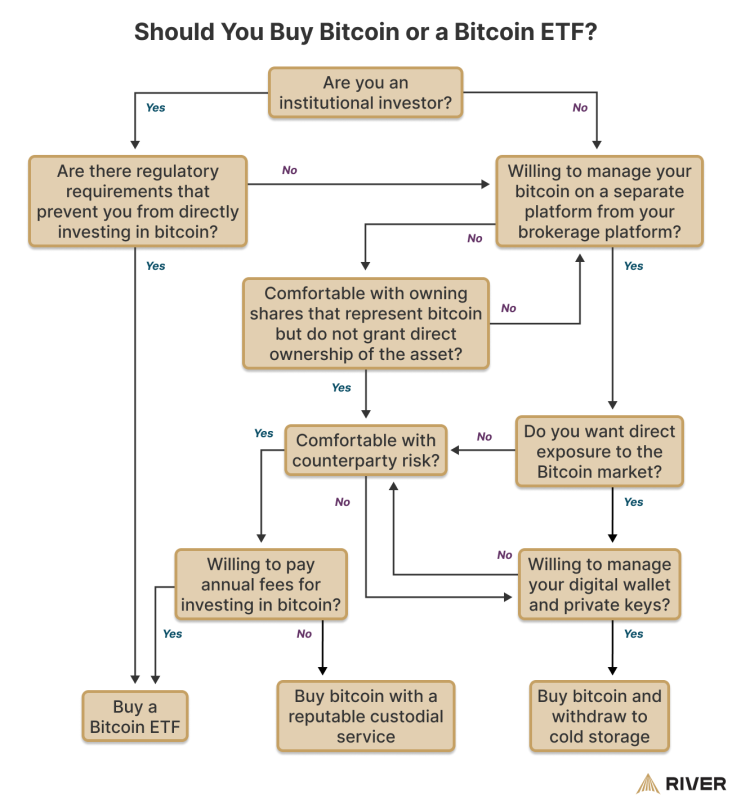

That’s not to say that ETFs are the ideal way for people to gain exposure to Bitcoin. Aside from the management fees that come with owning an ETF, there are many pros and cons to the product that could undermine the core value that Bitcoin offers: incorruptible money. These pros and cons are beyond the scope of this article, but the flowchart below illustrates some considerations.

Why didn’t Bitcoin bounce back further this quarter?

With ETF adoption so high, it may be surprising that the price of Bitcoin is only up 50% year-to-date. In fact, with a 48% allocation from the top hedge funds today, how much upside could there really be left?

Although ETFs have broad ownership, the average allocations of the institutions that own them are fairly small. Among the major ($1 billion-plus) hedge funds, RIAs, and pensions that make allocations, the weighted average allocation is less than 0.20% of AUM. Even Millennium’s $2 billion allocation represents less than 1% of its reported 13F holdings.

Therefore, the first quarter of 2024 will be remembered as the time when institutions ‘came out of zero’. When will we stop dipping our toes in the water? Only time will tell.

This is a guest post written by Sam Baker from River. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.