MicroStrategy: Investing in Bitcoin

In November 2023, software company MicroStrategy took a big gamble. More than 16,000 Bitcoins were purchased and nearly $600 million was spent.

He then tossed it into a pile of Bitcoin he had been hoarding, giving him a total of 175,000 Bitcoin worth $5 billion. This puts them in the top 10 list of Bitcoin holders along with Binance, the US government, and Satoshi Nakamoto.

MicroStrategy makes about $500 million a year in revenue, so I wonder why they need $5 billion in Bitcoin. MicroStrategy CEO Michael Saylor told Time: “My job now is to fix the world’s balance sheet.”

In Saylor’s view, “cash is trash,” so holding the company’s assets in rapidly inflating U.S. dollars is like holding on to “melting ice.” Bitcoin, on the other hand, is “digital gold,” a persistent store of value.

While this has made Saylor a hero in the eyes of Bitcoin believers, our view is different. Saylor took unnecessary risks by betting everything on Bitcoin. He bet on Bitcoin.

What does MicroStrategy do?

MicroStrategy news headlines can be hard to remember because they’re all about Bitcoin. Actually it’s a business.

MicroStrategy creates business intelligence software that helps companies analyze and visualize large amounts of complex data. Competitive products include Tableau, Microsoft Power BI, or Qlik.

The company has continually innovated its products, making it easier to develop applications that connect with data, providing extensive support for mobile users, and adding advanced AI features.

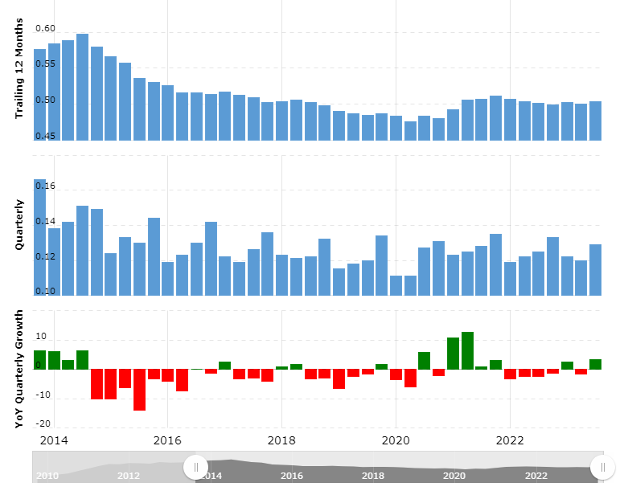

MicroStrategy’s revenue has been declining gradually over the past decade, but its fortunes have improved somewhat over the past few years.

Meanwhile, MicroStrategy’s stock ($MSTR) is up more than 200% since Saylor began stockpiling Bitcoin in 2020. faster It is cheaper than the price of Bitcoin, making it an attractive option for investors who cannot invest in Bitcoin directly.

On the other hand, MicroStrategy’s huge Bitcoin holdings make the stock extremely volatile, almost as if it were buying Bitcoin directly. Note the correlation with BTC price.

Saylor’s obsession with Bitcoin has thrown the company’s economics into disarray. In our opinion, if you purchase $MSTR stock, you will You are not buying a business, you are buying bitcoin.

A question arises: Why not buy Bitcoin directly??

learn from history

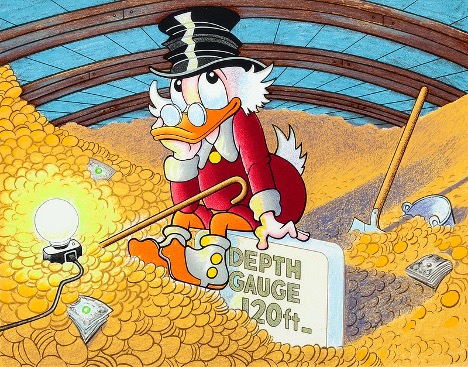

Saylor is like a modern-day Scrooge McDuck rolling around a huge pile of Bitcoin.

There’s nothing wrong with having a lot of cash saved up for a rainy day. Alphabet, Microsoft, and Facebook have billions of dollars in cash and marketable securities, giving them options when they need to acquire competitors or expand quickly into new markets.

However, the historical performance of hoarding practices has been mixed at best. for example:

apple stockpile gold: Steve Jobs believed that gold was the ultimate hedge against inflation. (Sound familiar?) So for most of the 1970s and 1980s, Apple maintained massive gold reserves. The company sold off most of its gold in the 1990s and was later criticized for not investing that money back into the business.

Sugar in Coca Cola: For most of the 20th century, Coca-Cola maintained strategic supplies of sugar to protect its supply chain from sugar shortages and unexpected price increases. This practice continued until the late 2000s, when sugar markets became more stable and global.

Iranian oil reserves: This is a good example of resource stockpiling on a national scale. Because oil is one of Iran’s most valuable assets, Iran’s vast oil reserves give it economic and political influence. However, this brings with it oil price fluctuations and the threat of international sanctions.

De Beers is stockpiling diamonds: When a company had a monopoly on diamonds, they hoarded the precious gem in order to manipulate prices and maintain market power. Fortunately, better regulation and smarter consumers have allowed De Beers to diversify its holdings.

Sometimes hoarding works for a while. But our view is Resources are usually better used to grow the business.This is especially true in the fast-moving technology industry. In the long run, Scrooge McDuck would be better off investing in his nephew’s new idea.

The Risks of Betting Your Business on Bitcoin

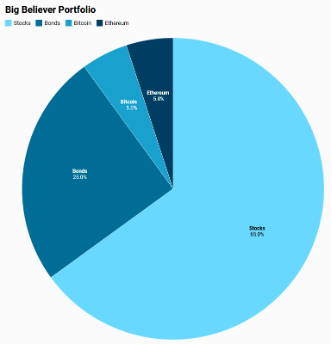

In our investment approach we recognize: Bitcoin is dangerous: It’s a roller coaster. That’s why we hedge the risk I invest primarily in common stocks and bonds and only allocate a portion of my portfolio to Bitcoin.

I wonder why Saylor doesn’t do the same. What about hedging the risks of Bitcoin with other investments, even gold?

By investing everything in Bitcoin, he is literally doing what we are constantly warned about. We don’t bet on Bitcoin.

Only for sailors He’s betting his business on Bitcoin..

In fact, it is highly unlikely that Bitcoin will ever go to zero. In fact, his Bitcoin investment may have multiplied tenfold.

What next? Would you like to buy more Bitcoin?

Lots of risk, uncertain reward

Ultimately, the purpose of a company is to create new value in the world. If MicroStrategy is buying Bitcoin without reinvesting it, investors should ask what the business is about. really do. Is it a Bitcoin holding company with a bit of software business on the side?

So where is the value?

Make no mistake. We are Bitcoin believers. More importantly, we believe in a new financial system. This is where MicroStrategy has tremendous potential. MicroStrategy can leverage its significant expertise to develop new financial software products or services that will bring the world into the cryptocurrency era.

But the company, which holds $5 billion worth of Bitcoin, faces enormous market uncertainty. This puts MicroStrategy on the Bitcoin roller coaster. The risks are high and the rewards are uncertain.

The solution for investors looking to invest in Bitcoin is simple. invest in bitcoin. Not MicroStrategy.

Subscribe to Bitcoin Market Journal Discover more investment opportunities in blockchain!