Korean Stock Recommendations (November 2024)

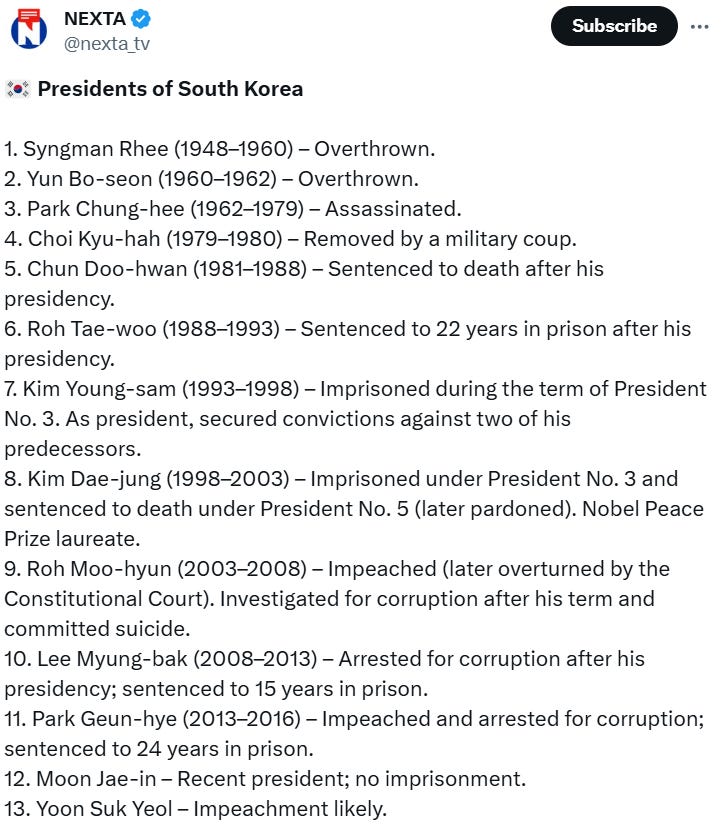

I can’t add much insight other than repeating what I said about what’s been happening in Korean politics over the past few weeks. Mentioned on Monday: Attempts to declare martial law politics as usual Martial law, presidents being jailed for corruption, and general political chaos are common occurrences in Korean politics. As this tweet points out again:

The Korean stock market (especially the Korea Composite Stock Index (KOSPI), i.e. all common stock indices) seems to have largely ignored recent political events.

Here’s what Trading Economics says about the Korean Won:

To be honest, whenever there is political noise here, I see the currency move bigger through the Malaysian ringgit. However, the Korean Won seems to have been on a downward trend since COVID-19 (or worse)…

Stocks covered in the rest of this post (including our brief explanation) Japan, Korea, Taiwan stock indices (including price/book value, forward P/E, forward dividend yield, and long-term technical charts):

(Note: In desktop browsers, an auto-generated table of contents will appear on the left linked to each stock. I will add the link below after I post/email this post…)

Korean Air, Ecopro BM / LS Marine Solutions / Green Cross Holdings, Korea Zinc, Hyundai Motor Company, KG Inicis Co., Ltd., Lotte Chilsung Beverage, Kakao Pay, NHN KCP Co., Ltd., Hyundai Motor Securities, Eoflow, LG Co., Ltd., Korea Reinsurance Company, SK Square, Double Down Interactive, Pharma Research Co., Ltd., Ray Co., Ltd., Dio Implant, CJ CheilJedang Co., Ltd., Samsung Life Insurance, KB Financial Group, Gravity Co., Ltd., Naver, Samsung Electronics, Iljin Electric Co., Ltd., SK Offshore Plant, BY same company, JYP Entertainment, hmm, SoluM Co., Ltd., KEPCO Plant Service and Engineering, Nexon Games, Pearl Abyss Co., Ltd., Neowiz, people and technology, Cosmecca Korea, Amore Pacific Group, Batek, LG U+, KT Co., Ltd., LIG Nex1 Co., Ltd., SK Biopharm, Netmarble Co., Ltd., Kumho Petrochemical, Grand Korea Leisure, ISU PETASYS Co., Ltd., Hyundai GF Holdings & Hyundai Iswell, KT&G Co., Ltd., Gradient Co., Ltd., InBody, Jin Air, Vieworks, this, CS Wind Co., Ltd., Cafe24 Co., Ltd., Krafton, Paradise Co., Ltd., Kakao Co., Ltd., Kakao Games, SK Telecom, he was tall, Hugel, Jeju water, Coupang, Winsco, Hyundai Mobis, SM Entertainment, Douzone Bizon, i-sense, S-Oil Co., Ltd., Pan Ocean, NCSoft Co., Ltd., ST Pharm, LX International, Hyundai Glovis, Lotte Tourism Development, E-Mart & Shinsegae Inc, GS Construction Co., Ltd., Hyosung Heavy Industries Co., Ltd., OCI Holdings, Cosmo New Material Technology, SK IE Technology, Amore Pacific Co., Ltd., Hanwha Solutions, Hanwha Aerospace, Hansol Chemical, Soulbrain & POSCO Holdings

As mentioned earlier, Japan, Korea, Taiwan stock indices Updated (now includes: 216 Korean stocks) with Link to all stocks Wikipedia (🇼) item, preferred stock availability (🅿️) and ticker (usually second), tag (🏷️), etc.

And as always, this post Provided for informational purposes only (And to make your life easier…). This does not constitute investment advice and/or recommendations…

🔬 Research analysis (including articles/blog posts by fund managers, etc.) 🎥 video; 🎙️ podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 📯 press release; 💻 Substack/Blog/Website Articles; ✅ Our own posting; 🗃️ Linked archive articles; ⏰ Upcoming webinar or event ⚠️ Public or limited access, for example based on your location, investor status, etc. 🇼 Wikipedia page; 🏷️ These are tagged links to other posts about that stock.

💻 Korean Air leads the integration of the Korean aviation industry (Douglas Research Insights) $ November 30, 2024

🔬 Korean Air (003490KS/Buy) – Despite concerns, returns remain solid (Mirae Asset Securities) July 11, 2024 ⚠️

-

🌐🅿️ Korean Air (KRX: 003490 / 003495) – Flag carrier of the Republic of Korea. It is the largest airline based on fleet size, international destinations, and flights. 🇼 🏷️

-

Price/Book (most recent quarter): 0.87

-

Trailing P/E: 8.24 (no forward P/E) / Annual Dividend Yield: 3.06% (yahoo! financial resources)

💻 Ecopro BM’s KOSPI movement: Turning LS Marine Solutions and Green Cross into real transactions (Smart Karma) $ November 29, 2024

💻 Ecopro BM “Possibility of listing on KOSDAQ to KOSPI in the first quarter of 2025” (Douglas Research Insights) $ November 29, 2024

-

🌐👼🏻 Ecopro BM Co., Ltd. (KOSDAQ: 247540) – Bulk cathode materials market. Mass production of high-nickel cathode materials for the first time in Korea 🏷️

-

Price/Book (most recent quarter): 10.17

-

Forward P/E: 60.98 / Annual Dividend Yield: Not applicable (yahoo! financial resources)

-

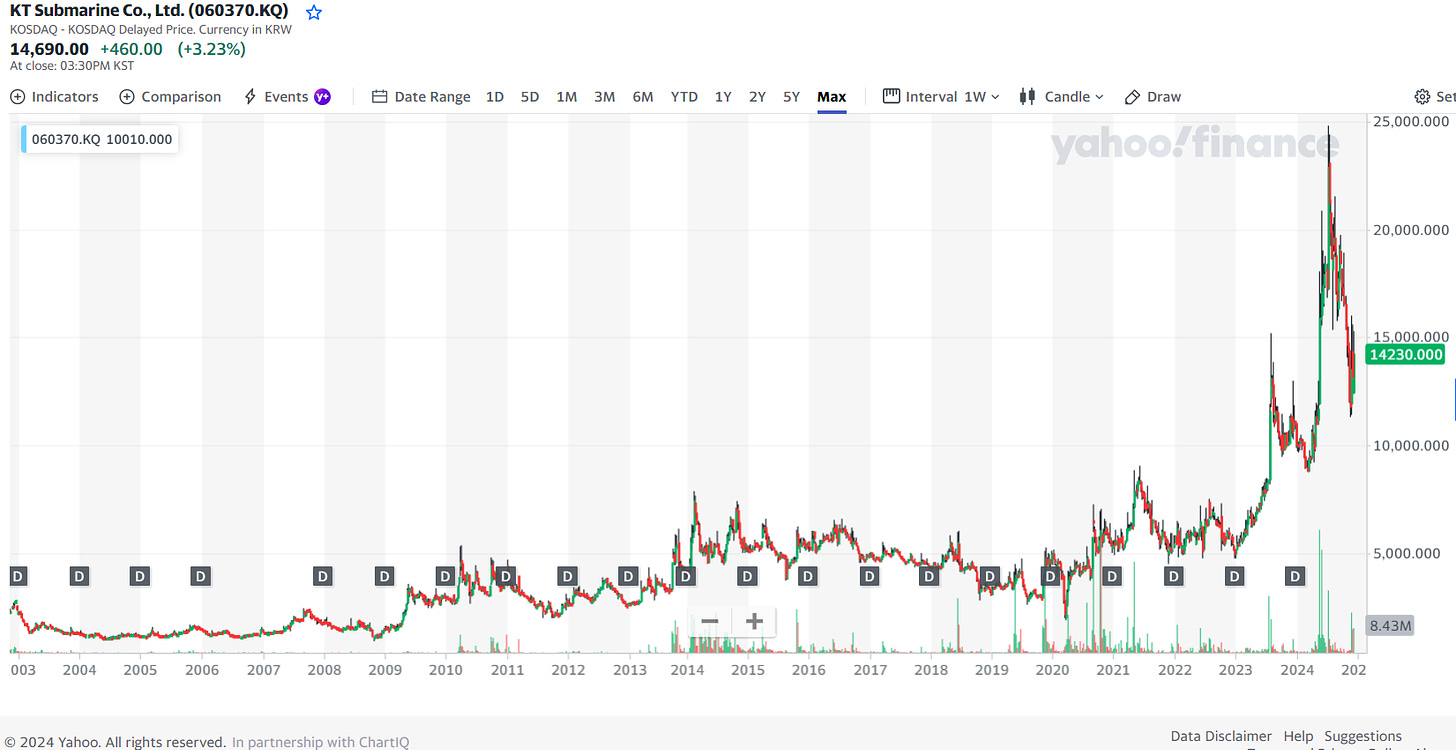

🌐 LS Marine Solution (KOSDAQ: 060370) – Marine solution provider, including submarine communication cable construction 🏷️

-

Price/Book (most recent quarter): 2.73

-

Trailing P/E: 32.19 (no forward P/E) / Annual Dividend Yield: Not applicable (yahoo! financial resources)

-

🌐 Green Cross Holdings (KRX: 005250) – Biotechnology (prescription and over-the-counter drugs). Pharmaceutical manufacturing and distribution. 🏷️

-

Price/Book (most recent quarter): 0.82

-

Trailing P/E: 49.84 (no forward P/E) / Annual Dividend Yield: 2.03% (yahoo! financial resources)

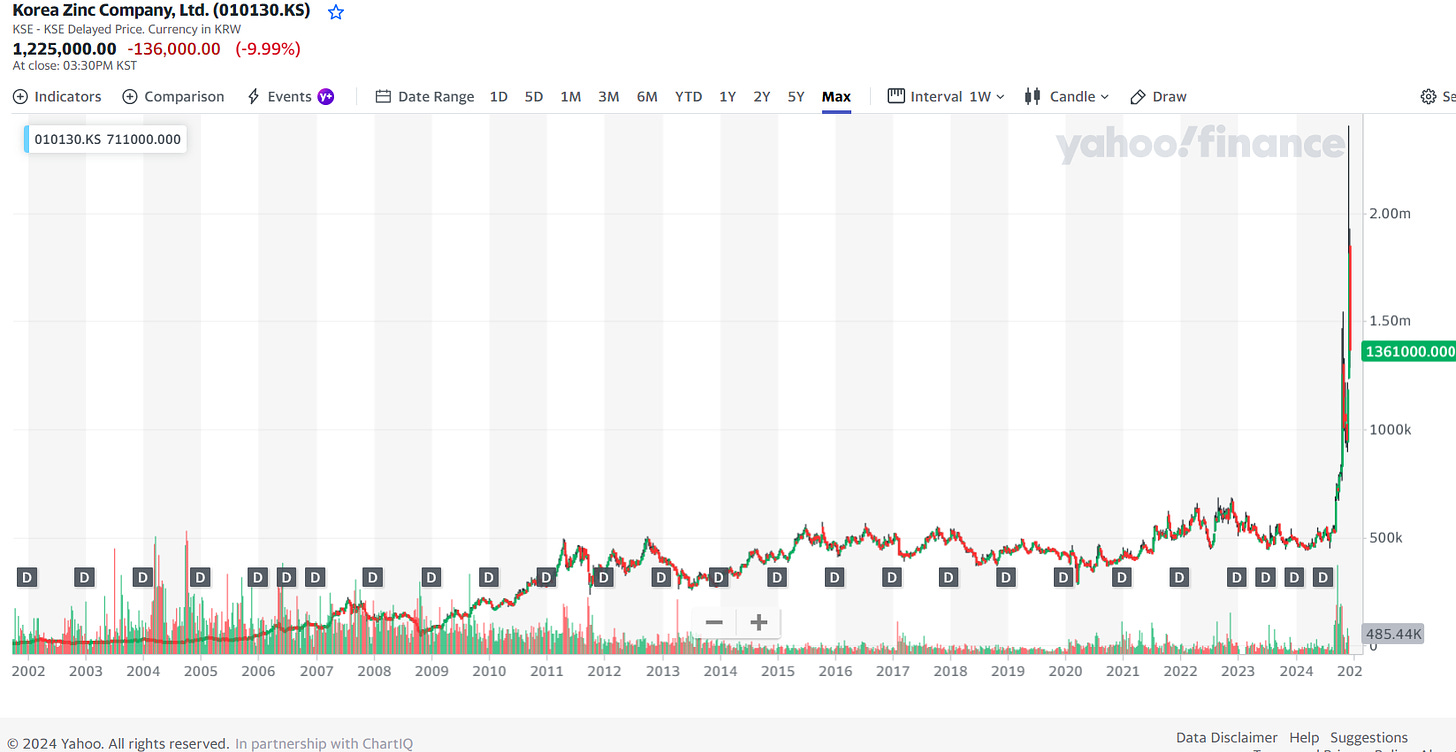

memo: This October FT article also provides a good summary of why fighting for your company is important. 📰 Bain joins battle for control of world’s largest zinc smelter (FT) October 2, 2024 $ 🗃️

💻 Korea Zinc Transforms into a Comedy Show: MBK’s Speculative Moves and How They Shape Our Trading (Smart Karma) $ November 29, 2024

💻 Korea Zinc proxy war in January 2025 (Douglas Research Insights) $ November 29, 2024

💻 Confirmation of major facts related to confusion regarding Geumyang paid-in capital increase (Smart Karma) $ November 28, 2024

💻 Finding Korea Zinc’s short selling entry point (Smart Karma) $ November 25, 2024

💻 MBK purchases an additional 1.36% stake in Korea Zinc (Douglas Research Insights) $ November 11, 2024

💻 Financial Supervisory Service may suspend Korea Zinc’s large-scale capital increase this year (Douglas Research Insights) $

-

🌐 Korea Zinc (KRX: 010130) – Overseas resource exploration and discovery of new rare metals + smelting-related industries and resource recycling business 🇼 🏷️

-

Price/Book (most recent quarter): 2.69

-

Trailing P/E: 44.51 (no forward P/E) / Annual Dividend Yield: 1.50% (yahoo! financial resources)