Chesapeake Energy: Maintain ‘Sell’ in light of natural gas price outlook

hedidwhat/iStock via Getty Images

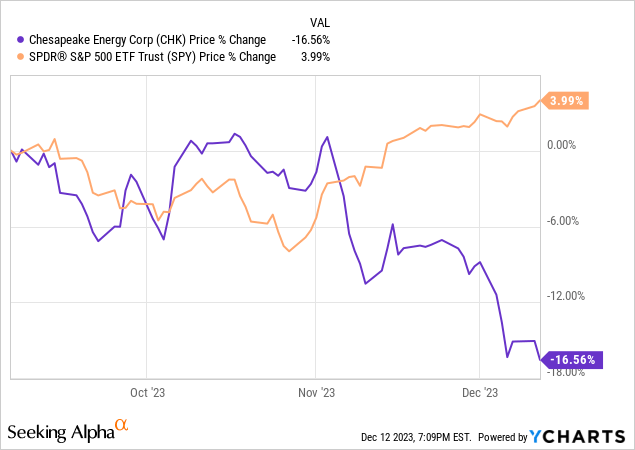

Chesapeake Energy (NASDAQ:CHK) Investors have had a disappointing 2023, including the past few weeks. Temperatures have recently been higher than normal and reports of delays in the Gold Bass LNG terminal project last week have resulted in persistent Falling natural gas prices. Since downgrading CHK to a sell rating in September, CHK shares have fallen about 15%. This is an update to a previous article.

CHK and S&P 500 ETF price changes since September 6 Article

Continuous share repurchase

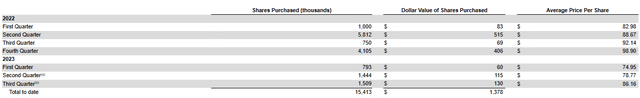

I’d like to start with an issue addressed in a previous article. Chesapeake Energy continued to buy back shares in the third quarter, even though it is a capital-intensive, raw material-based industry with very high risk. As we’ve covered before, management believes this cash should be used to repay debt to reduce risk or increase CAPEX.

Share buybacks in 2023 and 2022

sec.gov

They have already “lost” $221 million on buybacks. The current market value of CHK repurchased shares is $1.157 billion, compared to a total repurchase amount of $1.378 billion in 2022 and 2023 and an average repurchase price of $89.40 (current CHK price of $74.95).

Highly dependent on LNG exports

Many investors are buying/holding CHK for its LNG potential. Those expectations were negatively impacted last week when it was revealed that the opening of the Gold Pass LNG terminal in Texas would be delayed until the first half of 2025 rather than late 2024. I wouldn’t do that because the reality is that major construction projects are often delayed. Be surprised if there are additional delays. The importance of the export facility was also discussed on a recent conference call, with management saying it plans to increase Haynesville’s rig count from five to six in the second half of 2024. facility) will continue to progress and the strip appears to be holding up.”

On October 31, CHK announced that it had signed a 15-year non-binding LNG preliminary agreement with Vitol for up to 1 million tonnes of LNG per year from 2028. Last March, CHK announced a preliminary, non-binding agreement with Gunvor for: Up to 2 million tons per year from 2027. (One million tons of LNG is equivalent to about 48.7 Bcf of natural gas.) While this deal could be considered a very positive development, the price is a concern. Prices are based on the Japanese/Korean market – JKM index. This is a benchmark for the Asian LNG market, but if for some reason there is a natural gas surplus in the region and at the same time there are production/pipeline issues in Haynesville, this could be a big problem. I prefer long-term contracts that include both cost/cost and market price variables when determining the purchase price. I believe that unilateral long-term agreements are too risky.

One of the problems with large exposure to the LNG market is that there are now more geopolitical and international economic issues directly affecting CHK, which adds additional risk for investors. Before the United States began exporting LNG a few years ago, this risk was indirect. I expect some of their LNG exports will also be tied to the Title Transfer Facility (TTF). This is a pipeline pricing index and is often used when pricing LNG products in Europe. Therefore, CHK investors now have to worry about the weather not only in the US, but also in Europe and Asia. There are also shipping issues, such as the impact on shipping through the Panama Canal, which is currently a big problem.

Currently, natural gas prices in the United States are significantly different from those in most of Europe and Asia, making the LNG market very attractive. But that doesn’t mean those differences will persist in the long run. I think political hostility toward fossil fuel use is much stronger in most of Europe than in the United States. The reality is that if Europe’s various green parties eventually win enough seats and force a ban on fossil fuels, it could have a serious impact on the LNG market. Even usage has been reduced significantly.

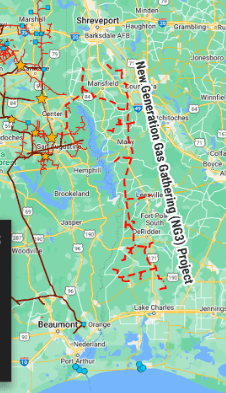

In an indication of how important the LNG market will be to the future, Chesapeake purchased a 35% stake in Momentum Sustainable Ventures, which is in the process of building a gathering system/pipeline from Haynesville to the Gulf Coast. Total 2023 investment in this transaction is estimated at $285 million to $315 million, according to a recent update. The project is expected to be operational in late 2024.

NG3 project

rextag.com

Natural Gas Prices – Weather Is Everything (Almost)

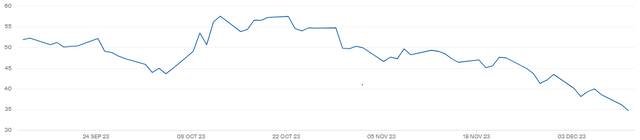

When building complex econometric models to predict natural gas prices, weather is one of the most important variables: current temperature, difference from average, and short-term and long-term temperature forecasts. Currently and over the past six weeks, all temperature indicators have had a negative impact on natural gas prices in the US and most of Europe, causing Henry Hub prices to plummet. Lower-than-normal natural gas usage has led to higher-than-usual natural gas storage, which will have an excess impact on the market even when temperatures return to normal levels later this winter.

Henry Hub futures price for January 2024

www.cmegroup.com

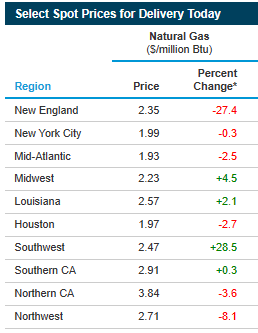

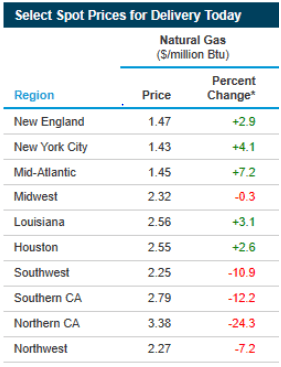

Investors often use Henry Hub prices, but because Chesapeake’s Marcellus products are sold to markets in the northeastern United States, there are often significant price differences.

www.eia.gov

Many local spot natural gas prices are currently quite similar to the prices featured in the CHK article I wrote in September. Prices in some areas rose significantly in October when temperatures were cooler than normal, then fell as weather in November and December became warmer than normal.

September 1, 2023

www.eia.gov

European prices, as measured by the Dutch TTF futures January 2024 contract, have also fallen sharply since the end of October.

January 2024 Dutch TTF Natural Gas Futures

www.ice.com

(Price: Eurocents per MWh)

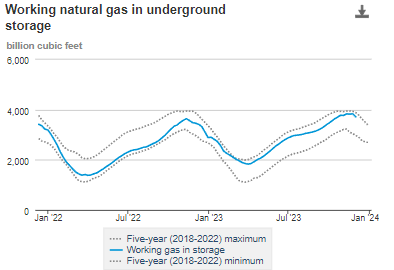

I keep reading the forecast that says the weather this winter will be warmer and wetter than normal due to El Nino. In my opinion, trading energy stocks based solely on weather forecasts is gambling, not investing. Instead of looking at future weather forecasts, I prefer to look at a known indicator: current natural gas underground storage. Current storage is close to a maximum of 5 years. That could mean there is already a significant amount of gas available to help supply that demand even when the weather becomes more normal later this winter.

www.eia.gov

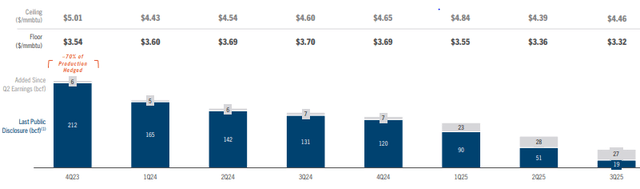

Hedging against falling prices

Chesapeake often hedges a significant portion of its projected future production. In Q4 2023, it is 70% hedged with a $3.54 mmbtu lower limit and a $5.01 upper limit, so if you have little or no hedged position, the impact of the recent price decline will not be very significant. However, what I found surprising is that because prices were relatively strong in October, the amount of new hedges added between August 1, 2023 and October 26, 2023 was very small, as you can see in the chart below: .

hedge position

investor.chk.com

Because CHK uses extensive hedging, it is not actually the best stock for trading expected natural gas price movements. Energy trusts that cannot be hedged are often more sensitive to price changes. These trusts typically include natural gas and/or oil call options at current market value.

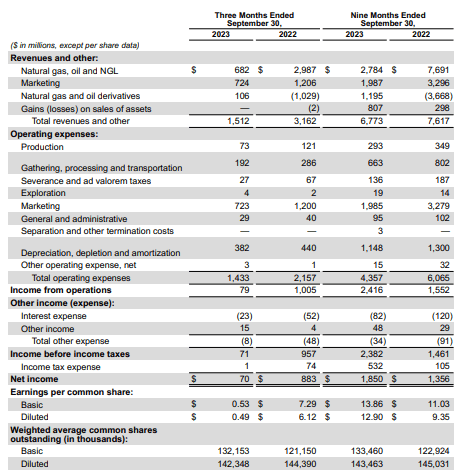

Latest Results – Q3 2023

Chesapeake’s third-quarter results highlight an important issue that investors too often ignore. Energy producers can still report mediocre results if prices are weak, even with Chesapeake’s top-tier assets. There have been dramatic changes to our core assets over the past few years with the purchase of the Marcellus asset and the recent sale of the Eagle Ford asset, which had some oil production, so it’s not really possible to compare previous long-term results to our current numbers. This is relevant when evaluating current operations.

3rd quarter 9 month income statement

investor.chk.com

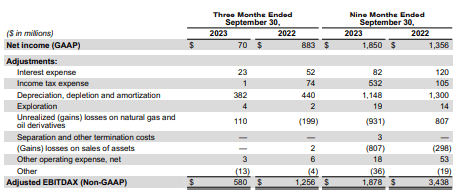

Third Quarter and Nine Month Adjusted EBITDAX

investor.chk.com

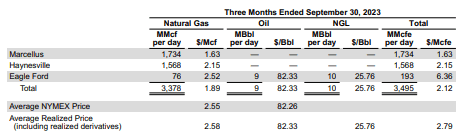

3rd quarter average daily production and warehouse price

investor.chk.com

conclusion

I am continuing my Sell recommendation on CHK. Because I think the stock could fall a few more points before it gets held up. Here are the main reasons why CHK may continue to fall: 1) This is because natural gas prices are expected to remain weak due to El Niño and the Russia/Ukraine war is expected to be resolved in the first half of 2024. 2) LNG exports are likely to be positive in the short term, but the long-term outlook for fossil fuels is very negative due to geopolitical pressures, especially in Europe. 3) I believe that management is not properly managing the balance sheet by buying back shares instead of reducing risk by paying down debt.