S & P 500: What is the risk just before 6,000? | Chart watch

key

Takeout

- The stock market is integrated, making investors uncertain about the next movement.

- The technical sector has recovered leadership, but does not show enough momentum to follow.

- The upcoming non -farm salary can decide whether the market is getting higher.

A lot of things happened in the stock market after liberation, and we put us on our toes. Volatility decreased significantly, stocks popped out of the lowest on April 7, and the economy remained elastic.

A lot of things happened in the stock market after liberation, and we put us on our toes. Volatility decreased significantly, stocks popped out of the lowest on April 7, and the economy remained elastic.

Still, if you still feel uncertain, you are not alone. The stock market is in a slight “atmosphere and view” mode, and when you identify the next movement, you will go through the integration period.

that S & P 500 ($ SPX) hesitates to welcome 6000 to reclaim the 200 -day simplicity (SMA). This uncertainty can make investors feel that they are trapped in the land of man. And it is not S & P 5 million. Most of the main indexes are in similar scenarios, except for the remaining small caps. It may be because the market is delayed in interest rate reduction.

Technology is taking the lead

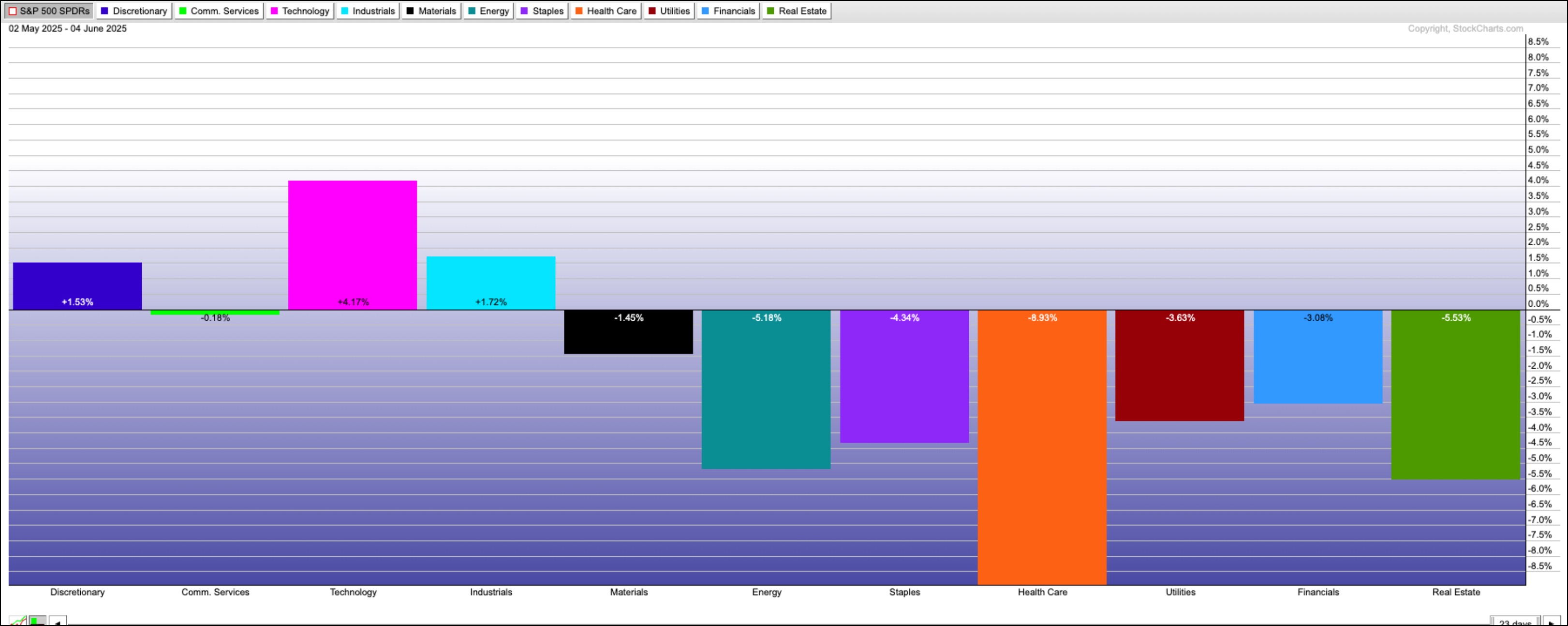

There are measures that should not be ignored when drilled as a major index. Momentum was insufficient, but technology stocks began to lead the lead again. Over the past month, the technology sector has increased by more than 4%.

Figure. Technology is a clear leader with more than 4%profit.Image Source: Stockcharts.com. For educational purposes. It is encouraging to see technology stocks restoring leadership positions. Technology is the main force of the S & P 500 Nasdaq composite ($ Compq). Daily chart SPDR fund in technology selection sector (XLK) shows that ETF has been trying to go beyond the trapped range since mid -May.

Figure 2. Daily chart of XLK. The ETF is rarely broken than the integrated range, but we need to check the greater propulsion.Chart Source: Stockcharts.com. For educational purposes.There is nothing that interferes with the XLK’s all -time high, but no momentum is yet present. 14-Relative robbery index (RSI) is less than 70 years old and seems to stop almost consistent with the price measures of the entire stock market.

What is the market waiting for? Perhaps it is the same catalyst as a non -farm salary report on Friday. This week’s JOLTS, ADP and ISM service data did not move a lot of needles, but the NFP report can be a game change.

S & P 500 technology prediction

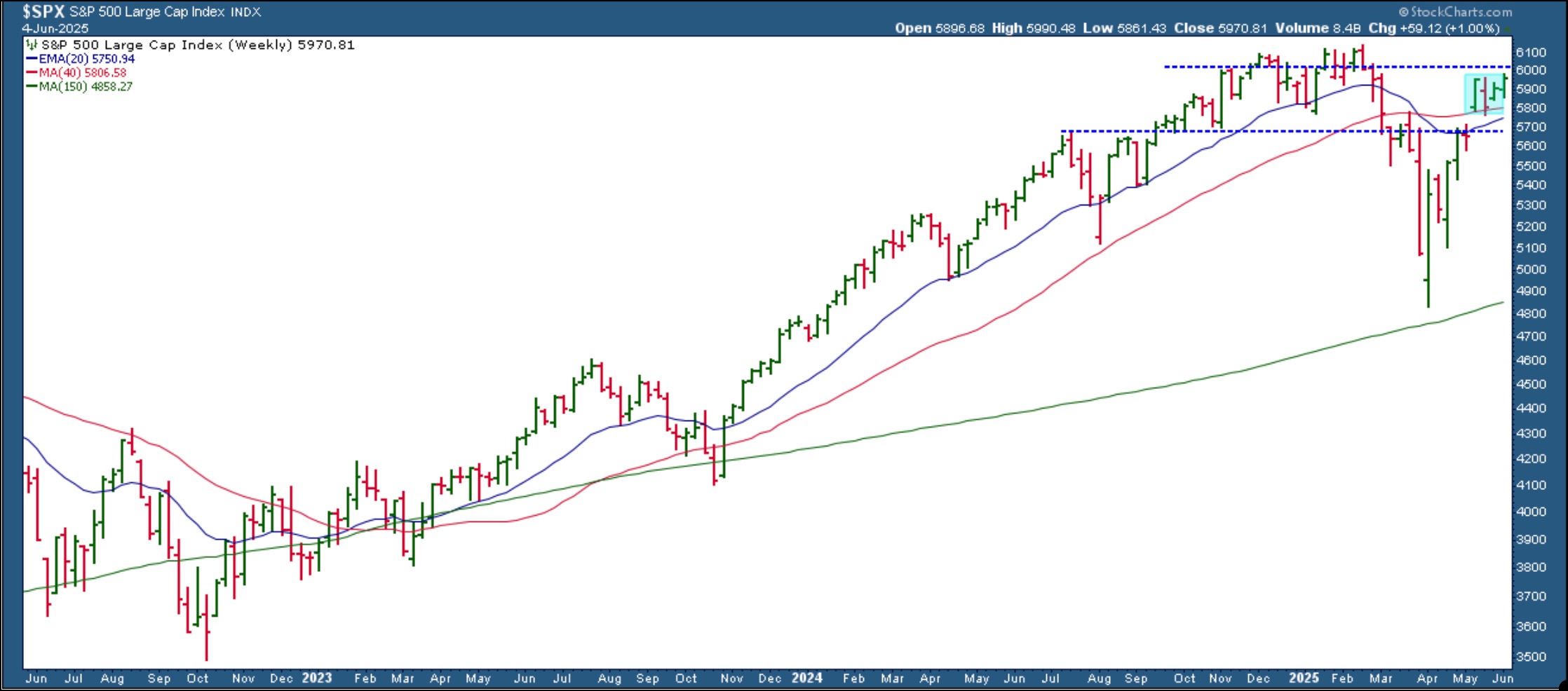

Where can S & P 500 go here? Let’s jump on the weekly chart.

Figure 3. Weekly chart of S & P 500. The index is far from the highest level. Beyond November’s highest will clean up the new best way.Chart Source: Stockcharts.com. For educational purposes.

The S & P 500 has surpassed 40 weeks of SMA on May 12. But it was integrated with XLK last month.

The S & P 500 is approaching the highest level in November 6017. On the other hand, slipping below 40 weeks can cause concern and may mean that the interval of May 12 may be filled. Keep in mind 5688. The S & P 500 will be close to that level and it will be a healthy correction. Additional disadvantages means that you are patient or partial positions.

What is happening with gold and bonds?

While the stock is grinding sideways, gold prices are rising and bond prices are showing green shoots. According to this price measure, investors can whistle to slow down. It is not something to be embarrassed.

Check out the Stockcharts Market Summary page and dashboard to briefly look at what gold, bonds and all major indexes are doing.

So, what should you do?

Do you hold onto, add, or contact you? It is a big question. The market needs time to digest a lot of time, from economic data to designated risks and policy headlines. Continue to check in, monitor the sector, observe index performance, and pay attention to how other areas of markets such as precious metals and bonds are responding.

disclaimer: This blog is used only for educational purposes and should not be interpreted as fiscal advice. You should not use ideas and strategies without evaluating your personal and financial situations first or consulting financial experts.

Jayanthi Gopalakrishnan is a site content director of Stockcharts.com. She spends time finding a content strategy, providing content to educate traders and investors, and finding how to make technical analysis fun. Jayanthi managed the editor -in -chief of T3 Custom, a content marketing agency of financial brands. Before that, we managed the technical analysis editor of stocks and product magazines for more than 15 years. Learn more