Emerging Market Links + The Week Ahead (November 18, 2024)

Like with the 3D printing bubble, there are signs we might be nearing the end of the road for the AI bubble (From: Another warning that the AI bubble is near bursting… & Model Collapse: AI Chatbots Are Eating Their Own Tails):

The problem is fundamental to how they operate. Without new human input, their output starts to decay. Meanwhile, organizations that laid off writers and editors to save money are finding that they can’t just program creativity or common sense into machines.

AI is not the only thing getting crushed as Greenlight’s David Einhorn says the markets are broken and getting worse:

“It’s continuing to get worse,” the hedge fund manager told Picker. “We are in a secular destruction of the professional asset management community.”

As he has done several times before, Einhorn pointed a finger at passive, index investors: “The passive people, they don’t care what the value is.”

The good news: Value can still be found in emerging and frontier markets e.g. a number of emerging or frontier country ETFs have recently been liquidated while passive investing by foreign investors still has probably not touched or impacted many smaller or midsized EM or FM stocks not included in major global indices.

$ = behind a paywall

-

🌐 Korean Stock Picks (October 2024) Partially $

-

“Trump Trade” hits Korea & MSCI update + Posco International Corp, Hwaseung Enterprise, Hanwha Systems, Daewoo Engineering & Construction Co Ltd, Dear U Co Ltd, Samsung C&T Corp, Jusung Engineering, Samsung SDI, LG H&H, Korea Aerospace Industries, Samsung Electro-Mechanics, Shinhan Financial Group, Vitzrocell Co Ltd, SK Inc, Korea Zinc, Hyundai Rotem, Kia Corp, Shift Up Corp, Hyundai Mobis, HD Hyundai Electric, SK Telecom, Hyundai Motor, LigaChem Biosciences, Samsung E&A, SK Hynix, LS Electric, LG Innotek, Samsung Biologics, Hansae Co Ltd, Woori Financial, Doosan Bobcat / Doosan Enerbility / Doosan Robotics, Classys, Hyundai Engineering & Construction, SM Entertainment, CS Wind Corp, GC Biopharma Corp, KT Corp, LG Uplus, Hanssem Co Ltd, Jin Air, LG Electronics, KB Financial Group, JYP Entertainment Corp, S-Oil Corp, Hugel, T’Way Air, Shinsegae Inc, Hyundai Department Store, Hotel Shilla, GS Retail, BGF Retail, DL E&C Co Ltd, GS Engineering & Construction Corp, F&F Co, LG Energy Solution, Chong Kun Dang Holdings & Samsung SDS

-

-

🌐 EM Fund Stock Picks & Country Commentaries (November 17 2024) Partially $

-

US elections & EM impacts, Trump may help Vietnam industrial park stocks, India’s tax hiccups for funds + valuations have declined, “picks & shovels” AI companies, Africa frontier markets, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba (BABA US): 2Q25, Weak Quarter, But Waiting for Two Events to Benefit Top Line (Smartkarma) $

Total revenue grew slightly as we expected in our preview note.

The operating margin improved significantly, but this was due to the shrinks of non-cash items.

However, we believe Alibaba (NYSE: BABA) will benefit from the boycott against JD.com (NASDAQ: JD) and the disposal of Sun Art.

🇨🇳 Comments on Alibaba’s Third Quarter Earnings (The Great Wall Street – Investing in China)

Steady Progress Amid Challenges: Evaluating Alibaba (NYSE: BABA)’s Path Forward

This article continues the ongoing discussion I’ve had about Alibaba. My focus is straightforward: instead of analyzing every single detail, I highlight what stood out to me this time, cutting through the noise and focusing on key observations.

For context, I’ve written extensively about Alibaba in the past. For example, I’ve covered the strategy shift from Daniel Zhang’s tenure to the leadership under Eddie Wu and Joe Tsai. In my piece on last quarter’s results, I highlighted the early progress they made. I won’t repeat those points here in full details—you can revisit those articles in case you are interested. Instead, let’s examine what’s new and noteworthy this quarter.

🇨🇳 PDD Holdings: Strong Buy With An Outsized CAGR Likely Until 2026 (Seeking Alpha) $ 🗃️

🇨🇳 Comments on Tencent’s Third Quarter Earnings (The Great Wall Street – Investing in China)

Stable performance despite a challenging macro environment and an exciting new development

In this article, I provide a personal summary of Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY)’s Q3 2024 earnings, highlighting key points that stood out to me rather than covering every detail.

What consistently impresses me is Tencent’s management quality and strategic focus. Their approach is clear and highly disciplined, and whatever they predicted a few quarters ago ultimately materializes. This can be seen in these points:

🇨🇳 Tencent Music (TME): 3Q24, Began to Grow with Record Gross Margin (Smartkarma) $

Tencent Music Entertainment Group (NYSE: TME)

The quarterly gross margin hit historical high again in 3Q24.

As expected, the growth rate exceeded 5% YoY for the first time in three years, as the weak business became insignificant in total revenue.

The P/E band suggests an upside of 124% and a price target of US$26 for the end of 2025. Buy.

🇨🇳 Miniso: IP-Centered Retail To Drive Sustained Growth (Seeking Alpha) $ 🗃️

🇨🇳 Sunshine tries out asset leasing as insurance demand cools (Bamboo Works)

The insurer has agreed to invest in a financial leasing company owned by Legend Holdings (HKG: 3396 / FRA: 1PC / OTCMKTS: LGNRF) in an attempt to diversify its businesses

Sunshine Insurance Group Co Ltd (HKG: 6963 / FRA: E57) will acquire 39.9% of JC International Finance & Leasing, a provider of asset leasing services for small businesses

While the deal may appear to help Sunshine diversify, actual benefits may be marginal due to JC International’s small profit

🇨🇳 How Crane’s Process Flow Technologies Are Quietly Powering Revenue Growth! (Smartkarma) $

(Material handling equipment for non-ferrous metallurgy and port terminals industries) Zhuzhou Tianqiao Crane Co Ltd (SHE: 002523) recently presented its third-quarter 2024 financial results, showcasing several key highlights and challenges.

The company’s performance this quarter was marked by a solid increase in both core sales and earnings per share, despite encountering multiple operational disruptions.

Firstly, Crane demonstrated robust financial performance by exceeding expectations, with adjusted earnings per share (EPS) rising to $1.38.

🇨🇳 Xingda (1899 HK): A Surprising Result as Offer Declared Unconditional (Smartkarma) $

On its first closing date on 15 November, (manufacture and trading of radial tire cords, bead wires and other wires) Xingda International Holdings Ltd (HKG: 1899 / FRA: XDH / OTCMKTS: XNGIF) declared the Chairman’s offer unconditional as the offeror and concert parties represented 60.76% of outstanding shares.

The result was surprising. The IFA opined that the offer was not fair or reasonable, and the independent Board recommended that the shareholder not accept it.

The CCASS movements suggest that the offer was declared unconditional mainly because friends and family supported the Chairman’s offer. The gross/annualised spread is 1.6%/92.6%.

🇨🇳 Anxian Yuan (922 HK) (Asian Century Stocks)

Today, we have the great pleasure of hearing Portuguese investor Diogo Perneta discuss Chinese cemetery operator Anxian Yuan China Holdings (HKG: 0922 / OTCMKTS: ANXYF) —US$45 million).

We’ve been communicating for some time and agreed that Anxian Yuan was worth investigating. It owns a unique cemetery in Hangzhou, China, and trades at a low P/E of just 6.1x, with a 13.3% dividend yield.

Anxian Yuan was formed in 2010 through a reverse merger between electronics company China Boon Holdings and the Anxian Yuan cemetery. Well-connected former government official Shi Hua used the ListCo to take over the asset, and he has since expanded operations to parts of the country.

🇭🇰 Café de Coral slumps as dark clouds hover over restaurant industry (Bamboo Works)

Hong Kong’s leading fast-food operator and rival Fairwood Holdings Ltd (HKG: 0052 / OTCMKTS: FRWDF) have both issued profit warnings this month as growing consumer caution takes a bite from their business

Cafe De Coral (HKG: 0341 / OTCMKTS: CFCGF) said it expects to report its profit fell 30% year-on-year in the six months to September, the first half of its fiscal year

Hong Kong’s leading fast-food chain could face more turbulence as competition looks set to intensify in the local restaurant market

🇭🇰 CK Asset: Watch Share Buybacks And Financial Outlook (Seeking Alpha) $ 🗃️

-

🌐 CK Asset Holdings (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF) 🇰🇾 – Property development & investment, hotel & serviced suite ops, property & project management, pub operation & investment in infrastructure & utility asset operation. 🇼

🇭🇰 China Overseas Land: Property Sales And Operating Margin Are Key Considerations (Seeking Alpha) $ 🗃️

🇲🇴 Wynn Macau’s results miss the mark as gaming boom cools (Bamboo Works)

Lower income from resort hotels and retail outlets has crimped the casino operator’s quarterly earnings, disappointing investors

Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) revenues rose 6.3% to $870 million in the third quarter from the year-earlier period but fell 1.5% sequentially

Per capita spending by visitors to Macau dropped 17% in the first three quarters from the same period last year

🇲🇴 Any Fertitta bid for Wynn complicated by Macau: CBRE (GGRAsia)

The possibility of a takeover of casino group Wynn Resorts Ltd (NASDAQ: WYNN) by U.S. billionaire Tilman Fertitta would be a “complicated and expensive endeavour given its sizeable enterprise value and international gaming licences” in Macau and the United Arab Emirates (UAE), says CBRE Equity Research.

Analysts John DeCree and Max Marsh noted in a Friday memo that news on Thursday that Mr Fertitta had upped his stake in Wynn Resorts to 9.9 percent – from a 6.1 percent “passive” stake disclosed in October 2022 – meant he was now the second-largest shareholder behind Elaine Wynn.

The brokerage added: “This is a bargain, especially compared with the approximately 10x multiple he would likely need to pay for a single standalone regional casino today, or the US$3 billion-plus likely needed to develop his proposed casino resort on the Las Vegas Strip.”

🇲🇴 SJM posts profit of US$13mln in 3Q, EBITDA up 83pct y-o-y (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) reported a profit attributable to its owners of HKD101 million (US$13.0 million) for the three months to September 30, compared with a loss of HKD410 million in the prior-year period.

Moody’s Investors Service Inc said in a September report that it expected the ramp-up of Grand Lisboa Palace to “help SJM gain market share by building a significant presence in Cotai”.

🇲🇴 SJM only Macau op with 3Q share, GGR gains: DB (GGRAsia)

Only SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) and Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) among Macau’s six casino operators showed sequential gains in market share in terms of casino gross gaming revenue (GGR) in the third quarter. But only SJM Holdings reported a sequential increase in its actual GGR for the period, according to Deutsche Bank Securities Inc.

Deutsche Bank analyst Carlo Santarelli gave an overview of the three months to September 30, now that all the market participants have reported their quarterly data.

🇲🇴 Grand Lisboa to tap ex-junket space as villas: Daisy Ho (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is to convert former junket areas at Grand Lisboa (pictured), its downtown casino hotel flagship, into luxury hotel space, says Daisy Ho Chiu Fung, the company’s chairman.

“At Grand Lisboa, the group is set to expand its room capacity by over 10 percent through the conversion of former junket areas into exclusive villas, mansions, and suites, further enhancing guest experiences,” stated Ms Ho in a press release accompanying Tuesday’s unaudited third-quarter results highlights.

🇲🇴 Galaxy Ent can opt new finance model post founder: analyst (GGRAsia)

🇰🇷 Naver: Improved Outlook And Attractive Valuations (Rating Upgrade) (Seeking Alpha) $ 🗃️

-

🌐 NAVER (KRX: 035420 / OTCMKTS: NHNCF) – Global ICT company. Korea’s #1 search portal “NAVER” + LINE messenger, SNOW camera app, digital comics platform + R&D (AI, robotics, mobility & other future technology). 🇼 🏷️

🇰🇷 Isupetasys Announces a Rights Offering of 32% of Outstanding Shares and Acquisition of Jeio (Douglas Research Insights) $

(Printed circuit boards) Isu Petasys Co Ltd (KRX: 007660) announced a large-scale rights offering worth 550 billion won. The company plans to issue 20.1 million new shares (32% of outstanding shares).

About 55% of the capital raise proceeds will be used to acquire a 30.1% stake in (secondary battery materials, plant engineering, and equipment manufacturing and distribution) JEIO Co Ltd (KOSDAQ: 418550). Remaining 45% will be used to invest in Isupetays’ core business.

Valuations on Isupetasys are not compelling. Isupetasys is also buying Jeio which has high P/E multiples, which could further result in capital outflow on Isupetasys among some value conscious investors.

🇰🇷 Trump Trade: Korean Construction Vs Military Stocks Amid Potential End of War in Ukraine? (Douglas Research Insights) $

Although it is UNCERTAIN when the wars in Ukraine and the Middle East will end, if these wars indeed come to an end, this could POSITIVELY IMPACT Korean construction sector.

The end of the wars in Ukraine and the Middle East is likely to NEGATIVELY IMPACT the Korean military/defense sector.

The major Korean construction companies have low valuation multiples. On the other hand, the major Korean military/defense companies have high valuation multiples.

🇰🇷 Negative Trump Trade: Korean Rechargeable Battery Sector (Douglas Research Insights) $

With Trump becoming the next President of the United States, we explain why the rechargeable battery sector in Korea is likely to get further battered in the coming months.

Trump administration could eliminate or significantly slash the $7,500 consumer tax credit for electric vehicle (EV) purchases, which is one of the key provisions of the Inflation Reduction Act (IRA).

We expect the sell-side to further cut their earnings estimates on the key key names in the Korean rechargeable battery sector in the coming months.

🇰🇷 Trump Catalyst – Korean Shipbuilding Sector (Douglas Research Insights) $

In the Korean stock market, one of the biggest positive catalysts of Donald Trump becoming the next United States President has been the shipbuilding sector.

About 20 years, the United States had a dominant naval superiority versus China. That is no longer the case.

There is a likely scenario of the US Navy increasingly outsourcing the construction and after-service of its fleet to Korean companies such as Hanwha Ocean (KRX: 042660) and HD Hyundai Heavy Industries (KRX: 329180).

🇰🇷 Philly Shipyard’s Transformation: How Hanwha’s Investment Is Driving U.S. Navy Readiness (Heritage.org)

Earlier this year, Hanwha Ocean (KRX: 042660) bought Philly Shipyard for $100 million.

The Philly Shipyard is well positioned to compete for contracts to construct Constellation-class frigates.

As our Navy works to meet the challenges of tomorrow, Hanwha’s new investment means Philadelphia will be playing a leading role in the fight.

🇰🇷 MBK Purchases Additional 1.36% Stake in Korea Zinc (Douglas Research Insights) $

After the market close on 11 November, it was reported that MBK Partners/Young Poong Precision Corporation (KOSDAQ: 036560) alliance purchased additional 1.36% stake (282,366 shares) in Korea Zinc (KRX: 010130) from the market.

The gap in the voting rights shares between MBK/Young Poong alliance and Korea Zinc/Choi family alliance has widened from about 3% three weeks ago to about 5% today.

We would further caution investors that if more investors perceive MBK/Young Poong as the clear winner, there could be a further downside risk on Korea Zinc’s share price.

🇰🇷 Di Dong Il Corp: Share Cancellation of 15% of Outstanding Shares (Douglas Research Insights) $

On 14 November, (textile and clothing) DI Dong Il Corp (KRX: 001530) announced that it plans to cancel 3.78 million treasury shares (representing 15% of outstanding shares) on 29 November.

The company currently has 5.84 million outstanding shares. Thus, the share cancellation of 3.78 million shares represent 65% of its treasury shares.

The company is facing an investigation due to suspicions that it conducted a loan transaction with its largest shareholder, the Jung-Hun Foundation, without board approval.

🇰🇷 Amorepacific Group: Significant Increase in Dividend Payout (Douglas Research Insights) $

On 12 November, Amorepacific Group (KRX: 002790) announced that it will increase dividend payout to about 50% to 75% of its non-consolidated net profit.

If we take the mid-point (63%) of the new dividend payout policy, this would be 51% higher than the average dividends/non-consolidated net profit ratio (41.8%) from 2021 to 2023.

Amorepacific Group is targeting average annual sales growth rate of 10% from 2024 to 2027, operating margin of 12% from 2027, and average ROE of 5-6% from 2024 to 2027.

🇰🇷 Samsung Electronics: A Massive 10 Trillion Won Share Buyback Program (Douglas Research Insights) $

Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) announced a massive share buyback program worth 10 trillion won which represents 3.1% of its market cap.

Of this total amount, about 3 trillion won will be purchased and cancelled in the next three months. This will include 50,144,628 common shares and 6,912,036 preferred shares.

We believe that this massive share buyback and cancellation is likely to boost Samsung Electronics’ share price resulting in a strong outperformance relative to KOSPI in the next 6-12 months.

🇰🇷 SBI Fintech Solutions: Tender Offer and Delisting (Douglas Research Insights) $

After the market close on 14 November, SBI FinTech Solutions Co Ltd (KOSDAQ: 950110) announced that the Japanese financial group SBI is pushing for a tender offer and delisting of SBI Fintech Solutions.

The tender offer price is 5,000 won per share, which is 36% higher than the closing price on 14 November. The tender offer size amount is about 26 billion won.

Given the relatively solid upside, we believe SBI Holdings is likely to successfully complete this tender offer and take the company private.

🇰🇷 MNC Solution IPO Valuation Analysis (Douglas Research Insights) $

Our valuation analysis suggests an implied price per share of 120,295 won for (hydraulic parts for construction machinery) MNC Solution, which is 29% above the high end of the IPO price range.

Our base case valuation is based on EV/EBITDA of 24.1x which is 30% higher than the average EV/EBITDA multiple of the comps in 2023.

We believe a premium valuation to the comps’ valuation multiple is appropriate due to higher sales growth, operating margins, and ROE.

🇰🇷 Grand Korea Leisure 3Q net income halved y-o-y to US$4mln (GGRAsia)

Third-quarter net income at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, declined by 49.5 percent year-on-year to approximately KRW6.04 billion (US$4.3 million). The firm gave the information in its unaudited quarterly financial results filed with the Korea Exchange on Monday.

Measured sequentially, Grand Korea Leisure’s net income for the quarter ending in September was down 46.6 percent on the second quarter’s nearly KRW11.33 billion.

🇰🇷 Gravity: An Undervalued Gem With Significant Concentration Risk (Seeking Alpha) $ 🗃️

🇵🇭 Globe Telecom: Bullish On Strong Earnings Growth And Higher Fintech Contribution (Seeking Alpha) $ 🗃️

🇵🇭 Jollibee Foods: Sector-Beating Growth Fuelled by Value-For-Money Appeal. (Smartkarma) $

Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) delivered strong sales and profit growth in 3Q, driven by robust Same Store Sales Growth (SSSG) in its home market and key overseas regions, excluding China.

Jollibee’s value-for-money appeal has likely driven its impressive Same Store Sales Growth (SSSG), outpacing industry peers struggling with rising customer price sensitivity and fall in SSSG.

However, in China, Jollibee’s delay in adapting to a quickly shifting market landscape has led to EBITDA losses, a sharp reversal from the profitability seen in Q2.

🇸🇬 Shopee & Grab both had a solid quarter – can they grow further? (Momentum Works)

Shopee parent Sea Limited (NYSE: SE) and Grab Holdings Limited (NASDAQ: GRAB), Southeast Asia’ two largest listed tech platforms, both reported expectation-beating earnings yesterday (12 Nov 2024, Asia time).

The capital market responded positively, sending both stock prices up by >10%. Year to date, Sea Group share price has risen by 180%, while Grab’s by 48%.

As usual, refer to analyst reports for detailed analyses of the financials, here are some of our thoughts:

🇸🇬 Grab built its own map in Southeast Asia, and is now going after Google (Rest of World)

The super-app uses its own drivers and cameras to create hyperlocal maps in eight countries.

Grab Holdings Limited (NASDAQ: GRAB) began mapping locations because Google Maps and Here were inadequate for its drivers’ needs.

It has trained drivers to use its own cameras to map streets and alleys.

Hyperlocal maps are essential, but taking on the dominant players is tough.

🇸🇬 Grab: A Waking Giant (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: Grab This Bargain Before It Gets Too Expensive (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings Earnings: Cautious Optimism Amid Strong Q3 Momentum (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: This Is Why Shares Could Still Go Much Higher (Seeking Alpha) $ 🗃️

🇸🇬 Sea: E-Commerce Surges To Profitability, But Watch For Cracks In Gaming (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Sea (SE US): Strong 3Q, Upbeat Management Talk Fires up the Stock (Smartkarma) $

Sea Limited (NYSE: SE)‘s management expects all three business segments – ecommerce, financial services and entertainment – to deliver high growth and profitability in 2025, supported by strong macro-economic tailwind.

It’s GAAP revenue was US$4.3 billion, up 30.8% year-on-year and net income was US$153.3 million, as compared to total net loss of US$(144.0) million for 3Q2023.

Its e-commerce business achieved positive adjusted EBITDA in 3Q 2024 in both Asia markets and Brazil.

🇸🇬 DBS Group: Management’s Dividend Growth Plan Remains Compelling (Seeking Alpha) $ 🗃️

🇸🇬 Dark Skies Ahead: Can Singapore Airlines See its Profit Recover? (The Smart Investor)

With more competition in the skies, can Singapore’s flagship carrier witness a profit recovery?

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF), or SIA, is seeing dark skies ahead.

Singapore’s national carrier’s share price hit its 52-week high of S$7.38 back in February this year but has since declined by 14.2%.

Year-to-date, shares of the airline are down around 3%.

🇸🇬 DBS, OCBC and UOB Share Prices Are Hitting All-Time Highs: Which Bank Should You Pick? (The Smart Investor)

🇸🇬 BitFuFu makes big gains as cryptocurrency booms (Bamboo Works)

Revenue for the provider of digital mining services jumped 47.5% in the third quarter on strong gains for its core cloud-mining services, as well as its self-mining business

BitFuFu Inc (NASDAQ: FUFU / FUFUW)’s third-quarter revenue jumped 47.5% to $90.3 million, led by 51.4% growth for its cloud-mining services and 40% growth for its self-mining operation

The digital mining services provider is looking to lower costs by transitioning from its asset-light model to one that manages a diverse portfolio of bitcoin mining infrastructure

🇮🇳 Fairfax India: A Great Way To Invest In India? (Seeking Alpha) $ 🗃️

🇮🇳 OLA Electric: Wimpy Quarter. But, Bigger Question—How Long Will the Disruptor Play Last? (Smartkarma) $

Ola Electric Mobility Ltd (NSE: OLAELEC / BOM: 544225)’s management, during Investor call, seemed confident in driving volume growth through expanded distribution, new model launches, and focused on technology upgrades and vertical integration for cost advantages.

The company, however, remains intent on continuing its disruptor play strategy of aggressive discounts and competitive pricing to drive volume growth—uncommon in India’s auto sector.

Investors seeking profitability and capital returns will need patience (and faith in Ola’s strategy), while competitors like Bajaj Auto Ltd (NSE: BAJAJ-AUTO / BOM: 532977) and TVS Motor Company Ltd (NSE: TVSMOTOR / BOM: 532343) may feel the pressure.

🇮🇳 The Beat Ideas: Arvind Smartspaces- Growing Real Estate Co with Asset Light Model (Smartkarma) $

With an asset-light model and a solid alliance with HDFC (HDFC Bank (NYSE: HDB)), (real estate arm of Kasturbhai Lalbhai Group) Arvind Smartspaces Ltd (NSE: ARVSMART / BOM: 539301) greatly increases its project pipeline to 75.47Mn square feet, propelling a 30–35% increase in business development.

Together with its strong market positions in Bangalore and Ahmedabad, the company’s strategic asset-light approach guarantees effective capital use, rapid project turnover, and improved cash flow visibility.

Arvind Smartspaces is well-positioned for long-term, high-margin growth supported by strong cash flows, minimal leverage, and distinct geographic and product diversification.

🇮🇳 Swiggy: Expect Soft Debut in a Weak Market. Will It Regain Lost Mojo with IPO Boost? (Smartkarma) $

Swiggy Ltd (NSE: SWIGGY / BOM: 544285) debuts today amid bearish market sentiment, pressured by FII selling and disappointing corporate earnings.

The IPO received lukewarm interest from retail investors, who had minimal allocation – this could limit listing day selling pressure.

Swiggy’s valuation discount to Zomato Limited (NSE: ZOMATO / BSE: ZOMATO) is noteworthy; improved metrics, financials could drive gains, but escalating competition and regulatory risks loom large in the near term.

🇮🇳 Zomato Vs Swiggy: The Great Indian Delivery War (Smartkarma) $

Swiggy Ltd (NSE: SWIGGY / BOM: 544285) debuts with an 8% premium, raising Rs. 11,328 crore in IPO for Dark store expansion, brand promotion, tech & inorganic growth.

Swiggy lags behind Zomato Limited (NSE: ZOMATO / BSE: ZOMATO) across metrics, while Zomato diversifies with high-growth ticketing and “Going Out” segments.

With both segments is on the edge of becoming Contribution and EBITDA positive, one need to look the results of upcoming quarters of swiggy carefully.

🇮🇳 The Beat Ideas: Prakash Industries Limited, A Mining Catalyst (Smartkarma) $

Prakash Industries Limited (NSE: PRAKASH / BOM: 506022) Bhaskarpara Coal Mine is now received all the government approvals ensuring stable, self-supplied coal for steel production as well as open market sale.

This development reduces raw material costs, boosts EBITDA potential, and strengthens PIL’s valuation amid past corporate governance concerns.

PIL has manageable debt and with rising EBITDA, the company is available at a very attractive valuation compared to its peers.

🇯🇴 Invest In Global Growth With International General Insurance (Seeking Alpha) $ 🗃️

🇦🇪 Yalla holds out 2025 as its ‘Year of the Game’ as growth picks up (Bamboo Works)

The Middle Eastern social media company held two major live events in the third quarter, as it prepares to start testing its new self-developed mid-core games by year-end

Yalla Group (NYSE: YALA) is nearing the testing phase for two of its self-developed mid-core games, with wide-scale launches possible sometime next year

The company’s revenue grew 4.4% in the third quarter, but analysts expect that pace to pick up next year as it ramps up initiatives aimed at mid- and hardcore gamers

🇿🇦 Harmony Gold: Solid Bullish Conviction In The Market. Possible “Dip” Opportunity (Seeking Alpha) $ 🗃️

🇿🇦 Sibanye-Stillwater grapples with challenges in South African gold mining operations (IOL)

Sibanye Stillwater Ltd (NYSE: SBSW) CEO Neal Froneman has disclosed that the company is still navigating through a period of instability, despite having secured a wage agreement with labour unions.

The agreement included a 5.5% wage increase along with a one-off payment of R900 for various employee groups, set to take effect for one year. The company plans to revisit wage discussions in July 2025 when the one-year wage agreement expires.

While current conditions in the gold market have seen prices rise, South African gold producers, including Sibanye-Stillwater, are facing mounting operational costs that necessitate a strategy of cost rationalisation.

🇿🇦 Gold Fields boosts production by 12% while reducing costs in the latest quarter (IOL)

Gold Fields (NYSE: GFI) lowered costs all-in sustaining costs by 3% and boosted production by 12% to 510 000 ounces in the quarter to the end of September compared to the previous quarter ending in June.

This comes after South Deep mine ramped up output by 23% on a quarter-on-quarter basis.

Mike Fraser, CEO of Gold Fields said yesterday that the company had recorded material improvement in its operating performance across the portfolio during the quarter under review.

🇿🇦 Telkom’s share price rises after predicting strong interim earnings growth (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1)’s share price rang up 6.8% in value yesterday afternoon after it said adjusted headline earnings per share (HEPS) were expected to increase between 50% and 60% for the six months to September 30.

It said in a trading statement that adjusted HEPS was expected to be between 292.5 cents and 312 cents, up from 195 cents per share at the same time last year.

🇿🇦 Woolworths reports strong sales growth as consumer sentiment improves (IOL)

Woolworths Holdings (JSE: WHL) has announced a promising uptick in sales and turnover for the 18 weeks leading up to November 3, recording growth of 6.5% and 6.8% respectively compared to the same period last year.

This positive trend was observed across Woolworths’ segments, including food, fashion, beauty, and home, demonstrating a measure of resilience amidst the ongoing economic challenges facing consumers.

For the grocer’s South Africa market, there was however constrained discretionary spending by consumers although “consumer sentiment is improving, supported by moderating inflation, the start of easing interest rates, and the prolonged suspension” of load shedding.

🇰🇾 Fabrinet – Fabrinet: An Insight Into Its Automotive & Industrial Innovation & Other Major Drivers (Smartkarma) $

(Optical component maker) Fabrinet (NYSE: FN)‘s first-quarter results for fiscal year 2025 reveal both promising growth and challenges.

With a revenue of $804 million, the company surpassed the upper end of its guidance range, representing a 17% year-over-year increase and a 7% sequential rise from the previous quarter.

This growth was driven by significant performances in its major operating segments, particularly in optical communications.

🌎 Ternium: Don’t Judge A Book By Its Cover (Seeking Alpha) $ 🗃️

-

🌎 Ternium S.A. (NYSE: TX) – Luxembourg HQ’d. Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. 🏷️

🌎 DLocal Earnings Update: Improving Fundamentals For 2025 (Seeking Alpha) $ 🗃️

🌎 Patria Investments’ Q3: Strong Fundraising And Attractive Valuation (Seeking Alpha) $ 🗃️

-

🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds.

🌎 MercadoLibre: Post-Earnings Correction Shouldn’t Scare You (Seeking Alpha) $ 🗃️

🌎 MercadoLibre Q3: 16% Drop In Stock Is An Opportunity (Seeking Alpha) $ 🗃️

🌎 MercadoLibre Inc.: How Are They Successfully Tackling Supply Chain and Fulfillment Challenges? – Major Drivers (Smartkarma) $

MercadoLibre (NASDAQ: MELI) reported robust financial results for the third quarter of 2024, showcasing strong performance across its e-commerce and fintech sectors in Latin America.

The company’s gross merchandise volume (GMV) saw significant growth, with Brazil witnessing a 34% increase year-on-year and Mexico a 27% rise.

Moreover, the company made substantial gains in market share in these key countries.

🇦🇷 Bioceres Is Getting Cheaper, Not Yet An Opportunity But More Interesting (Seeking Alpha) $ 🗃️

🇦🇷 Grupo Financiero Galicia Stock: Still Bullish In The Early Stages Of Argentina Macro Recovery (Seeking Alpha) $ 🗃️

🇦🇷 YPF Sociedad Anónima: De-Risked And Executing Growth Plan (Seeking Alpha) $ 🗃️

🇦🇷 YPF S.A: Vaca Muerta, The Only Long-Term Policy In Argentina (Seeking Alpha) $ 🗃️

-

🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇦🇷 Banco Macro: Improved Economic Conditions Support Further Upside (Seeking Alpha) $ 🗃️

🇧🇷 Vibra Energia: A Top Player In Brazil’s Fuel And Energy Market, But Caution Advised On Its ADR For Now (Seeking Alpha) $ 🗃️

-

🇧🇷 Vibra Energia SA (BVMF: VBBR3 / FRA: V5F0 / OTCMKTS: PETRY) – Manufactures, processes, distributes, trades, transports, imports & exports oil-based products, lubricants & other fuels. 🇼

🌎 LATAM Airlines: Flying Out Of Bankruptcy With Significant Upside (Seeking Alpha) $ 🗃️

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subsidiaries in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇲🇽 Grupo Aeroportuario Del Centro Norte: Stock Is Still A Buy Despite Higher Concession Taxes (Seeking Alpha) $ 🗃️

🇲🇽 What a shuttered quarry says about Mexico’s investment climate (FT) $ 🗃️

Vulcan Materials Company (NYSE: VMC)

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Hedge Fund CIO: “China’s Xi Watches In Cold Sweat As Trump Is Announcing His New Team” (Zero Hedge)

(Eric Peters, CIO of One River Asset Management)

Xi had watched in a cold sweat as America’s president-elect announced his new team, China hawks, trade hawks, anti-establishment players, people committed to challenging orthodoxy in every area of government; appointments unlike anything seen in modern American history.

And the policy platform for the world’s largest economy appeared to be designed to fuel a domestic boom, which if achieved would put further distance between the US, China, Europe, in fact every serious nation. This increasingly evident contrast would spark further unrest amongst the citizens in these same nations whose leaders were failing them in so many ways.

“China’s goal of a stable, healthy and sustainable China-US relationship remains unchanged,” declared Xi, outwardly calm, statesmanlike, but inside praying that somehow, someway, this would be the time that America’s remarkable and chaotic propensity for producing prosperity, revolution within, reinvention, would finally fail.

🇨🇳 China’s AI App Startups Should Plan Overseas Expansion as ‘Quickly as Possible’ (Caixin) $

Going global may be the answer for many Chinese artificial intelligence (AI) app developers looking to get off the ground, as the potential to tap lucrative foreign customers is a sure way to attract investors, industry insiders said. However, gaining a foothold overseas can be a difficult and costly endeavor.

“Going global as early and quickly as possible” has become a priority for AI investors, said Chen Yu, a partner at Shanghai-based venture capital firm Yunqi Partners, explaining that overseas markets can be a major source of revenue as foreign users are “more willing to pay for AI apps” than their Chinese counterparts.

🇨🇳 Air freight groups and airlines rush to increase flights out of China (FT) $ 🗃️

🇲🇾 Malaysian equities: brush off the dip as a blip (The Asset) 🗃️

Strong fundamentals to support stock market amid short-term correction

Malaysia’s equity market has taken a breather after a months-long winning streak. The long-dormant market rallied over the past eight months, only to decline more than 4% since the beginning of September. Nonetheless, the market remains on the recovery path amid strong infrastructure activity, foreign investor interest, and government support.

🇹🇭 A Thai law on casino resorts may get nod 2025: PM aide (GGRAsia)

Thailand’s government is working to get a law on casino resorts – currently at a draft stage – passed during 2025 by the two chambers of the country’s parliament, reported Bloomberg on Friday, citing an interview with Prommin Lertsuridej, Secretary-General to the country’s Prime Minister, Paetongtarn Shinawatra.

The draft law is likely to be approved by Thailand’s cabinet before the end of this year, prior to being considered by the parliament, the report suggested.

It cited the Thai official as stating: “The law should be passed in six months from now at the earliest, so it should be next year to start.”

🇹🇭 🇸🇬 Thailand GGR maybe US$9bln, passing Singapore: Citi (GGRAsia)

Thailand could move from a proposal for casino legalisation to industry implementation “as quickly and as efficiently” as the Singapore government did two decades ago, says Citigroup.

But a Thai industry could when “fully ramped” generate US$9.1 billion annually in gross gaming revenue (GGR), exceeding the performance of Singapore’s current duopoly, and “only behind Macau and Las Vegas”, stated analysts George Choi, Preenapa Detchsri, and Timothy Chau, in a report on the outlook for Thailand.

The institution was working from a presumption of two licences in the Thai capital, Bangkok, and one each in the vicinity of Pattaya, Phuket, and Chiang Mai, three places popular with foreign tourists.

🇿🇦 S&P revises South Africa’s outlook to positive amid economic reform (IOL)

The National Treasury “notes and welcomes” S&P Global Ratings decision to revise South Africa’s ratings outlook from stable to positive on improved reform programme and economic growth potential.

However, the ratings agency, in a statement late on Friday night, maintained South Africa’s credit ratings status below investment grade, with the sovereign’s long-term foreign and local currency debt ratings at ‘BB-’ and ‘BB’, respectively.

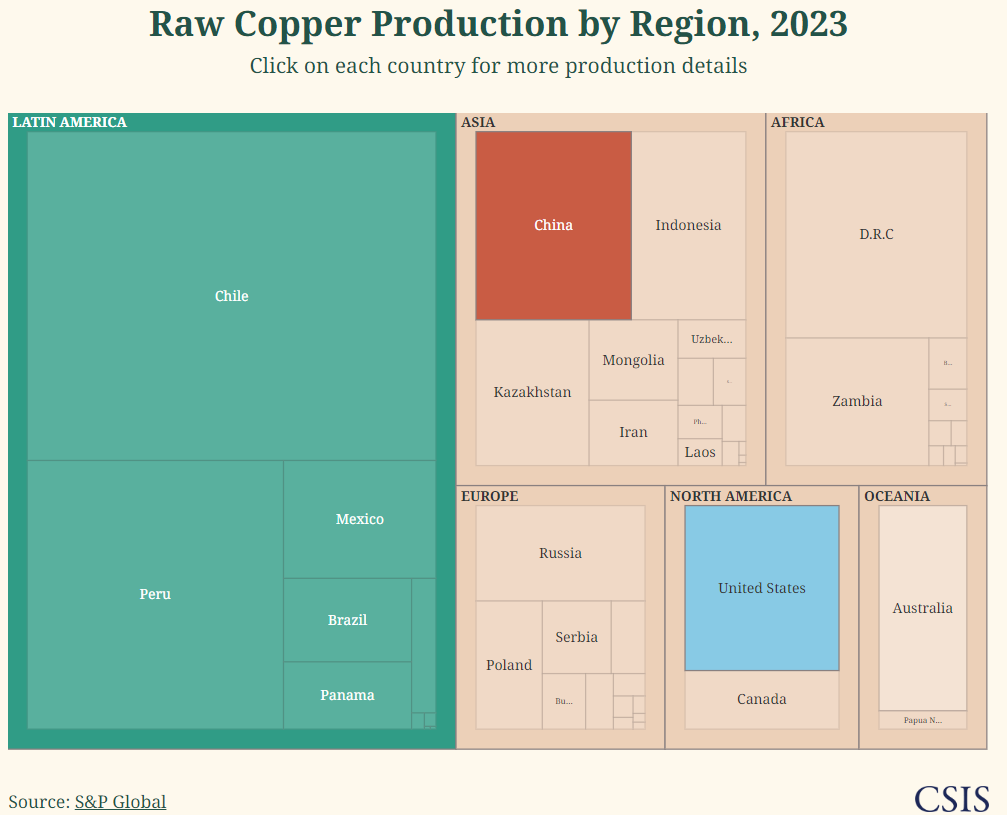

🌎 Latin America: The World’s Copper Stronghold (CSIS)

However, the United States only mines 5 percent of the world’s copper.

Latin America, which cumulatively mines nearly half (46 percent) of the world’s raw copper—the largest share of any global region—holds significant potential as a sourcing partner. Chile and Peru have the two largest copper reserves globally.

🌐 Another warning that the AI bubble is near bursting… (Mind Matters)

We’ve heard it from Gary Smith and Jeffrey Funk. But now, once again, from AI analyst Gary Marcus: The AI bubble created, in part, by Large Language Models (LLMs) or chatbots is nearing its peak:

You may also wish to read: Model Collapse: AI Chatbots Are Eating Their Own Tails. The problem is fundamental to how they operate. Without new human input, their output starts to decay. Meanwhile, organizations that laid off writers and editors to save money are finding that they can’t just program creativity or common sense into machines.

🌐 Greenlight’s David Einhorn says the markets are broken and getting worse (CNBC)

Greenlight Capital’s David Einhorn was interviewed by our Leslie Picker at CNBC’s Delivering Alpha event Wednesday.

“It’s continuing to get worse,” the hedge fund manager told Picker. “We are in a secular destruction of the professional asset management community.”

As he has done several times before, Einhorn pointed a finger at passive, index investors: “The passive people, they don’t care what the value is.”

🌐 EM Assets Hit By Negative Macro Backdrop Amid Trump’s Expected Tariff Flurry Sparking Strong Dollar (Zero Hedge)

On Thursday, Bloomberg’s Sebastian Boyd published a list showing Trump’s tariff risks and trade uncertainty represent a negative growth hit for the rest of the world…

Since last Tuesday, the dollar has reigned supreme, while emerging markets and global stock ex-US have slipped into negative territory.

EM asset underperformance will persist as long as the dollar remains strong.

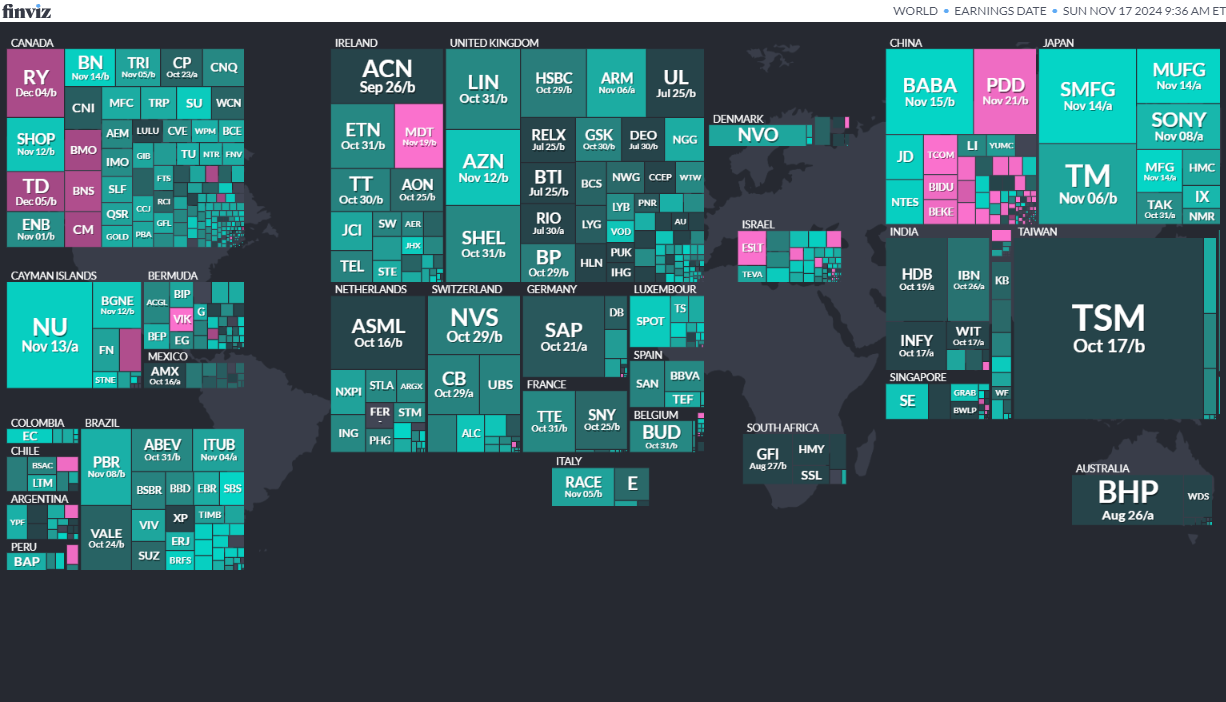

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

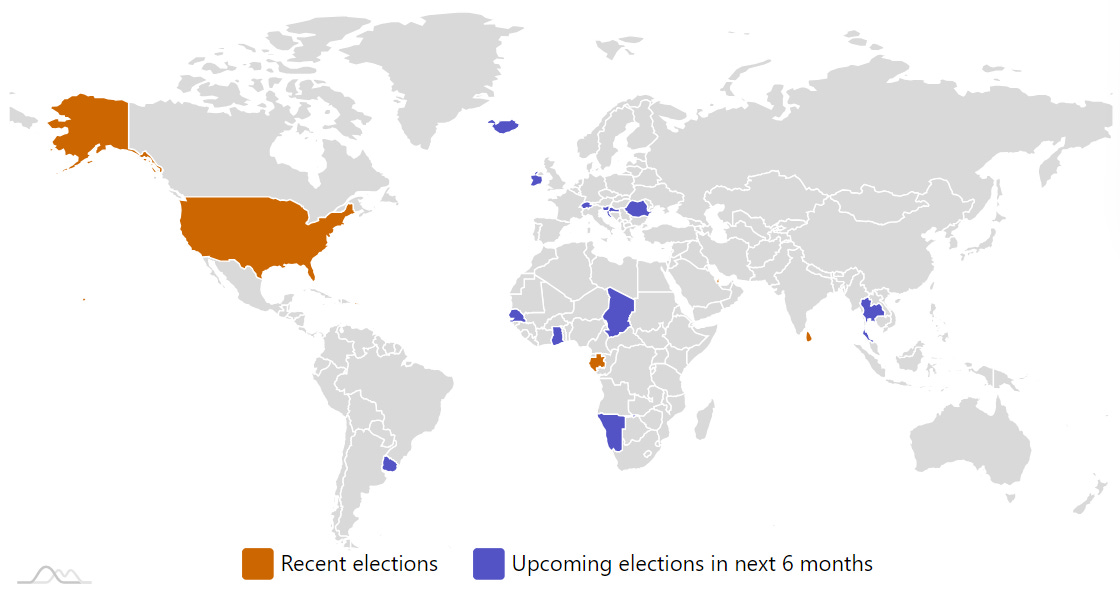

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Sri LankaSri Lankan ParliamentNov 14, 2024