EM Fund Stock Picks & Country Commentaries (March 16, 2025)

See fast interesting fund manager: Aberdin Lowing a collection from the name under the former CEO ABRRDN; But the vowel now returns to the new CEO (the logo name of the website) under the new CEO trying to turn things.

📰 British asset manager Abrdn changes itself to Aberdeen (ft) $ 🗃️

The company said MOVE will end its ‘distraction’ after the brand ring, which was widely ridiculed in 2021.

RAE MAILE, an analyst at Panmure Liberum, wrote to the customer:The market did not believe that Aberdin (eg, EE has returned) with costs or growth strategies. That view is challenged today. ”

(Now, Aberdeen must scatter all the research on a variety of websites where all studies are placed…)

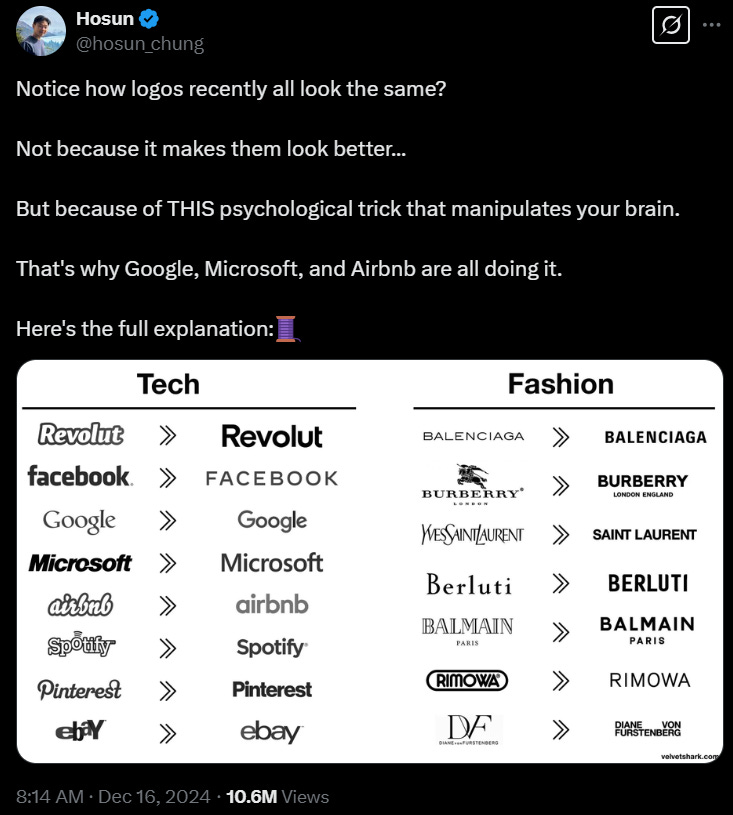

If only the company can do it halt Their logo is ugly and all look similar. But as this interesting Twitter thread explains, there are scientific reasons for the marketing manager (Hint: “Digital Revolution…”).

Since mid -March, there are many new updates and some annual reports (continued updated. Here is a post that contains all the funds.) With the new research available:

-

🔬∎ There is a good thing about this Yanus Henderson Investor piece: Why do you choose a technology fund rather than individual stock recommendations? – Global Technology Leaders Team discusses why fund approaches to investments in technology stocks benefit from active management by experiencing previous waves.