EigenLayer founder reiterates support for Ethereum. Why is ETH struggling?

This article is also available in Spanish.

Despite the scalability and high gas fees faced by Ethereum, the founder of liquidity recapture platform EigenLayer claims the network is superior, especially compared to Solana. Solana is the third most valuable smart contract platform after Ethereum and the BNB chain. Over the years since its launch, it has solidified its position on Ethereum, taking more market share.

Is Ethereum better than Solana?

Solana’s reputation is clear, but Sreeram Kannan, founder of EigenLayer, said: assert In X’s post, Solana stated that it prioritizes low latency and global node synchronization over other core features.

Related Reading

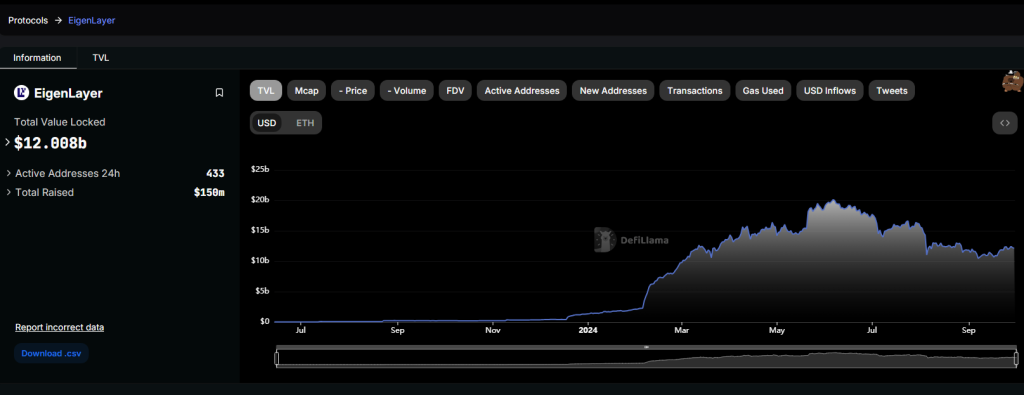

Ethereum, on the other hand, took a different approach, emphasizing the need for stability and decentralization. Therefore, in Kannan’s view, the first smart contract platform offers a more comprehensive solution than its competitors. According to DeFiLlama, EigenLayer currently manages over $12 billion in assets on Ethereum.

Kannan acknowledges Solana’s efficiency, but the founders nevertheless pick up on some limitations now that the platform is building a global state system. At the top of the list are blockchains, where programmability and verifiability are sacrificed.

Meanwhile, EigenLayer leaders believe that Ethereum is excelling, especially when it comes to performance, thanks to the success of Rollup and its subsequent widespread adoption. This off-chain solution provides instant confirmation and outperforms web2 applications.

At the same time, Ethereum is programmable, allowing EigenLayer to add more features, such as random decentralization of verifiable operations. As a result, Kannan added, the liquidity recapture platform enables cloud-scale programming.

Layer 2 Platforms Prosper: Why is ETH struggling?

Mustafa Al-Bassam, co-founder of Celestia thank you It’s something that Ethereum brings to the table that’s absent or underdeveloped in other networks. In a post about X, Al-Bassam said the first smart contract platform was “underrated.”

Related Reading

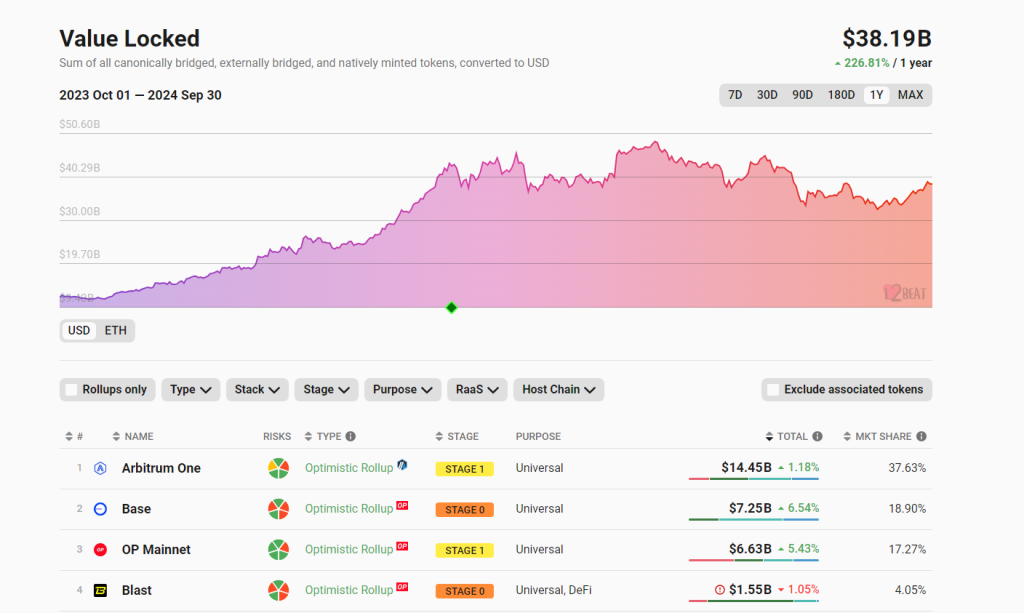

In particular, the co-founder praised Ethereum’s thriving rollup ecosystem as “by far the largest and most successful.” As of September 30, Ethereum’s layer 2 ecosystem manages more than $38 billion, with Arbitrum and Base being among the largest platforms, according to L2Beat data.

Even as Base and other Ethereum layer 2 platforms are driving activity, the native currency, ETH, is struggling to gain momentum. A daily chart is displayed. The bull market has not yet surpassed $2,800, but support remains at $2,400.

The decline in upward momentum is partly due to the proliferation of layer 2 scaling solutions. As more activity is routed back off-chain, the network will experience inflation and enable improvements like Dencun to make layer 2 transactions more affordable. report Ultra Sound MoneyFewer ETHs are burning.

Featured image by DALLE, chart by TradingView