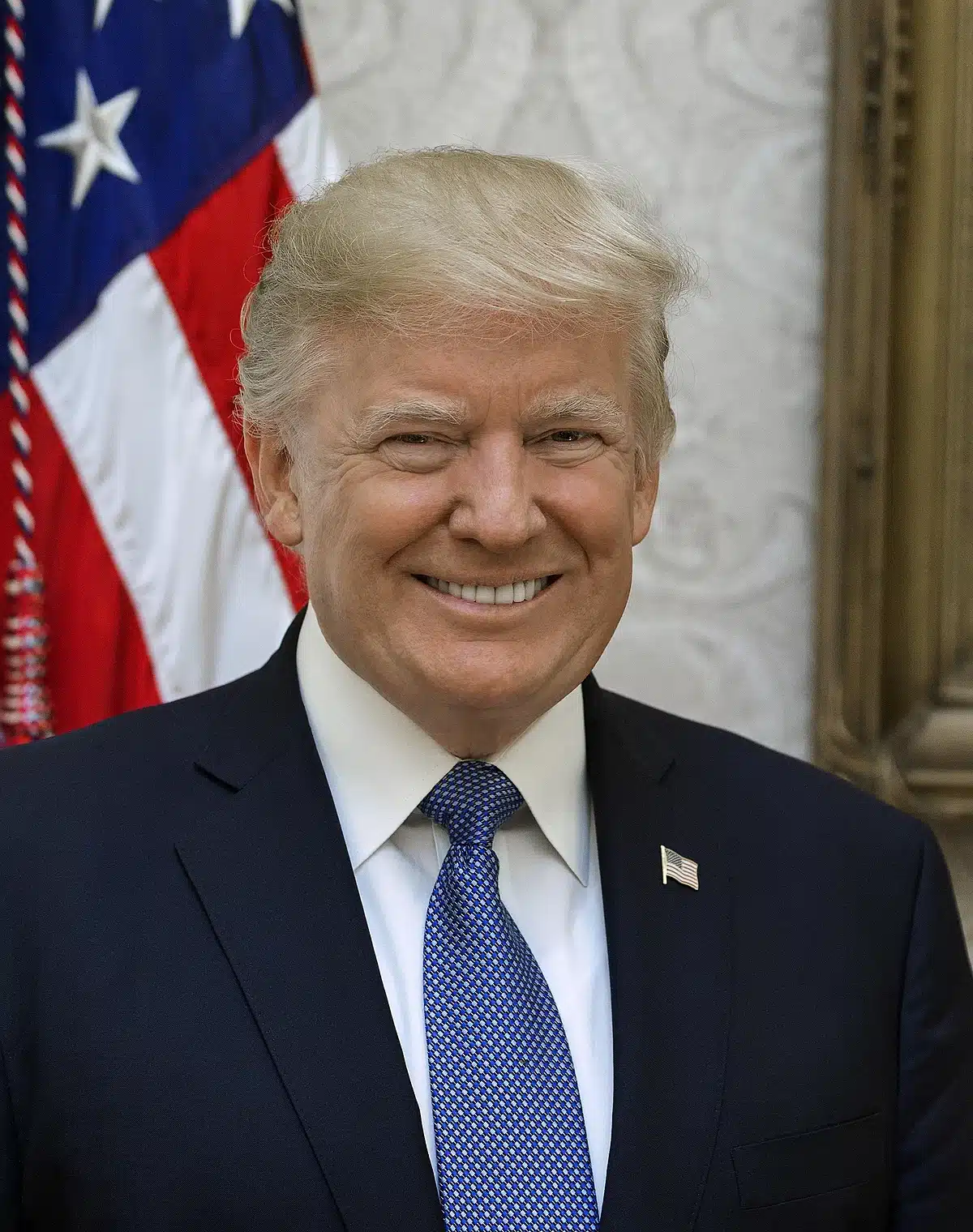

Trump’s Tariff Promises: Why General Motors Could Face Headwinds

In a bold policy change, President Trump recently announced: significant tariffs We are targeting imports from Canada, Mexico and China. This includes a 25% tariff on goods from Canada and Mexico and an additional 10% tariff on imports from China. for General Motors (GM)As a multinational automotive giant that relies on a complex global supply chain network, it poses a direct challenge to its cost structure and profitability.

GM, which sources a significant portion of its vehicle parts internationally, is bearing the brunt of these actions. From engine parts from Mexico to electronic modules imported from China, the company’s production model depends on smooth international trade. Not only would the tariffs disrupt this model, it would also put GM in a precarious position, potentially leading to higher costs and squeezed margins in an already highly competitive auto market.

Impact of Proposed Tariffs

The proposed tariffs would have a two-layer impact on GM’s operations. First, the 25% levy on Canadian and Mexican products will impact the cost of sourcing parts such as transmissions and engines. These parts are essential to vehicle assembly at GM’s U.S. plants. Second, the additional 10% tariffs on Chinese imports primarily target electronic modules and batteries critical to GM’s fast-growing electric vehicle (EV) segment.

For GM, sourcing parts domestically as a way to avoid tariffs can increase costs by 15 to 20 percent. Moreover, the high tariffs on steel and aluminum imports introduced over the past few years have already inflated material costs, and additional tariffs will only make the problem worse. GM has also suffered from raw material price fluctuations that have pressured its profit margins over the past two fiscal years. Adding these tariffs to the equation risks placing additional strain on the balance sheet.

In particular, GM’s recent Third Quarter Financial Results It showed steady growth with sales of $48.8 billion and net profit of $3.1 billion. But absorbing billions of dollars in additional tariff-related costs could offset those gains and limit the company’s ability to invest in strategic areas such as electrification and autonomous technologies.

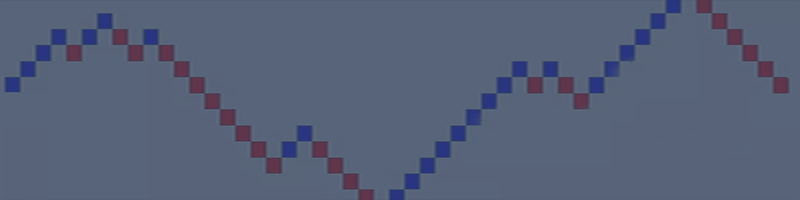

market reaction

Wall Street’s reaction to the tariff announcement highlights investor concerns. GM stock down 9%About $4 billion in market capitalization was wiped out in a matter of hours on November 26th. This decline was steeper than the decline experienced by the following competitors: Ford Motor Company (Female) (2.6%) and Stellantis NV (STLA) (5.7%), both of which have relatively low dependence on imported components.

Volatility has risen across the automotive sector as analysts struggle to re-evaluate revenue forecasts under a potential tariff regime. GM’s vulnerability is that it relies heavily on a just-in-time supply chain model that prioritizes efficiency but leaves little buffer against external shocks such as tariffs. With profit margins already slim in the mass-market vehicle segment, the additional costs are expected to add to financial pressures. Investors appear to be wary of the ramifications of these tariffs, especially if other trading partners retaliate and further constrain the global trade ecosystem.

Strategic Considerations for GM

To weather these headwinds, GM must rethink its operating strategy. The first and perhaps most difficult option is to accelerate the localization of the supply chain. GM could potentially avoid tariff-related costs by sourcing parts from domestic suppliers. However, this requires time-intensive and capital-intensive investments in supplier partnerships and manufacturing infrastructure in the United States.

Another alternative is to absorb increased costs by streamlining operations or increasing efficiency elsewhere. GM’s significant investments in automation and manufacturing technology could play a pivotal role here. The company has already invested billions of dollars in modernizing its plants, and further upgrades could help offset higher input costs.

Passing the costs on to consumers by increasing vehicle prices is a third option. Although this approach is simple, it risks alienating customers in a competitive market where affordability is critical. Price pressures can be particularly severe in segments such as compact cars and entry-level SUVs that attract cost-conscious buyers.

Finally, GM could step up its lobbying efforts to seek tariff exemptions or other forms of government relief. Securing temporary waivers for key components could alleviate immediate cost pressures, but this strategy depends on favorable political negotiations.

investor outlook

Despite the challenges posed by tariffs, GM’s underlying financial strength provides some reassurance. Third quarter 2024 results highlighted resilience, revenue 10.5% compared to the previous year Automobile free cash flow increased 18.8% to $5.8 billion. The company’s commitment to electrification has positioned it as a leader in the transition to sustainable mobility, with EVs accounting for an increasing portion of its production portfolio.

However, the long-term impact of ongoing tariffs remains a concern. Higher production costs could reduce margins, reduce GM’s ability to compete on price and slow its EV ambitions. Moreover, if tariffs cause prolonged supply chain disruptions, the resulting production delays could impact GM’s market share.

The path forward requires careful consideration by investors. Long-term shareholders who are confident in GM’s strategic direction may choose to maintain their position, betting on its ability to resolve tariff-related issues and capitalize on EV growth. Meanwhile, short-term investors wary of volatility may choose to stay on the sidelines until there is more clarity on tariff policy and GM’s response.