Emerging Market Links + The Week Ahead (January 21, 2025)

Monday was a US holiday (Martin Luther King Day) plus Trump’s inauguration with Chinese New Year starting next week on January 29th. Hopefully, the Year of the Snake, which is said to represent wisdom, transformation, and resilience, will continue to live up to its reputation…

I am traveling at the end of next weekend and will try to get a Monday post out as soon as possible or will have one scheduled with what I have gone through already (then back to the normal 9PMish EST time, or as close as possible, for publishing start of the week posts).

$ = behind a paywall

-

🇰🇷 Korean Stock Picks (December 2024) Partially $

-

KEPCO, Daesang Corp & Daesang Holdings, E-Mart, POSCO Holdings & Posco International Corp, Korea Zinc, Hyundai Motor & Kia Corp, SK Telecom, Chabiotech Co Ltd, Woori Financial, LG Electronics, Lotte Shopping, Samsung Electro-Mechanics, SM Entertainment, Celltrion, KT Corporation, Hyundai Motor Securities, Doosan Bobcat / Doosan Enerbility / Doosan Robotic, KB Financial, Ecopro BM & DB HiTek

-

-

🌐 EM Fund Stock Picks & Country Commentaries (January 19, 2025) Partially $

-

Brief California wildfire note (check out Edison International), what do falling Chinese yields tell us, cautious optimism for commodities, China healthcare outlook, December/Q4 fund updates, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 ACM Research straddles growing U.S.-China microchip divide (Bamboo Works)

The California-based manufacturer of chipmaking equipment is growing quickly on demand from China, even as its strong Chinese ties become increasingly tricky

ACM Research (NASDAQ: ACMR), a U.S.-based chip equipment maker with strong China ties, expects 2025 revenue of up to $950 million, nearing its $1 billion target early

Despite strong growth prospects, U.S. restrictions targeting China’s microchip industry and the background of ACM’s founder pose significant risks to the company’s operations

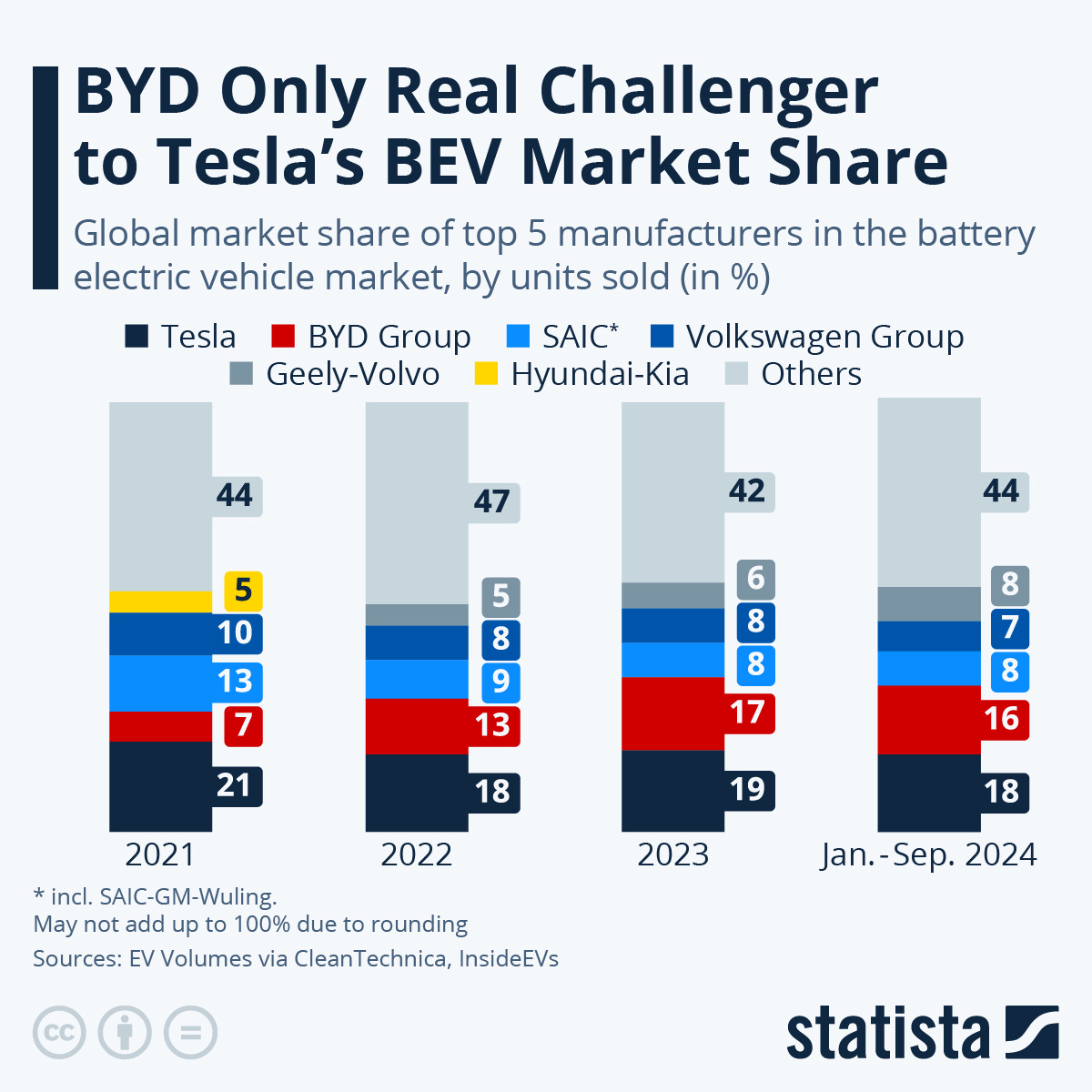

🇨🇳 China’s BYD Is Only Real Contender To Tesla’s Global EV Market Share Dominance (Zerohedge) / Tesla and BYD Claim a Third of the Global BEV Market (Statista)

🇨🇳 Pinduoduo: The Mother of All Frauds? (The Great Wall Street – Investing in China)

Analyzing PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Valuation, Fraud Concerns, and What It Means for Investing in China. Fraud or opportunity?

Sure, I’ve covered some challenges in my review of their last quarterly earnings—tough competition, China’s unforgiving market dynamics, and let’s not forget, they’re going up against giants like Amazon, a company that practically wrote the playbook on e-commerce dominance—but even with all that, this valuation feels…off.

🇨🇳 In Depth: E-Commerce Giants Shun Supermarkets as Sales Slump (Caixin) $

China’s retail sector is undergoing a major shake-up: E-commerce giants are scaling back their brick-and-mortar investments and new players such as fast-growing Chinese retailer MINISO Group Holding (NYSE: MNSO) and private equity firms are stepping in to fill the gap.

JD.com (NASDAQ: JD) reduced its stake in Yonghui Superstores Co Ltd (SHA: 601933), China’s second-largest hypermarket chain, by a total of 11.25% last year, while in February 2024, Alibaba (NYSE: BABA)’s chairman called its traditional retail segment a “non-core business” in an earnings call.

🇨🇳 Investment thesis on Alibaba Group (BlackSwan Investor)

Calculated Risks for Compelling Rewards

Alibaba (NYSE: BABA) is commonly referred to as the “Amazon of China”. Like Amazon, it’s a leader in technology and e-commerce. Also like Amazon, it runs a conglomerate of ventures with their main pillars being e-commerce and the cloud computing segment. However, not everything is the same and the strategy employed between the two are actually quite different due to the geographical and cultural differences between the two companies.

Notably, our rationale for investing in Alibaba also differs greatly from that of Amazon.

In summary, I believe Alibaba is a good investment when weighing risk/reward if purchased under $110 per share and is one of the stocks in my 2025 Swan Select Portfolio.

🇨🇳 JD.com (JD US) (Asian Century Stocks) $

Trusted online retailer trading at a 9x P/E with a coming margin inflection

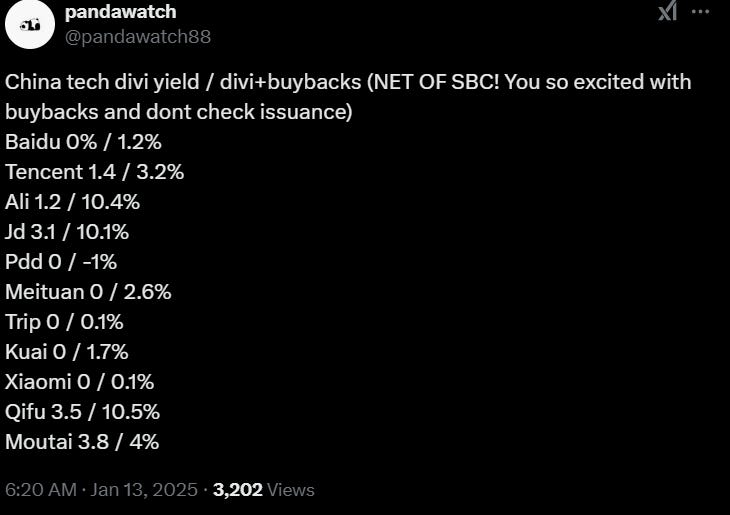

China-focused Twitter user “pandawatch” posted a tweet comparing the total shareholder return of Chinese tech companies.

At the top of the list was online retailer JD.com (NASDAQ: JD) (JD US — US$57 billion) with a total dividend yield and buyback yield of 10% — even after deducting share-based compensation. That’s impressively high.

JD is one of China’s largest e-commerce companies. It dominates the niche of selling authentic, branded goods online with fast and reliable delivery. Unlike Alibaba (NYSE: BABA), JD focuses on selling authentic products directly to consumers, taking on inventory risk and delivering packages straight to customers’ doors.

🇨🇳 FinVolution finds riches, achieves growth despite headwinds, in global markets (Bamboo Works)

The fintech lender launched its international expansion in 2018, and plans to enter more countries this year and next

FinVolution (NYSE: FINV) has accelerated its overseas expansion as demand slows in its home China market, with its international business contributing a fifth of revenue in the third quarter

The fintech lender’s international revenue grew 8.7% in last year’s third quarter and is expected to accelerate as the dust settles from recent regulatory changes in Indonesia

🇨🇳 Yibin Bank’s IPO spotlights challenges facing regional lenders (Bamboo Works)

The Sichuan-based bank raised HK$1.8 billion in gross proceeds in a Hong Kong IPO to replenish its capital base

Yibin City Commercial Bank Co Ltd (HKG: 2596) raised fresh funds in a Hong Kong IPO after slower growth in its profits relative to its loan growth eroded its capital buffer

The regional lender’s revenue growth stalled in the first half of last year amid weak credit demand and falling interest rates

🇨🇳 Haier Smart Home (6690 HK) (East Asia Stock Insights) $

The Chinese appliances giant winning globally

Haier Smart Home (SHA: 600690 / HKG: 6690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) is one of China’s “big three” appliance makers, alongside Midea Group (SHE: 000333 / HKG: 0300 / FRA: 1520 / OTCMKTS: MGCOF) and Gree Electric Appliances Inc. of Zhuhai (SHE: 000651). Among them, Haier stands out as the leader in large appliances, holding the top position in sales volume for refrigerators and washing machines both in China and globally. Haier is also the most internationally focused of the three, with 60% of its sales coming from markets outside China.

So why Haier (and why now)?

🇨🇳 Miniso looks to spread the love for cute and collectible trinkets (Bamboo Works)

MINISO Group Holding (NYSE: MNSO)

The Chinese store chain is raising $550 million in convertible bonds to fund a deeper push into overseas markets, guided by an upbeat branding strategy

The proceeds from the equity-linked securities will be spent on expansion plans, brand promotion and share buybacks

The company’s international revenue has been growing fast, jumping 39.8% in the third quarter of last year

🇨🇳 Miniso Seems Poised For Further Upside (Seeking Alpha) $ 🗃️

🇨🇳 ANTA Sports: Bullish On Sales Outperformance And Capital Allocation Upside (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇨🇳 Lifestyle China (2136 HK): Thomas Lau Bumps, but the Offer Remains Light (Smartkarma) $

(“Fashionable Lifestyle” department stores + a commercial complex) Lifestyle China Group Ltd (HKG: 2136) disclosed a revised offer from Mr Thomas Lau at HK$0.98 per share, a 7.3% premium to the previous HK$0.913 offer. The offer has been declared final.

The bump was unsurprising. Crucially, the shares have traded above the revised offer on 20 of the 25 trading days since the previous offer was announced.

The revised offer remains light, and minorities remain unimpressed. The high AGM minority participation rates remain a vote risk. Head for the exit as the shares are trading at terms.

🇨🇳 Fu Shou Yuan (1448 HK): Another Special Dividend Proposal (Smartkarma) $

Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF)‘s share price rebound over the last two days may have well-reflected the special dividend proposal. It has, however, opened up the room for disappointment.

Assuming the same special DPS as last time, it is sitting on a 9% yield. The dividend sustainability is uncertain, and without this, it will be only 4.7% for FY25.

Earnings have been cut by 32.5% over the last six months on consumption downgrade. This near-term headwind will overshadow its long-term story.

🇨🇳 Foshan Haitian Flavouring & Food (603288 CH): Index Inclusion Post H-Share Listing (Smartkarma) $

🇨🇳 Henlius (2696 HK): Hurtling Towards a Likely Deal Break (Smartkarma) $

The vote on Fosun Pharma’s HK$24.60 offer for Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) is on 22 January. The gross spread has ballooned to 21.8%, which suggests a deal break.

I previously stated that LVC’s trading behaviour over the coming days will indicate its voting intentions. Unfortunately, this behaviour suggests a high likelihood of blocking the vote.

Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF) has two potential options to secure LVC’s backing: increase the share alternative cap or introduce a rollover option. Both have challenges and are, therefore, not viable options.

🇨🇳 Henlius (2696 HK): Musings on the Deal Break Price (Smartkarma) $

Fosun Pharma’s HK$24.60 offer for Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) is heading for a deal break. LVC has not changed its shareholding since amassing a blocking stake.

In the absence of a last-ditch effort by Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF) to rescue the deal, the key question is the potential deal break price.

Based on four methods, the potential deal break price is HK$17.28, 12% below the last close price of HK$19.58.

🇨🇳 WuXi Biologics sells vaccine plant as new U.S. law looms (Bamboo Works)

The Chinese drug services giant built an Irish factory to produce vaccines for Merck, but has now opted to sell the plant to the U.S.-based multinational for $500 million

Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) estimated that it stood to make just $55 million in profit from the vaccines site, far short of the expected return

Despite concern over a pending U.S. biosecurity law, the Chinese firm recently clinched two big deals with U.S. drug companies

🇨🇳 Legend Biotech Surges Amid Takeover Speculation—What’s Next for CARVYKTI? (Smartkarma) $

Legend Biotech (NASDAQ: LEGN) has been making headlines with its breakthrough CAR-T therapy, CARVYKTI, which has revolutionized the treatment of multiple myeloma.

This pioneering therapy, co commercialized with Johnson & Johnson, has achieved record-setting launches and boasts a significant survival benefit over standard treatments.

The company’s robust clinical pipeline, recent partnerships, and aggressive manufacturing expansions signal strong growth potential.

🇨🇳 Zhengye Biotech’s ‘pet-sized’ IPO leaves plenty of room for more fundraising (Bamboo Works)

The veterinary vaccine producer raised a modest $6.9 million in its New York listing by selling just 3% of its shares, as it diversifies into the household pets market

Zhengye Biotechnology Holding Ltd (NASDAQ: ZYBT) plans to use $6.9 million raised in its New York IPO to fund R&D and add new manufacturing capacity for its expansion into pet vaccines

Collapsing pork prices after China’s recent bout of African swine fever subsided hit the animal vaccine maker’s top and bottom lines, underlining the need for diversification

🇨🇳 Country Garden’s debt restructure hinges on stabilizing property market (Bamboo Works)

The debt-laden developer released two long-overdue financial reports last week after detailing a clearly defined debt restructuring plan

Country Garden (HKG: 2007 / OTCMKTS: CTRYF / OTCMKTS: CTRYY) revealed it lost 12.84 billion yuan in the first half of last year, as it released its long delayed interim report for 2024

The report showed the struggling developer’s total outstanding liabilities stood at 250.2 billion yuan at the end of last June

🇭🇰 PAX Global May Look Cheap, But There’s Little Momentum In The Business (Seeking Alpha) $ 🗃️

🇭🇰 Techtronic Industries: Anticipating Good Results With Tariff Fears Overblown (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q4 Preview: Focus On CoWoS And Gross Margin Guidance (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: My Top AI Pick For 2025 (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: A Pre-Earnings Evaluation (Technical Analysis) (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: A Growth Story That’s Still Undervalued (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Q4 2024 Earnings Outperformance: 3 Reasons To Buy Here (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Being Caught In The Crossfire Never Looked So Good — Reiterating Buy (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q4: Expecting Fabless Semi Inventory To Return To Healthier Level In 2025 (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q4 Earnings: An Exceptional Report (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: Strong Growth, Strong Outlook (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor’s Rich FY2025 Guidance Signals A Multi-Year Data Center Boom (Seeking Alpha) $ 🗃️

🇹🇼 TSMC profits from AI development, no matter which way political winds blow (Bamboo Works)

Despite being continually caught in tensions between the U.S. and China, the Taiwanese chipmaker’s latest results demonstrate its prowess as an AI powerhouse

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) reported revenue of $26.88 billion in the fourth quarter of 2024, up 38.8% year-on-year, fueled by strong demand for its cutting-edge chips

The company plans to increase capital spending to a new high of up to $42 billion this year as it seeks to maintain its position as the world’s leading contract chipmaker

🇹🇼 TSMC: Undisruptable And Undervalued! (Capitalist Letters)

🇰🇷 Align Partners Goes Activist on Coway (Douglas Research Insights) $

After the market close on 16 January, it was reported that Align Partners started to go activist on (household appliances maker) Coway (KRX: 021240).

Align Partners sent a public letter to Coway demanding improvements to shareholder returns and measures to enhance the independence of the board of directors.

The combination of higher shareholder returns, low valuations, and Align Partners putting further activist pressure are likely to lead to continued outperformance of Coway relative to KOSPI this year.

🇰🇷 LS Electric: Increasing Supplies for Distribution Board Components to Elon Musk’s XAI Data Centers (Seeking Alpha) $ 🗃️

LS Electric Co Ltd (KRX: 010120), one of the major power equipment providers in Korea, became a new supplier of distribution board components to Elon Musk’s xAI data centers in Memphis, Tennessee.

Some of the major electric utilities and other companies in the US have been reluctant to use electrical equipment products from China due to quality and security concerns.

Therefore, leading Korean companies such as LS Electric have been beneficiary of receiving more orders from the major US electrical utilities and other major companies in the US.

🇰🇷 Samsung: Now In Deep Value Territory (Seeking Alpha) $ 🗃️

🇰🇷 Samsung Electronics: Trading Strategy Post Another Inheritance Tax Sale (Douglas Research Insights) $

One of the biggest risk factors on Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) and other Samsung Group affiliates in the past several years has been the huge inheritance tax payments by the Lee family.

Despite the weak share price performances of the four major Samsung Group affiliates, their consolidated equity increased by 31.4% on average from end of 2019 to end of 3Q 2024.

Once Lee family pays off the fifth installment in 2025, the market could look upon this situation more favorably due to reduced overhang associated with additional future inheritance tax payments.

🇰🇷 Samsung Electronics: Revamping Executive Compensation to Include Stocks – Benchmarking TSMC (Douglas Research Insights) $

Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) announced that it will revamp its executive compensation system to include treasury shares as incentives. Samsung has benchmarked TSMC in terms of paying treasury shares to its employees.

Samsung Electronics’ decision to revamp its executive compensation system to include treasury shares as incentives aligns the interests of the shareholders along with the company’s management.

Now that Samsung Electronics has incorporated stock based incentive system, it is likely that other Korean companies that could follow suit.

🇰🇷 Dongbang Medical IPO Preview (Douglas Research Insights) $

Dongbang Medical is getting ready to complete its IPO in Korea in February 2025. The IPO price range is from 9,000 won to 10,500 won.

According to the bankers’ valuation, the expected market cap of the comps ranges from 191 billion won to 223 billion won.

Dongbang Medical specializes in the manufacturing and distribution of acupuncture needles, various cosmetic devices, and other medical devices.

🇰🇷 LG CNS IPO Book Building Results Analysis (Douglas Research Insights) $

(Digital Transformation (DX) Specialist and Digital Business Innovator) LG CNS reported a successful IPO book building results analysis. The IPO price has been finalized at 61,900 won per share (high end of the IPO price range).

The demand ratio from the institutional investors was 114 to 1. At the IPO price of 61,900 won, the expected market cap will be 6 trillion won.

According to our valuation analysis, it suggests a base case target price of 76,383 won per share, which represents a 23% upside from the IPO price of 61,900 won.

🇲🇾 Malaysia US$122mln tourism promo aids Genting: Maybank (GGRAsia)

(Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) / Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF))

Malaysia’s “eye-watering” tourism promotion budget of MYR550 million (US$122.1 million) included in the tabling of the government’s 2025 budget, could quickly support consumer sentiment for the country’s casino monopoly, says Maybank Investment Bank Bhd.

That is despite the money being earmarked for Visit Malaysia Year 2026. “History tells us that Malaysian tourism industry upcycles begin not during Visit Malaysia Years but the years preceding them,” observed analyst Samuel Yin Shao Yang in a Wednesday note.

“We forecast 25.2 million and 25.7 million Resorts World Genting visitor arrivals for 2025 and 2026,” respectively, he stated.

🇸🇬 Grab Holdings Remain Expensive Following Recent Correction – Return Profile Uncertain (Seeking Alpha) $ 🗃️

🇸🇬 Data Shows Grab Holdings Attained Strong Moat But Not Competitively Priced (Seeking Alpha) $ 🗃️

🇸🇬 Karooooo Ltd.’s Q3 Earnings Highlight SaaS Strength, But Valuation Stretches (Seeking Alpha) $ 🗃️

-

🇸🇬 Karooooo (NASDAQ: KARO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 Singapore Exchange: Changes Are Coming (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇸🇬 3 Shipping Companies That Posted Robust Earnings: Are They Screaming Buys? (The Smart Investor)

🇸🇬 SATS’ Share Price Soared 32% in 2024: Can the Ground Handler Keep Up This Momentum? (The Smart Investor)

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) is one of the blue-chip stocks that performed much better than the index.

The airline ground handler saw its share price climb 32.4% to end the year at S$3.64.

Investors may be wondering if the food caterer can pull off a similar performance this year. Let’s find out.

A solid performance for fiscal 2024

A good start to fiscal 2025

Clear skies ahead

Encouraging business developments

Get Smart: Revenue and profits taking flight

🇸🇬 DBS’s Share Price Hit an All-Time High Above S$45: What’s Next for Singapore’s Largest Bank? (The Smart Investor)

2025 has just arrived, and DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) is already setting new records.

Singapore’s largest bank saw its share price surpass the S$45 level for the first time, closing at S$45.44 on 8 January.

DBS produced a stellar performance last year that saw its share price surge nearly 44% to close at S$43.72.

Investors may be wondering though: what’s next for the lender, and can it pull off a similar feat this year?

A record-high net profit

“Higher for longer” interest rates

Good prospects for non-interest income

Excess capital = higher dividends?

A recent catalyst

Get Smart: A bright outlook

🇮🇳 The Beat Ideas: Apcotex Industries Ltd, Beaten Down Value Pick (Smartkarma) $

Apcotex Industries (NSE: APCOTEXIND / BOM: 523694) promoted by Ex-Asian Paints Ltd (NSE: ASIANPAINT / BOM: 500820) MD Mr. Atul Choksey, is a leading manufacturer of synthetic rubber and latex in India.

Despite achieving record sales volume in H1 FY25, Apcotex experienced a decline in EBITDA margins due to RM pricing and Chinese competition.

Apcotex Industries (APCO IN) is at its worst possible margins and applied for anti-dumping duty for its product.

🇮🇳 Hyundai Motor India: Anchor Investor Lock-In Period Ends Today (Smartkarma) $

Lock up expiry today of 21.2 million shares held by Hyundai Motor India (NSE: HYUNDAI / BOM: 544274)‘s anchor investors. This could improve free float to 17.5% with rest held by the parent.

Hyundai India Management is positive about its CY2025 outlook and expects to grow by similar numbers or more in 2025 as it did in 2024.

Creta Electric’s launch is scheduled on Jan 17th; Hyundai hopes to replicate the growth and excitement seen with its original Creta model.

🇮🇳 The Beat Ideas: Allied Blenders & Distillers- Liquor Premiumization Play (Smartkarma) $

Allied Blenders & Distillers (NSE: ABDL / BOM: 544203) is shifting from mass-market spirits to premium offerings, leveraging IPO funds to reduce debt and boost margins amidst rising alco-beverage demand.

This pivot could enhance profitability, thanks to stronger pricing power, higher brand recall, and sustained ROCE above capital costs within India’s highly regulated but fast-growing alcoholic beverage industry.

Despite regulatory hurdles and stretched valuations, ABD’s balance sheet cleanup, premiumization strategy, and dominant mass-market presence suggest considerable long-term potential in India’s expanding alcohol sector.

🇮🇳 Forensic Analysis: Kalyan Jewellers on Allegations and Rumours ~ Cause And Reality (Smartkarma) $

Steep decline in the stock price triggered a wave of speculation and rumours, further fueling the negative sentiment surrounding Kalyan Jewellers India Ltd (NSE: KALYANKJIL / BOM: 543278).

The rumours ranged from serious allegations of inventory overvaluation and IT raids to concerns about changes in franchisee agreements and even accusations of bribery.

While Kalyan Jewellers (KALYANKJ IN) has dismissed the overvaluation allegations, its inventory turnover ratio (ITR) has consistently lagged behind the industry leader Titan Company (NSE: TITAN / BOM: 500114).

🇮🇳 Kalyan Jewellers: Rumour-Driven Stock Slide, F&O Ban—Is There Room for Further Correction? (Smartkarma) $

Kalyan Jewellers India Ltd (NSE: KALYANKJIL / BOM: 543278) stock has dropped 36% year-to-date and is now under an F&O ban after open interest hit threshold limits.

The rumours driving the stock decline lack financial or strategic relevance with no substantial reason for long-term investors to panic.

The stock correction has realigned Kalyan’s P/E discount to Titan Company (NSE: TITAN / BOM: 500114), with current levels likely to stabilise and thus provide a near term support for Kalyan Jeweller’s stock price.

🇮🇳 Infosys Ltd.: Share Price Drop Represents An Attractive Entry Point (Seeking Alpha) $ 🗃️

🇮🇳 Monthly Sales Overview of Listed Indian Passenger Vehicle Companies (Smartkarma) $

The Passenger vehicle (PV) segment (cars, utility vehicles, vans) recorded strong wholesale volume in December 2024.

Growth was driven by low dealer inventory post the Diwali festive season , low base last year and year end discounts by manufacturers.

Maruti Suzuki (NSE: MARUTI / BOM: 532500) led with 30% YoY growth. Mahindra & Mahindra (NSE: M&M / BOM: 500520 / OTCMKTS: MAHMF) reported 18% YoY growth. Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) showed modest performance with 1.4% YoY growth.

🇮🇳 Monthly Sales Overview of Listed Indian Commercial Vehicle Companies (Smartkarma) $

The 9M FY2025 sales volume of commercial vehicle(CV) companies have been soft due to the elections, uneven monsoon and slow capital expenditure.

In December2024, sales showed varied performance across major players. Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) saw slight YoY decline, while Ashok Leyland (NSE: ASHOKLEY / BOM: 500477) & Eicher Motors (NSE: EICHERMOT / BOM: 505200) experienced growth in exports.

A recovery in sales is expected in Q4 FY2025 due to improved freight movement, resumption of construction and mining activities, and renewed government spending on infrastructural projects.

🇮🇳 Event Driven: Shankara Building Products, A Demerger Play (Smartkarma) $

Shankara Building Products Ltd (NSE: SHANKARA / BOM: 540425) plans to demerge its steel manufacturing and building materials marketplace, enabling each business to operate independently with tailored leadership and capital allocation strategies.

This separation allows for targeted expansions in non-steel product lines and dedicated manufacturing improvements, potentially raising margins and fueling profitable growth in India’s booming construction market.

Focused leadership, improved transparency, and strategic capital deployment could enhance investor confidence, offering significant upside as Shankara refocuses on high-growth segments and streamlines its operations post-demerger.

🇮🇳 Tata Consulting Services (TCS) (Long-term Investing)

Q3 FY 2025 Results

Tata Consultancy Services (NSE: TCS / BOM: 532540) is India’s largest (Market Cap $178bn) IT Enabled Services (ITES) companies. We discussed the sector before and that report can be found here. We also wrote about two of their competitors Accenture (ACN) and Infosys (INFY) recently and that report can be found here.

TCS is listed in India. Only Indian Residents, Non-Resident Indians (NRIs) and Foreign Portfolio Investors (FPIs) registered with the local regulator can invest in the Indian stocks. However, it is still worth looking at the TCS Results to see what insights it can give for stocks like CAN, INFY, CTSH and EPAM.

🇰🇿 Kaspi: A High-Quality Technology Business Trading On A Dirt Cheap Multiple (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇮🇱 El Al Airlines Stock: Very High Risk And Very High Reward Potential (Seeking Alpha) $ 🗃️

🇮🇱 A Quick Take on Mobilicom (Shareholdersunite Essentials)

Appealing risk/reward

Mobilicom (NASDAQ: MOB) is an Israeli company producing hardware and software solutions for drones and other ‘uncrewed’ devices like robots.

We introduced the company in our extensive primer, here we summarize and consider reasons for investing in the company.

🇿🇦 Pan African Resources: The Overlooked Jewel In Africa’s Mining Crown (Seeking Alpha) $ 🗃️

🇿🇦 Gold Fields: A Tough 2024 On Back Of Salares Norte Setback (Seeking Alpha) $ 🗃️

-

🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🇵🇱 We found a promising Polish compounder (The Dutch Investors)

After Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) and Auto Partner SA (WSE: APR / FRA: 6KF), we might have found another fast-growing Polish businesses with net margins of over 50% and ROIC of over 100%.

We just released our premium fundamental analysis of Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) in both audio and text on www.thedutchinvestors.com. And what a promising and interesting company!

Text S.A. is a Polish small-cap operating in the live chat technology industry. The company is led by its three original founders, who remain actively involved. The company has returned a solid 13% CAGR since it’s IPO back in 2014.

To give you an idea of what they do. You’ll find a ‘Chat with us’ icon on almost every website these days. It was designed to enhance the customer experience and improve customer service. This is partly what Text SA offers as well.

🇵🇱 Tarczynski S.A. (Quality Value Investing Substack)

Polish meat producer with 33% ROE trading at 9x P/E.

Tarczynski (WSE: TAR) is an innovative Polish producer of meat products, with ca PLN2bn in revenue (ca €450m). The Company offers a range of ca 300 meat and sausage products, and is notably the leader in the pre-packed kabanos category in the premium segment, with a market share of >70%. Kabanos are traditional Polish sausages that are thin, dry and can be eaten as a snack or appetizer. The Company was founded in 1989 and has grown rapidly since then, with a focus on strong branding and premium products. Its conveniently packaged products are sold in the snack aisle as opposed to the meat counter, and are at higher price points than competition, but still affordable.

🇬🇷 #69 Jumbo S.A. (Kroker Equity Research)

Greek retailer

I’ve been wanting to write this post about Jumbo Anonymi Etairia (ASE: BABr / FRA: 5JB / 5JB1 / OTCMKTS: JUMSF) for quite some time. I invested in the stock a few months ago and have grown to appreciate the business and its strategy. However, it’s important to note that Jumbo is a small-cap stock based in Greece, with relatively low liquidity.

Jumbo S.A. (Ticker: BELA) is a leading retail company based in Greece, renowned for its extensive range of products, including toys, household goods, stationery, seasonal items, and various low-cost offerings. The company operates 85 stores across Greece, Cyprus, Bulgaria, and Romania as of the end of 2023, and has further expanded internationally through franchise agreements, adding 36 stores in non-EU countries such as Albania, Kosovo, Serbia, North Macedonia, Bosnia, Montenegro, and Israel.

🌎 My Biggest Investment For 2025: Patria Investments (Seeking Alpha) $ 🗃️

-

🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds.

🌎 MercadoLibre: Numerous Macro Headwinds (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌎 I Bought This High-Quality Compounder! (FluentInQuality)

In the last five years, this company (MercadoLibre (NASDAQ: MELI)) grew its share price by 22.01%, with an estimated long-term EPS growth of roughly 24%, and a 10-year revenue CAGR of a whopping 40%.

I came across this excellent business a while back, but it was too expensive to buy into the company. After following its earning calls for a while, reading its shareholder letter, and finally putting in more effort to truly understand the business, I pulled the trigger. It is still not cheap today, but it is cheap enough for my liking compared to the required return rate that I’m looking for.

🇧🇷 Ambev: Battered And Bruised By Currency And Margin Headwinds (Seeking Alpha) $ 🗃️

🇧🇷 Double-Digit Dividend Yield: Why Vale Stands Out (Seeking Alpha) $ 🗃️

🇧🇷 Vale: In LATAM, The Political Context Matters (Seeking Alpha) $ 🗃️

-

🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 B3: Risks Stand Out (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: A Rare Buying Opportunity (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Why Braskem’s Stock Breakout Signals A Strong Buy Opportunity (Seeking Alpha) $ 🗃️

🇧🇷 Bradesco: Betting On A Slow But Steady Turnaround (Seeking Alpha) $ 🗃️

🇧🇷 CI&T Restarts Headcount Growth As Demand Improves (Upgrade) (Seeking Alpha) $ 🗃️ (?)

🇲🇽 Coca-Cola FEMSA: Solid Value Hiding In Plain Sight (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Sureste: The Colombian Airports Are Gaining Altitude (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇵🇪 Auna S.A. (AUNA): Unlocking Potential in Latin American Healthcare (Safe Harbor Stocks)

Leading high-complexity care and oncology in Spanish-Speaking Latin America (SSLA)

This deep dive into Auna SA (NYSE: AUNA) is more comprehensive than my usual posts, delving into the complexities of its markets, financial strategy, and growth trajectory. While the analysis is detailed, it’s tailored for advanced investors who seek to understand not just the numbers but the strategic underpinnings that make Auna a compelling investment. If you’re up for exploring the nuances of this high-growth healthcare company, read on—you may find insights to fuel your portfolio.

🌐 Nebius: An Emerging Leader In The AI Infrastructure Space (Seeking Alpha) $ 🗃️

🌐 Nebius: Strong R&D And Technology Legacy Applied To New Growth Markets (Seeking Alpha) $ 🗃️

🌐 Nebius Group: This AI Infrastructure Stock Could Be A No-Brainer (Seeking Alpha) $ 🗃️

🌐 Nebius Group: A Hidden AI Gem At A Reasonable Price (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Glencore: M&A In 2025 Could Ignite This Stock (Seeking Alpha) $ 🗃️

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 China can outfox Trump’s tariffs (FT) $ 🗃️

🇨🇳 Temu and Shein Face Challenges as Countries Tighten Rules for Small Package Imports (Caixin) $

Chinese e-commerce platforms such as Temu and Shein are facing new challenges in delivering low-priced products from China to international markets, as countries including the United States enforce stricter regulations on small package imports.

On Jan. 11, U.S. Customs and Border Protection (CBP) introduced new rules targeting shipments sent to the same recipient via different channels on the same day or declared for import, if their total value exceeds $800.

🇨🇳 In Depth: China’s Booming Cross-Border E-Commerce Pits Alipay, WeChat Pay Against the World (Caixin) $

The explosion in China’s cross-border e-commerce fueled by online platforms such as Temu, Shein and Amazon, as well as flourishing international tourism, has led to a boom in business for companies that process and settle international payments.

But it’s become a headache for financial watchdogs and banks who are increasingly worried that the current system lacks transparency on cost and the origin of transactions, and increases the potential for fraud and money laundering. As nonbank payment service providers (PSPs) like Alipay and WeChat Pay transform the landscape of cross-border payments with a one-stop shop for services for merchants that is cheaper and more efficient, they are also taking business away from the country’s commercial banks that have traditionally dominated the sector.

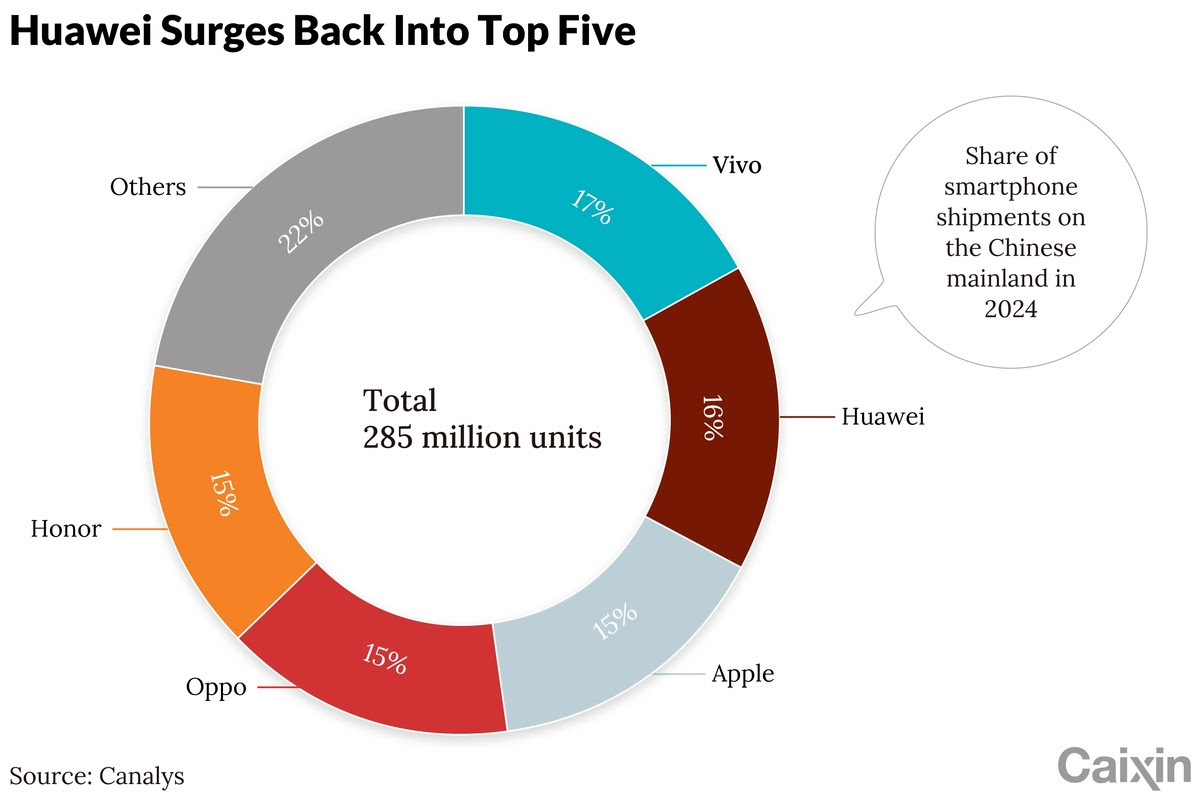

🇨🇳 Chart of the Day: Huawei’s Smartphone Comeback in China (Caixin) $

Huawei Technologies Co. Ltd. was China’s fastest growing major smartphone brand last year, riding a wave of momentum as the country’s market began to grow after two years of decline.

Huawei shipped 46 million smartphones on the Chinese mainland in 2024, which put it in the No. 2 spot nationally with a 16% market share, according to a report published by Canalys on Thursday. Its 37% year-on-year shipment growth was greater than any of the other brands in the top five, three of which saw their shipments contract.

🇨🇳 In Depth: Why China’s Banks Are Stock Market Darlings — for Now (Caixin) $

Investors in China’s mainland stock market made a beeline for bank stocks last year, making the sector the market’s top performer despite the country’s sluggish economy, a slowdown in loan growth, and concerns about a deterioration in asset quality.

The reason? Dividends. Banks doled out cash payments to shareholders like confetti. And with their valuations hovering at close to record lows, the yields were among the most attractive in the market and double or triple those on Chinese government bonds (CGBs).

🇰🇷 Martial law and Trump: political shocks add to South Korea’s economic woes (FT) $ 🗃️

🇰🇷 The Launch of the KRX TMI (Total Market Index) – Korea’s TOPIX Index (Douglas Research Insights) $

Korea Exchange disclosed the new KRX TMI (Total Market Index) on 13 January. This is a market index that consists of eligible stocks in the entire KOSPI and KOSDAQ markets.

The KRX TMI index is similar to Japan’s TOPIX index. The KRX TMI index is calculated by adopting a free-float market capitalization weighting method.

We provide a list of 20 companies in KOSDAQ that could benefit from the launch of the KRX TMI index.

🇰🇷 President Yoon’s Approval Ratings Surges to 47%, Gets Arrested, and Declares Rampant Election Fraud (Douglas Research Insights) $

Yoon Suk-Yeol became the first sitting South Korean President to be arrested.

A recent local poll showed that President Yoon’s approval rating surged to 46.6%.

President Yoon released a letter to the Korean people. The heart of the letter is about the rampant election fraud in Korea and the desperate need to restore election integrity.

🇰🇭 Local punters tighten grip on Cambodia stock market (The Asset) 🗃️

Securities exchange expects at least six new listings and first ETFs this year

Cambodia Securities Exchange ( CSX ) says average daily trading values in 2024 shrank 35% from a year earlier, although the number of new trading accounts climbed to 12,745, up from 11,890 in 2023.

“There has been a noticeable increase gradually in local investor participation,” says an annual market review released on January 13.

CSX, a joint venture between the Ministry of Economy and Finance and Korea Exchange, says local investors accounted for 93% of trading volume last year, up from 86% in the previous year.

🇮🇩 🇵🇭 Indonesia’s Pertamina buys Citicore stake for US$115 million (The Asset) 🗃️

Philippines ranks second to India as most attractive emerging market for renewable energy investment

PT Pertamina Power Indonesia ( Pertamina New & Renewable Energy or Pertamina NRE ), a subsidiary of state-owned enterprise Pertamina, has made its first foray into the Philippine renewable energy sector, with a 6.69 billion peso ( US$115 million ) investment in Philippine pure-play renewable energy company Citicore Renewable Energy Corporation ( CREC ).

🇹🇭 More work once Thai casino bill passes: commentators (GGRAsia)

A number of voices in the Thai business sector has expressed support for the country’s plan for entertainment complexes each with a casino, adding that careful work was still needed prior to implementation. The remarks came after it was reported on Monday that the Thai cabinet had approved in principle the Entertainment Complex Bill.

🇹🇭 Chinese tourists avoid Thailand after actor’s kidnapping (Caixin) $

More Chinese travelers are avoiding Thailand after the recent kidnapping of a Chinese actor raised safety concerns about the country.

On Jan. 5, a social media post revealed that Wang Xing, a minor Chinese actor, went missing in a northwestern Thai town near the Myanmar border after traveling to Thailand for a casting session. He was forcibly taken across a river into Myanmar, where he was coerced into learning scamming techniques. Wang was rescued on Jan. 7 in a joint operation by Thai and Myanmar authorities, who identified him as a victim of human trafficking

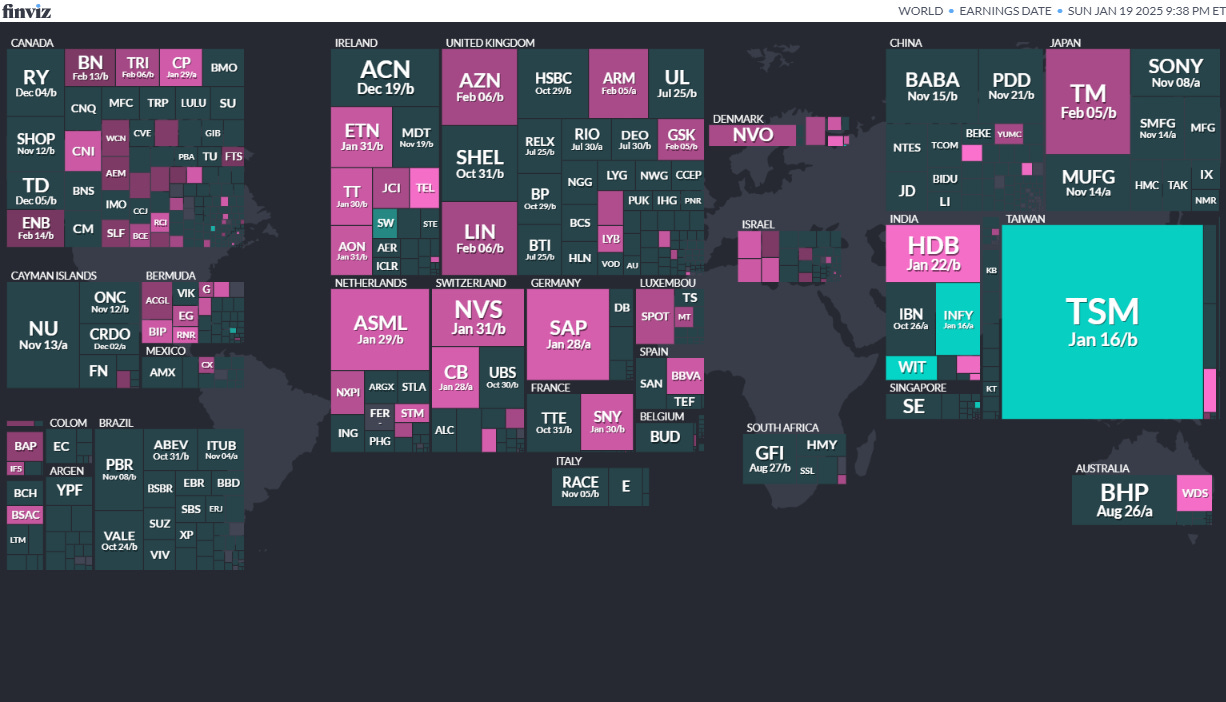

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

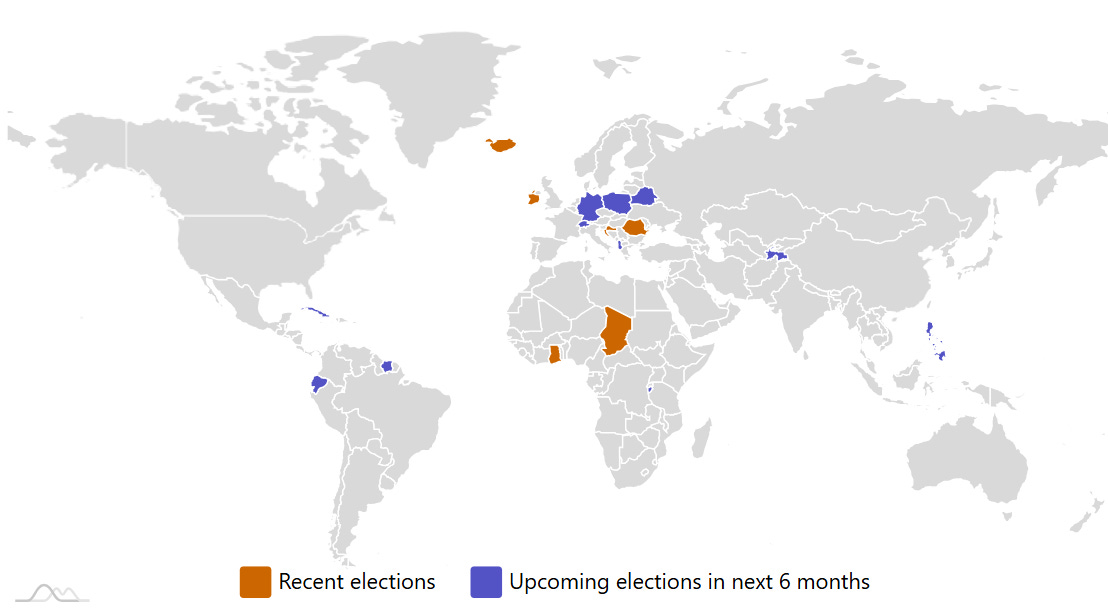

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

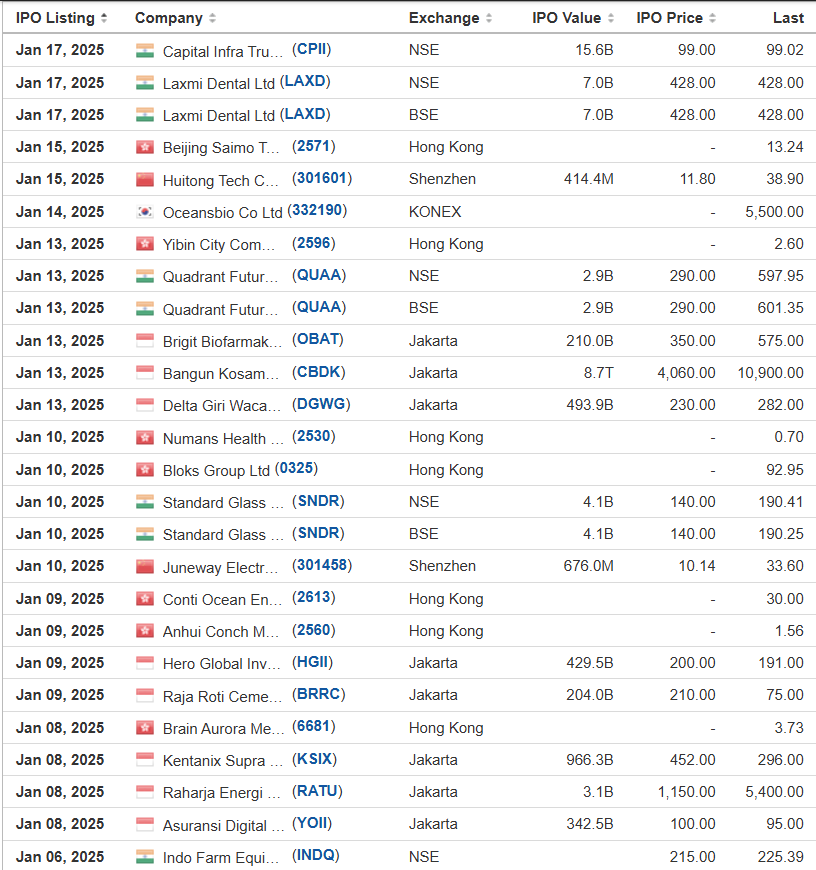

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Uni-Fuels Holdings Limited UFG R.F. Lafferty & Co., 2.1M Shares, $4.00-4.00, $8.4 mil, 1/14/2025 Priced

We are a service provider of marine fuels solutions, headquartered in Singapore. (Incorporated in the Cayman Islands)

We market, resell and broker marine fuels products such as very low sulfur fuel oil (“VLSFO”), high sulfur fuel oil (“HSFO”), and marine gas oil (“MGO”). We offer these products to shipping companies and marine fuels suppliers worldwide in-port and offshore. In addition, we may from time to time provide shipping related services to our customers including but not limited to the arrangement of ship agents, ship provisions and marine fuels surveyors. We provide value to our customers by leveraging on our global supply network and market solutions facilitated by our integrated capabilities.

We operate an integrated business model where we serve our customers through two operating models, sales of marine fuels solutions and brokerage (i.e. acting as intermediary between marine fuels suppliers and customers for a commission). In the sales model, we control and manage the customer relationship throughout the entire transaction and provide value-added solutions such as trade credit, financing, risk management, market intelligence and operational expertise. In the broker model, we refer the customer to a third-party supplier in exchange for a brokerage fee. In a sales transaction, we manage and guarantee the supply of marine fuels to the customer while we procure the marine fuel, including its delivery, from a third-party supplier. In a brokerage transaction, the third-party supplier will manage and guarantee the supply of marine fuels to the customer.

During the two years ended Dec. 31, 2023, we have arranged for marine fuel supply (under both our reselling and brokerage business) at 103 geographical ports worldwide, of which 35.9% of the supplies were carried out in South East Asia, 27.2% in North East Asia, 8.7% in South Asia, 8.7% in North America, 7.8% in Europe, 3.9% in South America, 3.9% in Middle East, 2.9% in Africa and 1.0% in Central America.

During the two years ended Dec. 31, 2023, we have arranged for marine fuel supply to 88 customers, of which 77.3% are based in South East Asia, 15.9% in North East Asia, 4.6% in Europe and 2.3% in Middle East. Our customers are mainly shipping companies operating in market sectors such as bulk, tanker, offshore, container, general cargo, tug and barge, car carrier, cruise, yacht and dredging. Our customers also include other marine fuel suppliers operating in similar capacity as our Group.

Our Industry

Marine fuels supply, also commonly known as bunkering, is the process of supplying marine fuels products to ships. Bunkering is an essential aspect of the shipping industry that ensures a ship has the necessary fuel to operate at sea. Marine fuels supply is a fuel logistics business that operates within the broader framework of the maritime transportation sector. The supply of marine fuels plays a vital role is facilitating global trade by providing marine fuels to ships trading around the world. It is an industry that is closely influenced by factors such as global trade volumes, economic growth, shifting trade patterns, and regulatory changes that govern the marine fuels industry.

Marine fuel, also commonly known as bunker fuel(s) or bunker(s), refers to fuel consumed by ship engines. The process of supplying marine fuels is most frequently delivered by bunker barges to the receiving vessels. The supply of marine fuels can also be delivered by road trucks and less frequently by pipelines at berths.

The marine fuels industry comprises a diverse range of stakeholders, ranging from marine fuels suppliers and shipping companies to port authorities and regulatory bodies. The supply chain infrastructure of the marine fuels industry includes refineries, oil tankers, storage terminal, and bunker barges.

The commercial participants in the marine fuels supply ecosystem generally include the following parties: (1) physical distributors, (2) resellers, and (3) brokers.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended June 30, 2024.

(Note: Uni-Fuels Holdings Limited priced its micro-cap IPO of 2.1 million shares at $4.00 per share – in sync with the terms in its prospectus – to raise $8.4 million on Monday night, Jan. 13, 2025.)

(Note: Uni-Fuels Holdings Limited cut its IPO’s size and price to 2.1 million shares – down from 3.0 million shares initially – at $4.00 – the low end of its previous price range of $4.00 to $5.00 – to raise $8.4 million, according to an F-1/A filing dated Nov. 27, 2024.)

(Note: Uni-Fuels Holdings Limited filed its F-1 on Oct. 25, 2024, and disclosed the terms for its IPO: 3.0 million shares at a price range of $4.00 to $5.00 to raise $13.5 million. Background: Uni-Fuels Holdings Limited filed confidential IPO documents with the SEC on May 3, 2024.)

Hong Kong Pharma Digital Technology Holdings Limited HKPD Bancroft Capital/Eddid Securities USA, 1.5M Shares, $4.00-4.00, $6.0 mil, 1/15/2025 Priced

We are a holding company. (Incorporated in the Cayman Islands)

Our Hong Kong subsidiaries are active in two main categories: (i) OTC pharmaceutical cross-border e-commerce supply chain services, primarily conducted through our Hong Kong subsidiary, Joint Cross Border, which we refer to as the “Supply Chain Services” division and (ii) OTC pharmaceutical cross-border procurement and distribution, primarily conducted through our Hong Kong subsidiary, V-Alliance, which we refer to as the “Procurement and Distribution” division.

Based in Hong Kong, Joint Cross Border has established itself as a leading provider of third-party supply chain services in Mainland China’s OTC pharmaceutical cross-border e-commerce market. According to the Frost & Sullivan Report, we ranked first in this sector by revenue in 2022.

Through our engagement with OTC pharmaceutical suppliers, logistics companies, and merchants who operate stores on Chinese e-commerce platforms, Joint Cross Border offers a convenient one-stop solution for Mainland Chinese customers who wish to access OTC pharmaceutical products outside Mainland China. Joint Cross Border’s offering includes a comprehensive array of services such as pre-consultation, product information review, procuring overseas OTC pharmaceutical products, enlisting OTC pharmaceutical products to the Hong Kong Department of Health (“HKDOH”), obtaining import and export permits and clearances, storing products at warehouses, packaging, and arranging for logistics and end-to-end delivery services for consumers.

Note: Net income and revenue are for the fiscal year that ended March 31, 2024.

(Note: Hong Kong Pharma Digital Technology Holdings Limited priced its small-cap IPO on Jan. 14, 2025, at $4.00 – the low end of its $4.00-to-$6.00 price range – and sold 1.5 million shares – the number of shares in the prospectus – to raise $6.0 million on Tuesday, Jan. 14, 2025. Hong Kong Pharma Digital Technology Holdings’ stock is expected to start trading on Wednesday, Jan. 15, 2025, on the NASDAQ.)

(Note: Hong Kong Pharma Digital Technology Holdings Limited filed its F-1 for its IPO on Oct. 29, 2024, and disclosed the terms: 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million. Background: Hong Kong Pharma Digital Technology submitted confidential IPO documents to the SEC on March 29, 2024.)

Diginex Ltd. DGNX Dominari Securities/ Revere Securities, 2.3M Shares, $4.00-6.00, $11.3 mil, 1/20/2025 Week of

(Incorporated in the Cayman Islands)

DSL is the wholly owned subsidiary of Diginex Limited. Accordingly, Diginex Limited owns 100% of DSL and all of DSL’s business lines and subsidiaries.

DSL is an impact technology business that helps organizations to address the some of the most pressing Environmental, Social and Governance (“ESG”), climate and sustainability issues, utilizing blockchain, machine learning and data analysis technology to lead change and increase transparency in corporate social responsibility and climate action. Our products and services solutions enable companies to collect, evaluate and share sustainability data through easy-to-use software. The Group’s principal executive office is in Hong Kong where the CEO, CFO and CTO are based. The Hong Kong office is in a co-working shared space facility with 9 seats and the Hong Kong based employees operate under a hybrid model as they work both from the office and from home with the majority of working hours spent working from home. There is also an executive office in Monaco that is used by the Chairman and COO. DSL has subsidiaries in the United Kingdom and United States, however the subsidiary in the United States is inactive. DSL also outsources a component of IT development and maintenance support to engineers in Vietnam.

Our customers include Coca-Cola, HSBC, Unilever and Reckitt, whose brands include Woolite.

DSL has built several accessible, affordable and intelligent products to help democratize sustainability and offers multiple supporting services to complement the product suite.

DSL’s suite of products includes the following:

digninexESG: is an accredited Hong Kong Monetary Authority award winning cloud based ESG platform that offers end to end reporting from topic discovery, data collection to collaborative report publishing. Our diginexESG platform is ISO-27001 Certified (an international standard to manage information security), official partner of Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), World Economic Forum and signatory of the United Nations Principles of Responsible Investment (UN PRI).

The diginexESG platform guides companies through the entire ESG journey; from materiality assessment & stakeholder engagement, framework & indicator selection, the data collection and collaboration process, report creation, validation and ultimately report publishing. By leveraging machine learning and data analytics, diginexESG is able to drive material efficiencies in the reporting process, and the blockchain-enabled audit trail, whereby a record of each data activity is created and stored on a blockchain, provides greater transparency in the data thus increasing its value. Originally targeted specially at Small and Medium Sized Enterprises (SMEs) around the world who are new to ESG reporting and lack the budget or bandwidth to engage with traditional and often expensive consultants, diginexESG has increased its feature set to include functionality that also targets larger companies with more complex organizational structures. diginexESG has also been adopted by global commercial banks like HSBC to help engage with their diverse customer base at scale.

diginexLUMEN: allows companies to execute comprehensive supply chain risk assessments about working conditions within the supply chain. Supplier information is validated against worker feedback and automated risk calculations enables companies to prioritize issues for mitigation and prevention of adverse impacts and improvement efforts.

diginexLUMEN focuses on broad data collection through complex inter-jurisdictional supply chains with a specific focus on social governance issues such as forced labor due diligence, gender risk and child labor risk. Through the collection of data from suppliers and validation by workers, diginexLUMEN relies on proprietary algorithms to generate risk scores to help companies identify which parts of their supply chain require greater scrutiny. The platform then auto-generates corrective action plans which allow the brands and suppliers to work together to remedy potentially problematic areas and reduce the risk score.

diginexAPPRISE: is a multilingual application that collects standardized, actionable data related to working conditions directly from workers in global supply chains. Through tailored question sets, companies can deploy surveys directly to workers in their supply chain on a variety of topics such as responsible recruitment, gender equality and pulse check living and working conditions. The worker voice tool was initially developed by the United Nations University Institute in Macau (UNU-IIST) in partnership with The Mekong Club – an organization working with the private sector to bring about sustainable practices against modern slavery, and was acquired by DSL on December 14, 2021.

diginexAPPRISE is available both as a standalone tool and also fully integrated into diginexLUMEN.

diginexCLIMATE: is a proprietary carbon footprint calculator based on the GHG protocols that is currently available as an integrated part of the diginexESG platform. This allows companies to seamlessly calculate their Scope 1, 2 and 3 carbon footprint as part of their overall ESG reporting journey. Scope 1 are those direct emissions that are owned or controlled by a company, whereas scopes 2 and 3 indirect emissions are the result of the activities of the company but occur from sources not owned or controlled by it.

DSL also offers the following complementary services:

diginexADVISORY: is a service offered by DSL as a complement to the suite of DSL software license sales. diginexADVISORY provides clients strategy and advisory support at every stage of the sustainability journey, including assurance solutions for credible reporting. We also offer custom framework creation for clients who need more complex reporting templates or who want to set a benchmark for others in their industry. As part of diginexADVISORY we also develop and run one-off or programmatic training sessions covering a range of topics from a general introduction to ESG to complex carbon accounting and emissions.

diginexPARTNERS: is a service whereby DSL develops white label versions of both diginexESG and diginexLUMEN for companies who then want to run either diginexESG or diginexLUMEN as an extension of their own service offering. This service often requires custom technology work up front for our clients that generates initial revenue as well as ongoing service and maintenance licenses which generate ongoing recurring revenue.

In addition, DSL develops custom software platforms as part of a project consortiums for organizations like the United States Department of State, United States Department of Labor, and the United Nations.

diginexMANAGEDSERVICES: is service to be offered by DSL to provide oversight and support to clients in operationalizing the rollout of our software products within their organizational structure or supplier base. This service can include training and education, onboarding, data collection and analysis, as well as general on-going support. We will be offering this kind of vertical integration as a service from 2024 onwards and expect it to become an important part of our overall product and service offering.

As of June 2024, DSL has a current headcount of 30, among which 21 are employees in Hong Kong and United Kingdom and 9 are contractors based in France, Germany, Spain, USA, Canada, Dubai, Mexico and Australia.

Note: Net loss and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: Diginex Ltd. filed its F-1 for its IPO on Sept. 11, 2024, and disclosed the terms – 2.25 million shares at a price range of $4.00 to $6.00 to raise $11.25 million. Background: Diginex submitted confidential IPO documents to the SEC on Feb. 12, 2024.)

LZ Technology Holdings LZMH Benjamin Securities/ D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 1/20/2025 Week of

We are a holding company whose operating subsidiaries provide advertising services in China. (Incorporated in the Cayman Islands)

The Company is an information technology and advertising company. Its operations are organized primarily into three business verticals: (i) Smart Community, (ii) Out-of-Home Advertising, and (iii) Local Life.

Smart Community. The Company provides intelligent community building access and safety management systems through access control monitors and vendor-provided SaaS platforms. The Company’s intelligent community access control system makes resident access to properties simpler. As of June 30, 2024, approximately 72,773 of the Company’s access control screens had been installed in over 4,000 residential communities, serving over 2.7 million households.

Out-of-Home Advertising. The Company offers clients one-stop multi-channel advertising solutions. Capitalizing on the Company’s network of monitors that span approximately 120 cities in China such as Shanghai, Beijing, Guangzhou, Shenzhen, Nanjing, Xiamen, Hefei, Dalian, Ningbo, Chengdu, Hangzhou, Wuhan, Chongqing, Changsha, the Company’s Out-of-Home Advertising services help merchants display advertisements in a variety of formats across its intelligent access control and safety management system. Advertisements are placed on the monitors and within the SaaS software. Residents are exposed to these advertisements each time they enter and exit community buildings or open the SaaS software. This level of visibility serves as a highly effective means of advertising, assisting merchants in effectively promoting their brands and accelerating their product sales. Moreover, the Company partners with other outdoor advertising providers to maximize coverage by placing the advertisements on the partners’ numerous displays in public transportation, hotels and other settings as well as deploying posters at events. This broad approach provides clients with a truly comprehensive out-of-home advertising solution.

Local Life. The Company connects local businesses with consumers via online promotions and transactions. With its strong technological capabilities, the Company helps local restaurants, hotels, tourist companies, retail stores, cinemas and other merchants offer deals and coupons to consumers on social media platforms such as WeChat, Douyin (the Chinese version of TikTok) and Xiaohongshu. The Local Life vertical bridges the businesses’ need for product sales and promotions and the consumers’ need for dining, shopping, entertainment, tourist attractions and other local services. In addition, deals from local businesses can also be displayed on the access control screens. In this way, clients of the Company’s Local Life services can also reach the Smart Community residents, leveraging the Company’s access control screens’ extensive coverage and high exposure potential. Since early 2023, we have embarked on executing the strategy of deepening engagement with merchants and manufacturers within our Local Life space through facilitating retail sales of diversified goods and services, including beverages, groceries and travel packages.

The Company reports financial results in one segment. Currently, a substantial portion of the Company’s revenues are generated from advertising and promotional activities, namely by the Out-of-Home Advertising and Local Life verticals. Revenues from Smart Community, which mainly consist of product sales of access control devices and service fees, contribute only a small portion to the Company’s total revenues. Thus, the Smart Community revenues are grouped with other miscellaneous revenue sources, such as advertising design and production and social media account operations, under the catch-all category titled “Other Revenues” in the description of the Company’s revenues.

For the years ended December 31, 2022 and 2023, the Company had a total of 247 and 255 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. For the six months ended June 30, 2024 and 2023, the Company had a total of 168 and 102 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. The Company, however, has derived a large portion of its revenues from a few customers. For the years ended December 31, 2022 and 2023, the Company’s top three customers collectively accounted for approximately 84.4% and 24.2% of its total revenue, respectively. For the six months ended June 30, 2024, the Company’s top three customers collectively accounted for approximately 33.2% of its total revenue.

Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the 12 months that ended June 30, 2024.

(Note: LZ Technology Holdings cut the size of its IPO to 1.5 million shares – down from 10.0 million shares previously – and kept the price range at $4.00 to $6.00 – to raise $7.5 million, according to an F-1/A filing dated Oct. 30, 2024.)

Skyline Builders Group Holding SKBL Dominari Securities, 1.5M Shares, $4.00-4.00, $6.0 mil. 1/20/2025 Week of

Through our subsidiary, Kin Chiu Engineering, we offer construction services for roads and drainage projects in Hong Kong. (Incorporated in the Cayman Islands)

Kin Chiu Engineering, our subsidiary, is an approved public works contractor. The company works mostly as a subcontractor. However, it is qualified to serve as a main contractor.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended March 31, 2024.

(Note: Dominari Securities is the book-runner with Revere Securities acting as the co-manager. Dominari and Revere replaced the original sole book-runner, Pacific Century Securities, according to Skyline Builders Group’s SEC filings.)

Smart Logistics Global Ltd. SLGB Benjamin Securities/Prime Number Capital, 1.0M Shares, $5.00-6.00, $5.5 mil, 1/20/2025 Week of

We are a holding company whose operating subsidiary in China manages a business-to-business logistics provider, focused on the transportation of industrial raw materials. (Incorporated in the Cayman Islands)

Note: Net loss and revenue are for the 12 months that ended June 30, 2024.

(Note: Smart Logistics Global Ltd. filed an F-1/A dated Dec. 6, 2024, and updated its financial statements through the period ending June 30, 2024. Background: Smart Logistics Global Ltd. filed an F-1/A dated Nov. 20, 2024, and disclosed the terms of its IPO: The company is offering 1 million shares at a price range of $5.00 to $6.00 to raise $5.5 million. Background: Smart Logistics Global Ltd. filed its F-1 for its IPO on Oct. 4, 2024, with estimated IPO proceeds of $10 million.)

Decent Holding Inc. DXST Craft Capital/D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-4.50, $6.4 mil, 1/22/2025 Wednesday

We are a holding company with no material operations of our own. We conduct our operations in China through our subsidiary, Shandong Dingxin Ecology Environmental Co., Ltd., which is our PRC Operating Subsidiary (“Decent China” or “Operating Subsidiary.” (Incorporated in the Cayman Islands)

We specialize in providing industrial wastewater treatment, ecological river restoration and river ecosystem management, as well as microbial products that are used for water quality enhancement and pollutant removal, through our Operating Subsidiary, Shandong Dingxin Ecology Environmental Co., Ltd. Our main services and products include (1) wastewater treatment, (2) river water quality management, and (3) microbial products that are used for water quality enhancement and pollutant removal. For the fiscal year ended October 31, 2023, our revenue primarily comes from (1) provision of wastewater treatment service, representing approximately 25.49% of our revenue; (2) provision of river water quality management service, representing approximately 46.39% of our revenue; and (3) sale of microbial products, representing approximately 28.03% of our revenue.

We have an in–house research and development (“R&D”) team with members possessing technical expertise in engineering and chemistry as well as a sharp business sense that we believe can accurately capture and meet our customers’ needs. As of the date of this prospectus, we own 12 patents and 9 software copyrights.

We have received a number of industry awards and certifications recognizing our success and achievements, including the “Yantai City Industrial Design Center” awarded by the Yantai Municipal Bureau of Industry and Information Technology in 2022, the “Yantai New Special Expertise Enterprise” awarded by the Yantai Municipal Bureau of Industry and Information Technology in 2022, the “High-Tech Enterprise” awarded by the Shandong Provincial Department of Science and Technology, Shandong Provincial Department of Finance, and Shandong Provincial Taxation Bureau of the State Administration of Taxation in 2019 and 2022, the “Shandong Province ‘One Enterprise, One Technology’ Innovative Enterprises” awarded by the Shandong Provincial Bureau of Small and Medium Enterprises in 2015.

Management Team

Mr. Dingxin Sun is the founder, Chairman of the Board and director of the Company. He has accumulated substantial experience in entrepreneurship in the past two decades, during which he founded multiple companies in Shandong, including Yantai Dingxin Environmental Limited, Yantai Sunshine Gymnastic Limited, Yantai Tongqu Wanxiang Cultural Entertainment Limited. Mr. Sun also worked at Sinopec Yantai branch and served as the general manager of the office, where he was responsible for the retail business of more than 200 gas stations under Sinopec. While at Sinopec Yantai branch, he carried out extensive reform of the business model and compensation model of the Yantai branch and successfully boosted the revenue of gas stations.

Ms. Dingyan Sun is the director of our company. She is the sister of Mr. Dingxin Sun. Ms. Sun has 19 years of experience in accounting. Currently, she is serving as the director and cashier of Decent China, where she is responsible for handling and managing the day-to-day cash flow of the company, including tasks such as cash withdrawals, payments, deposits, and maintaining cash ledgers. Previously from December 2020 to November 2021, she served as the manager of Yantai Development Zone Xingshun Petroleum Co., Ltd. where she was responsible for the overall management of the company’s daily operations, including but not limited to gasoline and diesel fuel retailing, bulk customer delivery and financial accounting. From November 2004 to November 2020, she worked as the accountant of Yantai Development Zone Xingshun Petroleum Co., Ltd and was mainly responsible for the day-to-day operations of the gas station, including accounting documents, account statements, oil settlement, expense review and reimbursement, and other financial duties..

Haicheng Xu is our CEO. Since 2012, Mr. Xu has been working for Decent China as the general manager, responsible for all business docking, market development and sales. He is responsible for expanding the business scope and managing ongoing projects, selecting suppliers and implementing safety control. Prior to joining Decent China, Haicheng XU has held managerial positions at Yantai Huaqiao Hotel, Bohai Ferry Group Co., Ltd. and Yantai Dingxin Cargo Limited from 2000 to 2011, where he acquired industrial knowledge and substantial management experience.

Francis Zhang has been our CFO since September 2024. Mr. Zhang was the Chief Financial Officer and Director of Jiuzi Holdings Inc (Nasdaq: JZXN) from August 2020 to August 2024. Prior to joining Jiuzi Hoildings, Inc., from February 2019 to July 2020, he served as the Executive Director of Shanghai Qianzhe Consulting Co., Ltd, where he was mainly responsible for overseas M&A projects, and follow-on investments and management of newly formed financial holding groups. From June 2013 to January 2019, he served as the Deputy General Manager of Tebon Innovation Capital Co., Ltd, where he was responsible for business development and asset management. From May 2012 to May 2013, he was the Senior Manager of the Investment Department at Sanhua Holding Group, during which he was in charge of overseas M&A projects, new financial investments, and post-investment management. From May 2010 to May 2012, Mr. Zhang was the Investment & Asset Management Supervisor at China Calxon Group Co., Ltd.’s Capital Management Centre. He handled private placement of newly listed companies, took charge of other capital market financing access, and reviewed and appraised operating investment projects. From August 2006 to May 2010, he served as the Assistant Manager of the Investment Banking Department of KPMG Advisory (China) Limited, where he engaged in several auditing and financial advisory projects, which included public-listed companies and IPO projects.

Note: Net loss and revenue are for the 12 months that ended April 30, 2024 – in U.S. dollars converted from China’s currency.

(Note: Decent Holding Inc. filed its F-1 on Oct. 4, 2024, and disclosed the terms for its IPO: 1.5 million shares at a price range of $4.00 to $4.50 to raise $6.38 million.)

FBS Global Ltd. (New Filing December 2024) FBGL WallachBeth Capital, 2.3M Shares, $4.50-5.00, $10.7 mil, 1/24/2025 Friday

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing on Dec. 5, 2024. Background: This filing followed the company’s withdrawal of its previous IPO plans in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO. FBS Global’s path to going public began in mid-September 2022 when the Singapore company submitted confidential IPO documents to the SEC.))

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net loss and revenue are in U.S. dollars (converted from Singapore’s currency) for the 12 months that ended June 30, 2024.

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing dated Dec. 5, 2024, in which it kept the same terms from its original IPO filing: The company plans to offer 2.25 million shares at a price range of $4.50 to $5.00 to raise $10.69 million.)

(Note: FBS Global Ltd. withdrew its IPO filing in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO.)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

ALE Group Holding Limited ALEH Dawson James Securities/D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-6.00, $6.3 mil, 1/27/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Baiya International Group BIYA Cathay Securities/ Revere Securities, 2.5M Shares, $4.00-6.00, $12.5 mil, 1/27/2025 Week of

(Incorporated in the Cayman Islands)

We, Baiya International Group Inc. (“Baiya”), are an offshore holding company. As a holding company, we have no material operations and conduct all of our operations in China through the VIE, Shenzhen Gongwuyuan Network Technology Co., Ltd. (“Gongwuyuan”), and its subsidiaries, collectively, “PRC operating entities”. We entered into a series of Contractual Arrangements with the VIE and certain shareholders of Gongwuyuan, and this structure involves unique risks to investors. See “Risk Factors — Risks Relating to Doing Business in China” for more information. Neither we nor our direct and indirect subsidiaries own any equity interests in the PRC operating entities.

Gongwuyuan started to provide job matching services in 2017. In November 2019, Gongwuyuan began developing its cloud-based internet platform to provide one-stop crowdsourcing recruitment and SaaS-enabled HR solutions on the Gongwuyuan Platform to supplement its offline job matching services and started to position itself as a SaaS-enabled HR technology company by introducing its Gongwuyuan Platform in the flexible employment marketplace. We have been and will continue to strategically develop and improve the Gongwuyuan Platform with product features that work together with our traditional offline service model to improve the job matching and HR related services in the flexible employment marketplace.