Stocks remain in weak “moving” trend as communications provide a helping hand | GoNoGo Chart

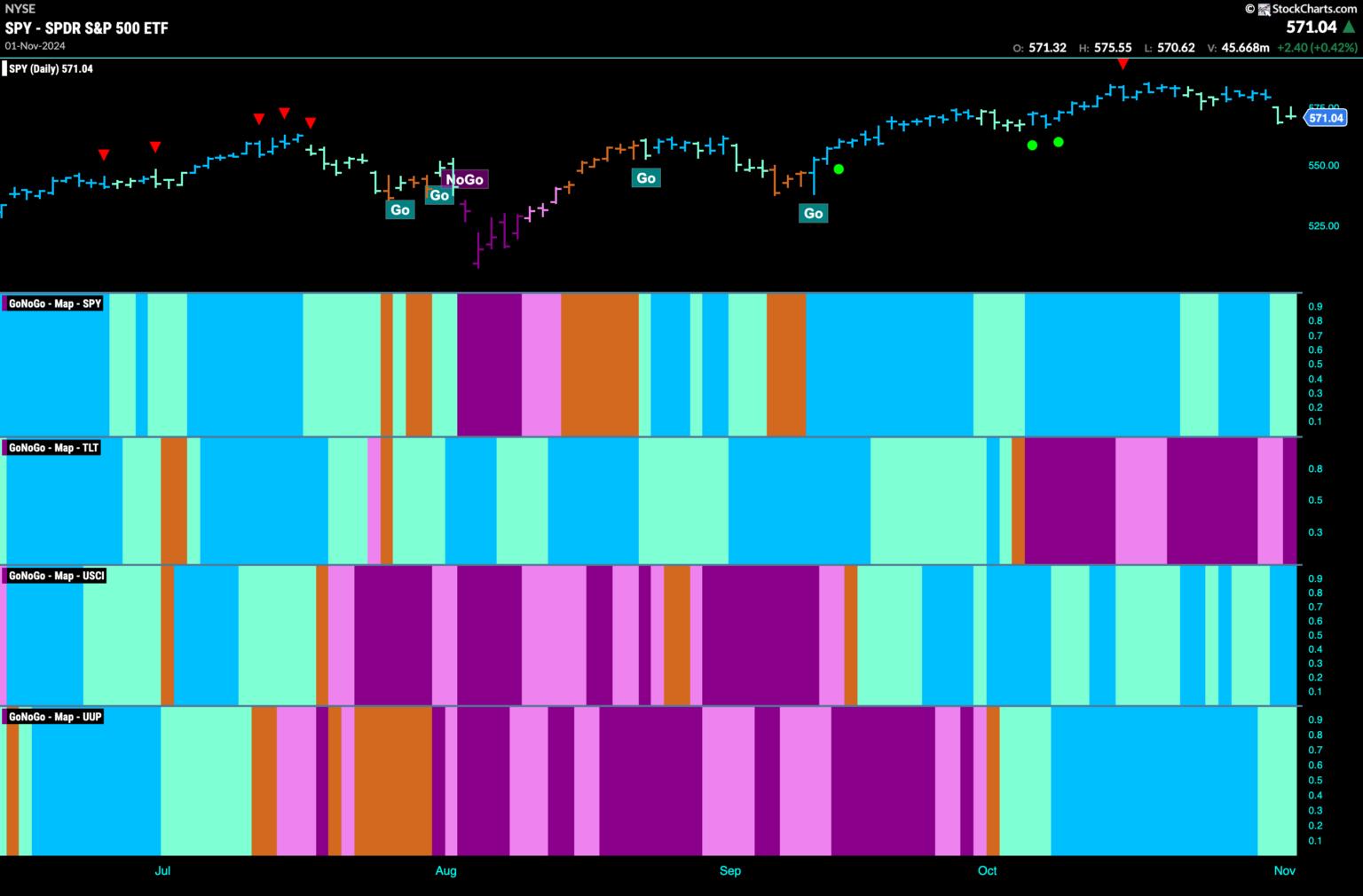

good morning. Welcome to this week’s Flight Path. The stock saw its “Go” trend continue this week, but showed some weakness in a few aquabars. Looking at the GoNoGo trend, it appears that the ‘NoGo’ trend in treasury bond prices strengthened over the weekend. US Commodities maintained their “Go” trend and were actually bullish with the light blue bars. The US dollar also maintained its “Go” trend, but the indicator shows aquabar weakness.

$SPY shows a weakness with a pair of aqua bars.

If you look at the GoNoGo chart below, you can see that it has yet to overcome last month’s highs. This week, prices fell further, narrowing the price gap and weakening the Aqua Bar. If you look at the oscillator panel, you can see that it held several bars at the zero level before breaking into negative territory and increasing volume. We will be watching closely to see if this further threatens the ongoing “Go” trend.

The longer time frame chart shows that the trend is still strong, but we could see another lower weekly close this week after the Go Countertrend Correction icon (red arrow) mentioned above the recent price. As the price approaches the last high of the summer, we will see if it finds support. The GoNoGo Oscillator is falling but still in positive territory, so let’s pay attention to what happens as it gets closer to the zero line.

Treasury yields remain in a strong “Go” trend.

Treasury yields saw their “Go” trend continue this week, with the week closing in a strong blue “Go” color after the price hit another high this week after two weak aqua bars. The GoNoGo oscillator shows that the momentum is still in positive territory, but it is no longer overbought as the value has dropped to 3. If we get there we will find support at the 0 level.

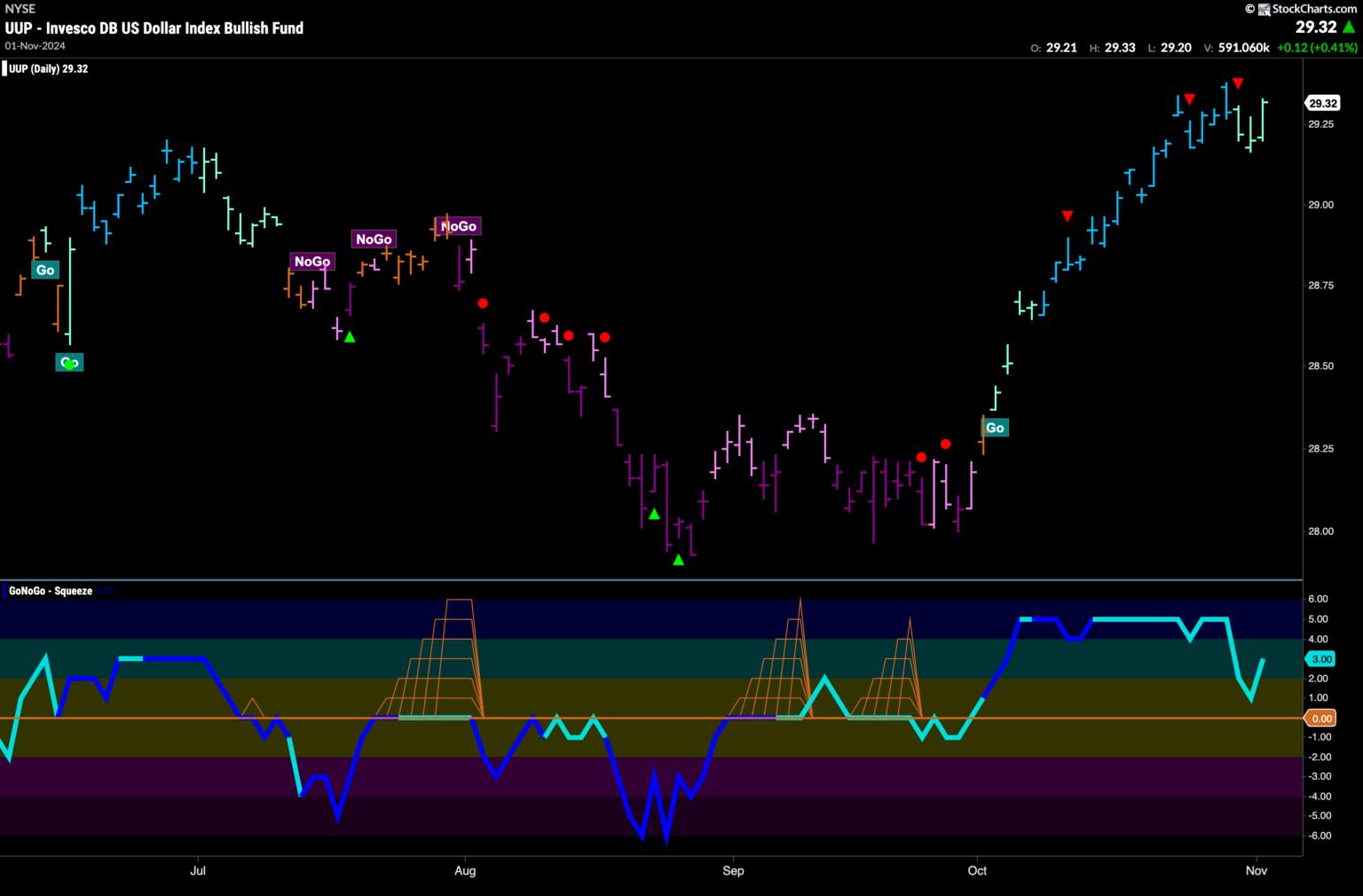

Dollar Sees Weakness in “Go” Trend

Shortly after the price hit its new high this week, we saw another Go Countertrend correction icon (red arrow). Since then we have seen successive aqua bars showing some trend weakness. Prices bounced back with a strong bar on Friday, so it will be interesting to see if the trend strengthens as it approaches previous highs. GoNoGo Oscillator plummeted, but bounced from a value of 1 and is now rising to a value of 3, confirming the “Go” trend in the price panel.

Tyler Wood, CMT, co-founder of GoNoGo Charts, is committed to expanding the use of data visualization tools that simplify market analysis, removing emotional bias from investment decisions. Tyler has served as Executive Director of the CMT Association for over 10 years, advancing the proficiency and skill of investors in mitigating market risk and maximizing capital markets returns. He is a seasoned business executive focused on educational technology for the financial services industry. Since 2011, Tyler has presented technical analysis tools to investment firms, regulators, exchanges and broker-dealers around the world. Learn more

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software developer. For the past 15 years, Alex has led technical analytics and data visualization teams, directing business strategy and product development of analytics tools for investment professionals. Alex has created and implemented training programs for large corporations and individual clients. His lectures cover a wide range of technical analysis topics, from introductory to advanced trading strategies. Learn more