JPST ETF: A Solid Fund for Conservative Investors (NYSEARCA:JPST)

Riasik

JPMorgan has been a beast when it comes to offering exchange-traded fund (ETF) products, and one of its most popular products designed for investors looking for low-volatility returns is ETFs. JPMorgan Ultra-Short Income ETF (NYSEARCA:JPST). This is actively managed Exchange-traded funds strive to provide returns while maintaining low volatility of principal at attractive yields consistent with most taxable bond funds. This is an especially useful tool for income-focused investors, such as retirees, who seek stability to help mitigate the impact of market fluctuations on portfolio withdrawals.

JPST has limited sensitivity to changes in interest rates by investing at least 80% of its assets in a diversified portfolio of short-term investment grade corporate and structured debt securities. The fund is overseen by a team of portfolio managers from JP Morgan Asset Management’s Global Fixed Income, Currencies and Commodities team. of the fund The focus on short-term securities means that interest rate changes have minimal impact on the portfolio.

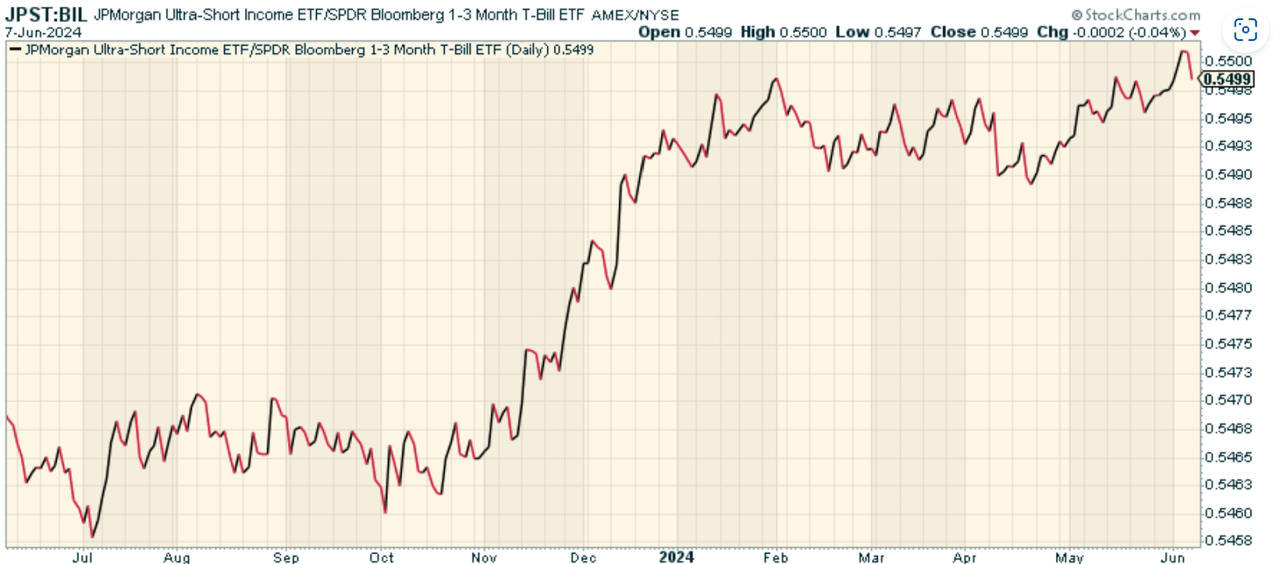

Explore Holdings

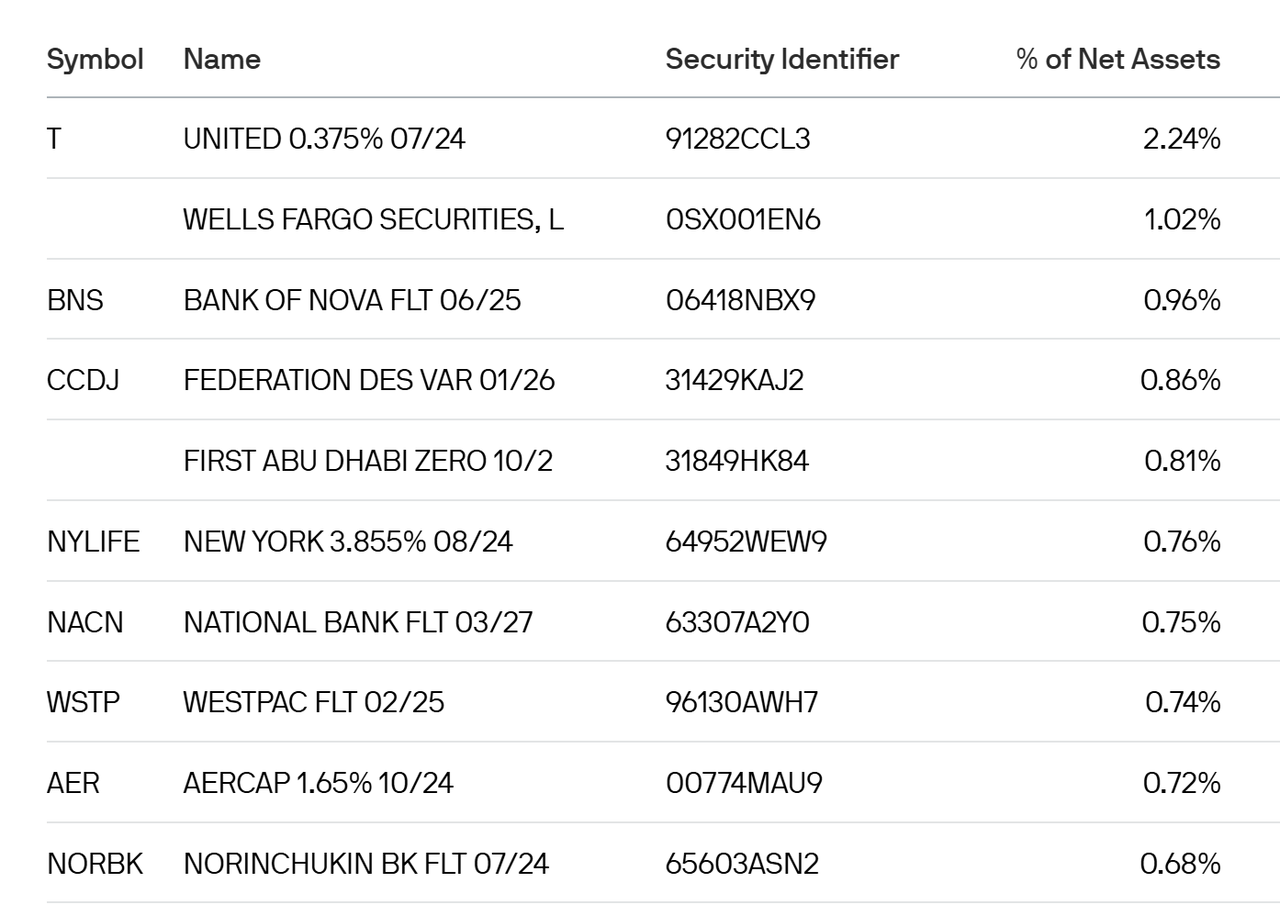

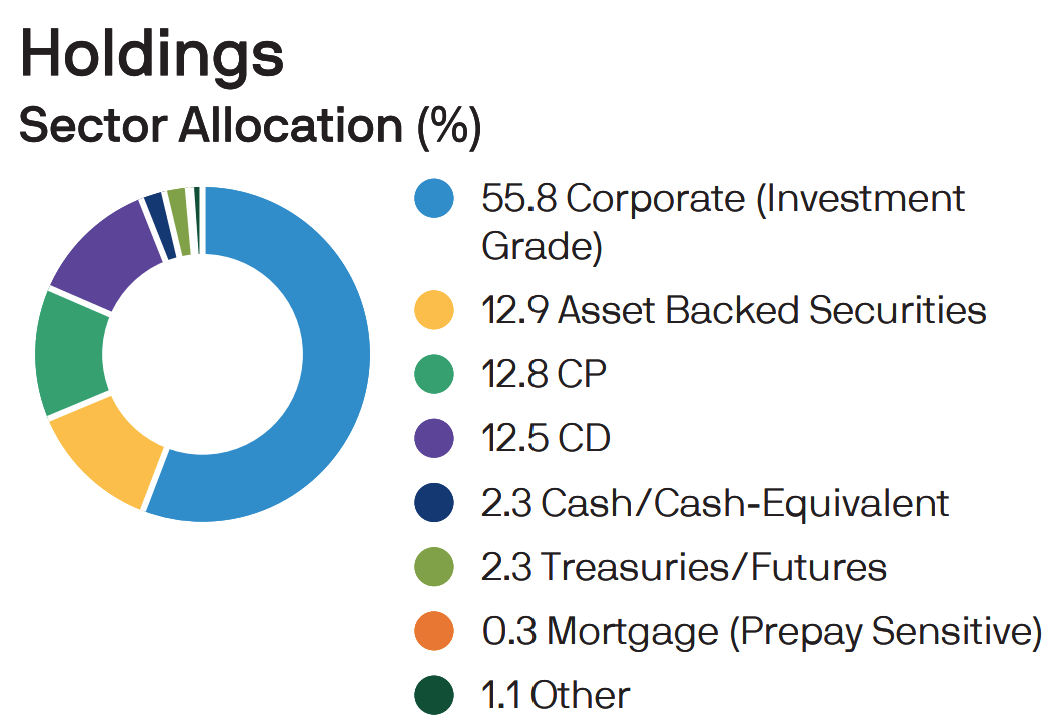

JPST’s portfolio is very diverse, investing in many different types of bond instruments.

jpmorgan.com

Most of them are investment grade corporate bonds. Debt securities issued by companies with high credit ratings reduce the probability of default. These investment grade corporate bonds typically pay higher interest rates than government bonds while carrying lower overall risk.

jpmorgan.com

The Fund’s asset-backed securities are a form of fixed-income securities collateralized by a pool of underlying assets, including automobile loans, credit card receivables or student loans. This has roughly the same weight as the commercial paper quota (12.8%). Commercial paper includes short-term, unsecured promissory notes issued by corporations to finance their short-term liquidity needs. The only other major distribution is a good old-fashioned certificate of deposit, a form of term deposit issued by a bank or credit union. These deposits pay a predetermined, fixed interest rate for a set period of time.

The 690+ holdings are all high quality with minimal risk, resulting in a portfolio with a duration of just 0.51.

jpmorgan.com

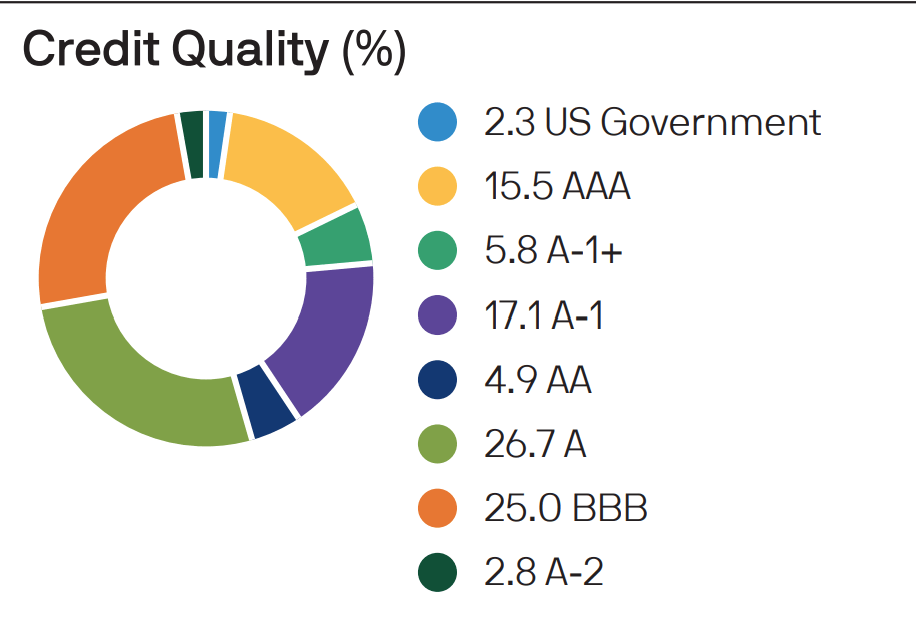

peer comparison

JPST’s claims are hard to resist, but other contenders in the ultra-short-term income category are also worth looking at. One worth comparing is the SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL). Since this ETF only purchases U.S. Treasury bonds, it technically has less risk (negligible) than JPST. Looking at the two price ratios, we can see that JPST performed better, especially in November and December last year. I prefer JPST given its slightly higher yield profile compared to the diversified blend.

stockcharts.com

strength and weakness

On the positive side? JPST is easy to understand and has delivered significant returns. It’s cheap for a fund that yields just 0.18% and is a great, low-risk alternative to cash. The short-term focus helps protect the fund from interest rate fluctuations. This, combined with active management, helps mitigate risk, for example when portfolio managers feel the need to pivot tactically in response to changing market conditions.

On a downward trend? If you’re looking for knockout returns, you won’t get it with a fund like this. There is also some credit risk, but it is obviously minimal. And while short-term interest rates are positive, if the Fed cuts interest rates, this will not yield meaningful benefits.

conclusion

Overall, the JPMorgan Ultra-Short Income ETF looks like a great fund. It has over $23 billion in assets under management and a 30-day SEC yield of 5.37%, which has garnered a lot of attention among powerful allocators. But does it stand out among the many other funds operating in the same space? I’m not that sure. The performance metrics are all there, and while it’s part of the fixed income space that’s easiest to capture with funds like this, there are plenty of other short-term bond funds with similar returns. But overall, if you’re a conservative investor or have some extra cash and don’t know what to do with it, JPST is worth considering.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of living as a passive investor and ready to take control of your financial future? Introducing the Lead-Lag Report, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk drivers, discovering high-reward ideas, and gaining valuable macro observations. Stay ahead of the competition with critical insights into leaders, laggards, and everything in between.

Switch from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to get access and try the Lead-Lag report free for 14 days.