Future Note: Keep a wonderful state in a technically challenging environment. Price measures for this level are important | Indian analysis

In the meantime, the Indian stock market showed strong elasticity in the constant uncertainty between India and Pakistan. They just integrated just a week before they finished with moderately negative notes. The range of transactions was humble. Nifty vibrated in the 590 point range. Volatility has soared. India VIX, a volatile barometer, has from 18.49%per share to 21.63. The headline index finally closed with a net loss per share of 338.70 points (-1.39%).

Some important things to note from a technical perspective. 200-DMA is 24044. 50 weeks MA is at 23983. This makes the area of 23950-24050 a very important support area of Nifty. Indexes continue to integrate in the defined range as long as they can defend this area. Incremental weaknesses occur only if the 23900 level is decisively violated. In a higher aspect, as the chart suggests, the market has resisted the continued increasing trend resistance. From now on, NIFT’s actions on the area of 23950-24050 will be important to pay attention to. The ability of the index to defend or defend this area will order the trend for the next few weeks.

The levels of 24350 and 24600 are expected to act as possible resistance points in the future. The supports are 23900 and 23630.

Weekly RSI is 54.36. It maintains a neutral state and is not different from the price. Weekly MACD is optimistic and stays on the signal line. The weak candle appeared. The appearance near the pattern resistance adds reliability to the resistance near 24500-24600.

According to the pattern analysis of the daily and weekly charts, nifty is quite traded within the expected line and the analysis range. It is resisting the upward trend resistance near 24500-24600. So far, it has defended the keys created between 200-DMA and 50 weeks MA. The market will only weaken if it violates an important 23900 level. As long as this point is defended, we can expect the market to be integrated to the defined range.

Based on the overall technology structure, the market is likely to not see an immediate rise. If the market remains a violation of 23900, there is a doubt that it will still start sustainable trend up and soon exceed 24500. Hedging activities and hemp costs increased. This is clear in VIX, which has increased significantly over the last few days. NIFTY has defended its main support level so far, but remains a technically challenging environment. Market participants should focus on stocks with low beta stocks and relative intensity to adopt a defense approach. As the leverage position is lowered, the prudent prospects are recommended in the future.

Analysis of the upcoming week

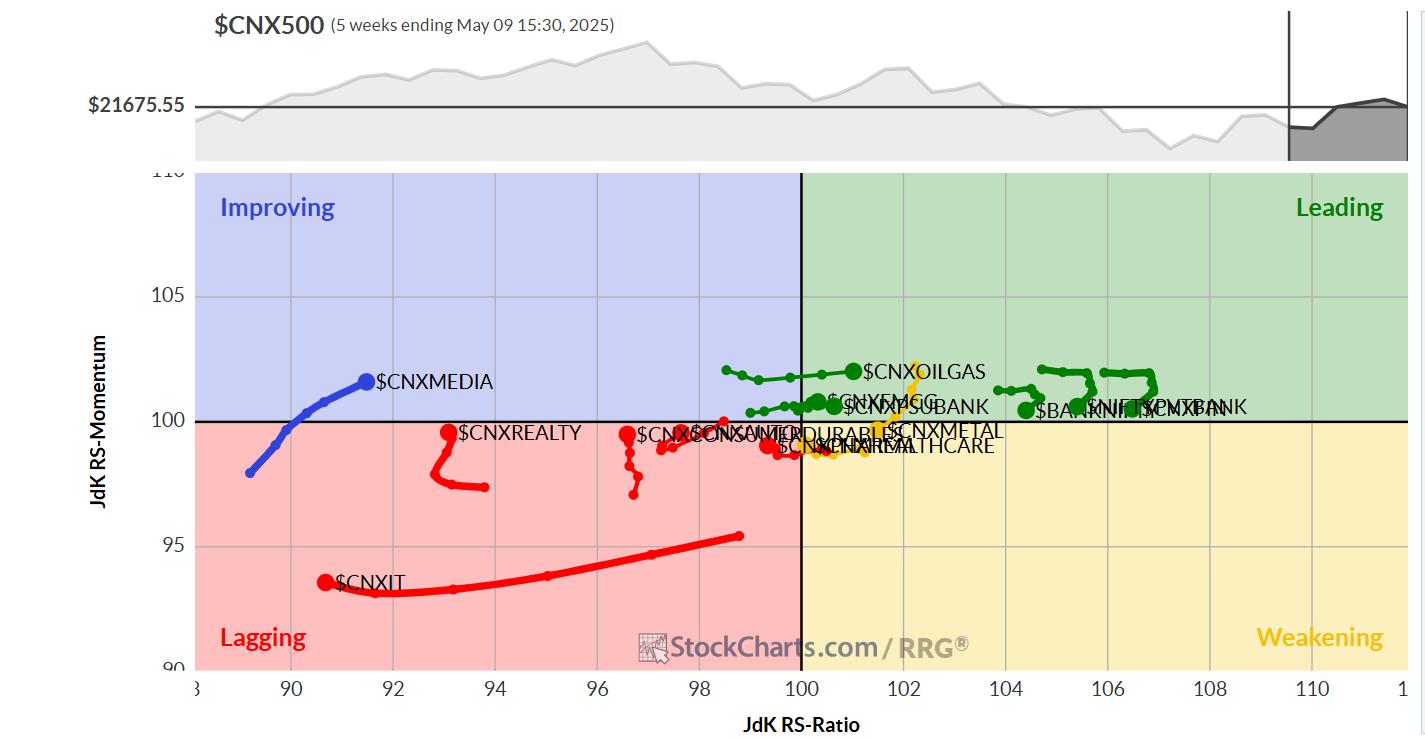

Looking at the relative rotating graph ®, we represents more than 95% of the total market cap of all listed stocks by comparing various sectors with the CNX500 (Nifty 500 Index).

The relative rotating graph (RRG) shows that the NIFTY PSE index is rolled within the main quadrant. Infrastructure, Nifty Bank, PSU BANK, FMCG, Consumption, Products and Financial Services Indexes are also within the main quadrant. This group is likely to surpass a relatively wider NIFTY 500 index.

Nifty metal index rolled in a weakened four -way. This can slow this sector and give up relative performance. The service index remains in this quadrant.

The NIFTY IT Index continues to suffer from the Lagging Quadrant, but AUTO and Realty Indices greatly improve their relative exercise for a wider market while staying in this quadrant.

The NIFTY MIDCAP 100 Index rolled inside the quadrant. The relative performance in the future can be improved. The media and energy indexes are also inside this quadrant, and relative achievements in the wider market can continue to improve.

Important reference: The RRG ™ chart shows the relative strength and momentum of the stock group. The above chart shows relative performance of the NIFTY500 index (wide market) and should not be used directly as a purchase or sales signal.

Milan VashnaV, CMT, MSTA

Technical analyst consulting

www.equityRESEASIA | www.chartwizard.AE

MSTA is a capital market expert with Milan VashnaV, CMT and MSTA with nearly 20 years of experience. His specialty includes portfolio/fund management and advisory service consulting. Milan is the founder of Chartwizard Fze (UAE) and Gemstone Equity Research & Advisory Services. As a consulting technology research analyst for more than 15 years, he has provided customers with an independent technology study centered on premium India. He now contributes every day to the ET market and the economic time of India. In addition, I wrote one of the most accurate “Daily / Weekly Market Outlook” in India, the daily / weekly newsletter in the 18th year. Learn more