Ethereum could be set to explore new highs as on-chain indicators brighten.

This article is also available in Spanish.

On-chain data shows that indicators related to Ethereum’s network activity have surged recently, which could set the stage for further upside.

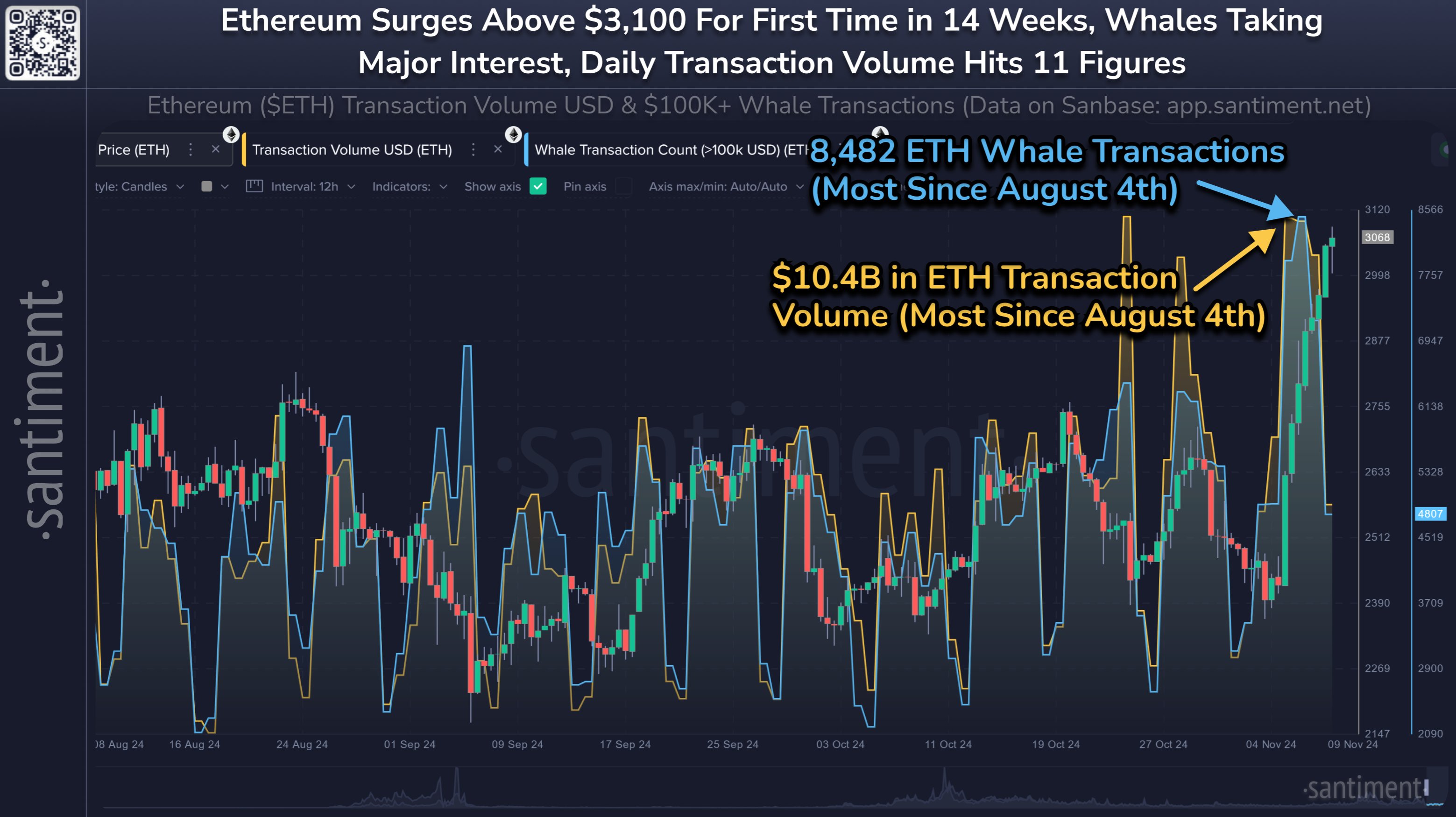

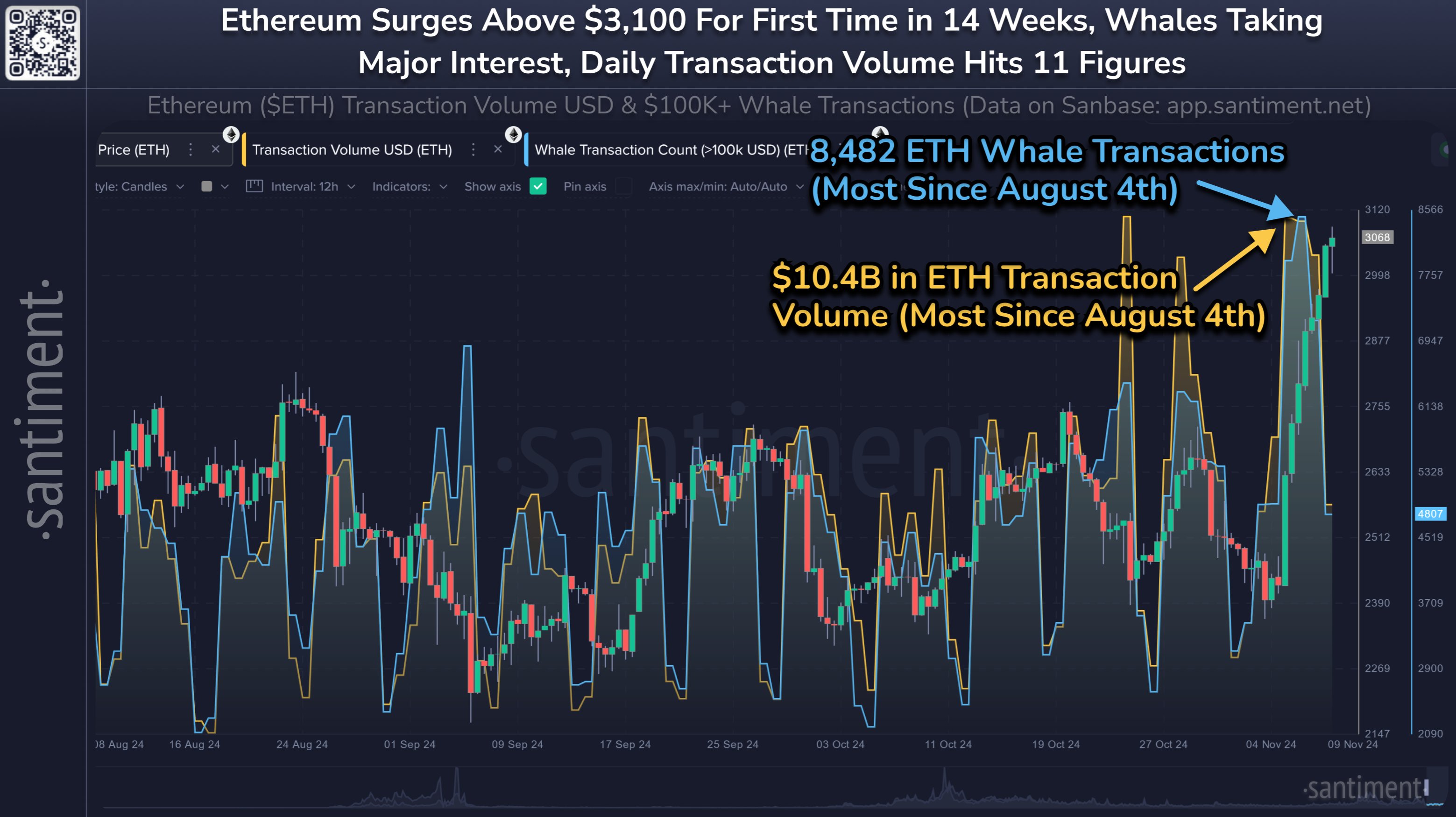

Ethereum trading volume and whale transfer volume have recently surged.

Data from on-chain analytics firm Santiment shows that Ethereum has seen improvements in two activity-related indicators. The indicators in question are volume and number of whale trades.

The first of these, “transaction volume”, tracks the total amount of cryptocurrency (in USD) that users on the ETH network move across the network through transactions.

Related Reading

A high value of this indicator means that the ETH blockchain is currently handling a large number of coin transfers. This trend suggests that investors are actively investing in asset trading.

On the other hand, a low indicator means that interest in the cryptocurrency may be low at the moment because holders are only moving small amounts of ETH.

We now have a chart showing Ethereum trading volume trends over the past few months.

As you can see in the graph above, Ethereum trading volume has been surging recently, which means that interest in the asset has increased along with the price rise.

This can be considered a constructive development for cryptocurrencies, as rallies typically require an increase in network activity to sustain.

In the past, some price movements have started sharply but volume has not increased significantly at the same time. Such movements usually died out before long.

The chart also includes data on “Number of Whale Transactions,” another relevant metric here. This indicator measures the total amount of ETH transfers worth more than $100,000.

Trading of this size is assumed to occur in whale populations, so the number of whale trades reflects the level of activity of high-net-worth investors.

Looking at the graph, it is clear that this indicator has recently surged on Ethereum as well. This means that the recent increase in trading volume is a sign of interest from huge hands as well as smaller investors.

Naturally, it is impossible to determine whether an investor is buying or selling based on these indicators alone. Because from an investor’s perspective, all types of transactions look the same. This activity so far has probably been for accumulation, as ETH has been on a sharp rise recently.

Related Reading

The analyst firm explains:

Expecting Bitcoin to grow during this bull market could see profits redistributed to Ethereum and potentially push it towards all-time highs while activity on the network looks very healthy.

ETH price

After observing a surge of over 27% over the past seven days, Ethereum has surpassed the $3,150 level.

Dall-E, featured image from Santiment.net, chart from TradingView.com