Bitcoin Miners Surge in 2025 with AI Hosting and BTC Return Strategies

Bitcoin miners are pursuing yield strategies on their BTC holdings and diversifying into AI computing, according to a recent Clear Street report.

A report titled ‘BTC Mining: Key Themes Emerging in 2025;‘ describes three themes for 2025. That means monetizing Bitcoin reserves, leveraging existing infrastructure for HPC initiatives, and benefiting from a shift in U.S. regulatory leadership.

Bitcoin Returns and Spot ETF Upgrades

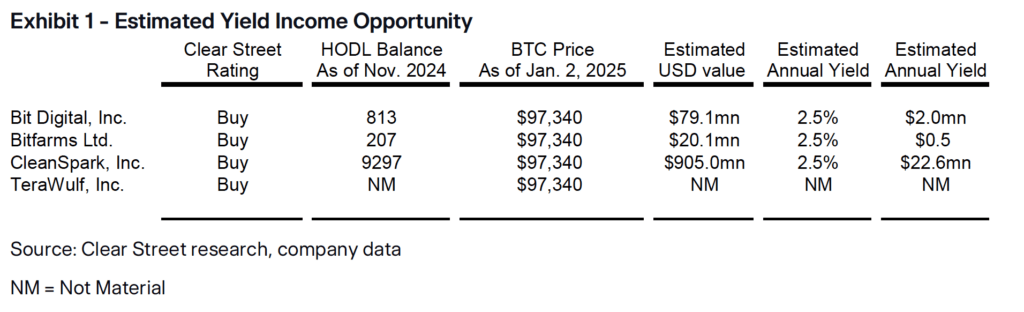

Clear Street’s authors indicate that several miner management teams are investigating ways to monetize their stored BTC through securities lending, which they describe as a potentially viable approach pending regulatory adjustments. The report states that the SEC’s new position could allow spot issuance of BTC exchange-traded fund shares, allowing miners to exchange Bitcoin directly for ETF units and then work with prime brokers for stock loan income. . While conventional collateral securities yield low to mid-single digit yields, higher yields may apply if ETF shares become difficult to borrow.

Clear Street added that the legal changes will bring BTC securities lending on par with broader lending practices and force sector players to focus on operational details. Our analysis shows that CleanSpark has a notable HODL balance and could earn millions of dollars in annual interest if the strategy expands. Bit Digital, Bitfarms, and TeraWulf are cited for different holdings or approaches, including programmatic staking or not holding any Bitcoin at all, depending on company policy. Clear Street anticipates that this revenue mechanism could create additional revenue streams and help miners optimize large-scale operations that might otherwise be idle.

HPC Computing and AI Diversification

The report also highlights the growing shift toward HPC computing as miners repurpose data centers, power sources, and advanced equipment to handle AI-based workloads. The authors see a path for companies to diversify their revenues beyond mining. Bit Digital is said to be transforming into a data center company with the Montreal acquisition, with the goal of hosting HPC customers for stable fees and potential upside. TeraWulf is notable for its new HPC contract, which can scale to over 100 MW of capacity, targeting demand for complex AI research requirements. Figures from Clear Street show that HPC services can generate attractive revenue per megawatt, with margins ranging depending on data center configuration and contract size.

According to the report, political changes may strengthen the industry’s outlook. President Trump’s administration is portrayed as friendlier to Bitcoin interests due to potential changes at the SEC and Department of Energy and a more open view toward BTC products. Trump’s pick to chair the SEC, Paul Atkins, has been involved in digital asset initiatives in the past, and proposed Treasury Secretary Scott Bessent appears to be more accepting of cryptocurrencies than previous leadership.

But the study warns that federal spending cuts or energy policy changes could create uncertainty, especially if renewable energy credits are modified. Clear Street also notes the possibility that reduced government spending could reduce inflationary pressures, which some investors believe is beneficial for Bitcoin.

The analysis highlights several companies as top choices based on valuation, expansion potential, and current HPC roadmap.

Clear Distance Recommendations for Bitcoin Miners

Bit Digital (BTBT) was labeled a Buy due to its shift from an asset-light mining model to HPC revenue, and management cited its pipeline of potential data center tenants. CleanSpark (CLSK) is presented as a popular pure-play miner, supported by a best-in-class energy strategy and a pipeline for growth through 2027. TeraWulf (WULF) has a larger multiple compared to others, but aims to justify it with its new HPC. Trading and improved mining metrics. Bitfarms (BITF), seen as a BTC mining specialist, reportedly has a stable of energy contracts and could potentially enter HPC in late 2025 or early 2026.

According to Clear Street, these forecasts depend on each company’s ability to scale data center operations, secure or renew power contracts, and navigate the final regulatory stages for securities lending. The authors emphasize that clarity from the SEC on spot BTC ETF share creation will be pivotal in boosting returns on HODL balances.

According to their predictions, participating miners are expected to see higher returns as new practices mature and capital inflows expand from institutional partners seeking additional exposure to digital assets. Bitfarms, Bit Digital, CleanSpark, and TeraWulf remain in focus based on Clear Street’s current forecast.