Intel Could Win Again (NASDAQ:INTC)

Tupungato

My last article about Intel (NASDAQ:INTC) returned in October 2022 and was trading at around $25 per share at the time. When I wrote that article, I was bullish on Intel. And after about 13 months, the stock It roughly doubled in value, trading at around $50 in December 2023. But things changed and the stock price fell back to around $30 per share. Once again, I think now is a good time to buy Intel stock, and have been doing so recently. I know many investors have a negative stance on Intel and can point to a number of reasons, including its relative poor performance compared to NVIDIA (nvidia). But that’s looking in the rearview mirror, and I’m mainly interested in how Intel stock can perform. from now on. One thing is certain: expectations for Intel seem very low and expectations for NVIDIA seem very high. This is often a great setup for stocks of companies with low expectations to actually perform. With that in mind, let’s take a closer look at Intel.

elephant in the room

Taiwan has a potentially big problem, and that problem is, of course, China. China has made it clear that it wants unification in one way or another. A recent Newsweek article summarizes the situation:

The People’s Republic of China claims Taiwan as its territory, even though it has never ruled the island. President Xi said that unification through force, if necessary, is inevitable. U.S. officials believe he has ordered his troops to invade by 2027. “But that doesn’t necessarily mean this year or any other year has been chosen for this work.”

We saw some supply chain issues when Ukraine was invaded, but this type of disruption will have a much bigger impact in Taiwan. Taiwan produces about 60% of the world’s chips and about 90% of the world’s advanced chips, so these supply disruptions could impact the global economy. Escalating tensions between China and Taiwan appear to be causing considerable anxiety among some customers of Taiwan Semiconductor (TSM). A recent article confirmed this anxiety, as some customers wanted TSM to move its factories out of Taiwan. It says:

Taiwan Semiconductor Manufacturing has discussed moving chip facilities out of the island nation with some customers amid heightened tensions with China, but such a move is not possible, Reuters reported.

“The instability in the Taiwan Strait is really a consideration for the supply chain, but I would say we certainly don’t want a war to break out,” CC Wei, TSM’s chairman and CEO, told reporters after the company’s annual general meeting, where he was elected unanimously. “

Intel is the “home team”

Intel has so much to offer because it is not only an American company and chip designer, but also a manufacturer and a company that makes chips for other companies. For a company so concerned about potential supply chain disruptions that Taiwan Semiconductor is asking if it can move out of Taiwan, it appears it wants a Plan B that could provide some to Intel. The same goes for their business.

Sourcing from only one source is a huge risk to your business. If something happens to that supplier, your company could be seriously affected. So even if you prefer one product supplier over another, it makes sense to hedge and source at least some of your products from a second supplier. For this reason alone, it makes sense for the company to hedge and source from Intel as well, rather than relying too much on just one chipmaker like Taiwan Semiconductor.

Intel has an advantage in terms of pricing and onshoring and can keep up with new AI chips.

Whether you’re a chip designer like Nvidia or an end user who needs to buy chips to make a specific product, it makes sense to do at least some business with Intel. Taiwan has significant potential geopolitical and supply chain risks, which means doing business with Intel is a smart way to hedge against these risks.

Another reason Intel could win is through its very competitive pricing and high-end chip offerings such as Gaudi 3. A recent article points out that Gaudi 2 and Gaudi 3 have performance and price advantages over Nvidia’s H100, explaining:

Second, in an unusual move to highlight the value proposition of Gaudi chips, Intel announced attractive pricing for system providers. The AI kit with eight of the latest Gaudi 2 AI chips and a universal baseboard will cost system providers $65,000, while the version with eight Gaudi 3 AI chips will cost $125,000. Intel estimates that these kits cost only one-third and two-thirds, respectively, of competing platforms.

Intel is undercutting Nvidia on price, but expects its chips to deliver impressive performance. The company estimates that a cluster of 8,192 Gaudi 3 chips can train AI models up to 40% faster than a cluster of the same number of Nvidia H100 chips.”

Intel recently launched the ‘Xeon 6’ chip, an advanced processor ideal for AI applications. I think this is another sign that Intel is serious about catching up with the AI market.

humanoid robot

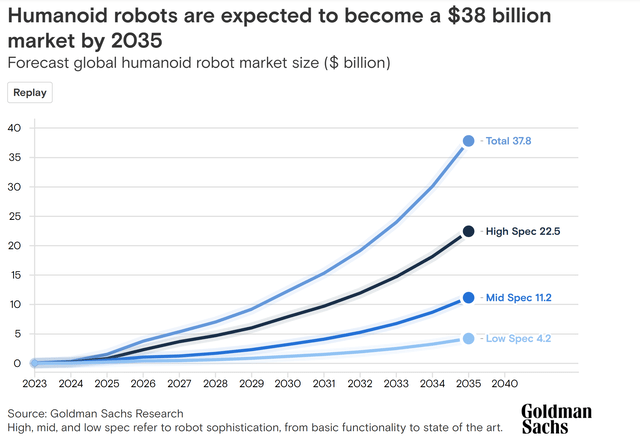

There is a lot of interest in AI these days, and I believe that in the next 2 to 4 years, AI will merge with hardware and become the starting point for the mainstream adoption of humanoid robots. This seems like a truly enormous opportunity, especially since many of the leading tech leaders and tech billionaires on the AI side now seem to see a huge opportunity in humanoid robots. Humanoid robots require a variety of chips, from basic to advanced. Intel stands to benefit significantly from the potential growth of this emerging industry.

Apple (AAPL) is reportedly considering developing personal robots. Tesla is developing “Optimus,” a humanoid robot that Elon Musk said could be bigger than any other product Tesla currently makes. Elon Musk said Tesla may be ready to start selling robots in 2025. Another humanoid robot company, Figure AI, received funding from Amazon (AMZN)’s Jeff Bezos and Nvidia’s Jensen Huang. Goldman Sachs (GS) analysts predict that humanoid robots could become a $38 billion industry by 2035, as shown below:

Goldman Sachs

Sentiment and market share can change quickly for chip and technology stocks

Sentiment and market share can change in a very short period of time, and of course we’ve seen the rise and fall of many chip stocks. A few years ago, I wrote an article about Advanced Micro Devices (AMD) when it was trading at around $3 per share. At the time, many investors thought things would end badly for AMD, but this turned out to be a huge buying opportunity. In 2016, Nvidia stock traded for about $7, but now it trades for about $1,200 per share. This shows that investors have a history of underestimating the potential of chip stocks.

It’s important to keep in mind that almost every major technology stock had a period when investors were very negative, growth was gone, and they felt these companies would never regain their footing. This happened at Microsoft (MSFT) under Steve Balmer, it happened at Apple (AAPL) in the past, and it happened at Meta Platform (META). At the time, the stock had fallen to less than $100 a share just two years ago due to growth concerns. It now sells for almost $500.

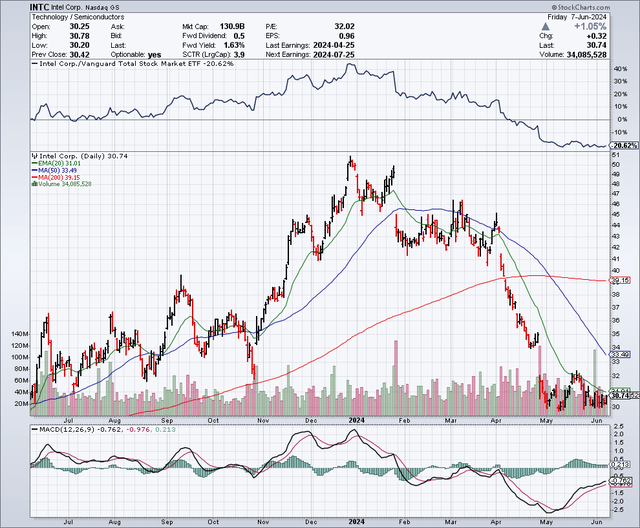

Chart

As you can see in the chart below, Intel stock was trading around $50 in December 2023, but over the past few months, the stock has nearly halved. Intel stock is currently trading well below its 50-day moving average of $33.98 and its 200-day moving average of approximately $39.18.

StockCharts.com

Revenue Estimates and Balance Sheet

Intel’s bar appears to be quite low this year. Analysts expect Intel to earn $1.10 per share and $55.84 billion in revenue in 2024. But growth investors will be happy to see 2025 earnings estimates nearly doubling to $1.98 per share and revenue reaching $62.63 billion. Earnings are expected to surge again in 2026, estimated at $2.57 per share and $68.58 billion in revenue. Investors seem fixated on lackluster 2024 revenue estimates, but considering how much revenue is expected to grow beyond 2025, there appears reason for optimism.

Looking at the balance sheet, Intel’s debt is approximately $52.45 billion and its cash is $21.31 billion.

Potential Downside Risk

It’s clear that Intel has dropped the ball in the past by allowing much smaller companies to come up from behind and take huge market share in terms of high-end chips. However, it seems like they have acknowledged this and acknowledged the need to get back on track. I think Intel has solid plans to not only maintain its viability but also reclaim the throne to some degree in the future, but this will obviously take time. However, competition from Nvidia will remain fierce and could pose a continued downside risk for Intel. Management execution is clearly a potential downside risk, as are macro issues such as a potential recession. Tariffs and chip bans could be another potential downside risk as tensions between China and the United States increase.

to sum up

Sentiment toward Intel appears to be very negative, which is not uncommon when the stock is trading at or near its 52-week lows. But this is when it gets interesting for value and contrarian investors. I know why I’m skeptical about Intel, but I’ve seen this same type of negativity and skepticism about other stocks that turn out to be buying opportunities. I don’t have a huge position in Intel, but I’d add some more weakness and give the company time to take advantage of all the tailwinds it could enjoy over the next few years, from PC cycle refreshes to AI. Even humanoid robots. Intel is also uniquely positioned as a “home team” that can act as a hedge and key supply chain partner for many technology companies, especially in the event of disruption in Taiwan.

Again, sentiment can change quickly in the technology sector, especially chip stocks. For example, remember that Intel’s stock price has been $50 for the past 52 weeks. As sentiment turns more positive, I believe it will rise above $50 in the next few years.