‘Bitcoin is exponential gold,’ says Fidelity’s global macro director.

Fidelity’s Global Macro Director Jurrien Timmer recently made a notable statement, describing Bitcoin as “exponential gold” and an emerging player in the “store of value” team. Timmer’s comments were shared in a series of posts, in which he detailed Bitcoin’s evolving role in the financial ecosystem.

In my opinion, Bitcoin is the exponential gold and the standout player in the store of value team. My work shows that the price of Bitcoin is primarily driven by the growth of the network, which is driven not only by Bitcoin’s inherent scarcity, but also by monetary and financial implications.

— Jurien Timmer (@TimmerFidelity) June 13, 2024

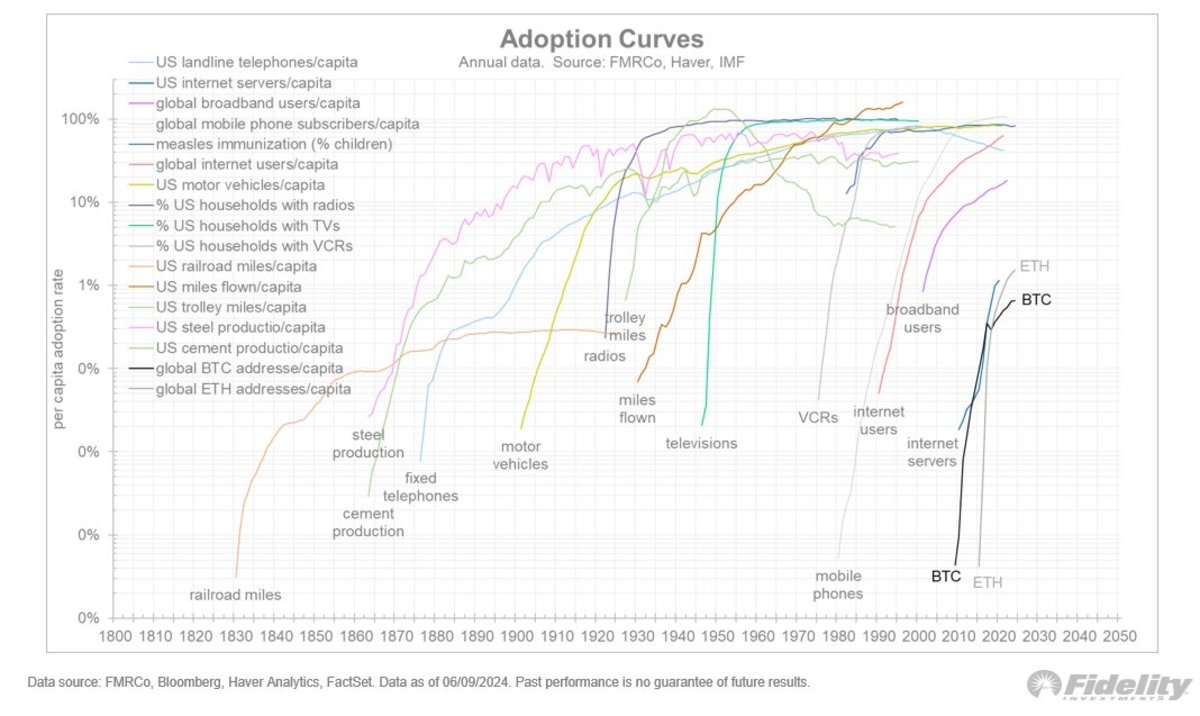

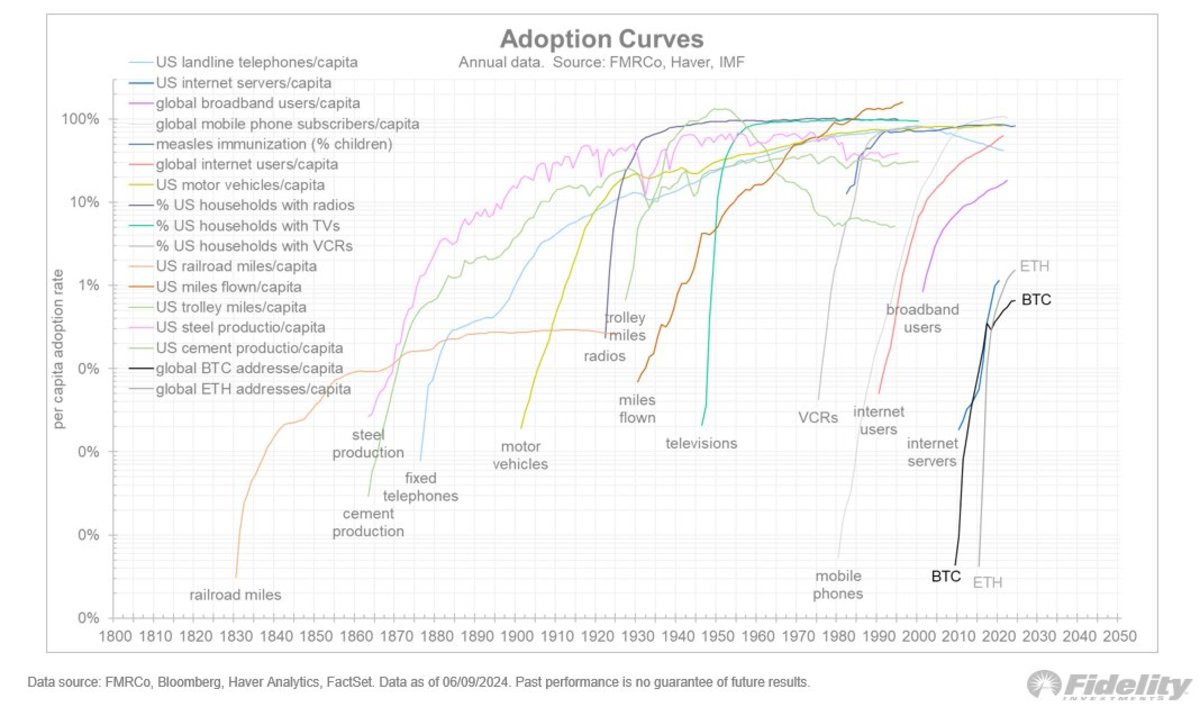

Timmer highlighted Bitcoin’s unique position in the market and compared Bitcoin’s growth trajectory to the exponential adoption curve seen in technologies such as the internet and mobile phones. He emphasized that Bitcoin’s scarcity and growing acceptance as a digital asset contribute to its potential as a long-term store of value similar to gold.

Jurien Timmer

In his post, Timmer suggested that adoption rate and network growth are important factors in valuation. He pointed out that although Bitcoin is still in its infancy compared to traditional assets, adoption is accelerating exponentially, supporting the argument that Bitcoin could become a significant store of value in the future.

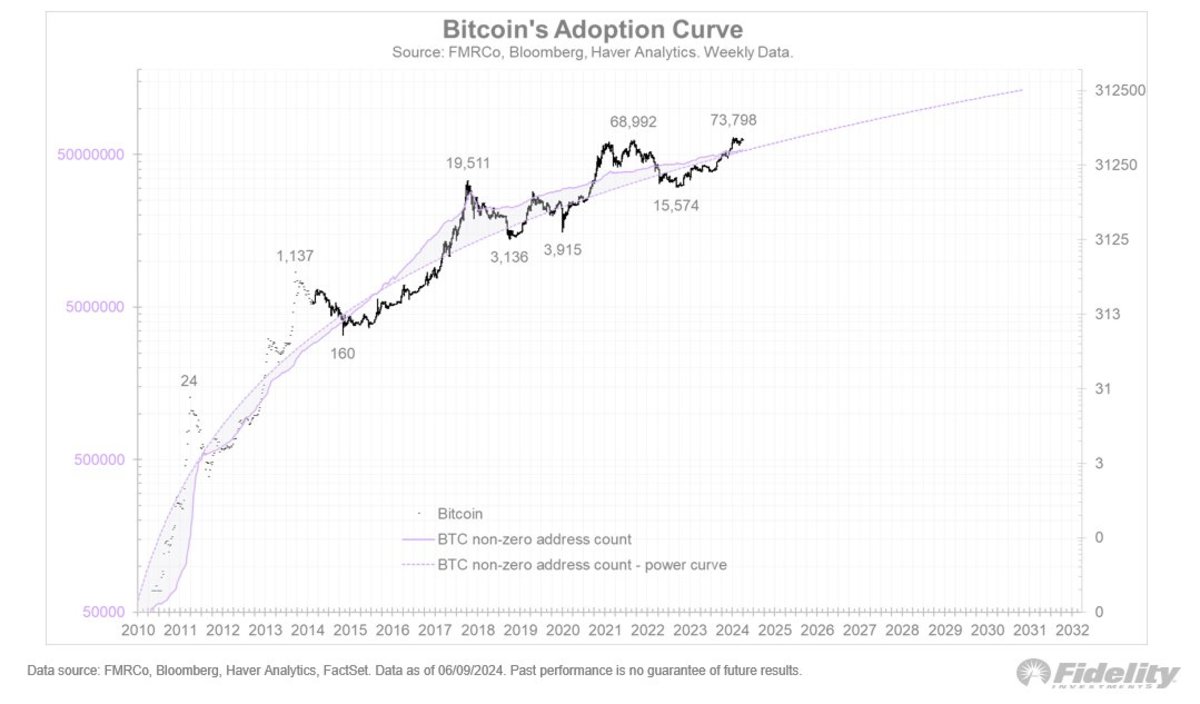

“The chart below shows Bitcoin’s network growing along a simple power curve. The number of non-zero addresses converged on this power curve, and the Bitcoin price oscillated around it like a pendulum,” he said. “This is Bitcoin’s unique series of boom-bust cycles.”

Jurien Timmer

Timmer’s endorsement is consistent with a broader trend among institutional investors recognizing Bitcoin’s potential. His views reinforce Bitcoin’s growing legitimacy within the financial industry and suggest that Bitcoin could play an important role in future investment strategies.

“The growth of the Bitcoin network has slowed in recent months, but the price continues to rise,” he concluded. “In my opinion, this gap between price and adoption could explain why Bitcoin has slowed down a bit on its path to a potential new all-time high. The pendulum will only swing so far. To continue hitting new highs, the network needs to You may need to speed it up again.”