EM Fund Stock Recommendations and Country Commentary (December 13, 2023)

Some excerpts from this post include:

-

A number of Singapore stocks selected by various local brokers.

-

Several Polish stocks This would benefit the EU as it releases funds frozen by Brussels under the previous Polish government.

-

A possible reality check for Javier Milei about what Argentina actually needs to do (but it won’t be the first country to do so…).

-

More emerging or frontier markets funds with good economic and/or portfolio commentary etc. have updated their documents by the end of November.

In a recent podcast covered later in this post, I discussed Argentina with Javier Milei, along with two fringe economic or political commentators, and their thoughts are worth covering. The method was mentioned dollar only “What’s happening on Wall Street” Because everyone wants to open the country to develop its resources properly (although it has been observed that dollarization would “colonize the country”) + “Wall Street (aka the West…) has fewer and fewer places to invest as the BRICs and others continue to expand..

The podcaster also revealed that Milei “It’s like a cartoon” And he (being more of a liberal) can tell when a Marxist is trying to write or act like a liberal. Milei feels the same way about him. yes: “They think we talk like this… ”

The guest then added that he would get the same impression if he listened to Milei longer. For example, as you start to think more about what he said, it sparks more questions that Milei doesn’t have good answers for. All this makes him very suspicious.He already seems to be backtracking on several promises or some of his rhetoric. Argentina will remain in the Paris climate agreement under Miele, negotiator says.).

Then it was noticed that Argentines were tired of inflation etc. and wanted stability to plan their lives. (Aren’t we all???) with The only solution to default on IMF debt – But I think other countries should go first. That is, another case. “New investigation, but same result… ” For Argentina.

Afterwards, the discussion turned to: The Ultimate Solution to Strange Debt Most of the developing countries are suffering from the problem of changing their legal framework or shifting their alliance-legal framework etc. to the BRICs (e.g. Russia, China, etc.) to reform the UN, multilateral banks and other Western controlled institutions. They believe this too. Since the West cannot impose sanctions or invade, it provides an opportunity for China and Russia (Example: Libya, Iraq, etc.)Or Color Revolution folks.

Again, the podcaster and his guests are not fund managers, but here are their thoughts: If it turns out to be right, the implications for Western emerging and frontier market bond investors.. For example: Posted on October 3rd We discussed litigation financing stocks that benefited from a recent Western court ruling on the renationalization of YPF in Argentina. (Although I am not aware of anything they collect on this ruling and Argentina has a history of ignoring such rulings).

But not only are indebted emerging and frontier markets starting to ignore Western court rulings, they are simply The Obnoxious Debt Doctrine Defaulting on debts to Western-controlled entities and collaborating with the BRICs (or rather, China and Russia)? Again, the West cannot sanction, invade, or color revolution everyone, but such a move by one country (probably not Argentina under Millais) could have a domino effect.

Which country will be the first domino to fall? The podcast noted that Egypt’s president is unpopular and could lose power if the war in Gaza escalates or continues to be delayed. I would like to add that Egypt has serious economic and debt problems, e.g. Egypt faces external debt calculation after excessive borrowing) and might be a good candidate. And they could always try to raise more money from the Gulf, Russia, China (or all against each other), and considering the strategic importance of the Suez Canal, everyone will have to be careful…

Either way, emerging and frontier market bond investors with a long-term perspective should prepare for a changing world order over which the West and its financial institutions are not necessarily in control, or where there are alternatives to those institutions. Likewise, anyone who wants to speculate about changes in Argentina (Holdings of Flawed Global X MSCI Argentina ETF (September 2023)) must be prepared for A new investigation with the same results…

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

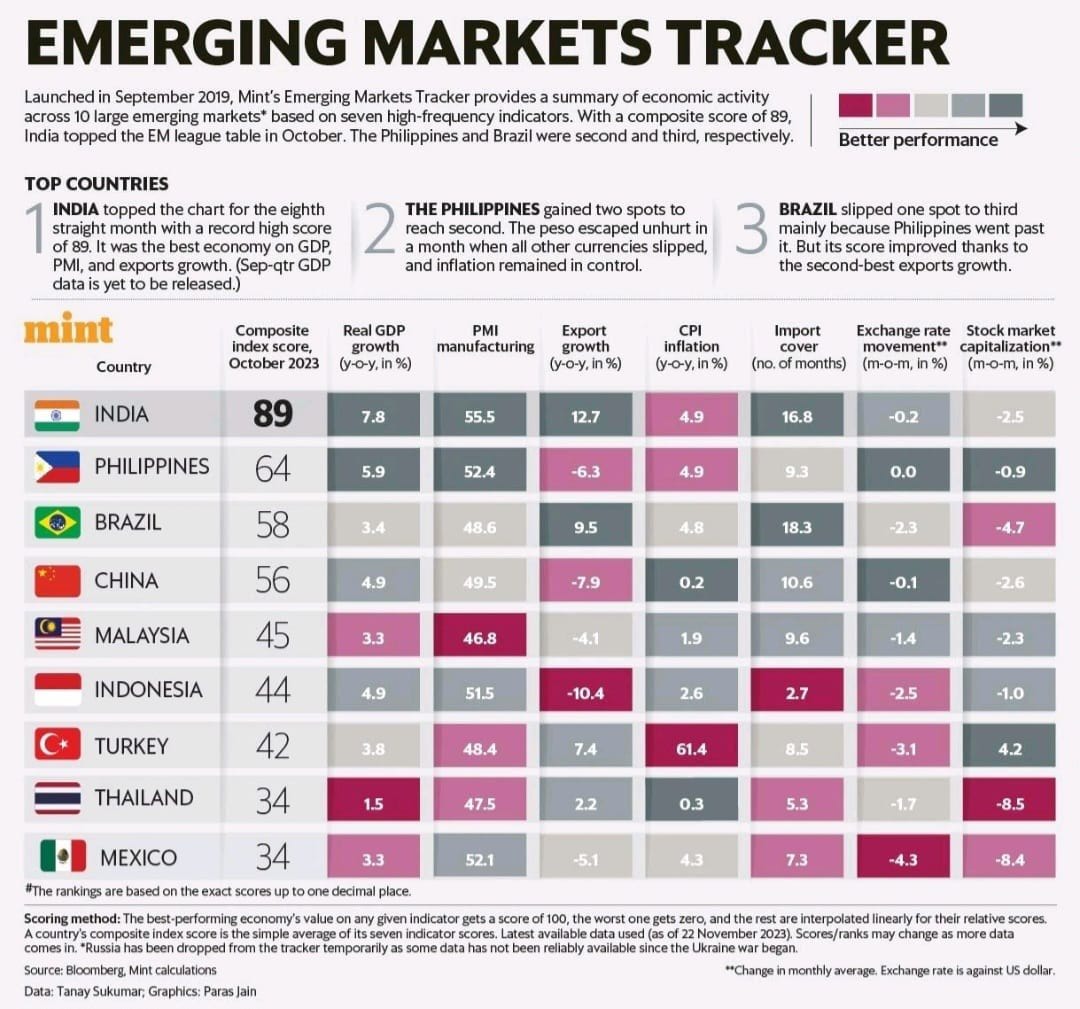

This graphic is being shared widely on Twitter.

This is taken from a monthly post in an Indian newspaper.

📰 India tops Mint’s EM tracker for eight consecutive months. (livemint.com) November 2023

In a short interview with an Australian fund manager, he talked about investing in Asian credit.

📰 As income investing comes back into vogue, it pays to think beyond the obvious. (Livewire Market) November 2023

While U.S. bonds and credit are getting a lot of attention, one area in our backyard offers higher yields for equivalent credit quality.

like john stoverportfolio manager Tribeca Asia Credit Strategy But he points out that Asia is much bigger than China and that there are opportunities beyond stocks.

he and his team “Finding easier and more attractive opportunities in the rest of the region” And he points to the following countries: India, Indonesia, Japan, Korea, Thailand.

The first part is short and the second part is also discussed. Top ranking changes by country:

🔬 EM Bonds Are in Good Shape Going into 2024 (Van Eck) December 2023

The picture for emerging market bonds remains favorable in 2024, thanks to a significant yield cushion and the possibility of a soft landing from the Fed.

🔬 2024 EM Bond Milestones (Van Eck) December 2023

The economic backdrop appears supportive for emerging market bonds heading into 2024. In this blog, we discuss five milestones that greatly support the asset class.

This emerging markets outlook (for professional investors only) was prepared in late November and includes:

🎬 Webinar: Ashmore’s 2024 Emerging Markets Forecast (Ashmore) 52:18 minutes (November 2023)

Gustavo Medeiros, Head of Research at Ashmore, discusses the outlook for emerging markets in 2024.

introduction – 00:00

Gustavo’s 2024 outlook remarks – 01:30

Audience Q&A – 16:05