How to expand global liquidity can lead the price of Bitcoin to a new all -time high

The price trajectory of Bitcoin once again captures the headline, and this time the catalyst seems to be a global liquidity trend that reconstructs investor feelings. Matt Crosby, the chief analyst of Bitcoin Magazine Pro in recent comprehensive failures, offers powerful evidence that binds the new optimism of digital assets to the global M2 currency. His insight not only reveals the future of Bitcoin prices, but also anchores macroeconomic relevance in a wide range of financial contexts.

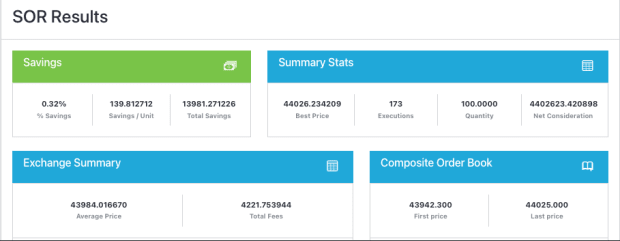

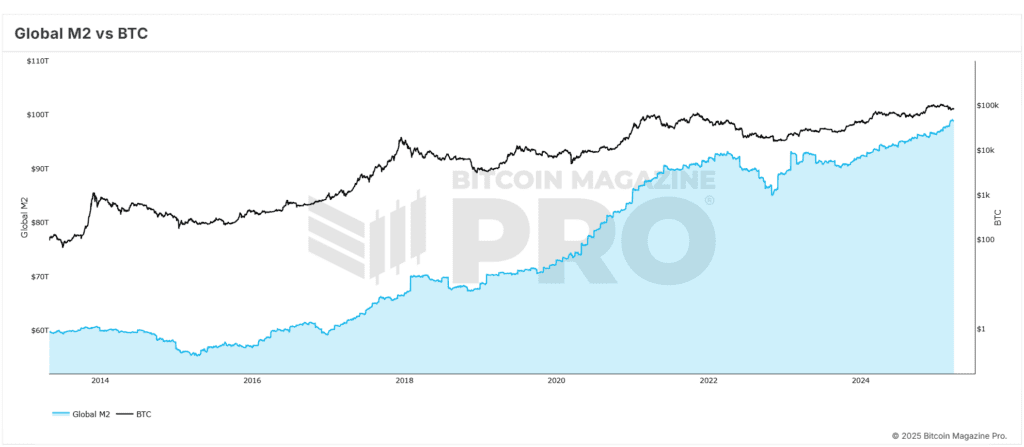

Bitcoin price and global liquidity: high shock correlation

CROSBY emphasizes an amazing consistent correlation that exceeds 84%between Bitcoin price and global M2 liquidity level. As liquidity increases throughout the global economy, Bitcoin prices generally respond to ascending exercises due to noticeable delays. Historical data supports the 56-60-day delay observation between financial expansion and bitcoin price hikes.

As Bitcoin prices rebound from $ 75,000 to $ 85,000, this insight has been proven to be accurate recently. This trend is closely related to the predicted recovery described by CROSBY and his team based on macro indicators, and verifies the strengths and reliability of the correlation that increases the price of bitcoin.

The reason why two -month delay affects Bitcoin prices

The two -month delay in the market response is an important observation for understanding the fluctuations of Bitcoin prices. CROSBY emphasizes that monetary policy and liquidity injection do not immediately affect speculative assets such as BTC. Instead, there are generally an incubation period of about two months, and in the meantime, liquidity is filtered through the financial system and begins to affect the price of bitcoin.

CROSBY adjusted the duration and offset by optimizing this correlation through various back tests. Their studies show that the 60 -day delay produces the most predictive accuracy in both short -term (1 year) and extended (4 years) historical bitcoin price behavior. This delay gives a strategic advantage for investors who expect Bitcoin prices soaring by monitoring macro trends.

Effects on S & P 500 and Bitcoin Price Trends

CROSBY expands analysis into a traditional stock market by adding more reliability to the paper. The S & P 500 has a more powerful correlation with the global liquidity. This correlation strengthens the claim that financial expansion is an important driving force for a wider risk asset class as well as bitcoin prices.

CROSBY compares the liquidity trend with multiple indexes, showing that bitcoin prices are part of a wider systematic pattern, not abnormal. As liquidity rises, both stocks and digital assets tend to benefit from benefits, so M2 is an essential indicator at the time of bitcoin price fluctuations.

By June 2025, we predicted the Bitcoin price of $ 108,000

To establish a future prediction point of view, CROSBY uses the historical fractal of the former bull market to project the future bitcoin price fluctuations. If such a pattern overlaps with macro data, the model is for $ 108,000 by June 2025, referring to a scenario that can resume Bitcoin prices and surpass the all -time high.

This optimistic projection for Bitcoin prices depends on the assumption that global liquidity continues to upward trajectory. According to a recent statement from the US -based preparatory system, if the market stability is shaken, another tail wind for the growth of Bitcoin can lead to more financial stimuli.

The expansion speed affects the price of Bitcoin

Although liquidity levels are important, CROSBY emphasizes the importance of monitoring liquidity expansion speeds to predict Bitcoin prices. M2 growth rate compared to the previous year offers a subtle view of macroeconomic exercise. Liquidity has generally increased, but the expansion speed has been temporarily slowed down before resuming the rise in recent months.

This trend is surprisingly similar to the conditions observed in early 2017 just before the price of bitcoin is in the index growth stage. This parallel strengthens Crossby’s strong prospects for bitcoin prices and emphasizes the importance of epidemiology rather than static macroscopic analysis.

Final Thought: Preparation of Daum Bitcoin Price Stage

Potential risks, such as the global economic downturn or significant stock market correction, continue, but the current macro indicators are headed for a favorable environment for bitcoin prices. CROSBY’s data -centered approach gives investors with strategic lenses that can interpret and explore the market.

For those who want to make a decision based on information in a variable environment, these insights provide executable intelligence based on economic basics to take advantage of Bitcoin price opportunities.

Visit BitcoinMagazinepro.com to see deeper research, technical indicators, real -time market alerts and more and more analyst communities.

Indemnity: This article is for the purpose of providing information and should not be considered financial advice. Always do your own research before making an investment decision.