Holdings of Flawed Global X MSCI Argentina ETF (October 2024)

It’s been roughly a year since Javier Milei was elected in Argentina. So it may be worth taking a moment to look again at your Argentina ETF and all its holdings (some of which may be a better way to gain exposure to Argentina).

Global (NYSEARCA: black)

Before last year’s elections in Argentina, I covered ETF holdings.Holdings of Flawed Global X MSCI Argentina ETF (September 2023) – If the ETF’s P/E is 11.52 and the return is 1.55%) It also contains several links or resources that address the chaos the country faced and how it got there, which can also be summarized by this meme.

our Posted on December 13, 2023I also read (Gold Goats and Guns) Talk to Alex Krainer. substack and twitter) – They both made interesting observations about Javier Milei and Argentina that you don’t hear in the corporate media.

🎙️ Podcast Episode #163 – Moving East’s Mortgage Pile with Alex Krainer (Gold Goats N’ Guns) 1:22:41 hours (December 2023)

Most discussions about Javier Millais and Argentina have centered around the two teams. 21:00, 38:00 minutes displayed The key points (after discussing the conflict situations in Venezuela and Guyana) are:

-

Luongo thought dollar just “What’s happening on Wall Street” And everyone wants to open up the country so that its resources can be developed properly.Wall Street (aka the West) has fewer and fewer places to invest as the BRICs and others continue to expand..

-

Krainer thought dollarization was the only way. Suitable for one credit cycle and good aggregate figures (GDP, etc.); But it will happen eventually Make Argentina a (American) colony…. He noted that when Argentina’s railways were privatized by Menem (the last man to open the country to Wall Street), the new private owners quickly reduced their footprint to maximize profits (but also move resources around and lower overall transaction costs). You need a railroad…). that The economies of regions where the railroads were cut off are dying (although they may now be needed again to extract the country’s natural resources). Also see the following interesting parts:

-

They then pointed out how powerful the legislature is in Argentina and how powerful the Mailays are. “I’m against ‘wokery,’ but where does all that ‘wokery’ come from?” (Hint: This ultimately comes from Western control agencies like the IMF, World Bank, Blackrock, etc. This means that when you are in their clutches it will be difficult to get rid of them…).

-

Luongo said Milei said: “It’s like a cartoon” And he (being more of a liberal) can tell when a Marxist is trying to write or act like a liberal. Milei feels the same way about him. yes: “They think we talk like this… ”

-

Krainer then added that if he listened to Milei longer, he got the same impression. For example, as he starts to think more about what he’s saying, it sparks more questions that Milei doesn’t have good answers to. All this makes him very suspicious.It was reported around the same time that Milei was backtracking on several of his promises or some of his rhetoric. Argentina will remain in the Paris climate agreement under Miele, negotiator says.).

-

Krainer also observed how Argentines were tired of things like inflation and wanted stability to plan their lives. The only solution to default on IMF debt – But we will have to take the risk of letting other countries go first. That is, it Argentina: “It’s a new investigation, but the result is the same…”

Their discussion turned to: The ultimate solution is: terrible debt Many parts of developing countries suffer from the following problems:

-

Reform the UN, multilateral banks and other Western controlled institutions by changing their legal framework… or…

-

Convert alliance-legal framework, etc. to BRICs (e.g. Russia, China, etc.).

They believe this too. Since the West cannot impose sanctions or invade, it provides an opportunity for China and Russia (Example: Libya, Iraq, etc.)Or Color Revolution folks. In other words, all you do is take on the risk that a country defaults on its debts to the West (the IMF, Blackrock and other bondholders, etc.). Russia/China etc. said (in a pre-arranged manner) that we would help (through credit lines, military support, etc.).. If that happens, there could be a domino effect of other countries doing the same…

Some measure of how well Milei is working to solve the problem is the following Argentine economic data:

(Note: These may be official rates that do not reflect reality.)

Now that we’re done talking about Argentina, let’s take a look at Argentina’s recent achievements. Argentina ETF Covering the COVID period (charts are linked back to Yahoo! Finance):

Here is the long-term performance chart:

This is a recent strong performance and an indicator of confidence or speculation by foreign and/or domestic investors that Argentina may finally be turning the corner. but, Stock markets in places like Turkey and Zimbabwe have seen an influx of money from local investors to stave off hyperinflation and currency devaluation.

However, a look at Argentina ETF holdings last year revealed potential. big bandit:

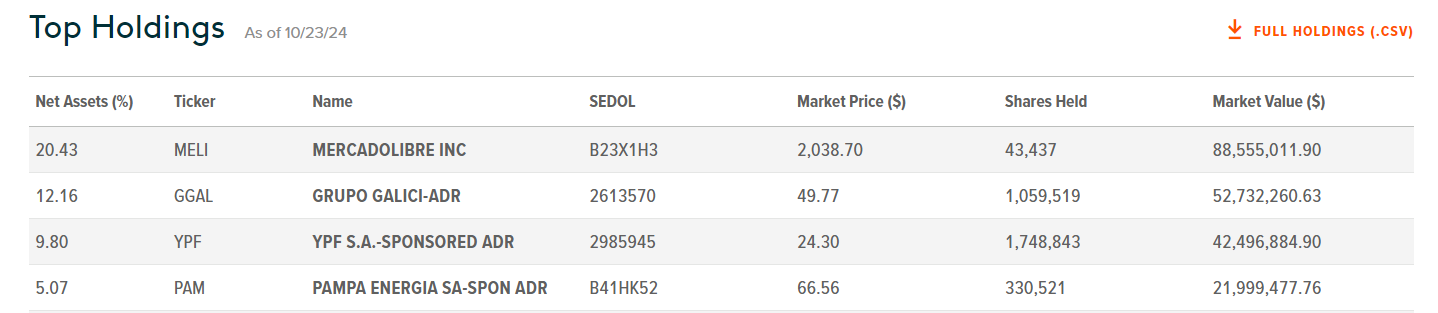

This time, exposure to pan-Latin American e-commerce and fintech players. Mercado Libre (NASDAQ: Melly) (currently headquartered in Uruguay) It has decreased to about 20%.

please refer to this The Latin American version of Amazon We achieved good results after the post-corona decline.

The ETF’s other holdings also include similar stocks that derive only a portion of their revenue directly from Argentina (that means investors). If you’re looking for more direct exposure to Argentina, for better or worse, you should look more closely at the ETF’s individual holdings). Again, this will be the next function. You need an ETF to hold liquid stocks (Many of the Argentina ETF’s holdings are listed on the NYSE. Argentina ADR List This also includes other Argentina resources).

To make your life easier, this post includes A much shorter explanation (our North American and Latin American stock indices) earlier posts to make it easier to skim through the entire post. (An automatically generated substack table of contents with each stock holding name is displayed as a small line on the left side of your desktop browser) Includes:

-

🌐🌏 etc. This is quite subjective. for example, Many stocks are part of global supply chains rather than purely domestic companies.

-

🏛️ Companies owned, controlled or influenced by the state.

-

👼🏻 ESG Friendly Stocks Example: Renewable Energy. This is quite subjective.

-

🅿️ Preferred shares available (Note: I do not see a complete list of preferred shares or preferred shares readily available on the internet…).

-

IR page link and Yahoo! A very simple explanation of stock quotes. Financial or other sites.

-

All Wikipedia pages ( 🇼) and a substack stock tag link (marked with 🏷️) linked to the post below. EM Stock Pick Tear Sheet.

-

It is the price/book value (most recent quarter) ratio plus the forward or trailing P/E plus the dividend yield tied back to Yahoo! This is a financial statistics page.

-

The latest long-term technical charts financial resources linked back to Yahoo!

And as always, this post Provided for informational purposes only (And to make your life easier by providing relevant information, links, and charts). This does not constitute investment advice and/or recommendations…

🇦🇷 🇧🇷 🇺🇾 Adecoagro Inc. (NYSE: agriculture) – Luxembourg-headquartered agro-industrial company producing and manufacturing food and renewable energy. Three sectors: Agriculture; sugar, ethanol and energy; and land conversion. 🏷️

-

Price/Book (most recent quarter): 0.88

-

Forward P/E: 11.03 / Annual Dividend Yield: 2.88% (yahoo! financial resources)

🌎 Arcos Dorados Holdings Inc (NYSE: Arco) – The world’s largest independent McDonald’s franchise. Exclusive right to own, operate and grant franchises of McDonald’s restaurants 20 Latin American and Caribbean countries and territories. 🇼 🏷️

-

Price/Book (most recent quarter): 4.02

-

Forward P/E: 14.51 / Annual Dividend Yield: 2.63% (yahoo! financial resources)

🇦🇷 Banco Macrosa (NYSE: BMA) – It is a comprehensive bank that provides a variety of financial services to low- and middle-income people and small and medium-sized businesses. 🇼 🏷️

-

Price/Book (most recent quarter): 1.37

-

Trailing P/E: 9.46 (no forward P/E) / Annual Dividend Yield: 29.79% (yahoo! financial resources)