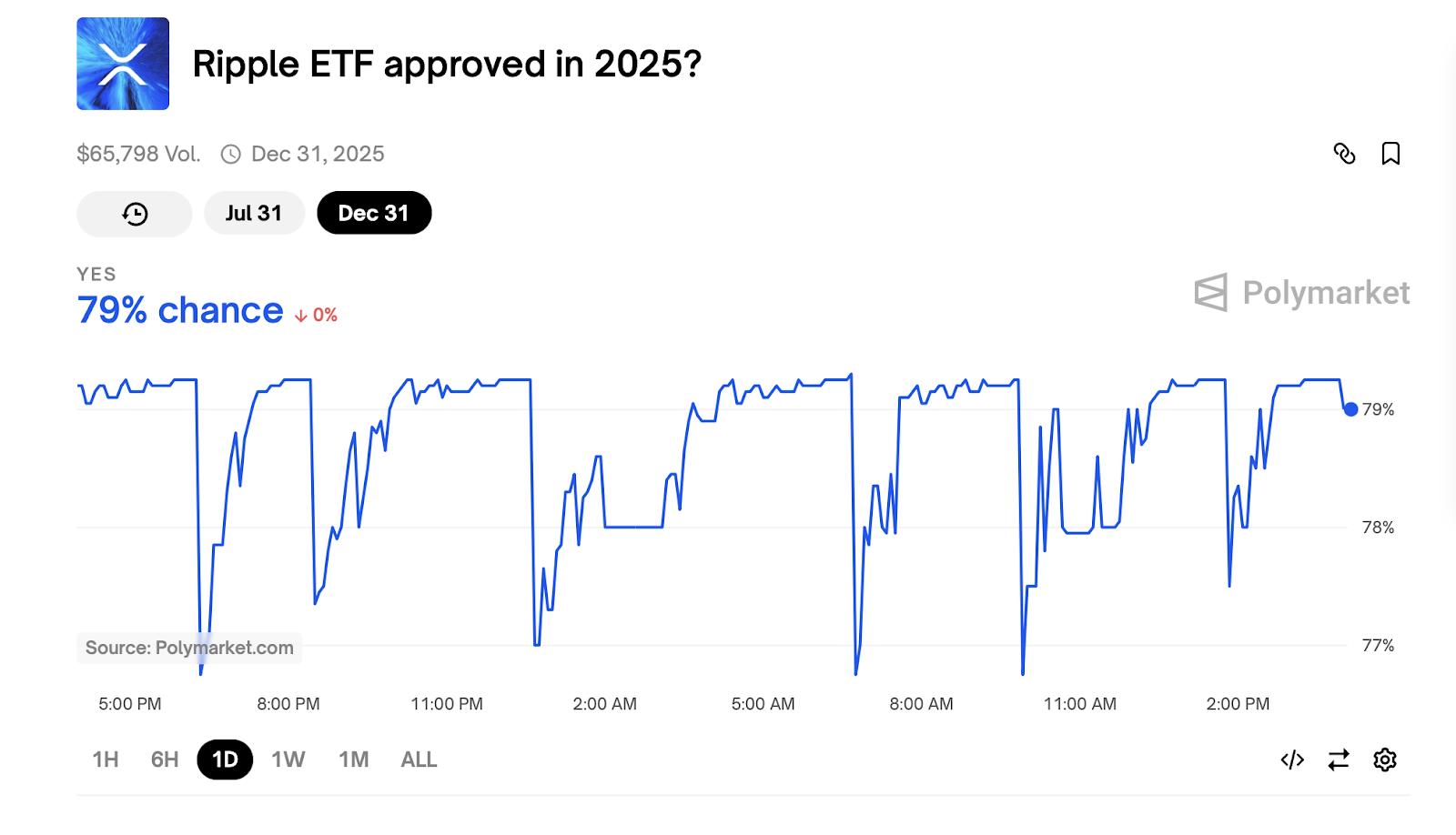

While the WiseCryptonews portal is being released, POLYMARKET puts 79%chance of approval of the XRP ETF.

WiseCryptonews reveals a platform built to track the most important development in digital assets, providing a clear view of changing emotions to readers in real time. With the heating of the XRP ETF approval discussion, we need more clear insights about how the encryption market, story and regulation cannot be emphasized.

Example: Distributed Predictory Platform PolyMarket now increases the probability of XRP ETF, which is now approved by SEC from 65%a few weeks to 79%by the end of 2025. Jump reflects the momentum renewal in the more optimism in the regulatory outlook of the asset and a wider ALTCOIN ETF conversation.

The probability of approval of XRP ETF increases to 79%as market trust increases.

According to PolyMarket’s data, this confidence has not been shaken recently. In the last 24 hours, this prediction has stayed in a tight range between 77% to 79%, and market participants suggest that the XRP ETF may be a reality before the start of the year. This optimism is part of a wider trend in which interest in Altcoin ETF in 2025 is rising with the improvement of regulatory clarity.

XRP ETF approval probability. Source: Poly Market

One of the main factors that causes this exercise is the development of relationships between Ripple Labs and US Securities and Exchange Commission. In March 2025, the SEC officially withdrew its long lawsuit against Ripple, eliminating the main legal protrusions that blurred the future of XRP for many years. When it was out of the road, the attention was changed to the potential launch of the regulated XRP ETF. This is a movement that allows both institutions and retail investors to be exposed to XRP through traditional financial markets.

SPOT XRP ETF has not been approved yet, but there was a significant movement on the futures. The SEC recently signed from three XRP futures-based ETFs (2X leveraged), short XRP ETF (-1X leverage) and Ultra short XRP ETF (-2X leverage). However, despite the initial report on the release on April 30, Proshares clearly stated that there was no ETF roll out on the date. The company later submitted an update proposed on May 14 with a new goal. But this is tentative and depends on the final SEC approval.

It should be noted that futures -based ETFs are not directly exposed to XRP itself. Instead, the price fluctuations through the contract can be useful for short -term speculation, but there is a lack of direct market links provided by ETF. Spot XRP ETF has basic assets to provide long -term investors with more clear and potentially less volatile paths.

Some major asset managers, including Franklin Templeton, GrayScale, 21Shares, Bitwise and WisDomtree, are suspended from the application for Spot XRP ETF. The SEC recently delayed the decision on the application of Franklin Templeton on June 17. Analysts are a procedural movement that says that it is common and not necessarily a sign of rejection.

As interest is established, analysts measure the weight of what XRP ETF means in the market. Standard Chartered predicted that the US -based XRP ETF could attract $ 8.3 billion in inflow of $ 8.3 billion, leading to an XRP price of $ 8 by 2026.

“NAVs approved by the US branch ETF so far are 3% of Etherrium and less than 6% of Bitcoin. The current XRP market cap will suggest the range of $ 4.4 billion to $ 8.3 billion as the total NAV measure of the future of XRP ETF.

On the other hand, the analysts of Bitfinex are more careful, and the XRP ETF is the main stage, but it suggests that the broader investor preference may not be introduced with Bitcoin ETF.

At the time of writing, XRP has a 24 -hour trading volume for $ 21.4 billion, which is about $ 2.20. On the last day, the price of the tokens dropped slightly, but the market focuses on regulatory signals. The next closed meeting of the SEC is set to May 8 and speculates that additional updates for Ripple or XRP ETF applications may appear.

All signs refer to the changing environment of the US encryption ETF. The final word of the SPOT XRP ETF is still holding, but the probability of both market and analysts continues to move favorably.

WiseCryptoNews Portal Launches While Polymarket Puts XRP ETF Approval Odds at 79%